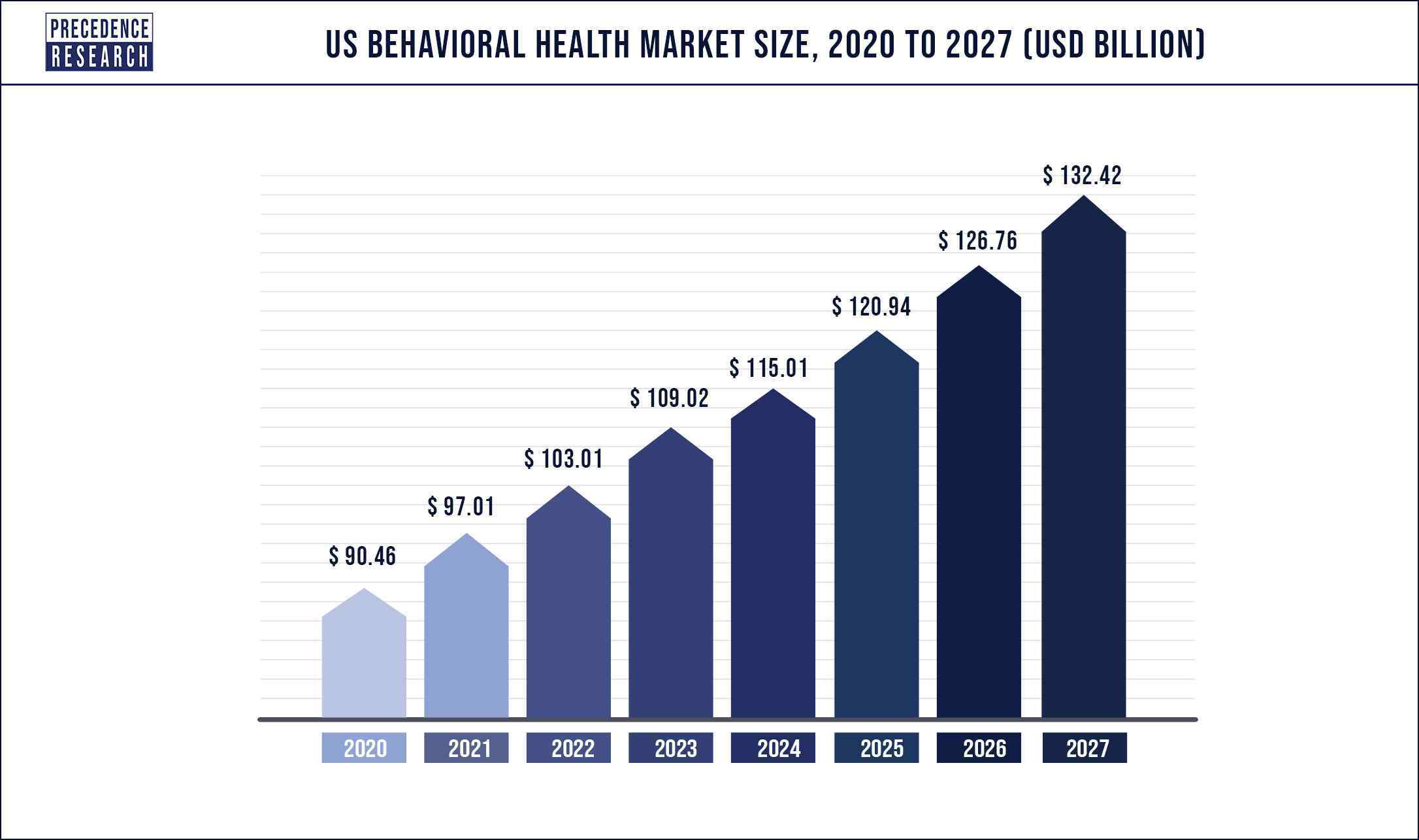

According to Precedence Research, The U.S. behavioral health market size garnered US$ 90.5 billion in 2020 and is expected to generate US$ 132.4 billion by 2027, manifesting a CAGR of 5.3% from 2020 to 2027. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The U.S. behavioral health market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit). the penetration of digital technologies such as telehealth and increased funding to address mental health issues had propelled the market for Behavioral Health in the US.

Mental health is a vitalpart of a person’s total health. People usually think a “healthy individual” as someone free of medical diseases; however, a perfectly healthy person is someone who is in a state of complete bodily, mental, and social well-being. A wide range of social, biological, and psychological elements all have a role in determining an individual’s mental health. External variables, such as stress, socioeconomic situations, prejudice, and violence, are frequently a component of the equation. Individuals with good mental health are more likely to be able to work efficiently, cope with the regular demands of daily life, and contribute to their families and communities.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1320

Mental disorders, on the other hand, are frequently described as conditions that affect a person’s behavior, mood, as well as how they feel, think or react. Anxiety disorders, psychotic disorders, eating disorders, drug abuse disorders, depression or bipolar disorders that affect an individual’s mood, trauma-related disorders, personality disorders, and eating disorders are all common mental illnesses with a wide range of severity. The COVID -19 pandemic along with the subsequent economic recessions have adversely impacted many people’s mental health and initiated new barriers for people who were previously suffering from substance use disorders and other mental ailments.

COVID-19 Pandemic has resulted to National Mental Health Catastrophe in the U.S. and has Opened New Avenues for Innovative Technologies in Behavioral Health Market.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global U.S. behavioral health market include:

Acadia Healthcare, Promises Behavioral Health (Elements Behavioral Health), Epic Health Services (Aveanna Healthcare), Universal Health Services, Behavioral Health Group, Inc., IBH Population Health Solutions, CuraLinc Healthcare, North Range Behavioral Health, Ardent Health Services and CRC Health Group.

U.S. Behavioral Health Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Home-based treatment services

Instead of being held in an office, home-based therapy takes place in the house of the individual receiving treatment. People who have trouble going to private practices or mental health facilities may benefit from it. Money concerns, age, chronic medical issues, agoraphobia, and responsibilities at home or work are all factors that may prevent someone from seeking treatment.

Many home-based rehabilitation programs are available through community health groups and child protective agencies. Whether or not access to care is a concern, private practice therapists may offer in-home sessions if it appears to be the most helpful method of treatment.

Home-based treatment can be provided by psychologists, psychiatrists, marriage and family therapists, counselors, social workers, and other mental health experts. In a session, a variety of approaches may be used. Individual treatment, couples’ therapy, play therapy, and family therapy are some of the options.

US Behavioral Health Market Share, By Service, 2020 (%)

| Service Segment | 2020 (%) | |

| Home-Based Treatment Services | 15.3 | % |

| Outpatient counseling | 35.1 | % |

| Emergency mental health services | 8.6 | % |

| Inpatient hospital treatment | 22 | % |

| Intensive care management | 19 | % |

Outpatient counseling

Outpatient mental health treatments can include one or more mental health therapies that do not require a lengthy stay in an institution. Patients who receive treatment in outpatient care learn to cope with pressures and regulate their mental health. Counseling, group therapy, medical consultations, and psychiatry are examples of these services. Short-term counseling to long-term care regimens that include therapy and/or medication is all options for treatment.

Outpatient care is the most popular treatment for many mental health issues since it is less expensive, more flexible with patients’ requirements and schedules, and has a broader provider pool. Outpatient treatment should be used only when continuous support is not required and it is healthier for the patient to remain in their natural surroundings to face stressors and learn to manage with expert assistance. For people suffering from eating disorders, depression, or anxiety, this is frequently the best course of action.

Emergency mental health services

A mental health crisis occurs when a person’s thoughts, emotions, and behaviors put them in danger of injuring themselves or others, or when they are unable to care for themselves or obtain food, clothing, or shelter. Acute conditions that could soon worsen into dangerousness or inability to care for oneself are also included in crises, even if they are not currently a concern. A mental health crisis can occur anywhere—in public, at home or work, or in a variety of clinical settings.

Emergency mental health services are an important aspect of a mental health hospital. Patients who are addicted to alcohol or drugs, schizophrenic, depressed, or suffer from panic attacks as a result of anxiety are frequently dealt with by family and caregivers. Several hospitals have hotlines as part of emergency mental health services.

US Behavioral Health Pre-COVID-19 Market Size and Estimations, By Service, 2016-2020 (USD Billion)

| Service Segment | 2016 | 2017 | 2018 | 2019 | 2020 |

| Home-Based Treatment Services | 9.06 | 9.06 | 10.89 | 11.87 | 13.86 |

| Outpatient counseling | 25.76 | 27.07 | 28.35 | 29.62 | 31.72 |

| Emergency mental health services | 6.42 | 6.73 | 7.04 | 7.34 | 7.64 |

| Inpatient hospital treatment | 16.29 | 17.13 | 17.97 | 18.80 | 19.61 |

| Intensive care management | 13.86 | 14.59 | 15.32 | 16.04 | 16.75 |

| Total | 71.39 | 75.48 | 79.57 | 83.66 | 87.75 |

Inpatient hospital treatment

Inpatient treatment is the most severe form of treatment for those with mental illnesses and addictions. It provides 24-hour care in a safe and secure environment, making it ideal for patients who require constant monitoring due to serious mental health or substance misuse concerns. Understanding the indicators of psychiatric disease, fast stabilization, devising methods to avoid re-hospitalization, and discharge planning are all priorities in the inpatient setting. Patients in inpatient treatment programs can work on regaining life skills without being exposed to negative influences that encourage them to continue their harmful behavior.

Acute inpatient care is still an important part of current mental health care. Despite their necessity, mental inpatient hospitals are still frequently perceived as terrifying environments, with overworked staff unable to deliver therapeutic care in an unpleasant physical environment.

Intensive care management

Intensive care management (ICM) is a community-based package of care aimed at providing long-term care for severely mentally ill patients who do not require emergency admission. ICM arose from two initial community-based care models, Assertive Community Treatment (ACT) and Case Management (CM), with ICM emphasizing the significance of a small caseload (less than 20) and high-intensity input.

Telehealth has been penetrating the ICM market segment gradually over the past few years. For instance, the Eastern Oklahoma VA Health Care System (EOVAHCS) with facilities in Tulsa and the rural areas of Muskogee, McAlester, Vinita, and Idabel, serves nearly 47,000 veterans in a 25-county region. Rural veterans in the intensive care unit (ICU) and emergency department will now have access to 24/7 remote patient monitoring thanks to a partnership between EOVAHCS and the Cincinnati VA Medical Center’s Tele-ICU Monitoring Center.

Teleconferencing equipment is available in twelve ICU rooms and three emergency department rooms at EOVAHCS. EOVAHCS also features two portable units that can be used to connect from any room in the institution. This device allows critical care nurses to communicate with providers and other critical care nurses at the Cincinnati VA Medical Center. Providers and nursing staff can use teleconferencing to retrieve patients’ bedside data, videoconference with patients, conduct consultations, and communicate with clinical professionals in the event of a medical emergency.

When a tele-ICU clinician or nurse enters a room virtually, the camera rotates to face the patient, allowing the provider and patient to converse. When the teleconference session is over, the camera goes off. Video is not recorded by the cameras.

Tele-ICU clinicians completed 11,058 video examinations on ICU patients at EOVAHCS from October 2019 to April 2021. This resulted in an additional 17,578 hours of assessment time by an Intensivist or a Certified Critical Care RN. This improves the quality of care delivered by bedside employees and adds another layer of support.

The emergency department (ED) has had difficulty using remote patient monitoring since the critical patient is not in a room equipped with the equipment. Staff members frequently use tele-ICU to report on patients who will be admitted to the ICU.

Due to camera failure, the tele-ICU team has been unable to visit patients due to technological issues. To address this, the facility’s patient monitoring system in the ICU and ED has been modified.

Large proportion of young adults reported with a number of pandemic-related consequences resulting into poor mental health.

Young adults of age amongst 18-24 have predominated the share with the symptoms of depressive disorder and anxiety to 56% as reported in December 2020 in comparison to other older adults. An earlier study conducted in June 2020 found comparable results for young adults whencompared to all individuals.Many young adults have experienced heightened worry, depression, sleep disturbances, andsuicidal thoughts as a result of the pandemic. They’ve also dealt with a slew of pandemic-relatedconsequences, including university closures, shifts to remote work, and loss of income or job, all of which might wreak havoc on their mental health. In comparison to older persons, a high number of young adults (ages 18-24) had reported symptoms of anxiety and/or depressive disorder throughout the pandemic – 56% as of December 2020 – according to a KFF study of the Household Pulse Survey

Adults with symptoms of anxiety or depressive disorder all over Pandemic, By Age (%)

The poll also discovered that substance abuse and suicidal ideationare more prevalent among young adults, with 25% stating that they began or escalated substance abuse during the pandemic (compared to 13% of all adults) and 26% having serious thoughts of suicide (compared to 11% of all adults). Young adults were already at high risk of poor mental health and substance use disorder before the coronavirus pandemic.

An array of innovative digital technologies have transformed the behavioral health ecosystem

Virtual mental health consulting through novel digital technologies turned out to be a boon to behavioral health market in the United States. The enormous and sudden challenges in the year 2020 has fueled the pace of behavioral health market and propelled the industry participants for the future new entrants as well as disruptors to take advantage of the trend, consumerism, technology for managing data and other scientific insights. The disruption factors of the pandemic and others stigma associated with ithad significantly contributed for the change in market by developing business models as well as solutions that hadradically transformed as well as amend behavioral health challenges to greater extent.

KEY HIGHLIGHTS OF THE STUDY

- The home-based treatment service is estimated to grow at the remarkable rate during the study period.

- Outpatient counseling accounted for the largest share in 2020 exhibiting one third of the total market share.

- Anxiety & depression disorder dominated the market, accounting for maximum share in 2020, and is expected to retain the same trend during the forecast period.

- The substance abuse disorder segment is expected to grow at the fastest growth rate during the forecast period.

- Outpatient clinics of end user segment generated the highest revenue in 2020 and are anticipated to maintain this trend throughout the forecast period. Whereas, homecare setting is growing at the fastest rate from 2021 to 2027.

Market Competitiveness and Business Outlook

The US behavioral health market is a highly fragmented market with the presence of pan-US network providers as well as single units of mental health hospitals and clinics; and non-profit organizations. The increasing prevalence of mental disorders such as PTSD, anxiety, depression, as well a substance abuse, especially over the last year due to the pandemic, is driving the market growth. However, decreasing the footfall of patients in hospitals due to greater emphasis on COVID cases has resulted in mental health treatment taking a backseat. These limitations have resulted in paving the way for telehealth solutions including phone/video consultations, apps for accessing doctor/pharmacy/patient information, and texting, among others. Over the next few years, the US behavioral market is expected to be characterized by the entry of several start-ups bringing in new tech to the market.

U.S. Behavioral Health Market Segments Covered

By Service

- Home-Based Treatment Services

- Outpatient counseling

- Emergency mental health services

- Inpatient hospital treatment

- Intensive care management

By Disorder

- Bipolar Disorder

- Anxiety Disorder

- Depression

- Post-Traumatic Stress Disorder

- Eating Disorder

- Substance Abuse Disorder

- Others

By End User

- Outpatient Clinics

- Hospitals

- Rehabilitation Centers

- Homecare Setting

Research Objective

- To provide a comprehensive analysis of the U.S. behavioral health industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global U.S. behavioral health market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the U.S. behavioral health

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Behavioral Health Market

5.1. COVID-19 Landscape: U.S. Behavioral Health Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Behavioral Health Market, By Service

8.1. U.S. Behavioral Health Market, by Service Type, 2021-2030

8.1.1. Home-Based Treatment Services

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Outpatient counseling

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Emergency mental health services

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Inpatient hospital treatment

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. Intensive care management

8.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 9. U.S. Behavioral Health Market, By End User

9.1. U.S. Behavioral Health Market, by End User, 2021-2030

9.1.1. Outpatient Clinics

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Rehabilitation Centers

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Homecare Setting

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. U.S. Behavioral Health Market, By Disorder

10.1. U.S. Behavioral Health Market, by Disorder, 2021-2030

10.1.1. Bipolar Disorder

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Anxiety Disorder

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Depression

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. Post-Traumatic Stress Disorder

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Eating Disorder

10.1.5.1. Market Revenue and Forecast (2019-2030)

10.1.6. Substance Abuse Disorder

10.1.6.1. Market Revenue and Forecast (2019-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 11. U.S. Behavioral Health Market, Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Service (2019-2030)

11.1.2. Market Revenue and Forecast, by End User (2019-2030)

11.1.3. Market Revenue and Forecast, by Disorder (2019-2030)

Chapter 12. Company Profiles

12.1. Acadia Healthcare

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Promises Behavioral Health (Elements Behavioral Health)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Epic Health Services (Aveanna Healthcare)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Universal Health Services

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Behavioral Health Group, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. IBH Population Health Solutions

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. CuraLinc Healthcare

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. North Range Behavioral Health

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ardent Health Services

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. CRC Health Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s U.S. behavioral health market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1320

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com