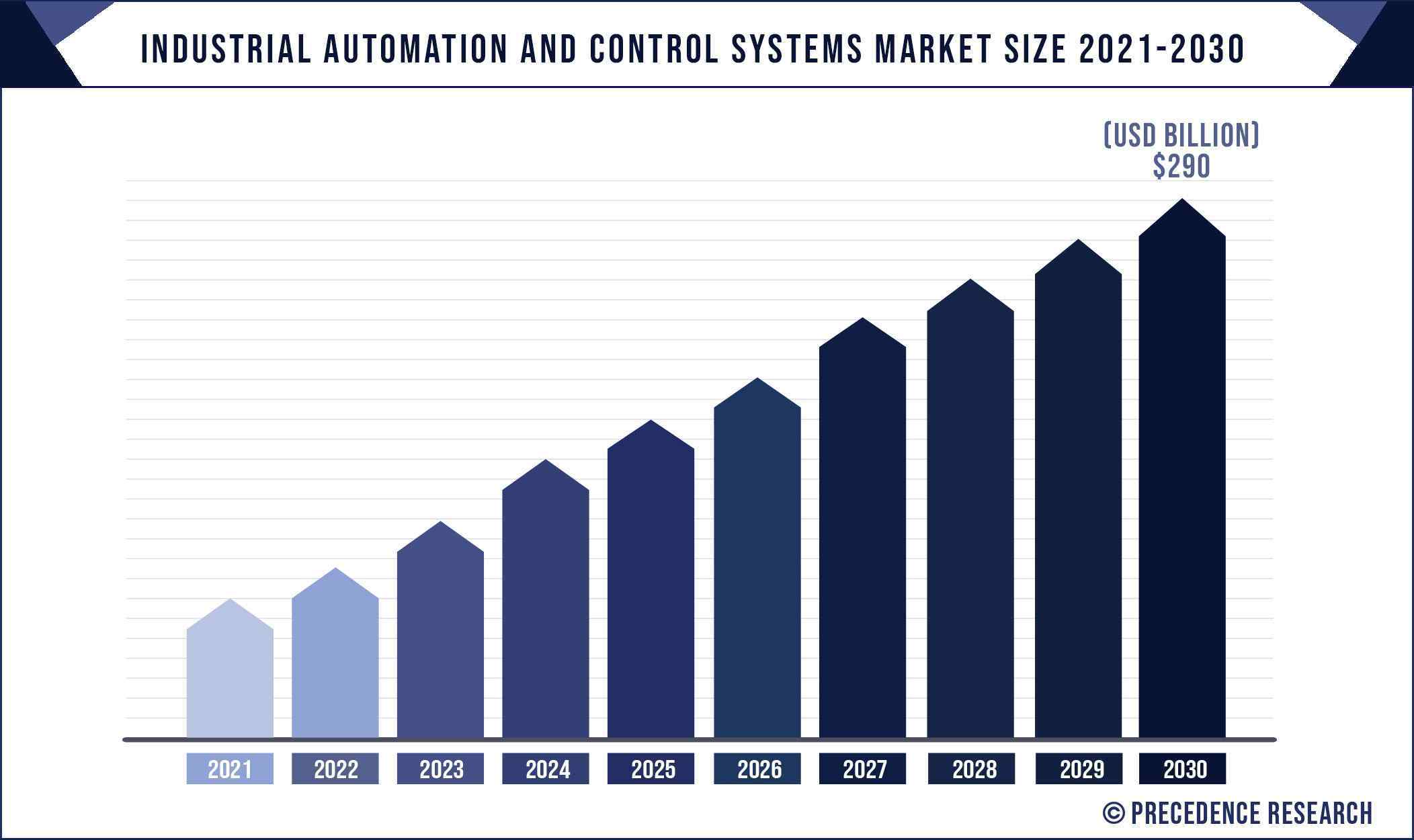

According to the industry experts, The industrial automation and control systems market garnered $ 145 billion in 2020 and is expected to generate $ 290 billion by 2030, manifesting a CAGR of 9.2% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The industrial automation and control system market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1344

Industrial Automation and Control Systems Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Crucial Factors of Industrial Automation and Control Systems Market

- Rapid shift of industries toward smart manufacturing.

- Investments in smart factory automation

- Increasing government spending on the automation system

- The innovation and technological advancement

- The increasing R&D expenditure of the market leaders

Industrial Automation and Control Systems Market Report Highlights

- Based on the component, the control valve segment is the most dominating in the industrial automation and control system market due to rapid growth in the technologies and it is expected to continue in the forecast period.

- The DCS is the major contributor in the industrial automation and control system market due to its advantages in the automation and control system.

- The manufacturing industry held the largest share in the industrial automation and control system market. Manufacturing industry trends are in the spotlight as the industry undergoes its most significant transformation in recent years.

Industrial Automation and Control Systems Market Dynamics

Driver

Because of significant technological breakthroughs in robotics, the industrial sector has seen an increase in the incorporation of robotics engineering and technology into its production processes. Industrial robots are versatile manipulator machines that are autonomously controlled and reprogrammable. Welding, painting, ironing, assembling, pick and place, palletizing, product inspection, and testing are common uses for industrial robots, all of which are achieved with high endurance, speed, and precision. Industrial robots perform repeatable operations, reducing the need for human labor.

Furthermore, the Internet of Things (IoT) is a dominant trend, with industrial and consumer products being connected via the internet. According to the World Bank, the number of IoT-connected devices increased to 20.35 billion in 2017, up from 15.41 billion in 2015, and is predicted to reach 51.11 billion by 2023. HMIs are becoming more sophisticated in order to operate the growing number of connected devices. Furthermore, the emergence of Industry 4.0 and the Industrial Internet of Things (IIoT) has made this more accessible, since it has become easier to convert smartphones into a type of mobile HMI, and technologies like as smartwatches have made HMI wearable, boosting accessibility and convenience of use.

Restraint – Large investments

Automation necessitates significant capital expenditure because it entails the installation of hardware such as dexterous robots, sensory perception devices, and mobility wheels. This results in exorbitant start-up costs. However, as costs fall over time, automation becomes increasingly competitive with human labor.

Replacing human workers may not necessarily result in a reduction in an organization’s operational expenditures. A single collaborative robot system can range in price from USD 3,000 to $100,000. An industrial robotic system is significantly more expensive, with prices ranging from USD 15,000 to USD 150,000. The cost of industrial robots, combined with integration and peripheral costs, such as end effectors and vision systems, makes automation an expensive investment for SMEs, particularly those involved in low-volume production.

Opportunities – The increasing government investments and initiatives

The government is aiming for an investment of 12 billion USD 362 million in the first year, expanding toUSD 6 billion Baht over the next five years in Thailand. The development plan also aims to reduce the import of robotics and automation systems by USD 3.97 billion on an annual basis.Companies like Cairn, an Indian oil and gas plant has shown that through automation and digitization, they were able to keep up their production of 1.6 lakh barrels of oil every day, as against 1.8 lakh barrels with less than 1/3rd of their workforce due to the quarantine measures. These investments and initiatives taken by the government companies will lead to the spur the market growth of industrial automation and control system.

Indonesia issued two stimulus packages in response to the COVID-19 outbreak. The first bundle, worth $725 million, was introduced in February 2020, while the second package, worth $8 billion, was released in March 2020. The second stimulus package was introduced to protect the economy and small and medium-sized firms (SMEs), notably those in the manufacturing sector. To mitigate the negative impact of COVID-19 on businesses, the Singapore government will not raise the goods and services tax (GST), which will stay at 7%.

Challenges – Skilled Manpower

The occupations will be mechanized are directly determined by the demand and supply of skilled and unskilled labor. Countries with higher wages, such as those in the service sector, may use automation earlier than countries with lower wages. India, being a growing country, continues to face a shortage of trained labor in the automation sector.

Regional Snapshots

The Asia Pacific is the most dominating in the industrial automation and control system market followed by North America and Europe. Asia Pacific is the market leader in industrial automation and control systems, followed by North America and Europe. According to CGTN, China’s industrial robot output increased by 29.2 percent year on year in June to 20,761 units, reaching a peak in the first half of 2020. According to National Bureau of Statistics data, the country manufactured 93,794 units of industrial robots over the past six months, up 10.3 percent from the same period last year, with growth accelerating from 16.9 percent in May.

The industrial sector in the United States continues to spend heavily in robots and automation. The United States’ automotive sector has the second highest robot density in the world, trailing only Japan. The industrial boom in North America continues unabated; assuming the global economy remains solid, robot shipments to Canada, Mexico, and the United States are expected to expand at a 5 to 10% yearly rate. Because of the high demand for industrial robots, the industrial automation and control system market will expand at a rapid pace.

Industrial Automation and Control Systems Market Key Players/Manufacturers

This report also provides detailed company profiles of the key market players. This research report also highlights the competitive landscape of the industrial automation and control system market and ranks noticeable companies as per their occurrence in diverse regions across the globe and crucial developments initiated by them in the market space. This research study also tracks and evaluates competitive developments, such as collaborations, partnerships, and agreements, mergers and acquisitions; novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the prominent players in the global industrial automation and control systems market include:

- ABB

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Yokogawa Electric Corporation

- General Electric

Industrial Automation and Control Systems Market Segments Covered

By Component

- HMI

- Industrial Robots

- Control Valves

- Sensors

- Others

By Control System

- DCS

- PLC

- SCADA

- Others

By Vertical

- Aerospace & Défense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the industrial automation and control system industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global industrial automation and control system market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the industrial automation and control system

Key Points of Industrial Automation and Control Systems Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Automation and Control Systems Market

5.1. COVID-19 Landscape: Industrial Automation and Control Systems Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Automation and Control Systems Market, By Component

8.1. Industrial Automation and Control Systems Market, by Component Type, 2021-2030

8.1.1. HMI

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Industrial Robots

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Control Valves

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Sensors

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Industrial Automation and Control Systems Market, By Control System

9.1. Industrial Automation and Control Systems Market, by Control System, 2021-2030

9.1.1. DCS

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. PLC

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. SCADA

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Industrial Automation and Control Systems Market, By Vertical

10.1. Industrial Automation and Control Systems Market, by Vertical , 2021-2030

10.1.1. Aerospace & Défense

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Chemical

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. Energy & Utilities

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Food & Beverage

10.1.5.1. Market Revenue and Forecast (2019-2030)

10.1.6. Healthcare

10.1.6.1. Market Revenue and Forecast (2019-2030)

10.1.7. Manufacturing

10.1.7.1. Market Revenue and Forecast (2019-2030)

10.1.8. Mining & Metal

10.1.8.1. Market Revenue and Forecast (2019-2030)

10.1.9. Oil & Gas

10.1.9.1. Market Revenue and Forecast (2019-2030)

10.1.10. Transportation

10.1.10.1. Market Revenue and Forecast (2019-2030)

10.1.11. Others

10.1.11.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Industrial Automation and Control Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.2. Market Revenue and Forecast, by Control System (2019-2030)

11.1.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.2. Market Revenue and Forecast, by Control System (2019-2030)

11.2.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Control System (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Control System (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.2. Market Revenue and Forecast, by Control System (2019-2030)

11.3.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Control System (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Control System (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Control System (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Control System (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Control System (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Vertical (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Control System (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Vertical (2019-2030)

Chapter 12. Company Profiles

12.1. ABB

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Emerson Electric Co.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Rockwell Automation, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Schneider Electric

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Siemens AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Honeywell International, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Kawasaki Heavy Industries, Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mitsubishi Electric Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. OMRON Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Yokogawa Electric Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. General Electric

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s industrial automation and control system market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1344

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com