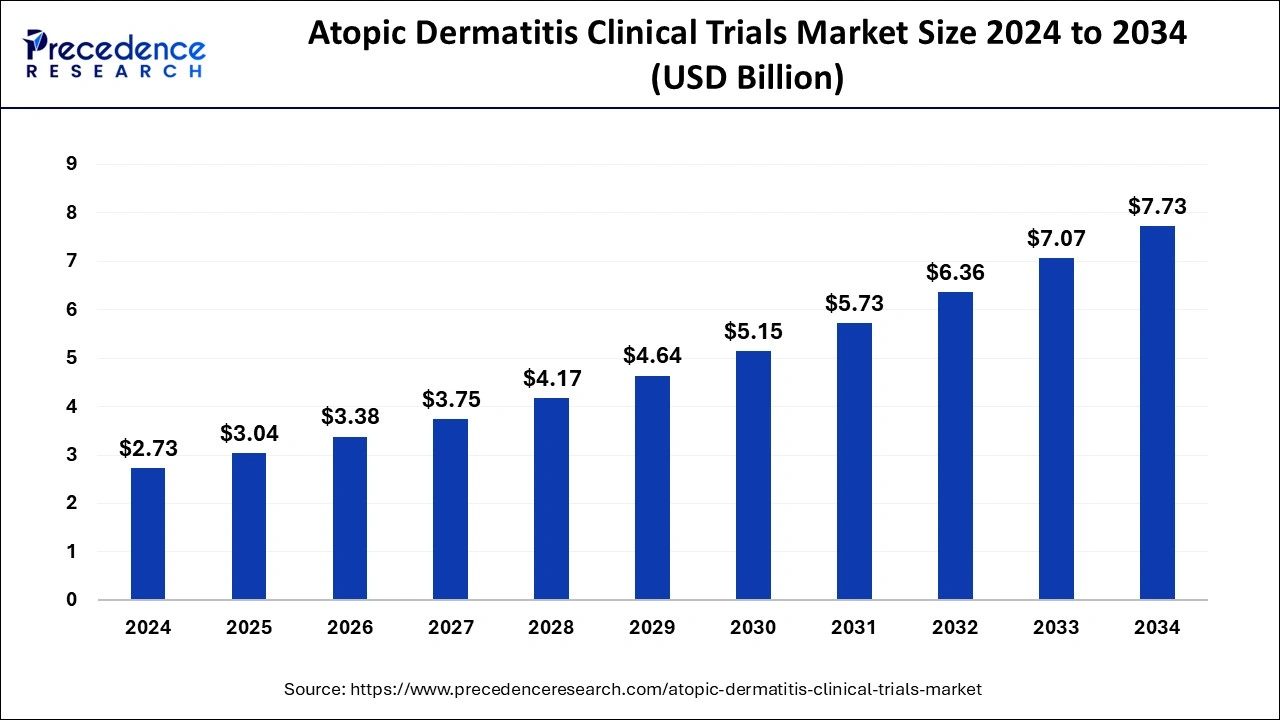

The global atopic dermatitis clinical trials market size surpassed USD 2.46 billion in 2023 and is anticipated to hit around USD 7.07 billion by 2033 with a CAGR of 11.14% from 2024 to 2033.

Key Points

- North America has contributed more than 37% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By molecule type, the large molecules segment has held the largest market share of 54% in 2023.

- By molecule type, the small molecules segment is anticipated to grow at a remarkable CAGR of 12.5% between 2024 and 2033.

- By study design, the interventional trials segment has generated over 72% of market share in 2023.

- By study design, the observational trials segment is expected to expand at the fastest CAGR over the projected period.

- By phase, the phase II segment has accounted more than over 48% of market share in 2023.

- By phase, the phase III segment is expected to expand at the fastest CAGR over the projected period.

The Atopic Dermatitis Clinical Trials Market is a dynamic segment within the broader pharmaceutical and healthcare industry, focused on the development and testing of therapies for atopic dermatitis (AD), a chronic inflammatory skin condition. Atopic dermatitis, also known as eczema, affects millions of individuals worldwide, with symptoms ranging from redness, itching, and swelling to more severe manifestations such as skin lesions and infections. The market for clinical trials in atopic dermatitis is driven by the increasing prevalence of the condition, the demand for innovative treatments, and advancements in medical research and technology. Pharmaceutical companies, research institutions, and healthcare organizations actively engage in clinical trials to evaluate the safety and efficacy of potential therapies, aiming to address the unmet needs of patients suffering from atopic dermatitis.

Get a Sample: https://www.precedenceresearch.com/sample/4021

Growth Factors:

Several factors contribute to the growth of the atopic dermatitis clinical trials market. Firstly, the rising incidence and prevalence of atopic dermatitis globally have fueled the demand for effective treatments, prompting pharmaceutical companies to invest in research and development initiatives. Additionally, the growing understanding of the underlying mechanisms of atopic dermatitis at the molecular level has paved the way for the identification of novel therapeutic targets, driving innovation in drug development. Moreover, regulatory agencies’ emphasis on expediting the approval process for promising therapies and the increasing adoption of precision medicine approaches have accelerated clinical trial activities in the field of atopic dermatitis. Furthermore, collaborations between industry players, academic institutions, and government bodies facilitate knowledge exchange and resource-sharing, fostering a conducive environment for research and development efforts in atopic dermatitis.

Region Insights:

The atopic dermatitis clinical trials market exhibits regional variations in terms of trial volume, patient demographics, regulatory landscape, and healthcare infrastructure. North America, comprising the United States and Canada, dominates the market due to the presence of a robust pharmaceutical industry, well-established clinical research infrastructure, and high prevalence of atopic dermatitis. Europe follows closely, driven by extensive government support for medical research, a large patient population, and strategic collaborations between academia and industry. In the Asia-Pacific region, countries such as Japan, China, and South Korea are witnessing a surge in clinical trial activity fueled by rapid urbanization, increasing healthcare expenditure, and a growing focus on dermatology research. Emerging economies in Latin America and the Middle East & Africa also present untapped opportunities for market expansion, propelled by improving healthcare access and rising awareness about atopic dermatitis.

Atopic Dermatitis Clinical Trials Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.14% |

| Global Market Size in 2023 | USD 2.46 Billion |

| Global Market Size by 2033 | USD 7.07 Billion |

| U.S. Market Size in 2023 | USD 640 Million |

| U.S. Market Size by 2033 | USD 1,830 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Molecule Type, By Study Design, and By Phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atopic Dermatitis Clinical Trials Market Market Dynamics

Drivers:

Several drivers propel the growth of the atopic dermatitis clinical trials market. Firstly, the inadequacy of existing treatment options for atopic dermatitis, characterized by limited efficacy and adverse side effects, underscores the urgent need for novel therapies. This unmet medical need incentivizes pharmaceutical companies to invest in clinical trials aimed at developing safer and more efficacious treatments. Secondly, the escalating economic burden of atopic dermatitis, attributable to healthcare costs, productivity losses, and diminished quality of life, motivates stakeholders to pursue innovative solutions through clinical research. Moreover, advancements in technology, such as biomarker discovery, genetic profiling, and targeted drug delivery systems, enable more precise and personalized approaches to atopic dermatitis management, driving research efforts. Additionally, the increasing prevalence of comorbidities associated with atopic dermatitis, including asthma, allergic rhinitis, and mental health disorders, broadens the scope of clinical trials to address complex patient needs comprehensively.

Opportunities:

The atopic dermatitis clinical trials market presents lucrative opportunities for stakeholders across the value chain. Pharmaceutical companies can capitalize on the growing demand for biologic therapies, topical agents, and immunomodulators by expanding their pipeline of atopic dermatitis treatments and leveraging innovative research platforms. Contract research organizations (CROs) and clinical research sites can enhance their service offerings in dermatology clinical trials, catering to the specialized requirements of sponsors and facilitating patient recruitment and retention. Academic institutions and research centers have the opportunity to collaborate with industry partners in translational research, biomarker discovery, and mechanistic studies, contributing to scientific advancements in atopic dermatitis. Furthermore, patient advocacy groups and regulatory agencies play a pivotal role in shaping the clinical trial landscape by advocating for patient-centric research priorities, streamlining regulatory processes, and ensuring ethical standards and patient safety.

Challenges:

Despite the promising growth prospects, the atopic dermatitis clinical trials market faces several challenges that warrant attention. Patient recruitment and retention pose significant hurdles due to the heterogeneous nature of atopic dermatitis, patient compliance issues, and the geographical dispersion of eligible participants. Moreover, the reliance on subjective clinical endpoints, such as patient-reported outcomes and physician assessments, introduces variability and bias in trial results, complicating data interpretation and regulatory decision-making. Additionally, the high cost and lengthy duration of clinical trials, coupled with the risk of trial failures and regulatory setbacks, deter investment in early-stage research and limit access to innovative therapies for patients. Furthermore, ethical considerations related to placebo-controlled trials, informed consent, and data transparency necessitate careful navigation to uphold scientific integrity and patient welfare. Addressing these challenges requires collaborative efforts from stakeholders to optimize trial design, enhance patient engagement, and implement innovative methodologies such as adaptive trial designs and real-world evidence integration.

Read Also: Diagnostic Testing Market Size Expected to Reach $264.12 Bn by 2033

Recent Developments

- In October 2023, LEO Pharma disclosed the favorable outcome of the DELTA 3 trial. This Phase 3 extension trial assessed delgocitinib cream, an investigational topical pan-Janus kinase (JAK) inhibitor, for potential treatment in adults with moderate to severe chronic hand eczema (CHE). This positive result bolstered the company’s pipeline value and is expected to facilitate the commercialization of the product.

- In May 2023, Dermavant Sciences, Inc. unveiled encouraging results from ADORING 1, Phase 3 studies investigating the efficacy and safety of topical VTAMA (tapinarof) cream 1% in adults and pediatric subjects as young as 2 years old with moderate to severe atopic dermatitis. These findings provided the company with a route to commercial success, expansion in the market, competitive differentiation, and increased investor support.

Atopic Dermatitis Clinical Trials Market Companies

- Pfizer Inc.

- Sanofi SA

- Regeneron Pharmaceuticals, Inc.

- AbbVie Inc.

- Novartis International AG

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Leo Pharma A/S

- Dermira, Inc. (acquired by Eli Lilly and Company)

- Galderma S.A.

- AnaptysBio, Inc.

- Dermavant Sciences, Inc.

- LEO Pharma A/S

- Amgen Inc.

Segments Covered in the Report

By Molecule Type

- Small Molecules

- Large Molecules

By Study Design

- Interventional

- Observational

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/