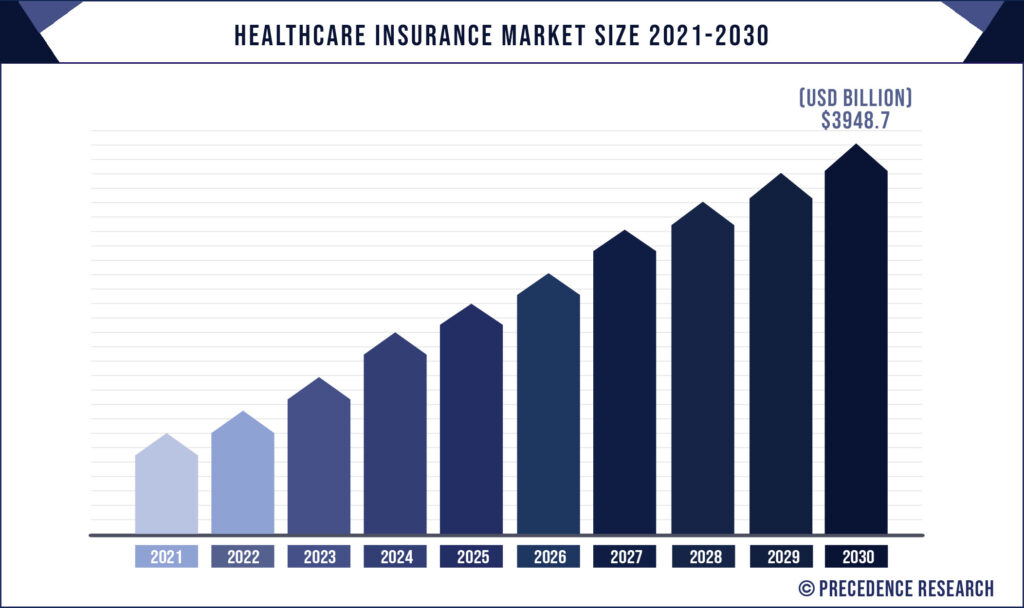

According to the industry experts, The global healthcare insurance market was valued at USD 1,899 billion in 2021 and is projected to reach US$ 3,948.7 billion by 2030, growing at a CAGR of 7.6% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The healthcare insurance market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The high costs associated with the healthcare are a major factor behind the burgeoning demand for the healthcare insurance market. The rising prevalence of various chronic diseases, high expense associated with the latest treatments, alarming rise in the number of road accidents, and improved services of the insurer regarding the claim settlement are the significant factors that are contributing towards the growth of the global healthcare insurance market.

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1369

The COVID-19 had a very evident impact on the global healthcare insurance market. The rapidly spreading COVID-19 disease among the population made people scared. Moreover, the private hospitals were offering very expensive treatment for the COVID-19 patients. This high cost of the COVID virus and higher chances of getting affected with the virus compelled the population to increasing opt for a healthcare insurance.According to Policybazaar.com, an online portal for all types of insurance products, it sold one million insurance policies between April and December in 2020.

Healthcare Insurance Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

North America dominated the market in 2020. The rising awareness regarding the healthcare insurance, increased adoption of technologically advanced treatments, and growing geriatric population are the major driving force of the market. Moreover, the increased disposable income and higher demand for the latest and expensive treatment methods is fueling the growth of the market.

Asia Pacific is expected to be the fastest growing market during the forecast period. Rapid urbanization, increased healthcare costs in the region, rising disposable income, rapidly growing healthcare and the insurance sector, and growing demand for saving medical expenses. The rising number of young population in the region are expected to be an important driver of the healthcare insurance market in the region.

The rising burden of diseases and associated expensive treatments remains the major driver of the healthcare insurance market. According to the International Agency for Research on Cancer, around 19.3 million new cancer cases and around 10 million cancer related deaths were reported in the year 2020, across the globe. According to the World Health Organization, diabetes is a major cause of blindness, kidney failure, heart attacks, and strokes. According to the WHO, road accidents are the major cause of death among the children and young adults, aged 5 years to 29 years. All these health risks are the major drivers of the healthcare insurance market.

The low awareness and less public confidence on the private players especially in the developing and underdeveloped nations is a major challenge for the healthcare insurance players. For instance, LIC Corporation is a Indian government controlled and funded insurance company and it enjoys 100% consumer confidence, while the private insurance companies lacks in building the confidence of the consumers.

The low disposable income of the consumers in the developing and the underdeveloped economies is a major factor that may hamper the market growth. The low income group utilizes all their income in fulfilling their basic needs and has no intention to invest in any kind of insurance policies. Moreover, the increased penetration of government hospitals that offers treatment and medicines at low cost or free of cost is the major factor that may hinder the market growth during the forecast period.

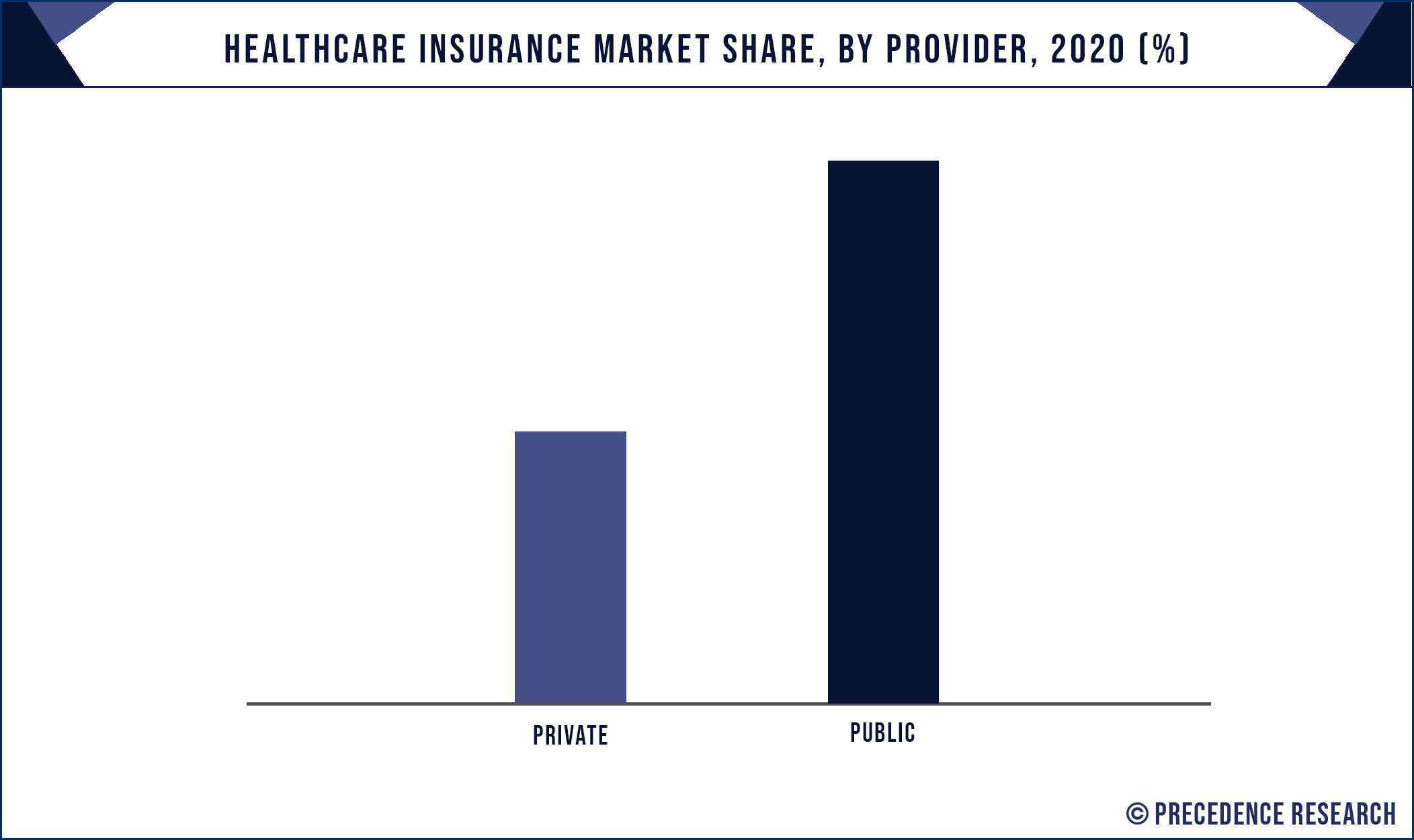

Based on the provider, the public segment dominated the market in 2020. This is because consumers seeks confidence and trust with their money and when the government itself becomes the insurer, it gets rapid traction in the market. For instance, Medicare and Medicaid are the government operated insurance companies in the US that has no trust issues in the minds of the common public.

Based on the coverage type, the term insurance segment is expected to be the fastest-growing segment during the forecast period. Term insurances provides higher coverage at lower cost as it mainly involves health insurance and it covers the expenses of any medical emergencies or critical health conditions. The healthcare costs are very high and consumers are opting for term insurance policies owing to the rising burden of diseases across the globe.

Based on the provider type, the preferred provider organization (PPO) was the dominating segment in 2020. The PPO offers huge number of options in the hospitals and doctors to choose from. The customers or the insurance policy holders have full independence of choosing his doctor or hospital. This is also the most common provider type, which is a major reason behind its dominance.

Read Also: Telemedicine Market Revenue to Reach US$ 225 Billion by 2030

Key Players/Manufacturers

This report also provides detailed company profiles of the key market players. This research report also highlights the competitive landscape of the healthcare insurance market and ranks noticeable companies as per their occurrence in diverse regions across the globe and crucial developments initiated by them in the market space. This research study also tracks and evaluates competitive developments, such as collaborations, partnerships, and agreements, mergers and acquisitions; novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the prominent players in the global healthcare insurance market include:

- Aetna Inc.

- AIA Group Limited

- Allianz

- ASSICURAZIONI GENERALI

- Aviva

- AXA

- Cigna

- Ping An Insurance (Group)

- UnitedHealth Group

- Zurich

Healthcare Insurance Market Segments Covered

Segments Covered in the Report

By Provider Type

- Public

- Private

By Coverage Type

- Term Insurance

- Life-time Coverage

By Health Insurance Plans Type

- Point of Service

- Preferred Provider Organizations

- Exclusive Provider Organizations

- Health Maintenance Organizations

By End-use Type

- Individuals

- Corporates

- Adults

By Level of Coverage Type

- Bronze

- Silver

- Gold

- Platinum

By Demographics Type

- Minors

- Adults

- Seniors

By Geography

- North America

-

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the healthcare insurance industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global healthcare insurance market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the healthcare insurance

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Healthcare Insurance Market, By Provider Type

7.1. Healthcare Insurance Market, by Provider Type, 2021-2030

7.1.1. Public

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Private

7.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Healthcare Insurance Market, By Coverage Type

8.1. Healthcare Insurance Market, by Coverage Type, 2021-2030

8.1.1. Term Insurance

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Life-time Coverage

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Healthcare Insurance Market, By Health Insurance Plans Type

9.1. Healthcare Insurance Market, by Health Insurance Plans Type, 2021-2030

9.1.1. Point of Service

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Preferred Provider Organizations

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Exclusive Provider Organizations

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Health Maintenance Organizations

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Healthcare Insurance Market, By End-use Type

10.1. Healthcare Insurance Market, by End-use Type, 2021-2030

10.1.1. Individuals

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Corporates

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Adults

10.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Healthcare Insurance Market, By Level of Coverage Type

11.1. Healthcare Insurance Market, by Level of Coverage Type, 2021-2030

11.1.1. Bronze

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Silver

11.1.2.1. Market Revenue and Forecast (2019-2030)

11.1.3. Gold

11.1.3.1. Market Revenue and Forecast (2019-2030)

11.1.4. Platinum

11.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Healthcare Insurance Market, By Demographics Type

12.1. Healthcare Insurance Market, by Demographics Type, 2021-2030

12.1.1. Minors

12.1.1.1. Market Revenue and Forecast (2019-2030)

12.1.2. Adults

12.1.2.1. Market Revenue and Forecast (2019-2030)

12.1.3. Seniors

12.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 13. Global Healthcare Insurance Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.1.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.1.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.1.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.1.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.1.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.1.7. U.S.

13.1.7.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.1.7.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.1.7.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.1.7.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.1.7.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.1.7.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.1.8.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.1.8.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.1.8.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.1.8.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.1.8.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.2.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.2.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.2.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.2.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.2.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.2.7. UK

13.2.7.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.2.7.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.2.7.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.2.7.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.2.7.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.2.7.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.2.8. Germany

13.2.8.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.2.8.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.2.8.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.2.8.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.2.8.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.2.8.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.2.9. France

13.2.9.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.2.9.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.2.9.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.2.9.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.2.9.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.2.9.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.2.10. Rest of Europe

13.2.10.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.2.10.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.2.10.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.2.10.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.2.10.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.2.10.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.3.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.3.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.3.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.3.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.3.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.3.7. India

13.3.7.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.3.7.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.3.7.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.3.7.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.3.7.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.3.7.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.3.8.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.3.8.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.3.8.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.3.8.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.3.8.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.3.9. Japan

13.3.9.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.3.9.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.3.9.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.3.9.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.3.9.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.3.9.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.3.10. Rest of APAC

13.3.10.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.3.10.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.3.10.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.3.10.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.3.10.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.3.10.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.4.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.4.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.4.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.4.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.4.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.4.7. GCC

13.4.7.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.4.7.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.4.7.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.4.7.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.4.7.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.4.7.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.4.8.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.4.8.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.4.8.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.4.8.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.4.8.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.4.9. South Africa

13.4.9.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.4.9.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.4.9.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.4.9.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.4.9.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.4.9.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.4.10. Rest of MEA

13.4.10.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.4.10.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.4.10.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.4.10.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.4.10.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.4.10.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.5.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.5.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.5.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.5.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.5.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.5.7. Brazil

13.5.7.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.5.7.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.5.7.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.5.7.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.5.7.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.5.7.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Provider Type (2019-2030)

13.5.8.2. Market Revenue and Forecast, by Coverage Type (2019-2030)

13.5.8.3. Market Revenue and Forecast, by Health Insurance Plans Type (2019-2030)

13.5.8.4. Market Revenue and Forecast, by End-use Type (2019-2030)

13.5.8.5. Market Revenue and Forecast, by Level of Coverage Type (2019-2030)

13.5.8.6. Market Revenue and Forecast, by Demographics Type (2019-2030)

Chapter 14. Company Profiles

14.1. Aetna Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. AIA Group Limited

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Allianz

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. ASSICURAZIONI GENERALI

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Aviva

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. AXA

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Cigna

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Ping An Insurance (Group)

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. UnitedHealth Group

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Zurich

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s healthcare insurance market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1369

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com