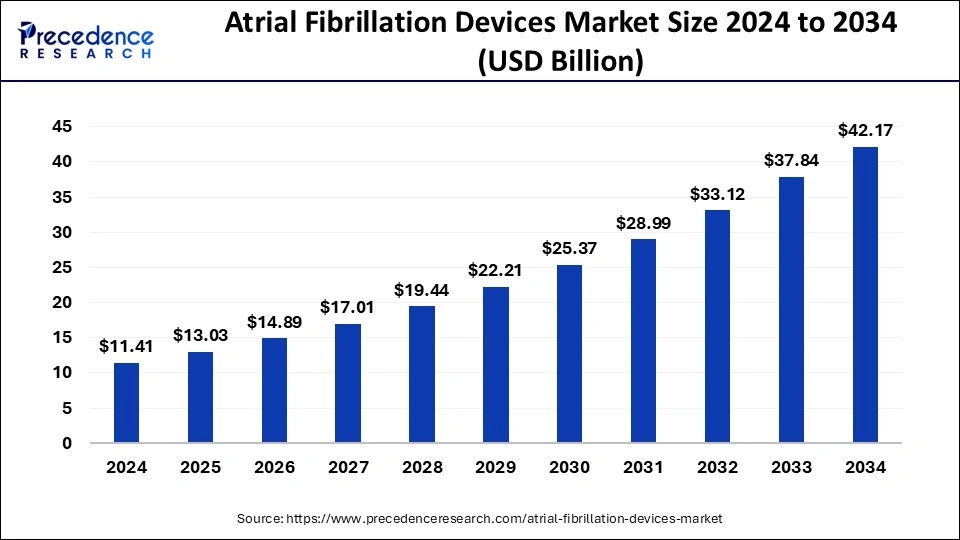

The global atrial fibrillation devices market size surpassed USD 9.99 billion in 2023 and is projected to be worth around USD 37.84 billion by 2033, growing at a CAGR of 14.25% from 2024 to 2033.

Key Points

- North America dominated the market share of 40% in 2023.

- By product, the EP ablation catheters segment dominated the atrial fibrillation devices market in 2023.

- By end-use, the hospitals segment dominated the market in 2023.

The Atrial Fibrillation (AF) Devices Market is witnessing significant growth globally, driven by the increasing prevalence of atrial fibrillation, a cardiac arrhythmia characterized by irregular and often rapid heart rate. AF is a major public health concern due to its association with an elevated risk of stroke, heart failure, and other cardiovascular complications. As a result, the demand for advanced medical devices aimed at managing and treating AF has surged in recent years. The market encompasses a range of devices, including implantable cardioverter-defibrillators (ICDs), pacemakers, catheter ablation systems, and cardiac monitors, among others. These devices play a crucial role in diagnosing, monitoring, and treating patients with AF, thereby improving their quality of life and reducing the risk of associated complications.

Get a Sample: https://www.precedenceresearch.com/sample/3950

Growth Factors:

Several factors are contributing to the growth of the AF devices market. Firstly, the aging population worldwide is a significant driver, as the prevalence of AF increases with age. With populations in many countries aging rapidly, the number of individuals diagnosed with AF is expected to rise, driving the demand for AF devices. Additionally, advancements in medical technology, particularly in the field of electrophysiology and cardiac interventions, have led to the development of more effective and minimally invasive devices for the diagnosis and treatment of AF. Moreover, increasing awareness about the importance of early detection and management of AF among healthcare professionals and patients is fueling the adoption of AF devices. Furthermore, favorable reimbursement policies for AF procedures in many countries are facilitating access to these devices, further stimulating market growth.

Region Insights:

The AF devices market exhibits regional variations in terms of market size, growth potential, and regulatory landscape. North America holds a significant share of the market, attributed to the high prevalence of AF, well-established healthcare infrastructure, and technological advancements in the region. Europe is also a key market for AF devices, supported by increasing healthcare expenditure and a growing geriatric population. In Asia-Pacific, rapid economic development, improving healthcare infrastructure, and rising awareness about cardiovascular diseases are driving market growth. Additionally, emerging economies in Latin America and the Middle East & Africa are witnessing increasing demand for AF devices due to improving access to healthcare and rising disposable incomes.

Atrial Fibrillation Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.25% |

| Global Market Size in 2023 | USD 9.99 Billion |

| Global Market Size by 2033 | USD 37.84 Billion |

| U.S. Market Size in 2023 | USD 3 Billion |

| U.S. Market Size by 2033 | USD 11.35 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atrial Fibrillation Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the AF devices market. Firstly, the rising prevalence of risk factors such as hypertension, obesity, diabetes, and cardiovascular diseases is contributing to the increasing incidence of AF globally. Moreover, advancements in medical technology, including the development of novel catheter ablation techniques, improved mapping systems, and enhanced monitoring devices, are expanding treatment options for AF patients. Additionally, growing investments in research and development by key market players to introduce innovative AF devices with enhanced efficacy and safety profiles are driving market growth. Furthermore, initiatives by healthcare organizations and government bodies to raise awareness about AF and its associated risks are encouraging early diagnosis and treatment, further boosting market demand.

Opportunities:

The AF devices market presents several opportunities for growth and innovation. One key opportunity lies in the development of advanced monitoring devices capable of detecting and diagnosing AF at an early stage, allowing for timely intervention and management. Moreover, expanding indications for existing AF devices, such as pacemakers and ICDs, to address other cardiac arrhythmias and heart conditions could broaden their market potential. Additionally, leveraging digital health technologies, such as remote monitoring and telemedicine, to improve patient outcomes and enhance the efficiency of AF management could create new avenues for market expansion. Furthermore, strategic collaborations and partnerships between medical device companies and healthcare providers could facilitate the development and commercialization of integrated solutions for AF management, catering to the evolving needs of patients and clinicians alike.

Challenges:

Despite the growth prospects, the AF devices market faces several challenges that could impede its growth. One major challenge is the high cost associated with AF devices and procedures, limiting access to advanced treatments for patients in low- and middle-income countries. Moreover, regulatory hurdles and reimbursement limitations in certain regions may hinder the adoption of AF devices, particularly in emerging markets. Additionally, the complexity of AF diagnosis and management, including the need for specialized skills and infrastructure for certain procedures such as catheter ablation, poses challenges for healthcare systems. Furthermore, concerns regarding the long-term safety and efficacy of AF devices, particularly implantable devices, necessitate ongoing monitoring and post-market surveillance to ensure patient safety and regulatory compliance. Addressing these challenges will require concerted efforts from healthcare stakeholders, including policymakers, regulators, industry players, and healthcare providers, to foster innovation, improve access, and enhance patient outcomes in the field of AF management.

Read Also: Cardiac Arrhythmia Monitoring Devices Market Size, Report 2033

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/