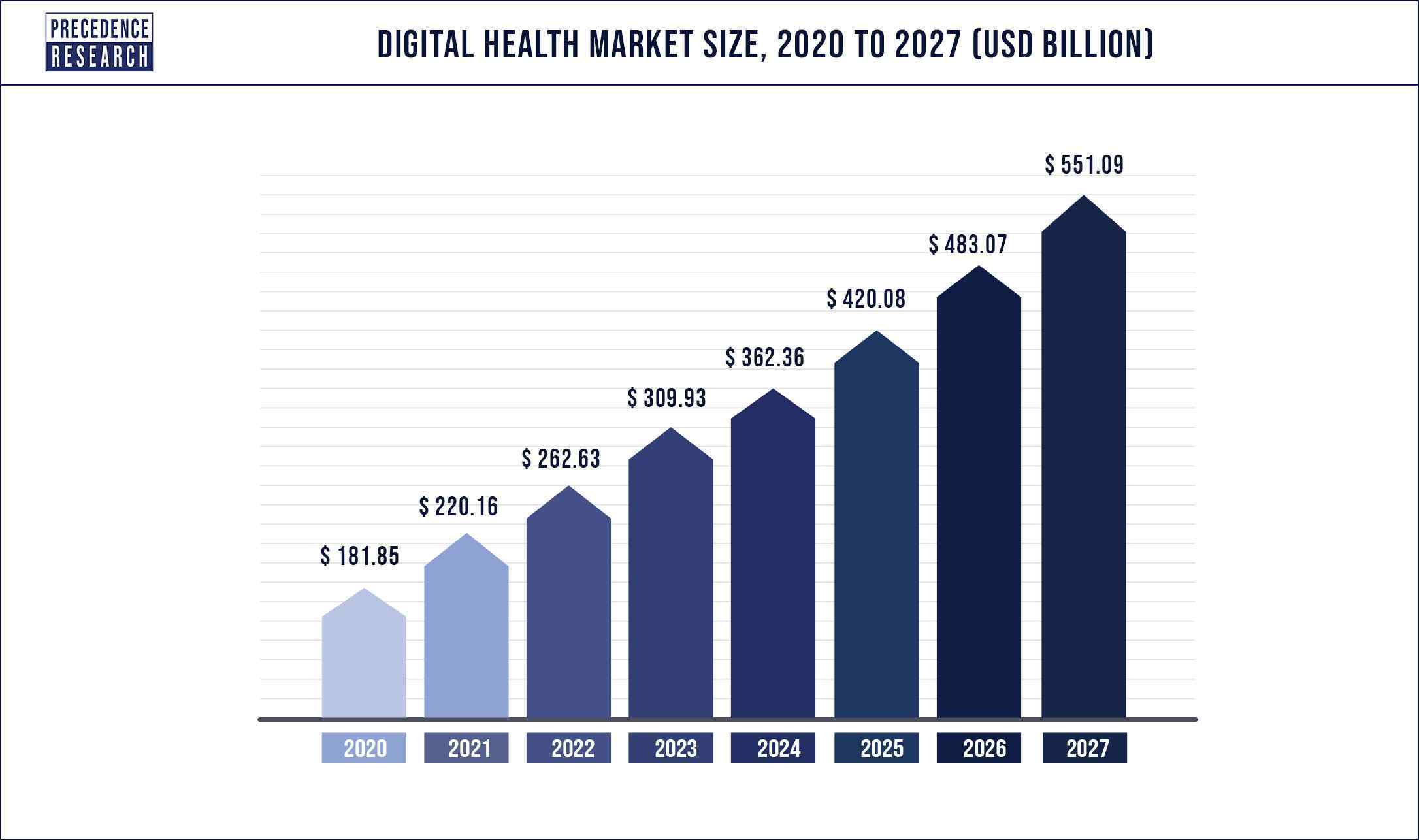

How big is digital health market? Up from US$ 220.16 Billion in 2021 to US$ 262.63 Billion in 2022 — and with an annual compounded growth rate of 16.5% worldwide — it’s predicted to exceed US$ 420.08 billion by 2025. And US$ 551.09 billion by 2027.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2027. The digital health market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Digital Healthcare function is largely based on the electronic health record (EHR), healthcare big data, electronic medical record (EMR), and many others. Digital healthcare provides smooth functioning of healthcare processes. Further, integration of artificial intelligence, machine learning, big data, and analytics platforms has prominently enhances the health functions and expected to continue the same trend over the upcoming years.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1145

Digital Health Market – Growth Factors

Significant increase in the number of healthcare apps is one of the major factors that contribute to propel the market growth. For instance, as per the data published by myhealthapps blog in 2017, there were nearly 325,000 health, medical, and fitness related mobile apps in the market. Where, health apps promote more effective and efficient communication between healthcare service providers and patients those are living in remote areas.

Moreover, the implementation of mobile devices is more common among the physicians. For example, according to HIMSS Mobile Technology Survey, conducted in the year 2015, 90% of the respondents were using mobile apps for patient engagement. In addition to this, nearly 40% of physicians believed that mHealth can significantly reduce the frequency of patient visits to the offices. Hence, increasing importance of mHealth and mobile devices in order to improve health outcomes along with patient care expected to positively influence the market growth.

Technological advancements and favorable initiatives for developing attractive digital solutions are the other key factors that estimated to drive the market growth. For example, in October 2015, AirRater, a health analytics app was introduced in Tasmania to track signs of people as well as to alert them regarding the air-borne pollutants, such as pollen.

However, data breach and security issue that is a major concern among the consumer that anticipated hampering the market growth over the forecast timeframe. Nonetheless, increasing penetration of analytics platform estimated to prosper the market growth over the coming years.

Digital Health Market Estimations Y-O-Y:

- Market Size Was Valued In 2021: US$ 220.16 Billion

- Market Size Is Projected to Reach By 2022: US$ 262.63 Billion

- Market Size Is Projected to Reach By 2027: US$ 551.09 Billion

- Compound Annual Growth Rate (CAGR) from 2022 to 2027: 4%

Scope of the Digital Health Market Report

| Report Highlights | Details |

| Base Year | 2021 |

| Forecast Year | 2022-2027 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Component, Technology and Regional Outlook |

Report Highlights:

- Based on the component, the service segment dominated the market in 2020 with a 64.58%. The service segment is estimated to be valued at US$ 141.54 billion in 2021 and is projected to increase to US$ 344.86 billion by 2027, witnessing a CAGR of 16% between 2021 and 2027. This is attributed to the increased adoption of software and the frequent upgradation of the software.

- The software companies offer a wide range of services post-installation like staffing, training, optimization, and other services. Furthermore, the surging investments in the development of digital infrastructure across the developed economies are significantly boosting the growth of the service segment.

- Based on the technology, mHealth segment dominated the global digital health market in 2019. This is primarily attributed to the rapid emergence of huge number of mHealth startups across the major markets. Moreover, the surging penetration of the digital devices and the improved access to internet has fueled the segment’s growth. The introduction of latest technologies like AI and sensors is expected to further drive the market growth in the forthcoming future.

- The tele healthcare segment is estimated to be valued at US$ 89.2 billion in 2021 and is projected to increase to US$ 296.2 billion by 2027, witnessing a CAGR of 22.14% between 2021 and 2027.

- North America was the leading digital health market with revenue share of 36.34%. The increased adoption of the digital technologies among the consumers and the healthcare providers has supplemented trhe market growth. According to the NCBI, around 95.0% of the adult population had a mobile phone, and around 64.0% of them owning smartphones in US in 2018. Fur4thermore, the amendments in the reimbursement policies pertaining to the telehealth services has significantly propelled the growth of the North America digital health market. The increased consumer awareness regarding the digital health and the increased prevalence of the chronic diseases coupled with high healthcare expenditure are some of the major factors that has driven the growth of the digital health market in North America.

- Asia Pacific is expected to witness growth at a CAGR of 19.11% during the forecast period. The presence of huge youth population, rising adoption of smartphones, growing literacy rate, rising healthcare expenditure, and rising awareness regarding the digital health are some of the prominent growth drivers of the Asia Pacific digital health market. The rising government investments in the digitization of healthcare infrastructure and development of smart hospitals are expected to foster the demand for the digital health in the near future.

- The europe region is estimated to be valued at US$ 79.09 billion in 2021 and is projected to increase to US$ 184.12 billion by 2027, witnessing a CAGR of 15.12% between 2021 and 2027.

Market Drivers: Rising demand for mobile health apps

The potential of mobile apps is being used to improve patient treatment in a variety of ways, including diagnosing illness, employing wearables, and ingestible sensors.We have become increasingly reliant on our smart devices now that we have entered the digital world. We continue to rely on smartphones to manage our calendars, coordinate our work and business operations, keep informed and connected through social media, and arrange doctor visits and healthcare check-ups. Healthcare app development has become both a need and a luxury.

The healthcare industry has seen significant changes as a result of technology advancements and meddling. We can see how mobile app development has aided in the evolution of the healthcare sector in recent years. The COVID-19 pandemic is still ongoing, and healthcare mobile apps have paved the path for great growth during this time of crisis, transforming people’s perceptions of the health industry worldwide.

Read Also: Digestive Health Products Market Size is Anticipated to Hit US$ 72.5 Billion by 2030

Digital Health Market – COVID-19 Impact Analysis

- The outbreak of the COVID-19 pandemic resulted in the increased adoption of the digital health products such as mHealth, telemedicine, EHR, and so on owing to the less number of visits to the hospitals.

- The fear of getting infected with COVID-19 disease has shifted the consumers towards the virtual technologies especially for receiving healthcare services.

- The rising trend of digitalization has gained extreme momentum during the COVID-19 period and is expected to sustain in the future.

Digital Health Market – Regional Snapshots

North America emerged as the dominating region in the global digital health market with nearly 40% of the value share in 2019. The growth of the region is mainly due to rising geriatric population along with high adoption rate of smartphones in the region. Further, the government favor regarding development of app and healthcare digital platforms in the region to cut the cost of healthcare spending is the other most prominent factor that escalated the growth of the region.

Besides this, the Asia Pacific examined to register significant CAGR over the upcoming years because of rising penetration of smartphones along with smart wearable devices in the region. Medical device companies are significantly collaborating with the software developers to develop different diagnostic and monitoring applications that enable the consumer to easily communicate with the healthcare physicians. Developing countries such as Thailand and Malaysia also encourages the development of low-cost healthcare mobile technology.

Key Developments in the Marketplace:

- In June 2018, Medidata acquired Shyft Analytics that helped Medidata to develop data platform to be used during the drug development phase.

- In October 2019, Meditech merged with Google to offer electronic health records data using the Google Cloud platform.

Some of the prominent players in the digital health market include:

- BioTelemetry Inc

- eClinicalWorks

- Allscripts Healthcare Solutions Inc

- iHealth Lab Inc

- AT & T

- Honeywell International Inc

- Athenahealth Inc.

- Cisco Systems

- McKesson Corporation

- Koninklijke Philips N.V.

- AdvancedMD Inc.

- Cerner Corporation

Market Segmentation

By Component

- Software

- Hardware

- Services

By Technology

- Telehealthcare

- Telehealth

- Video Consultation

- LTC Monitoring

- Telecare

- Remote Medication Management

- Activity Monitoring

- Telehealth

- mHealth

- Apps

- Fitness Apps

- Medical Apps

- Wearables

- Glucose Meter

- BP Monitor

- Pulse Oximeter

- Neurological Monitors

- Sleep Apnea Monitor

- Others

- Apps

- Digital Health Systems

- E-prescribing Systems

- Electronic Health Records

- Health Analytics

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

TABLE OF CONTENT

Chapter 1 Introduction

1.1 Research objective

1.2 Scope of the study

Chapter 2 Research Methodology

2.1 Research Approach

2.2 Market Research Process

2.2.1 Data procurement and data mining

2.2.2 Data analysis and standardization

2.2.3 Data processing and market formulation

2.2.4 Data validation

2.3 Market Research Approach1

2.4 Data Sources

2.4.1 Secondary Research

2.4.2 Primary Research

2.5 Assumptions & Limitations

Chapter 3 Executive Summary

3.1 Market snapshot

Chapter 4 Digital Health Market Variables and Scope

4.1 Introduction

4.1.1 Big data

4.1.2 Cloud computing

4.1.3 Connected health

4.1.4 eHealth

4.1.5 ePatients

4.1.6 Gamification

4.2 Market classification and scope

Chapter 5 COVID-19 Impact on Digital Health Market

5.1 COVID-19: Digital health industry impact

5.1.1 Immediate outbreak response

5.1.2 Impact mitigation

5.1.3 Growth opportunities

Chapter 6 Digital Health Market Dynamics Analysis and Trends

6.1 Market dynamics

6.1.1 Market drivers

6.1.1.1 Rising demand for mobile health apps

6.1.1.2 Rising penetration of Artificial Intelligence (AI), Internet of Things (IoT), and Big Data

6.1.1.2.1 Internet of Things (IoT)

6.1.1.2.2 Big Data

6.1.1.3 Artificial Intelligence (AI)

6.1.1.4 Converging AI, IoT, and Big Data in healthcare

6.1.2 Market restraint

6.1.2.1 Healthcare cybersecurity is a major restraint to the global digital health market

6.1.3 Market opportunities

6.1.3.1 Increasing penetration of digital health in emerging economies

6.2 Digital health supply chain analysis

Chapter 7 Global Digital Health Market, By Technology

7.1 Digital health market, by technology, 2016-2027

7.1.1 Market estimation and forecast, by technology, 2016-2027

7.2 Tele healthcare

7.2.1 Tele healthcare market estimation and forecast, by type, 2016-2027

7.3 mHealth

7.3.1 mHealth market estimation and forecast, by type, 2016-2027

7.4 Healthcare analytics

7.5 Digital health systems

7.5.1 Digital health systems market estimation and forecast, by type, 2016-2027

Chapter 8 Global Digital Health Market, By Component

8.1 Digital health market, by component, 2016-2027

8.1.1 Market estimation and forecast, by component, 2016-2027

8.2 Software

8.3 Hardware

8.4 Services

Chapter 9 Global Digital Health Market, By Region

9.1 Digital health market, by region, 2016-2027

9.1.1 Market estimation and forecast, by region, 2016-2027

9.2 North America

9.2.1 North America market estimation and forecast, by component, 2016-2027 (USD Billion)

9.2.2 North America market estimation and forecast, by technology, 2016-2027

9.2.3 US 58

9.2.3.1 US market estimation and forecast, by component, 2016-2027

9.2.3.2 US market estimation and forecast, by technology, 2016-2027

9.2.4 Rest of North America 60

9.2.4.1 Rest of North America market estimation and forecast, by component, 2016-2027

9.2.4.2 Rest of North America market estimation and forecast, by technology, 2016-2027

9.3 Europe

9.3.1 Europe market estimation and forecast, by component, 2016-2027

9.3.2 Europe market estimation and forecast, by technology, 2016-2027

9.3.3 Germany

9.3.3.1 Germany market estimation and forecast, by component, 2016-2027

9.3.3.2 Germany market estimation and forecast, by technology, 2016-2027

9.3.4 UK

9.3.4.1 UK market estimation and forecast, by component, 2016-2027 (USD Million)

9.3.4.2 UK market estimation and forecast, by technology, 2016-2027 (USD Million)

9.3.5 France

9.3.5.1 France market estimation and forecast, by component, 2016-2027

9.3.5.2 France market estimation and forecast, by technology, 2016-2027

9.3.6 Rest of Europe

9.3.6.1 Rest of Europe market estimation and forecast, by component, 2016-2027

9.3.6.2 Rest of Europe market estimation and forecast, by technology, 2016-2027

9.4 Asia Pacific

9.4.1 Asia Pacific market estimation and forecast, by component, 2016-2027

9.4.2 Asia Pacific market estimation and forecast, by technology, 2016-2027

9.4.3 China

9.4.3.1 China market estimation and forecast, by component, 2016-2027

9.4.3.2 China market estimation and forecast, by technology, 2016-2027

9.4.4 Japan

9.4.4.1 Japan market estimation and forecast, by component, 2016-2027

9.4.4.2 Japan market estimation and forecast, by technology, 2016-2027

9.4.5 India

9.4.5.1 India market estimation and forecast, by component, 2016-2027

9.4.5.2 India market estimation and forecast, by technology, 2016-2027

9.4.6 Southeast Asia

9.4.6.1 Southeast Asia market estimation and forecast, by component, 2016-2027

9.4.6.2 Southeast Asia market estimation and forecast, by technology, 2016-2027

9.4.7 Rest of Asia Pacific

9.4.7.1 Rest of Asia Pacific market estimation and forecast, by component, 2016-2027

9.4.7.2 Rest of Asia Pacific market estimation and forecast, by technology, 2016-2027

9.5 Latin America

9.5.1 Latin America market estimation and forecast, by component, 2016-2027

9.5.2 Latin America market estimation and forecast, by technology, 2016-2027 (USD Billion)

9.5.3 Brazil

9.5.3.1 Brazil market estimation and forecast, by component, 2016-2027 (USD Million)

9.5.3.2 Brazil market estimation and forecast, by technology, 2016-2027

9.5.4 Rest of Latin America

9.5.4.1 Rest of Latin America market estimation and forecast, by component, 2016-2027 (USD Million)

9.5.4.2 Rest of Latin America market estimation and forecast, by technology, 2016-2027

9.6 Middle East & Africa

9.6.1 Middle East & Africa market estimation and forecast, by component, 2016-2027

9.6.2 Middle East & Africa market estimation and forecast, by technology, 2016-2027

9.6.3 GCC

9.6.3.1 GCC market estimation and forecast, by component, 2016-2027

9.6.3.2 GCC market estimation and forecast, by technology, 2016-2027 (USD Million)

9.6.4 South Africa

9.6.4.1 South Africa market estimation and forecast, by component, 2016-2027

9.6.4.2 South Africa market estimation and forecast, by technology, 2016-2027

9.6.5 North Africa

9.6.5.1 North Africa market estimation and forecast, by component, 2016-2027 (USD Million)

9.6.5.2 North Africa market estimation and forecast, by technology, 2016-2027

9.6.6 Rest of MEA

9.6.6.1 Rest of MEA market estimation and forecast, by component, 2016-2027 (USD Million)

9.6.6.2 Rest of MEA market estimation and forecast, by technology, 2016-2027

Chapter 10 Competitive Landscape

10.1 Company market share/positioning analysis, 2020

10.2 Market players landscape

10.2.1 List of suppliers

10.2.2 List of end-users

Chapter 11 Company Profile

11.1 BioTelemetry Inc.

11.1.1 Company overview

11.1.2 Business outline

11.1.3 Product line

11.1.4 Recent developments

11.2 eClinicalWorks

11.2.1 Company overview

11.2.2 Business outline

11.2.3 Product line

11.2.4 Recent developments

11.3 Allscripts Healthcare Solutions Inc.

11.3.1 Company overview

11.3.2 Business outline

11.3.3 Financial performance

11.3.4 Product line

11.3.5 Recent developments

11.4 iHealth Lab Inc.

11.4.1 Company overview

11.4.2 Business outline

11.4.3 Product line

11.5 Honeywell International Inc.

11.5.1 Company overview

11.5.2 Business outline

11.5.3 Financial performance

11.5.4 Product line

11.5.5 Recent developments

11.6 athenahealth Inc.

11.6.1 Company overview

11.6.2 Business outline

11.6.3 Financial performance

11.6.4 Product line

11.6.5 Recent developments

11.7 Cisco Systems

11.7.1 Company overview

11.7.2 Business outline

11.7.3 Financial performance

11.7.4 Product line

11.7.5 Recent developments

11.8 McKesson Corporation

11.8.1 Company overview

11.8.2 Business outline

11.8.3 Financial performance

11.8.4 Product line

11.8.5 Recent developments

11.9 Koninklijke Philips N.V.

11.9.1 Company overview

11.9.2 Business outline

11.9.3 Financial performance

11.9.4 Product line

11.9.5 Recent developments

11.10 Cerner Corporation

11.10.1 Company overview

11.10.2 Business outline

11.10.3 Financial performance

11.10.4 Product line

11.10.5 Recent developments

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s digital health market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1145

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the CAGR of digital health market?” answer-0=”The global digital health market is growing at a compound annual growth rate (CAGR) of 16.5% during the forecast period 2022 to 2027. ” image-0=”” headline-1=”h6″ question-1=”How much is the global digital health market worth?” answer-1=”The global digital health market is valued at USD 220.16 billion in 2021 and is anticipated to hit USD 551.09 billion by 2027. ” image-1=”” headline-2=”h6″ question-2=”Who are the top key players in digital health market?” answer-2=”Some of the key players operating in the market are BioTelemetry Inc, eClinicalWorks, Allscripts Healthcare Solutions Inc, iHealth Lab Inc, AT & T, Honeywell International Inc, Athenahealth Inc., Cisco Systems, McKesson Corporation, Koninklijke Philips N.V., AdvancedMD Inc., and Cerner Corporation among others. ” image-2=”” headline-3=”h6″ question-3=”Which segment accounted for the largest digital health market share?” answer-3=”Based on component, services captured the major market revenue accounting for nearly half of the market share in 2019 due to the significant rise in the software upgradation. ” image-3=”” headline-4=”h6″ question-4=”Which region dominated the digital health market share?” answer-4=”North America dominated the market with a revenue share of around 40% in 2019 due to increasing number of geriatric population and rising prevalence of chronic diseases across the region. ” image-4=”” count=”5″ html=”true” css_class=””]