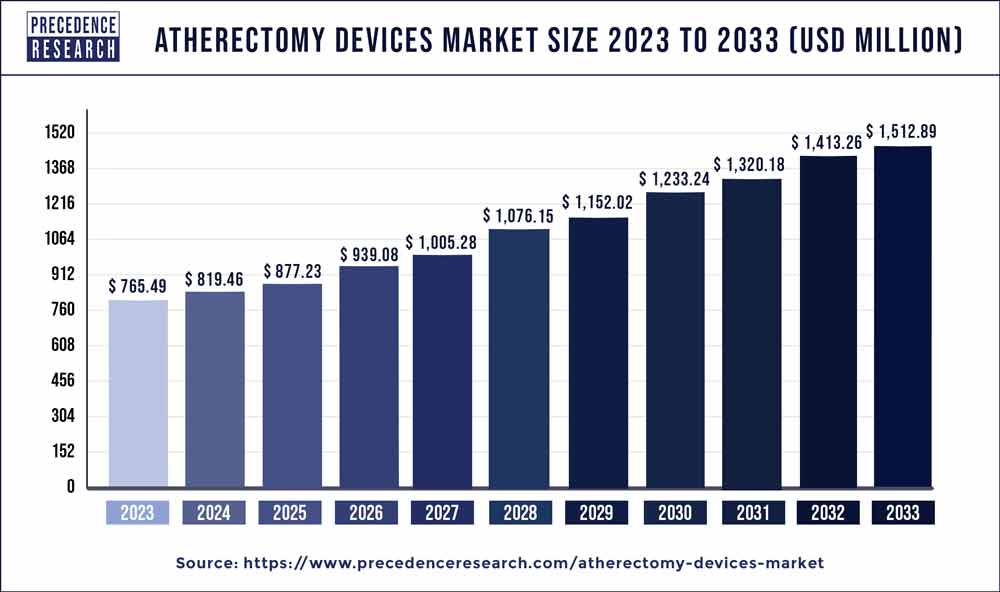

The global atherectomy devices market size was valued at USD 765.49 million in 2023 and is projected to reach around USD 1,512.89 million by 2033, growing at a CAGR of 7.05% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 45% in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By device type, the drug-coated balloons (DCBs) segment held the largest share of the market in 2023.

- By device type, the intravascular ultrasound (IVUS) catheter segment is expected to show the fastest growth.

- By application type, the peripheral artery disease segment held the dominating share of the market in 2023.

- By application type, the coronary artery disease segment represents another highly influential segment for the forecast period.

- By end-user, the cardiac catheterization labs segment held the dominating share of the market in 2023.

- By end-user, the interventional radiology departments segment is expected to witness a significant rate of expansion during the forecast period.

The Atherectomy Devices Market is experiencing robust growth driven by the rising prevalence of cardiovascular diseases globally. Atherectomy devices are specialized tools used to remove plaque buildup from blood vessels, particularly in cases of atherosclerosis. These devices play a crucial role in restoring blood flow and reducing the risk of heart attacks and strokes. With advancements in technology and increasing demand for minimally invasive procedures, the market for atherectomy devices is poised for significant expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3901

Growth Factors:

Several factors contribute to the growth of the atherectomy devices market. Firstly, the growing incidence of cardiovascular diseases, including coronary artery disease and peripheral artery disease, is driving the demand for effective treatment options. Atherectomy devices offer a minimally invasive alternative to traditional surgical procedures, making them increasingly popular among both patients and healthcare providers.

Moreover, technological advancements in atherectomy devices have led to the development of more efficient and precise tools. Manufacturers are incorporating innovative features such as rotational atherectomy and laser atherectomy, enhancing the effectiveness of plaque removal while minimizing damage to the surrounding tissues. These advancements not only improve patient outcomes but also contribute to the overall growth of the market.

Additionally, the rising geriatric population worldwide is expected to fuel demand for atherectomy devices. Elderly individuals are more susceptible to cardiovascular diseases, leading to a higher demand for interventions such as atherectomy procedures. As the global population continues to age, the prevalence of cardiovascular conditions is projected to increase, driving sustained growth in the market for atherectomy devices.

Furthermore, increasing healthcare expenditure and growing awareness about the importance of early diagnosis and treatment of cardiovascular diseases are key factors supporting market growth. Governments and healthcare organizations are investing in infrastructure development and preventive healthcare programs, which are expected to further boost the adoption of atherectomy devices.

Region Analysis:

The atherectomy devices market exhibits significant regional variation, influenced by factors such as healthcare infrastructure, prevalence of cardiovascular diseases, and regulatory environment. North America dominates the market, primarily attributed to high healthcare spending, advanced medical technology, and a large patient population suffering from cardiovascular diseases. The presence of major market players and ongoing research and development activities also contribute to the region’s leadership position.

In Europe, the market for atherectomy devices is driven by increasing awareness about cardiovascular health and favorable reimbursement policies. Countries such as Germany, France, and the United Kingdom are witnessing growing adoption of atherectomy procedures, supported by well-established healthcare systems and a strong focus on innovative medical technologies.

Asia Pacific represents a lucrative market opportunity due to the rising incidence of cardiovascular diseases in countries such as China, India, and Japan. Economic development, improving healthcare infrastructure, and increasing healthcare expenditure are driving market growth in the region. Moreover, initiatives aimed at promoting preventive healthcare and early disease detection are expected to further propel market expansion in Asia Pacific.

Atherectomy Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.05% |

| Global Market Size in 2023 | USD 765.49 Million |

| Global Market Size by 2033 | USD 1,512.89 Million |

| U.S. Market Size in 2023 | USD 241.13 Million |

| U.S. Market Size by 2033 | USD 476.56 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Devices Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis:

Strengths:

- Technological advancements leading to more effective and precise atherectomy devices.

- Growing demand for minimally invasive procedures driving adoption of atherectomy devices.

- Increasing awareness about cardiovascular health and preventive measures.

Weaknesses:

- High cost associated with atherectomy procedures may limit adoption, particularly in developing regions.

- Limited availability of skilled healthcare professionals proficient in atherectomy techniques.

- Regulatory challenges and reimbursement issues in some markets may impede market growth.

Opportunities:

- Untapped potential in emerging markets with growing healthcare infrastructure and rising disposable income.

- Collaboration and partnerships between healthcare providers and medical device manufacturers to improve access to atherectomy procedures.

- Expansion of product offerings and entry into new application areas to cater to diverse patient needs.

Threats:

- Intense competition among market players leading to pricing pressures and reduced profit margins.

- Regulatory uncertainties and evolving healthcare policies impacting market dynamics.

- Potential adverse events associated with atherectomy procedures leading to safety concerns among patients and healthcare providers.

Read Also: Green Cement Market Size to Cross USD 1,046.76 Million by 2033

Recent Developments

- In October 2023, Cardio Flow, Inc., announced U.S. Food and Drug Administration (FDA) 510(k) clearance for its FreedomFlow® Orbital Atherectomy Peripheral Platform.

- In September 2023, Avinger Inc., a commercial-stage medical device company, announced the full commercial launch of its Tigereye® ST next-generation image-guided chronic total occlusion (CTO) crossing system.

Atherectomy Devices Market Companies

- Abbott Laboratories

- Boston Scientific Corporation

- BD

- Cardinal Health Inc.

- Koninklijke Philips NV

- Medtronic Plc

- Terumo Corporation

- Avinger

- Cardiovascular Systems

- Ra Medical Systems

Segments Covered in the Report

By Devices Type

- Atherectomy Devices

- Angioplasty Balloon Catheters

- Stents (Bare-Metal, Drug-Eluting, Bioresorbable)

- Intravascular Ultrasound (IVUS) Catheters

- Optical Coherence Tomography (OCT) Catheters

- Drug-Coated Balloons

- Embolic Protection Devices

- Thrombectomy Devices

- Aortic Stent Grafts

- Endovascular Grafts

- Laser Atherectomy Devices

- Orbital Atherectomy Systems

- Rotational Atherectomy Devices

- Directional Atherectomy Devices

- Chronic Total Occlusion (CTO) Devices

By Application

- Peripheral Artery Disease (PAD) Treatment Devices

- Coronary Artery Disease (CAD) Intervention Devices

- Carotid Artery Disease Intervention Devices

- Renal Artery Disease Intervention Devices

- Aortic Atherosclerosis Intervention Devices

By End-user

- Cardiac Catheterization Labs

- Interventional Radiology Departments

- Vascular Surgery Centers

- Cardiology Clinics

- Academic Research Institutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/