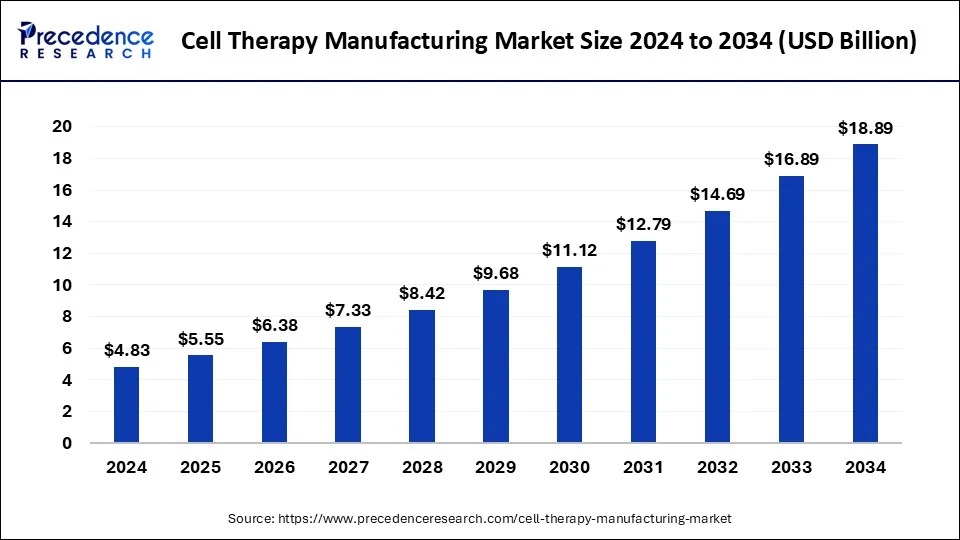

The global cell therapy manufacturing market size was calculated at USD 4.20 billion in 2023 and is expected to attain around USD 16.89 billion by 2033, growing at a CAGR of 14.93% from 2024 to 2033.

Key Points

- The North America cell therapy manufacturing market size accounted for USD 1.85 billion in 2023 and is expected to attain around USD 7.43 billion by 2033.

- North America led the market with the major revenue share of 44% in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By therapy type, the autologous cell therapy segment has held the biggest revenue share of 59% in 2023.

- By therapy type, the allogenic cell therapy segment is projected to be the fastest-growing segment over the forecast period.

- By technology type, the somatic cell technology segment held the largest share of the market in 2023.

- By technology type, the 3D technology segment is expected to grow at the fastest rate during the projected period.

- By source, the IPSC (induced pluripotent stem cell) segment dominated the market in 2023.

- By source, the bone marrow segment is the second largest segment in the global market.

- By application, the oncology segment has contributed the largest revenue share of 35% in 2023.

- By application, the neurological segment is projected to show fastest growth during the forecast period.

The cell therapy manufacturing market encompasses the processes involved in producing cellular therapies, which involve using living cells to treat diseases or disorders. This market has seen significant growth due to advancements in biotechnology and regenerative medicine. Cell therapies hold promise for treating a wide range of conditions, including cancer, autoimmune diseases, and genetic disorders. Manufacturing these therapies involves complex techniques to ensure the viability, purity, and safety of the cells used.

Get a Sample: https://www.precedenceresearch.com/sample/4283

Growth Factors

Several key factors are driving the growth of the cell therapy manufacturing market. One of the primary drivers is the increasing demand for personalized medicine. Cell therapies can be tailored to individual patients, offering targeted treatment approaches. Additionally, growing investments in research and development by pharmaceutical companies and academic institutions are fueling innovation in cell therapy manufacturing processes. Technological advancements, such as automation and improved bioreactor systems, are also contributing to market growth by enhancing efficiency and scalability.

Region Insights:

The cell therapy manufacturing market exhibits regional variations influenced by factors such as regulatory environments, healthcare infrastructure, and research capabilities. North America and Europe are leading regions in terms of market share, driven by robust biotechnology industries and supportive regulatory frameworks. Asia-Pacific is emerging as a rapidly growing region due to increasing investments in healthcare and rising adoption of advanced therapies. Countries like China and Japan are investing heavily in cell therapy research and manufacturing infrastructure.

Cell Therapy Manufacturing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.93% |

| Cell Therapy Manufacturing Market Size in 2023 | USD 4.20 Billion |

| Cell Therapy Manufacturing Market Size in 2024 | USD 4.83 Billion |

| Cell Therapy Manufacturing Market Size by 2033 | USD 16.89 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Therapy Type, By Technology Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cell Therapy Manufacturing Market Dynamics

Drivers:

Key drivers shaping the cell therapy manufacturing market include the rising prevalence of chronic diseases, particularly cancer and autoimmune disorders, which are driving demand for innovative treatment options. Additionally, regulatory initiatives aimed at expediting the approval process for cell therapies and fostering a supportive ecosystem for biotechnology companies are encouraging market growth. Advances in gene editing technologies like CRISPR-Cas9 are also expanding the potential applications of cell therapies, further propelling market expansion.

Opportunities:

The cell therapy manufacturing sector presents several opportunities for growth and innovation. Expansion into new therapeutic areas beyond oncology, such as neurodegenerative diseases and cardiovascular disorders, offers promising avenues for market players. Furthermore, partnerships and collaborations between industry stakeholders, including biopharmaceutical companies, contract manufacturing organizations (CMOs), and academic institutions, can facilitate knowledge sharing and accelerate the development of scalable manufacturing processes.

Challenges:

Despite its promise, the cell therapy manufacturing market faces significant challenges. One major hurdle is the high cost associated with developing and manufacturing cell therapies, which can limit patient access and reimbursement. Scalability and standardization of manufacturing processes pose technical challenges, particularly for complex cell therapies. Moreover, ensuring consistent quality control and regulatory compliance throughout the manufacturing process remains a critical challenge due to the biological nature of these therapies and evolving regulatory standards.

Read Also: Brazil Industrial Absorbent Market Size, Growth, Report by 2033

Cell Therapy Manufacturing Market Recent Developments

- In March 2024, Cellars announced the completion of the first Cell Shuttle, an automated, cGMP-compliant cell therapy manufacturing platform to support the global demand for cell therapies while reducing the cost of manufacturing and process failure rates.

- In March 2023, Cell One Partners and the Center for Breakthrough Medicines (CBM) entered into a strategic collaboration aimed at accelerating the development and commercialization of cell and gene therapies. This collaboration brings together the expertise and resources of both organizations to drive innovation and advance the field of regenerative medicine.

- In September 2022, the Cell Therapy Manufacturing Center (CTMC) and Ori Bio collaborated to expedite the process development, commercialization, and clinical integration of cell therapies. This partnership aimed to enhance the advancement of cell-based treatments and bring them to patients more efficiently.

Cell Therapy Manufacturing Market Companies

- Merck KGaA

- Thermo Fisher Scientific

- Catalent, Inc

- Bio-Techne

- Cytiva

- Lonza

- The Discovery Labs

- Novartis AG

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

Segments Covered in the Report

By Therapy Type

- Allogenic Cell Therapy

- Autologous Cell Therapy

By Technology Type

- Somatic Cell Technology

- Cell Immortalization Technology

- Viral Vector Technology

- Genome Editing Technology

- Cell Plasticity Technology

- 3D Technology

By Source

- IPSC (Induced Pluripotent Stem Cell)

- Bone Marrow

- Umbilical Cord

- Adipose Tissues

- Neural Stem

By Application

- Musculoskeletal

- Cardiovascular

- Gastrointestinal

- Neurological

- Oncology

- Dermatology

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/