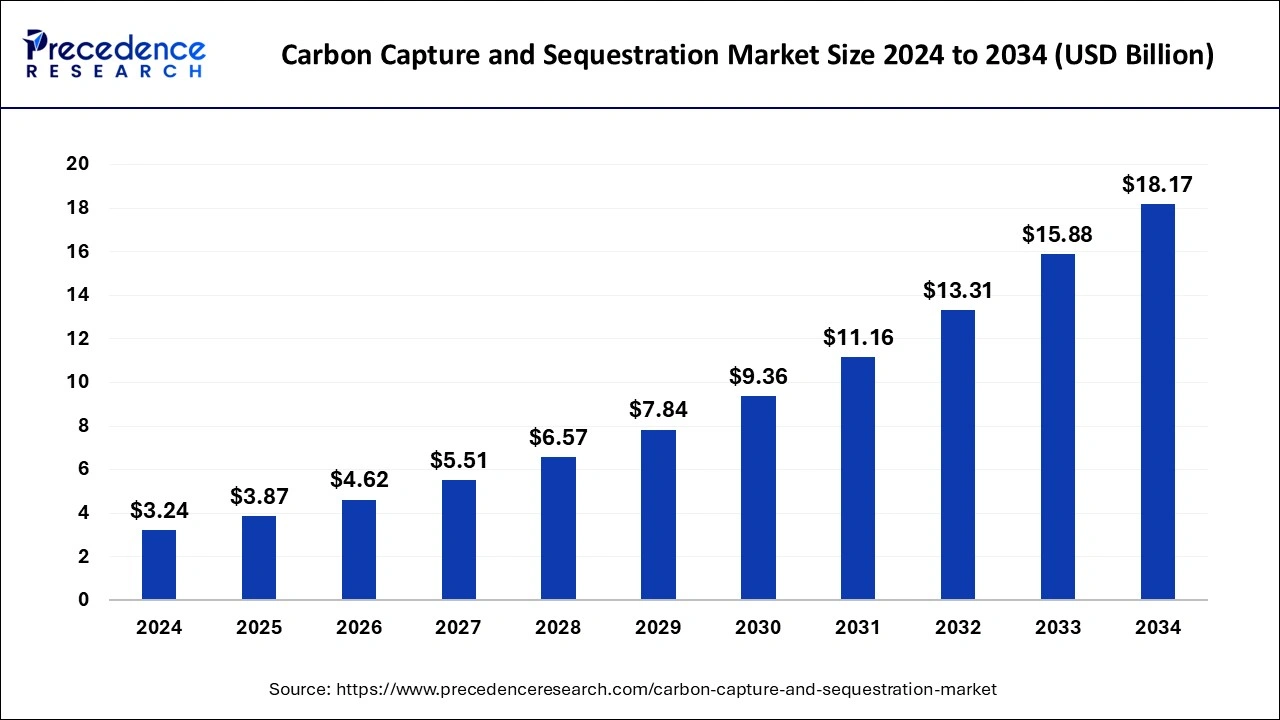

The global carbon capture and sequestration market size is expected to increase USD 15.88 billion by 2033 from USD 2.72 billion in 2023 with a CAGR of 19.30% between 2024 and 2033.

Key Points

- The North America carbon capture and sequestration market size reached USD 1.90 billion in 2023 and is expected to attain around USD 11.20 billion by 2033, poised to grow at a CAGR of 19.41% between 2024 and 2033.

- North America held the largest share of the carbon capture and sequestration market in 2023.

- Asia Pacific is expected to host the fastest-growing market in the upcoming years.

- By capture source analysis, the natural gas processing segment dominated the market in 2023.

- By capture source analysis, the power generation segment is expected to witness the fastest growth in the market during the forecast period.

- By end use, the dedicated storage & treatment segment led the global market in 2023.

- By end use, the enhanced oil recovery (EOR)segment is expected to grow at the highest CAGR in the market during the forecast period.

The Carbon Capture and Sequestration (CCS) market is focused on mitigating greenhouse gas emissions by capturing carbon dioxide (CO2) from industrial processes and power generation before it enters the atmosphere. This captured CO2 is then transported to storage sites, typically deep underground geological formations, where it is securely stored to prevent its release back into the atmosphere. The market is driven by increasing global efforts to combat climate change and meet emission reduction targets set by international agreements. Key players in the CCS market include technology providers for capture, transport, and storage systems, alongside governments and industries investing in carbon reduction strategies. Challenges include high initial costs, regulatory frameworks, and public acceptance of storage sites, yet advancements in technology and supportive policies are fostering growth prospects for the CCS industry globally.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/4575

Carbon Capture and Sequestration Market Companies

List of Contents

Toggle- Fluor Corporation

- Linde AG

- Shell CANSOLV

- Siemens

- Mitsubishi Heavy Industries

Capture Source Analysis Insights

Carbon Capture and Sequestration (CCS) technologies target emissions from various industrial and power generation sources to mitigate greenhouse gas emissions. In power generation, CO2 emissions from coal, natural gas, and oil-fired plants are significant capture sources. Post-combustion capture methods are commonly employed here, extracting CO2 from flue gases before they are released into the atmosphere. Industries like cement manufacturing, steel production, and chemical processing also emit CO2 during operations. For these sectors, pre-combustion and oxy-fuel combustion capture methods are often utilized, intercepting CO2 before it is discharged. Additionally, CO2 captured from oil and gas extraction processes, including natural gas processing plants and refineries, is crucial. These sources often implement capture technologies tailored to their emissions profiles.

End-use Applications Insights

Captured CO2 finds diverse applications once it is secured. Enhanced Oil Recovery (EOR) represents a prominent end-use for captured CO2, where it is injected into oil fields to enhance extraction rates by increasing pressure and reducing oil viscosity. This method is economically advantageous in regions supporting oil production. Industrial applications also utilize captured CO2, such as in the production of chemicals, fuels, and materials. Carbon capture and utilization (CCU) technologies convert CO2 into valuable products, thereby generating economic incentives for CCS implementation. Geological sequestration, involving the injection of CO2 deep underground into geological formations like depleted oil and gas reservoirs or saline aquifers, is the primary method for long-term carbon storage. This approach ensures CO2 remains securely sequestered, minimizing its environmental impact. Direct Air Capture (DAC) technology, while nascent, aims to capture CO2 directly from ambient air using specialized systems. DAC complements traditional CCS methods by targeting dispersed or challenging emissions sources.

Regional Snapshot

The Carbon Capture and Sequestration (CCS) market spans across various regions globally, driven by increasing regulatory pressures to reduce carbon emissions and combat climate change. North America leads in CCS adoption, bolstered by supportive government policies and investments in technologies like enhanced oil recovery (EOR) and industrial applications. Europe follows closely, with initiatives under the EU Emissions Trading System (ETS) encouraging CCS projects in power generation and industrial sectors. Asia-Pacific shows promising growth, driven by rapid industrialization and policies promoting clean energy transitions in countries like China and Japan. The Middle East and Africa are also exploring CCS to mitigate emissions from their oil and gas industries. Overall, the CCS market’s expansion is shaped by regulatory frameworks, technological advancements, and regional energy policies aimed at achieving carbon neutrality goals.

Carbon Capture and Sequestration Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 15.88 Billion |

| Market Size in 2023 | USD 2.72 Billion |

| Market Size in 2024 | USD 3.24 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 19.30% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Capture Source Analysis, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Carbon Capture and Sequestration Market Dynamics

Market Drivers

The Carbon Capture and Sequestration (CCS) market is primarily driven by stringent environmental regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing carbon pricing mechanisms and incentives to promote CCS adoption, particularly in high-emission sectors such as power generation, oil and gas, and manufacturing. These regulatory pressures compel industries to explore CCS technologies as a viable solution to meet emission reduction targets and comply with environmental standards. Additionally, corporate commitments to achieve net-zero emissions further stimulate demand for CCS technologies, creating a conducive market environment.

Opportunities

Opportunities in the CCS market are abundant, fueled by advancements in technology and growing industry interest in sustainability. Innovations in CCS technologies, including improvements in capture efficiency and cost reductions, present significant growth opportunities. Moreover, the potential for enhanced oil recovery (EOR) through CO2 injection in mature oil fields offers economic incentives for CCS deployment. International collaborations and investments in large-scale CCS projects also contribute to market expansion, fostering innovation and scalability in carbon capture and storage solutions.

Challenges

Despite its potential, the CCS market faces several challenges that could hinder widespread adoption. High initial capital costs associated with CCS infrastructure and operations pose a significant barrier, particularly for smaller industries and developing economies. Technical challenges related to the scalability and efficiency of CO2 capture technologies remain unresolved, requiring continued research and development efforts. Moreover, regulatory uncertainties and public acceptance issues regarding CO2 storage and transport safety need addressing to build stakeholder confidence and attract investment.

Read Also: Banking Encryption Software Market Size to Worth USD 7.55 Bn by 2033

Recent Developments

- In February 2023, A top government energy expert revealed that India is planning to introduce a carbon capture program that it claims will enable it to continue utilizing its abundant coal resources and address its increasing emissions. According to Rajnath Ram, energy adviser at Niti Aayog, the Indian government’s policymaking branch, the policy is anticipated to be unveiled later this year, assuming Prime Minister Narendra Modi’s government wins the next elections.

- In June 2024, a joint venture between SLB and Aker Carbon Capture (ACC) was established to facilitate the global deployment of novel and market-ready carbon capture and storage technologies for the power and hard-to-abate industrial sectors. In order to facilitate the rapid adoption of CCS for large-scale industrial decarbonization, the new business integrates technology portfolios, expertise, and operations platforms.

Segment Covered in the Market

By Capture Source Analysis

- Natural Gas Processing

- Power Generation

- Fertilizer’s Production

- Chemicals

- Others

By End-use

- Dedicated Storage & Treatment

- Enhanced Oil Recovery (EOR)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/sample/4575