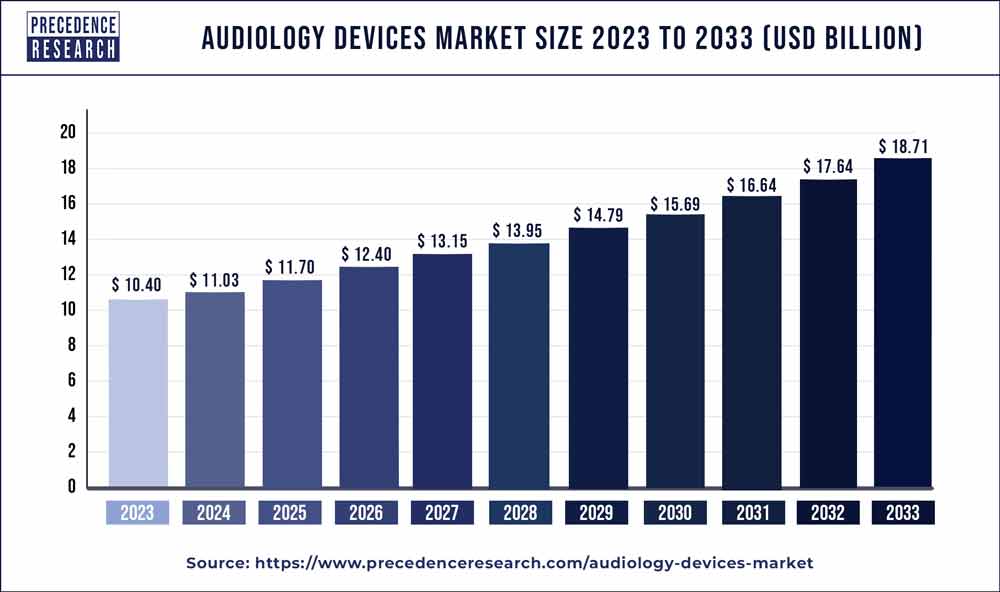

The global audiology devices market size was valued at USD 10.40 billion in 2023 and is projected to hit around USD 18.71 billion by 2033, growing at a CAGR of 6.04% from 2024 to 2033.

Key Points

- North America dominated the audiology devices market with a revenue share of 40% in 2023.

- By product, the hearing aids segment dominated the market with the largest share in 2023.

- By technology, the digital segment dominated the market with a revenue share of 93% in 2023.

- By sales channel, the retail sales segment has accounted revenue share of around 74.5% in 2023.

- By age group channel, the adult segment dominated the market with the largest share of 66.5% in 2023.

The audiology devices market is a rapidly growing sector driven by the rising prevalence of hearing disorders and advancements in technology. Audiology devices encompass a wide range of products designed to diagnose, treat, and manage hearing-related conditions such as hearing loss and tinnitus. These devices include hearing aids, cochlear implants, bone-anchored hearing aids (BAHA), and assistive listening devices (ALDs). The market is witnessing significant growth due to factors such as an aging population, increasing noise pollution, and the growing awareness about hearing health.

Get a Sample: https://www.precedenceresearch.com/sample/3909

List of Contents

ToggleGrowth Factors

Several factors contribute to the growth of the audiology devices market. One primary driver is the aging population worldwide, as elderly individuals are more prone to age-related hearing loss. Additionally, the rise in noise pollution levels, especially in urban areas, is leading to an increase in hearing disorders among younger populations. Moreover, technological advancements have resulted in the development of highly sophisticated audiology devices with improved efficacy and user-friendliness, further driving market growth. Furthermore, the growing adoption of hearing aids among younger demographics, including children and teenagers, is fueling market expansion.

Audiology Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.04% |

| Global Market Size in 2023 | USD 10.40 Billion |

| Global Market Size by 2033 | USD 18.71 Billion |

| U.S. Market Size in 2023 | USD 3.12 Billion |

| U.S. Market Size by 2033 | USD 5.61 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, By Sales Channel, and By Age Group Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insight

The audiology devices market exhibits significant regional variation in terms of demand, adoption, and regulatory landscape. North America and Europe are the leading regions, driven by high healthcare spending, advanced healthcare infrastructure, and increasing awareness about hearing health. These regions also have a large geriatric population, contributing to the demand for audiology devices. In Asia-Pacific, the market is witnessing rapid growth due to factors such as improving healthcare infrastructure, rising disposable incomes, and a growing prevalence of hearing disorders. Emerging economies in the region, such as China and India, present lucrative opportunities for market players due to their large population base and increasing healthcare expenditure.

Trends:

Several trends are shaping the audiology devices market. One prominent trend is the integration of digital technology into hearing aids and cochlear implants, leading to improved sound quality, customization, and connectivity features. Another emerging trend is the development of wearable hearing devices that are discreet and offer enhanced comfort and convenience to users. Moreover, there is a growing emphasis on tele-audiology services, enabling remote diagnosis, fitting, and adjustment of hearing devices, particularly in underserved rural areas. Furthermore, advancements in artificial intelligence (AI) and machine learning are being leveraged to develop smarter audiology devices capable of personalized and adaptive sound processing.

Read Also: Urinary Catheters Market Size to Grow USD 10.15 Bn by 2033

Recent Developments

- In October 2022, the debut of Sony Electronics’ first over the counter (OTC) hearing aids for the US market was announced. Sony is redefining the market for hearing aids with an emphasis on customization, accessibility, and innovation.

Competitive Landscape:

The audiology devices market is characterized by intense competition among key players, including manufacturers of hearing aids, cochlear implants, and diagnostic equipment. Major companies are focusing on research and development activities to introduce innovative products with advanced features and improved performance. Additionally, strategic collaborations, partnerships, and mergers and acquisitions are common strategies adopted by companies to expand their market presence and enhance their product portfolios. Leading players in the market include Sonova Holding AG, William Demant Holding A/S, GN Store Nord A/S, Cochlear Limited, and Starkey Hearing Technologies, among others. These companies are investing in product differentiation, marketing initiatives, and geographic expansion to gain a competitive edge in the global audiology devices market.

Audiology Devices Market Players

- Demant A/S

- GN Store Nord A/S

- Sonova

- Starkey Laboratories, Inc.

- MAICO Diagnostics GmbH

- Oticon Medical

- INVENTIS srl

- MED-EL Medical Electronics

- Cochlear Ltd.

- WS Audiology A/S

Segments Covered in the Report

By Product

- Hearing Aids

- Cochlear Implants

- BAHA/BAHS

- Diagnostic Devices

By Technology

- Digital

- Analog

By Sales Channel

- Retail Sales

- E-commerce

- Government Purchases

By Age Group Channel

- Adults

- Pediatrics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/