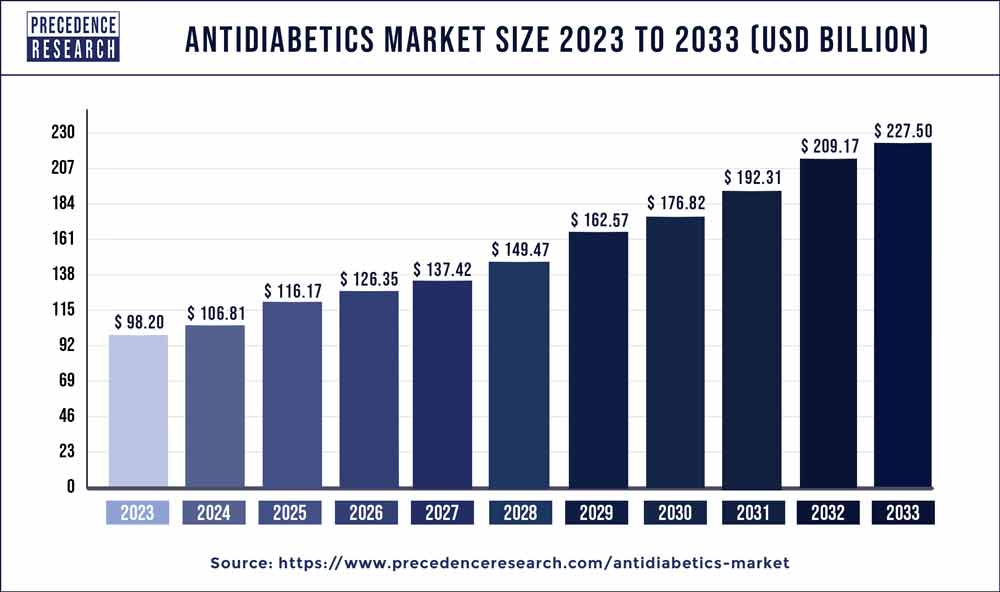

The global antidiabetics market size was valued at USD 98.20 billion in 2023 and is projected to hit around USD 227.50 billion by 2033 with a CAGR of 8.76% from 2024 to 2033.

Key Points

- North America has held the largest revenue share of around 39% in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the insulin segment dominated the antidiabetics market with the highest share in 2023.

- By product, the drug class segment is observed to grow at a significant rate during the forecast period.

- By patient population, the geriatric segment held the dominating share of the market in 2023.

- By route of administration, the oral segment led the market in 2023. The segment is observed to sustain the position.

- By route of administration, the insulin pen/syringe segment is observed to witness the fastest rate of expansion throughout the forecast period.

The antidiabetics market encompasses a broad range of pharmaceutical products designed to manage and treat diabetes mellitus, a chronic metabolic disorder characterized by elevated blood sugar levels. These medications play a crucial role in controlling blood glucose levels, preventing complications, and improving the quality of life for individuals with diabetes. The market includes various drug classes such as insulin, oral hypoglycemic agents, and injectable glucagon-like peptide-1 (GLP-1) receptor agonists, catering to the diverse needs of patients with diabetes.

Get a Sample: https://www.precedenceresearch.com/sample/3914

List of Contents

ToggleGrowth Factors

Several factors contribute to the growth of the antidiabetics market. One significant driver is the rising prevalence of diabetes globally, fueled by sedentary lifestyles, unhealthy dietary habits, and an aging population. Additionally, increasing awareness about diabetes management and the importance of early intervention has led to greater diagnosis rates, driving demand for antidiabetic medications. Moreover, advancements in drug delivery systems, such as insulin pens and pumps, have improved treatment adherence and patient convenience, further propelling market growth.

Region Insights

The antidiabetics market exhibits regional variations influenced by factors such as healthcare infrastructure, economic development, and prevalence of diabetes. Developed regions like North America and Europe dominate the market due to high healthcare expenditure, widespread access to advanced therapies, and well-established diabetes management programs. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth driven by increasing disposable incomes, expanding healthcare infrastructure, and growing awareness about diabetes management.

Antidiabetics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.76% |

| Global Market Size in 2023 | USD 98.20 Billion |

| Global Market Size by 2033 | USD 227.50 Billion |

| U.S. Market Size in 2023 | USD 30.26 Billion |

| U.S. Market Size by 2033 | USD 70.09 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Patient Population, and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Antidiabetics Market Dynamics

Drivers:

Several drivers fuel the growth of the antidiabetics market. One of the primary drivers is the escalating prevalence of diabetes worldwide, driven by factors such as sedentary lifestyles, unhealthy dietary habits, and aging populations. Additionally, growing awareness about the importance of early diagnosis and effective management of diabetes has led to increased demand for antidiabetic medications. Furthermore, advancements in drug delivery systems, such as insulin pens and patches, have improved treatment adherence and patient outcomes, contributing to market expansion.

Restraints:

Despite the positive growth drivers, the antidiabetics market faces certain challenges that hinder its growth trajectory. One significant restraint is the high cost of diabetes treatment, including medications, monitoring devices, and healthcare services, particularly in developing countries with limited access to affordable healthcare. Moreover, concerns about the safety and efficacy of certain antidiabetic drugs, along with the risk of adverse effects such as hypoglycemia and weight gain, pose challenges to market growth. Additionally, regulatory hurdles and patent expirations for key antidiabetic drugs may impact market dynamics and competition.

Opportunities:

Despite the challenges, the antidiabetics market presents several opportunities for growth and innovation. One promising opportunity lies in the development of novel therapeutic agents with improved efficacy, safety profiles, and mechanisms of action, addressing unmet needs in diabetes management. Furthermore, expanding market penetration in emerging economies offers significant growth potential, driven by increasing healthcare spending, rising disposable incomes, and growing awareness about diabetes prevention and management. Additionally, technological advancements in insulin delivery systems, such as smart insulin pumps and continuous glucose monitoring devices, present opportunities for enhancing treatment outcomes and patient experience. Moreover, collaborations between pharmaceutical companies, research institutions, and healthcare organizations can facilitate the development of innovative diabetes therapies and personalized treatment approaches, driving market expansion and improving patient care.

Read Also: AI in Computer Vision Market Size to Worth USD 274.80 Bn by 2033

Recent Development

- In February 2023, IOL Chemicals and Pharmaceuticals Ltd, a leading pharmaceutical company’s share increased 12.1% and noticed the 8.25% higher at Rs 437.3 piece during the intraday session. The price of stock increased after the announcement of the antidiabetic drug ‘Metformin Hydrochloride’ approved by China’s drug supervisor.

- In February 2024, Boehringer Ingelheim launched an antidiabetic drug in India for the treatment of chronic kidney dieases getting approval from the Central Drugs Standard Control Organization (CDSCO).

- In January 2024, Glenmark Pharmaceuticals launched the antidiabetic drug a biosimilar of the Liraglutide a famous antidiabetic drug. The drug gets approval from the Drug Controller General of India (DCGI).

- In January 2022, the Danish Drug Maker, Novo Nordisk introduce the launch of anti-diabetics drug semaglutide in India for the Type 2 diabetes treatment.

Antidiabetic Market Companies

- Sanofi-Aventis

- Takeda Pharmaceuticals

- Eli Lilly

- Oramed Pharmaceuticals

- Boehringer Ingelheim

- Merck & Co. Inc.

- Novo Nordisk

- Bristol-Myers Squibb

- Halozyme Therapeutics

- Pfizer

Segments Covered in the Report

By Product

- Insulin

- Rapid Acting

- Long Acting

- Premixed Insulin

- Short Acting

- Drug Class

- Biguanides

- GLP-Agonists

- Thiazolidinediones

- Sulphonylureas

- SGLT-2

- Alpha-Glucosidase Inhibitors

- DPP-4 Inhibitors

- Meglitinides

By Patient Population

- Pediatric

- Adults

- Geriatric

By Route of Administration

- Oral

- Infusion

- Intravenous

- Insulin Pump

- Insulin Pen/Syringe

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/