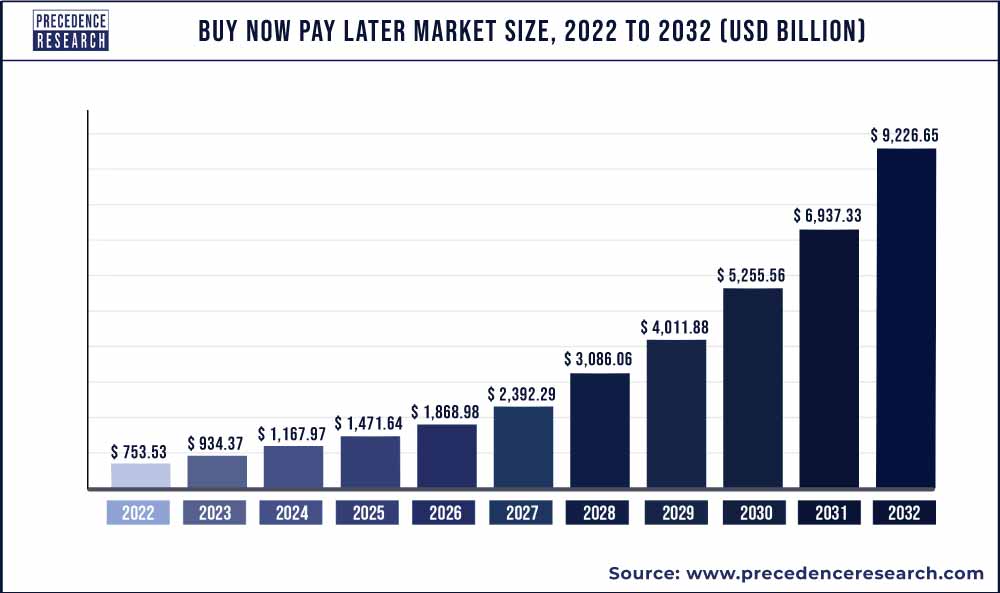

The buy now pay later market size is expected to reach around US$ 3268.26 billion by 2030, growing at a CAGR of 43.8% every year, according to a 2022 study by Precedence Research, the Canada-based market Insight Company.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The buy now pay later market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The people can use buy now pay later to make purchases online and in stores without having to pay the entire amount up front. The buy now pay later industry is likely to develop as people become more aware of installment-based payment solutions. Furthermore, the absence of interest fees levied by buy now pay later platforms is likely to boost the buy now pay later market’s growth prospects.

In comparison to other types of retail borrowing, the buy now pay later often requires fewer intensive credit checks a result, customers with bad credit and no credit who are not qualified for standard loan options prefer buy now pay later. As these consumers are looking for simple budgeting tools, the buy now pay later products assist them in meeting their financial goals. However, buy now pay later service providers’ absurdly high late fees are projected to stifle the buy now pay later market expansion during the forecast period. In addition, credit companies and banks who supply buy now pay later services charge both the customer and merchant.

Our Free Sample Reports Includes:

- In-depth Industry Analysis, Introduction, Overview, and COVID-19 Pandemic Outbreak.

- Impact Analysis 180+ Pages Research Report (Including latest research).

- Provide chapter-wise guidance on request 2021 Updated Regional Analysis with Graphical Representation of Trends, Size, & Share, Includes Updated List of figures and tables.

Updated Report Includes Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis by using Precedence Research methodology.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1559

Buy Now Pay Later Market Report Scope

| Report Coverage | Details |

| Market Size | US$ 3268.26 Billion by 2030 |

| Growth Rate | CAGR of 43.8% from 2022 to 2030 |

| Base Year | 2021 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Channel, Enterprise Size, End Use, Region |

Buy Now Pay Later Market Report Highlights

- Based on the channel, the online segment dominated the global buy now pay later market in 2020 with highest market share. The monthly installments are available through buy now pay later solutions, allowing for convenient purchases over time.

- North America is the largest segment for buy now pays later market in terms of region. Due to the multiple benefits, it provides, such as bill discounts and cashbacks, many customers in the North America region have started using online payment through digital wallets, buy now pay later platforms, and credit and debit cards.

- Asia-Pacific region is the fastest growing region in the buy now pays later market. Due to rising cost of numerous home appliances such as washing machines, smart televisions, and music systems, the Asia-Pacific region is predicted to rise at a high rate during the projection period.

Buy Now Pay Later Market Dynamics

Drivers

But now and pay later as convenient payment platform

The buy now pay later payment method provides people with numerous benefits, including affordable and convenient payment services, instant credit card fund transfer service at the point of sale (POS) platform, and increased personal information security, which drives the growth of the buy now pay later market. Furthermore, the buy now pay later platform supports a QR-code option, which allows individuals to make a payment via scan code and to allow transactions via UPI methods, further propelling market growth.

Furthermore, the buy now, pay later platform enables consumers to make secure payments without swiping a debit card, which boosts market growth globally. The benefits provided by the buy now platform to consumers and merchants drive the market’s global expansion over the forecast period.

Restraints

Buy now pay later encourages impulse spending

One of the major factors restricting the growth of the global buy now pay later market is the growing spending on purchases. The buy now pay later platforms is helping people to buy products and services without paying any amount of money at the time of purchase. The option of pay later is driving the market. But this factor can affect the business of buy now pay later market players. The option of buy now pay later can also lead to loss of money of the organizations. Thus, this factor is restricting the growth of the global buy now pay later market

Read Also: Solar Vehicle Market Size May Hit US$ 5.26 billion by 2030

Opportunities

Growing acceptance of online payment methods

The rise of the buy now pay later market is being accelerated by an increase usage of online payment methods among consumers in developing countries. The primary digital payment technologies are mobile payment, credit card, debit card, which provide individuals with several benefits such as faster cash transactions, lower transaction costs, and increased payment security, all of which contribute to the expansion of the buy now pay later market.

The availability of high-speed internet access, a boom in smartphone adoption, and increased awareness of digital payment services are all essential elements that encourage individuals to use online payment technology. As a result, the growing acceptance of online payment methods is creating lucrative opportunities for the growth of the buy now pay later market during the forecast period.

Challenges

Lack of consumer awareness in developing and underdeveloped nations

The concept of buy now pay later is not so trendy in developing and underdeveloped nations. The banking, financial services, and insurance (BFSI) agencies are trying to promote the buy now pay later platforms on a large scale but in developed countries. The government of developing and underdeveloped nations needs to run advertising campaigns for the promotion of buy now pay later. Thus, the lack of consumer awareness in developing and underdeveloped nations is a major challenge for the market growth.

Some of the prominent players in the global buy now pay later market include:

- Sezzle

- Afterpay

- Klarna Bank AB

- Laybuy Group Holdings Limited

- Quadpay

- Splitit

- Affirm Holdings Inc.

- Payl8r (Social Money Ltd.)

- PayPal Holdings Inc.

- Perpay

Segments Covered in the Report

By Channel

- Online

- Point of Sale (POS)

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End Use

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Leisure & Entertainment

- Retail

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333