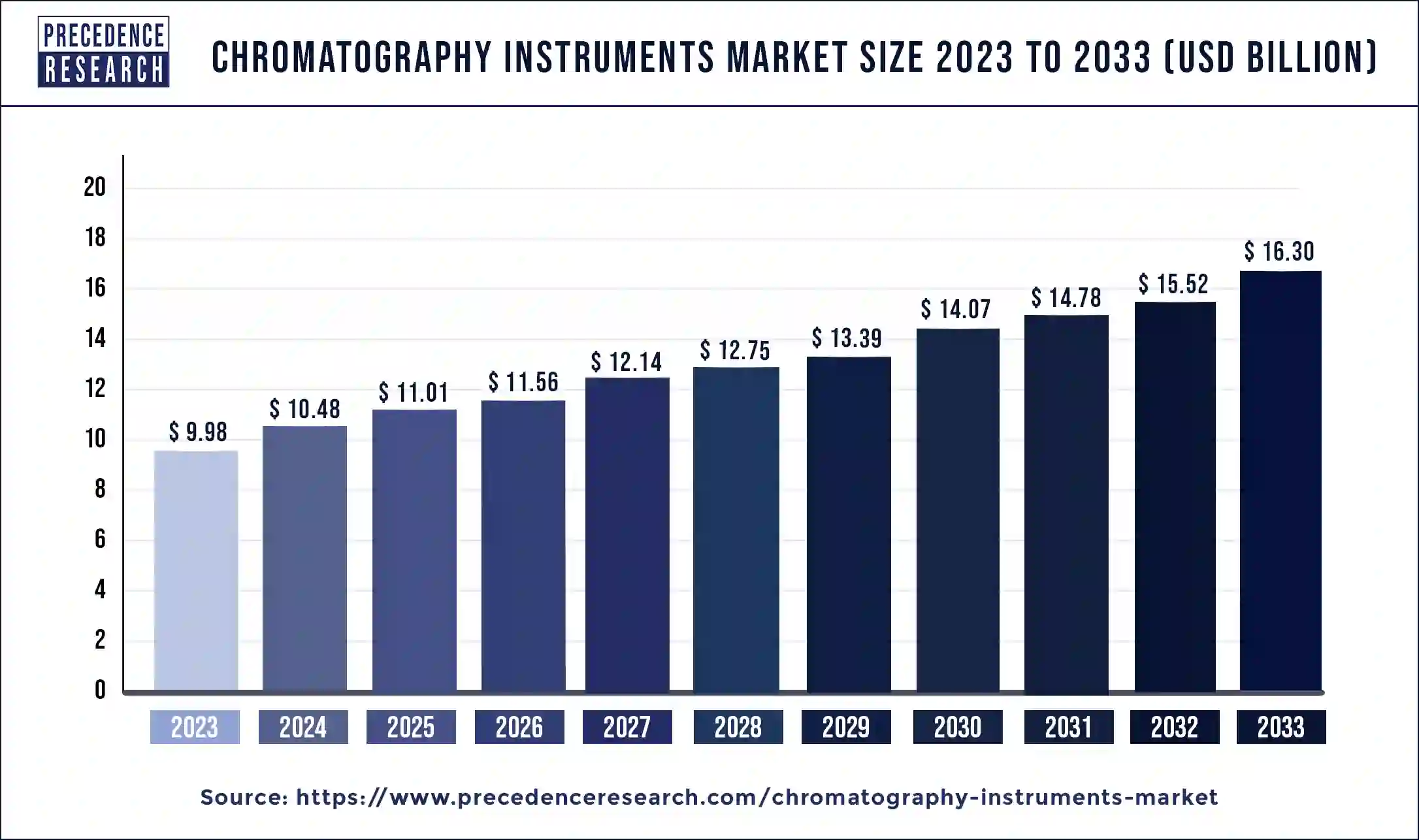

The global chromatography instruments market size is expected to increase USD 16.30 billion by 2033 from USD 9.98 billion in 2023 with a CAGR of 5.03% between 2024 and 2033.

Key Points

- The North America chromatography instruments market size accounted for USD 4.29 billion in 2023 and is expected to attain around USD 7.01 billion by 2033.

- North America dominated the market with the largest revenue share of 43% in 2023.

- Asia Pacific is expected to grow rapidly during the forecast period.

- By system, the liquid chromatography segment dominated the market in 2023.

- By system, the gas chromatography segment is expected to witness the fastest growth over the forecast period.

- By product, the consumables segment has held the biggest revenue share of 63% in 2023.

- By product, the component segment is expected to grow significantly during the projected period.

- By application, the pharmaceutical & life science firms led the market with the biggest market share of 54% in 2023.

The chromatography instruments market is a dynamic sector within the broader life sciences and analytical instrumentation industry. Chromatography is a technique used for separating and analyzing complex mixtures, and chromatography instruments play a crucial role in various applications such as pharmaceuticals, biotechnology, environmental testing, food and beverage analysis, and research laboratories. These instruments are essential for quality control, research and development, and process optimization in diverse industries.

Get a Sample: https://www.precedenceresearch.com/sample/4295

Growth Factors

The growth of the chromatography instruments market is driven by several key factors. First, increasing R&D activities in pharmaceutical and biotechnology companies to develop new drugs and therapies require advanced chromatography technologies for precise analysis and purification. Second, stringent government regulations related to food safety and environmental protection are boosting the demand for chromatography instruments for accurate testing and monitoring. Additionally, technological advancements such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS) are expanding the market’s capabilities and driving adoption.

Region Insights

The chromatography instruments market exhibits varying dynamics across different regions. North America and Europe dominate the market due to established pharmaceutical and biotechnology sectors, stringent regulatory frameworks, and advanced research infrastructure. Asia-Pacific is witnessing rapid growth driven by increasing investments in healthcare infrastructure, rising adoption of analytical techniques in emerging economies like China and India, and growing awareness of quality control standards in the region.

Chromatography Instruments Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.03% |

| Chromatography Instruments Market Size in 2023 | USD 9.98 Billion |

| Chromatography Instruments Market Size in 2024 | USD 10.48 Billion |

| Chromatography Instruments Market Size by 2033 | USD 16.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By System, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Chromatography Instruments Market Dynamics

Drivers

Several drivers propel the growth of the chromatography instruments market. The rising demand for chromatography techniques in drug development and quality control processes is a major driver. Moreover, the increasing focus on food safety and environmental monitoring is boosting the adoption of chromatography instruments globally. Additionally, technological advancements leading to more efficient and automated chromatography systems are driving market growth.

Opportunities

The chromatography instruments market presents several opportunities for expansion and innovation. The growing trend towards personalized medicine and biomarker discovery is creating new avenues for chromatography applications in healthcare. Furthermore, expanding research activities in proteomics, genomics, and metabolomics are driving the demand for sophisticated chromatography instruments with high sensitivity and resolution. Emerging markets in Latin America, Middle East, and Africa offer untapped opportunities for market players to expand their presence.

Challenges

Despite its growth prospects, the chromatography instruments market faces certain challenges. High initial costs associated with purchasing and maintaining chromatography equipment pose a barrier to adoption, particularly for small and medium-sized laboratories. Moreover, the complexity of chromatography techniques requires skilled personnel for operation and data analysis, leading to additional training costs and operational challenges. Additionally, competition from alternative analytical techniques like spectroscopy and mass spectrometry presents a challenge to market growth.

Read Also: U.S. Artificial Intelligence (AI) Market Size, Share, Report By 2033

Chromatography Instruments Market Recent Developments

- In July 2023, Valmet announced the acquisition of the Process Gas Chromatography business of Siemens. The former company intends to strengthen its automation segment and process automation with the addition of the latter company’s process industry gas chromatography system and process analyzer systems to its offering.

- In March 2023, US-based Waters Corporation introduced its next-generation HPLC chromatography system, Alliance™ iS, for its users in the QC laboratories.

- In June 2022, PerkinElmer, Inc. launched the GC 2400 Platform, an advanced, automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) solution designed to help lab teams simplify lab operations, drive precise results, and perform more flexible monitoring.

- In May 2022, Thermo Fisher Scientific Inc. inaugurated a new manufacturing facility for single-use technology in Utah, U.S. Furthermore, Thermo Fisher launched the Thermo Scientific SureStart portfolio for chromatography and mass spectrometry consumables in February 2022, showcasing its commitment to advancing chromatography solutions.

- In January 2022, RotaChrom announced the launch of its long-term strategic partnership with lea Red Mesa Science & Refining. Their first goal is to create new and profitable operations using RotaChrom’s centrifugal chromatography solution.

Chromatography Instruments Market Companies

- Agilent Technologies

- Bio-Rad Laboratories

- Cytiva

- PerkinElmer

- Pall Corporation

- Sartorius

- Shimadzu

- Shodex

- ThermoFisher Scientific

- Waters Corporation

Segments Covered in the Report

By System

- Liquid Chromatography

- Gas Chromatography

- Other Systems

By Product

- Components

- Autosamplers

- Pumps

- Detectors

- Column Accessories

- Fraction Collectors

- Other Components

- Consumables

- Tubes

- Columns

- Vials

- Solvents/Reagents

- Other Consumables

By Application

- Pharmaceutical/Biotechnology Industries

- Academic/Research Institutes

- Other Industries

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/