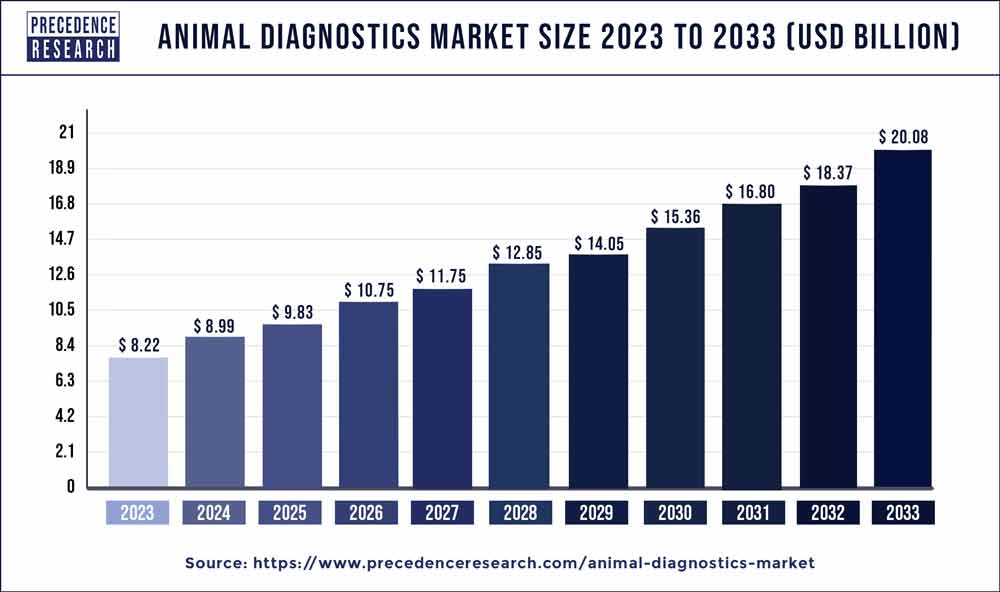

The global animal diagnostics market size was valued at USD 8.22 billion in 2023 and is projected to rake around USD 20.08 billion by 2033 with a CAGR of 9.34% from 2024 to 2033.

Key Points

- By region, North America dominated the animal diagnostics market in 2023.

- By region, Asia Pacific is expected to witness significant growth in the market during the forecast period.

- By product, the kits and reagent segment dominated the market in 2023.

- By product, the instruments segment is expected to grow in the market during the forecast period.

- By technology, the molecular diagnostics segment held the highest market share in 2023.

- By technology, the hematology segment is expected to grow at a significant rate in the market during the anticipated period.

- By animal type, the companion animals segment dominated the animal diagnostics market in 2023.

- By animal type, the livestock animals segment is expected to grow at a notable rate in the market during the predicted time period.

The animal diagnostics market is experiencing significant growth globally, driven by various factors such as the increasing prevalence of zoonotic diseases, rising demand for food safety, and the growing adoption of companion animals. Animal diagnostics involve the testing and analysis of samples from animals to diagnose diseases, monitor health, and ensure the safety of animal-derived products. These diagnostics play a crucial role in veterinary medicine, livestock production, and animal research, contributing to the overall well-being of both animals and humans.

Get a Sample: https://www.precedenceresearch.com/sample/3894

Growth Factors

Several key factors are fueling the growth of the animal diagnostics market. Firstly, the rising incidence of zoonotic diseases, which are infections that can be transmitted between animals and humans, has heightened the importance of early and accurate diagnosis in animals to prevent the spread of diseases to humans. Diseases such as avian influenza, brucellosis, and rabies highlight the critical need for effective diagnostic tools in veterinary medicine.

Secondly, the increasing awareness among consumers regarding food safety and quality has led to a growing demand for diagnostic tests in livestock production. Farmers and food producers are adopting advanced diagnostic technologies to ensure the health and safety of their animals and the products derived from them. This trend is particularly pronounced in regions with stringent regulations governing food safety standards.

Furthermore, the growing pet ownership and the humanization of pets have driven the demand for advanced diagnostic services in companion animal healthcare. Pet owners are increasingly investing in preventive healthcare measures for their pets, including regular check-ups and diagnostic tests for early detection of diseases. This trend is boosting the demand for a wide range of diagnostic services, including blood tests, imaging, and genetic testing, in veterinary clinics and hospitals.

Region Analysis:

The animal diagnostics market exhibits significant regional variation, influenced by factors such as economic development, regulatory environment, and the prevalence of animal diseases. North America and Europe are the leading markets for animal diagnostics, driven by factors such as high pet ownership rates, advanced healthcare infrastructure, and stringent regulations governing animal health and food safety.

In North America, the United States dominates the animal diagnostics market due to its large pet population, strong demand for companion animal healthcare services, and robust investment in research and development. Additionally, the presence of key market players and academic institutions focused on veterinary medicine further contributes to the region’s market growth.

In Europe, countries like Germany, the United Kingdom, and France are key contributors to the animal diagnostics market. These countries have well-established veterinary healthcare systems, supportive regulatory frameworks, and a high level of awareness regarding animal health and welfare. Moreover, the increasing adoption of companion animals and the growing demand for livestock products are driving the market growth in this region.

Asia Pacific is emerging as a lucrative market for animal diagnostics, propelled by factors such as the rising disposable income, urbanization, and changing dietary preferences driving the demand for animal-derived products. Countries like China, India, and Japan are witnessing a surge in pet ownership and livestock production, creating opportunities for market expansion. However, challenges such as limited access to advanced diagnostic technologies in rural areas and regulatory hurdles may impede market growth in some Asia Pacific countries.

Animal Diagnostics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.34% |

| Global Market Size in 2023 | USD 8.22 Billion |

| Global Market Size by 2033 | USD 20.08 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Increasing awareness regarding animal health and welfare

- Technological advancements in diagnostic tools and techniques

- Growing demand for companion animal healthcare services

- Strong regulatory frameworks governing animal health and food safety

Weaknesses:

- Limited access to advanced diagnostic services in rural areas

- High cost associated with advanced diagnostic tests

- Lack of skilled professionals in certain regions

- Limited adoption of preventive healthcare measures in some segments of the animal population

Opportunities:

- Untapped markets in emerging economies

- Development of point-of-care diagnostic solutions

- Integration of digital health technologies in animal diagnostics

- Collaborations and partnerships between market players and research institutions

Threats:

- Regulatory challenges and compliance issues

- Competition from alternative diagnostic methods

- Economic downturns impacting pet ownership and spending on animal healthcare

- Outbreaks of novel diseases affecting animal health and market dynamics

Read Also: Pregnancy Medication Market Size to Hit USD 135.43 Bn by 2033

Recent Developments

- In February 2024, Tata Trusts is about to launch its first-of-a-kind small veterinary hospital in Mumbai, India. The hospital is on five floors and has a capacity of over 200 beds. It is a super specialty hospital for pets and will provide 24/7 services.

- In February 2024, MiDOG Animal Diagnostics LLC, a leading player in the microbiome veterinary diagnostic works on the Next Generation DNA Sequencing analysis, introduced a renewed branding strategy in 2024. The latest branding includes the acceptance of MiDOG’s technology for all animal species.

- In February 2024, IDEXX Laboratories, Inc., a leading player in pet healthcare innovations, announced the launch of the Vello, a software application that combines clients and veterinary practices through modern digital tools.

Animal Diagnostics Market Companies

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Segments Covered by the Report

By Products

- Kits and Reagents

- Instruments

- Software and Services

By Technology

- Molecular Diagnostics

- Hematology

- Immunodiagnostics

By Animal Type

- Companion Animal

- Livestock Animal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/