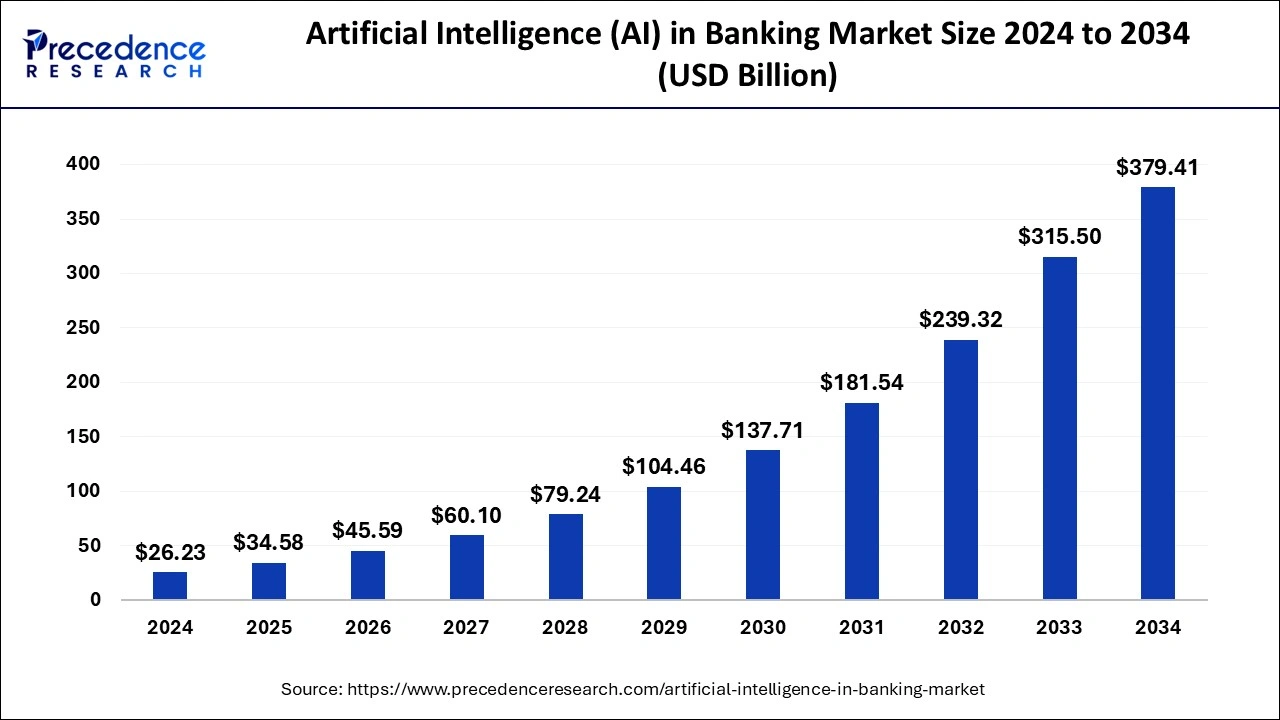

The global artificial intelligence (AI) in banking market size is expected to increase USD 315.50 billion by 2033 from USD 19.90 billion in 2023 with a CAGR of 31.83% between 2024 to 2033.

Key Points

- North America led the artificial intelligence (AI) in banking market in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By component, the solution segment dominated the market in 2023.

- By component, the service segment is expected to gain a significant share of the market during the forecast period.

- By application, the risk management segment held the largest share of the market in 2023.

- By application, the customer service segment is expected to increase its CAGR over the forecast period.

- By technology, the natural language processing (NPL) segment accounted for the largest of the market in 2023.

- By technology, the computer vision segment will grow rapidly in the market during the forecast period.

- By enterprise size, the large enterprise segment accounted for the largest share of the market in 2023.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to register significant growth in the market during the forecast period.

The Artificial Intelligence (AI) in banking market has witnessed significant growth in recent years, driven by advancements in technology and increasing demand for efficient and personalized banking services. AI technologies such as machine learning, natural language processing, and predictive analytics are revolutionizing various aspects of banking operations, including customer service, fraud detection, risk management, and process automation. This market encompasses AI solutions and services adopted by banks and financial institutions to enhance operational efficiency, improve decision-making processes, and deliver superior customer experiences.

Get a Sample: https://www.precedenceresearch.com/sample/4445

Growth Factors:

Several key factors contribute to the growth of AI in the banking sector. Firstly, the exponential growth in data volumes generated by banks has created a need for advanced analytics and AI-driven insights to extract valuable information and improve decision-making. Secondly, rising customer expectations for personalized banking experiences and real-time interactions have prompted banks to adopt AI technologies to deliver customized services efficiently. Moreover, regulatory pressures and the need for stringent compliance measures have fueled the adoption of AI for risk management and regulatory reporting in the banking industry.

Regional Insights:

The adoption of AI in banking varies significantly across regions. North America and Europe are at the forefront due to early investments in AI technologies by large banks and financial institutions. These regions benefit from mature regulatory frameworks that support innovation and digital transformation in banking. In contrast, Asia-Pacific is witnessing rapid growth driven by increasing digitalization of banking services, expanding fintech ecosystem, and government initiatives to promote AI adoption. Emerging economies in Latin America and Africa are also embracing AI in banking to leapfrog traditional banking infrastructure and offer innovative financial services.

Artificial Intelligence (AI) in Banking Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 19.90 Billion |

| Market Size in 2024 | USD 26.23 Billion |

| Market Size by 2033 | USD 315.50 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 31.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Application, Technology, Enterprise Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial Intelligence (AI) in Banking Market Dynamics

Drivers:

Several drivers propel the adoption of AI in the banking sector. Enhanced customer experience is a primary driver, as AI-powered chatbots and virtual assistants enable banks to offer 24/7 customer support, personalized recommendations, and seamless transactions. Cost reduction through process automation and operational efficiency is another significant driver, as AI technologies streamline back-office operations, optimize resource allocation, and reduce manual errors. Furthermore, AI plays a crucial role in fraud detection and cybersecurity, safeguarding financial transactions and protecting sensitive customer data from evolving cyber threats.

Opportunities:

The AI in banking market presents numerous opportunities for innovation and growth. Advancements in AI algorithms and deep learning techniques open doors for developing more sophisticated applications in credit scoring, loan underwriting, and investment advisory services. Collaborations between banks and fintech startups facilitate the integration of AI solutions into existing banking platforms, enabling rapid deployment of innovative services. Moreover, the expansion of AI-powered analytics capabilities enhances banks’ ability to generate actionable insights from complex data sets, improving risk management and regulatory compliance.

Challenges:

Despite the promising growth prospects, the adoption of AI in banking faces several challenges. Data privacy and security concerns remain paramount, as banks handle vast amounts of sensitive customer information susceptible to breaches and unauthorized access. Regulatory compliance poses another challenge, as stringent data protection regulations and ethical considerations surrounding AI algorithms require banks to navigate complex legal frameworks. Additionally, the shortage of skilled AI talent capable of developing and deploying AI solutions tailored to banking needs limits the industry’s ability to leverage AI’s full potential effectively.

Read Also: Automotive Plastics Market Size to Surpass USD 52.78 Bn By 2033

Artificial Intelligence (AI) in Banking Market Companies

- Amazon Web Services, Inc.

- Capital One

- Cisco Systems, Inc.

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

Recent Developments

- In May 2024, The Ministry of Industry and Advanced Technology (MoIAT) announced the collaboration with the Emirates Development Bank (EDB), a major financial engine of industrial advancements and economic development in the UAE, for providing AED 370 million in financing solutions for the development of new AI Innovation Program.

- In May 2024, Sterling Bank collaborated with AI in Nigeria to introduce the ‘Nigeria AI Landscape and Startup Report’, providing a diversified view of Nigeria’s ecosystem and startup scene.

Segments Covered in the Report

By Component

- Service

- Solution

By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

By Technology

- Natural Language Processing (NLP)

- Machine Learning & Deep Learning

- Computer Vision

- Other

By Enterprise Size

- Large Enterprise

- SMEs

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/