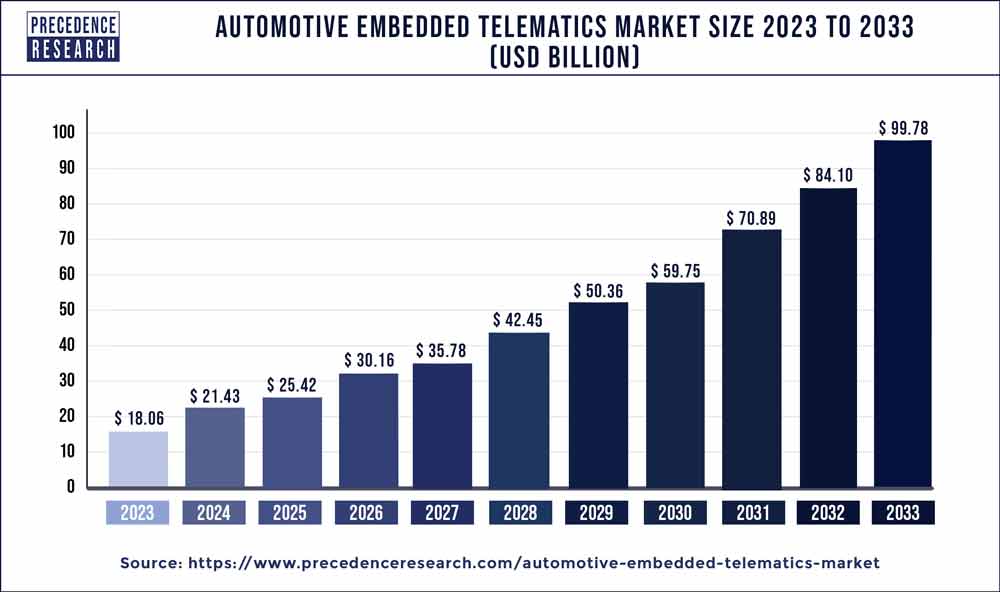

The global automotive embedded telematics market size was valued at USD 18.06 billion in 2023 and is projected to hit around USD 99.78 billion by 2033 with a CAGR of 18.64% from 2024 to 2033.

Key Points

- Europe has contributed for the largest market share of 34% in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR of 23.75% during the forecast period of 2024-2033.

- By solution, the safety & security segment held the largest market share of 49% in 2023.

- By solution, the remote diagnostics segment is anticipated to grow at a remarkable CAGR of 22.29% during the forecast period.

- By component, the services segment has generated the largest market share of 52% in 2023.

- By component, the hardware segment is growing at the fastest CAGR of 15.64% over the projected period.

- By application, the passenger cars segment has generated more than 75% of market share in 2023.

- By application, the commercial vehicles segment is expected to grow at a CAGR of 23.70% over the projected period.

The Automotive Embedded Telematics Market is witnessing unprecedented growth in the automotive industry, driven by the integration of advanced communication technologies into vehicles. Embedded telematics systems are playing a pivotal role in transforming the driving experience by providing real-time data, connectivity, and enhanced safety features. These systems leverage a combination of GPS, cellular communication, and onboard sensors to enable communication between vehicles, infrastructure, and external platforms. As the automotive industry evolves towards smart and connected vehicles, embedded telematics becomes a critical component, fostering a range of applications from navigation and infotainment to vehicle diagnostics and remote monitoring.

Get a Sample: https://www.precedenceresearch.com/sample/3886

Growth Factors

Several factors contribute to the robust growth of the Automotive Embedded Telematics Market. Firstly, the rising consumer demand for connected features and seamless communication within vehicles is a significant driver. Consumers increasingly seek advanced in-car experiences, leading to a surge in the adoption of telematics solutions. Moreover, stringent safety regulations and the need for efficient fleet management solutions are propelling the market forward. The integration of embedded telematics in commercial vehicles aids in real-time tracking, fuel efficiency, and overall operational optimization. Furthermore, the emergence of autonomous vehicles and the development of smart cities are creating new opportunities for embedded telematics, as vehicles become integral components of broader intelligent transportation systems.

Region Snapshot

The Automotive Embedded Telematics Market exhibits a global presence, with key regions driving its growth. North America stands out as a prominent market, owing to a high level of technological adoption and a robust automotive industry. The region’s focus on connected car technologies, along with a favorable regulatory landscape, contributes to market expansion. Europe follows closely, propelled by the presence of leading automotive manufacturers and a growing emphasis on road safety. Asia-Pacific is emerging as a significant player, with the increasing penetration of connected vehicles in countries like China and India. The market is also gaining traction in Latin America and the Middle East as automotive ecosystems in these regions embrace advanced telematics solutions.

Automotive Embedded Telematics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.64% |

| Global Market Size in 2023 | USD 18.06 Billion |

| Global Market Size by 2033 | USD 99.78 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Solution, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths: The Automotive Embedded Telematics Market benefits from several strengths that contribute to its growth. The integration of telematics enhances vehicle safety by providing features such as emergency assistance and crash notification. This not only addresses consumer concerns but also aligns with global safety standards. Additionally, the market benefits from the strong collaboration between automotive manufacturers and technology providers, fostering innovation and the development of cutting-edge telematics solutions. The widespread acceptance of embedded telematics by fleet operators and the increasing awareness among consumers about the advantages of connected vehicles further strengthen the market’s position.

Weaknesses: Despite its rapid growth, the Automotive Embedded Telematics Market faces certain weaknesses that merit attention. One challenge is the high initial cost associated with integrating telematics systems into vehicles. This cost can be a deterrent for price-sensitive consumers and may slow down the adoption rate, particularly in emerging markets. Interoperability issues between different telematics platforms and limited standardization pose another weakness. Standardization efforts are crucial to ensuring seamless communication between vehicles and infrastructure, and the industry needs to address this challenge to unlock the full potential of embedded telematics.

Opportunities: The market is ripe with opportunities, driven by technological advancements and evolving industry trends. The increasing demand for electric vehicles presents a significant opportunity for embedded telematics, as these vehicles require sophisticated monitoring and management systems. Moreover, the ongoing development of 5G technology opens doors for faster and more reliable communication, enhancing the capabilities of embedded telematics. The integration of artificial intelligence (AI) and machine learning (ML) into telematics systems allows for predictive analytics, enabling proactive maintenance and improving overall vehicle efficiency. As the automotive industry continues to evolve, the opportunities for embedded telematics to play a pivotal role in shaping the future of transportation are abundant.

Threats: While the Automotive Embedded Telematics Market enjoys substantial growth prospects, it is not immune to threats that could impact its trajectory. Cybersecurity concerns pose a significant threat, as connected vehicles become potential targets for malicious activities. Ensuring the security of data transmission and storage is crucial to maintaining consumer trust and regulatory compliance. Additionally, the competitive landscape is intense, with various players vying for market share. The threat of market saturation and the risk of commoditization could lead to pricing pressures and impact the profitability of telematics solution providers. Adapting to rapidly changing technology and regulatory environments is essential to mitigate these threats effectively.

Read Also: Mineral Supplements Market Size to Rake USD 29.66 Bn by 2033

Recent Developments

- In December 2022, CerebrumX Labs Inc. joined forces with Toyota to offer real-time insights for enhancing the safety and cost-effectiveness of connected fleet operations. The primary aim of this partnership is to reduce the Total Cost of Ownership (TCO) for fleets by utilizing telematics data obtained from Toyota vehicles within the network. The collaboration promotes data-driven decision-making, striving to elevate overall performance.

- In November 2022, CerebrumX Labs Inc. unveiled the integration of data from Ford connected vehicles. This integration seeks to enhance its data-centric Usage-Based Insurance (UBI)-as-a-Service model for insurance companies. CerebrumX aims to offer insurers a quicker, more cost-effective method to launch UBI programs by utilizing integrated telematics tailored for eligible Ford and Lincoln connected vehicles.

- In April 2022, Hitachi Solutions partnered with BitBrew, aiming to combine BitBrew’s connected vehicle platform with Hitachi Solutions America’s expertise in the insurance industry, enterprise integration, and deployment. This collaboration aims to deliver cutting-edge solutions for analyzing vehicle health and driver behavior in the insurance industry, leveraging real-time telematics data streams. By leveraging each other’s strengths, Hitachi Solutions America can provide reliable data-driven models and valuable connected services that meet the evolving needs of the insurance sector.

- In March 2022, Geotab Inc. collaborated with Free2move, a subsidiary of Stellantis. Through this partnership, Geotab seeks to equip Stellantis brand vehicles, including Ram, Jeep, Dodge, and Chrysler, with a Geotab Integrated Solution. This collaborative solution utilizes embedded telematics in Stellantis cars, enabling seamless integration of vehicle information from Free2move servers into the MyGeotab platform. Fleet executives can access a user-friendly telematics dashboard to generate reports and monitor crucial parameters, enhancing mobility and optimizing fleet performance.

Automotive Embedded Telematics Market Companies

- Verizon Connect

- Geotab

- TomTom Telematics

- AT&T

- Bosch Connected Devices and Solutions

- MiX Telematics

- CalAmp

- Teletrac Navman

- Harman International (a Samsung company)

- Continental AG

- Vodafone Automotive

- Telit

- Airbiquity

- Sierra Wireless

- WirelessCar

Segments Covered in the Report

By Solution

- Safety & Security

- Information & Navigation

- Entertainment

- Remote Diagnostics

By Component

- Hardware

- Services

- Connectivity

By Application

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/