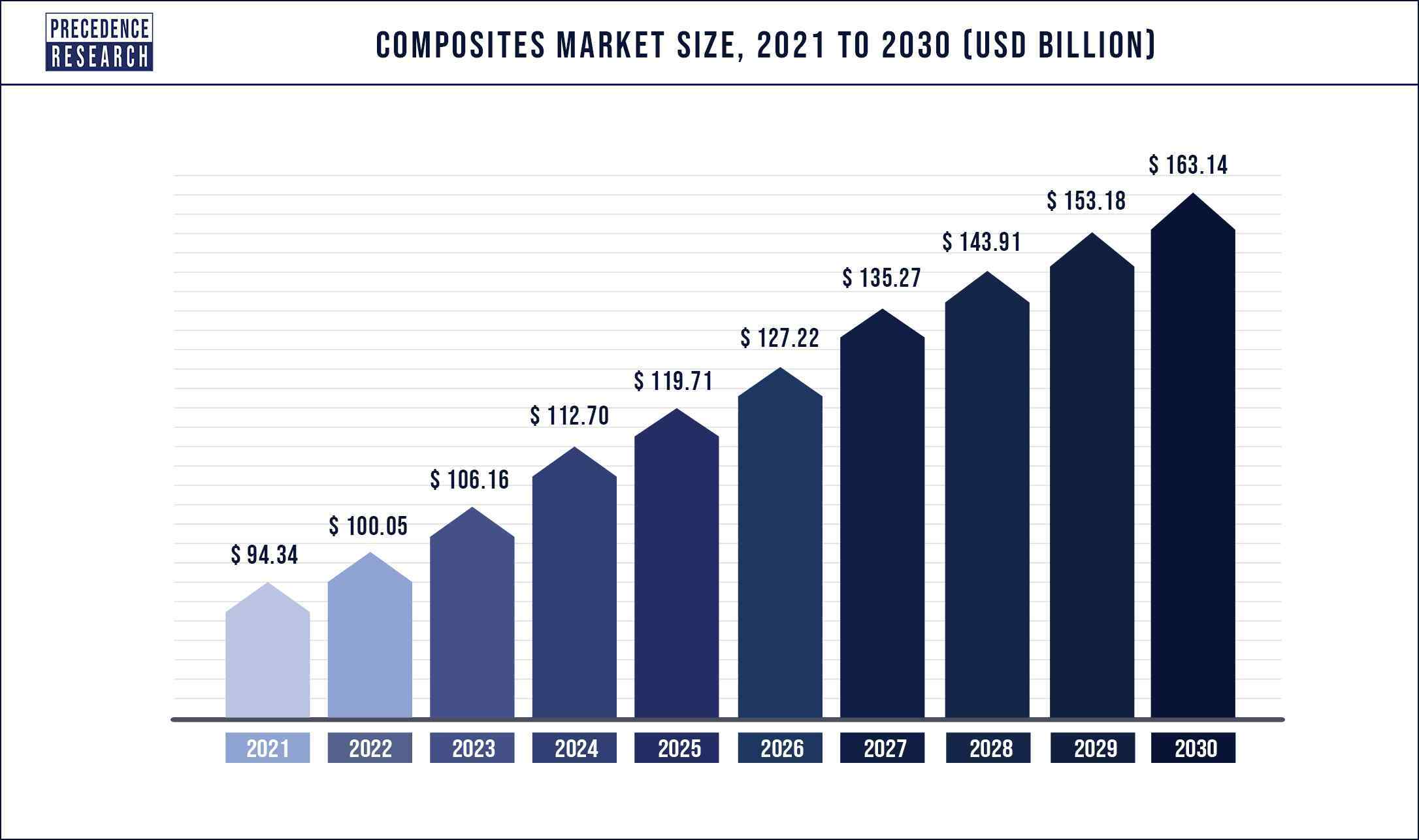

The composites market was valued approximately at US$ 94.34 Bn in 2021 and is projected to hit US$ 163.14 Bn by 2030, registering a CAGR of 6.3% every year.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The composites market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

When two or more components with different physiochemical properties are mixed and delivered, a new material known as composites is created with properties that are different from the origin source attributes. These composites can either be created naturally and artificially.

The few naturally occurring composites include wood, collagen, and wood, whereas other materials are handmade. Composites are popular in sectors such as aerospace, transportation, electronics, and automotive because of their properties.

The component firms’ procurement procedures will most likely be hampered by the high cost of raw materials for composites. The increased disposable income and a willingness to spend more on higher quality products, on the other hand, are expected to have a positive impact on the composites market growth during the forecast period.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1018

Composites Market Scope

| Report Highlights | Details |

| Market Size by 2030 | USD 163.14 Billion |

| Growth Rate | CAGR of 6.3% from 2022 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Composites Market Report Highlights

- Based on the product, the glass fiber segment dominated the global composites market in 2020 with highest market share 61.5%. These fibers are used in industrial and manufacturing applications because of their advantageous qualities such as high stiffness, low weight, minimal thermal expansion, and strong chemical resistance.

- Based on the manufacturing process, the layup process segment dominated the global composites market in 2020 with highest market share. Rising production of wind turbine blades and boats is likely to propel the layup process segment of the global composites market growth.

- Based on the end use, the automotive and transportation segment dominated the global composites market in 2020 with highest market share. Composites provide benefits to the transportation industry, such as fuel savings, because the components are substantially lower in weight, allowing for increased fuel efficiency.

Composites Market Regional Snapshot

North America is the largest segment for composites market in terms of region. The North America composites market is being influenced by a growing demand from the automotive industry, an increase in defense budgets in several nations, and an increase in demand from the electronics industry. Furthermore, increased market players’ awareness of the product’s benefits is expected to provide the region’s market growth a boost.

Asia-Pacific region is the fastest growing region in the composites market. The Asia-Pacific region’s robust vehicle manufacturing industries, combined with a high prevalence of electrical and electronic components companies, are expected to drive the demand for composites in the region.

Composites Market Growth Factors

Global composites market is largely influenced by ascending lightweight materials demand in many sectors like automotive, wind energy, transportation, aerospace and defense. Growing demand for composites in the automotive sector of emerging economies is predicted to lift the growth of global composite market during forecast period. Escalating prices of fuel have prompted the requirement for fuel-efficient vehicles.

Composites are largely employed as the replacement for wood, aluminum, and steel due to its greater strength to weight ratio. At present, against the backdrop of unsettled China/U.S. trade disagreements, the U.S. composites sector stays optimistic and endures to demonstrate positive growth. This mainly backed by stable growth of aerospace wind energy, and construction areas.

Composites Market Dynamics

Drivers

Rising demand for lightweight materials

The composites market is growing because to a surge in demand for lightweight materials in the automobile industry to improve fuel efficiency. Additionally, the growing use of high-performance composites in kinetic buildings, such as advanced composite technologies like the production of non-composite and biomimetic composite materials to replace traditional materials. As a result, the rising demand for lightweight materials is driving the growth of the composites market during the forecast period.

Restraints

Lack of standardization in manufacturing industry

The manufacturers of aerospace and automobiles are forced to choose conservative designs due to lack of material and methodology standardization, which impedes mass manufacturing and economic performance of automobiles and aircraft. Furthermore, a scarcity of labor resources with composites training and experience limits the use of composites in new applications. As a result, the lack of standardization in manufacturing industry is hindering the growth of the composites market.

Read Also: Cancer Therapeutics Market Size to Touch US$ 365.99 Billion By 2030

Opportunities

Surge in demand from the aerospace industry

The use of composites in the aerospace sector has grown and broadened since a decade. Both for commercial and business aircrafts, the aircraft manufacturers are taking steps to increase key structures in thermoplastic. The aircraft manufacturers were among the first to embrace long fibers reinforced thermoplastics technology. Polyetherimide with carbon is the most common thermoplastic composition in the industry today.

These materials have two key properties that make them appealing for aerospace applications. Thus, the surge in demand from the aerospace industry is creating lucrative opportunities for the growth of the composites market.

Challenges

Stringent environmental policies

The strict environmental policies and legislation, as well as increased restrictions and costs for landfill disposal are some of the challenges faced by the composites market. Furthermore, the growing use of life cycle assessment as part of the material selection process in a variety of industries is putting composite end of life waste management under close scrutiny.

In addition, rising plastic waste has compelled legislators around the world to enact strict environmental regulations. The introduction of single use plastic laws in a number of nations has drawn attention to the steps taken by governments to address the problems caused by plastic waste. Thus, the strict environmental policies are a huge challenge for the growth of the composites market during the forecast period.

Key Companies & Market Share Insights

- Huntsman Corporation LLC

- SGL Group

- Teijin Ltd

- PPG Industries, Inc.

- Toray Industries, Inc.

- Owens Corning

- Hexcel Corporation

- DuPont

- Momentive Performance Materials, Inc.

- Jushi Group Co., Ltd.

- Compagnie de Saint-Gobain S.A

- Weyerhaeuser Company

- Cytec Industries

Segments Covered in the Report

By Product Type

- Glass Fiber

- Carbon Fiber

- Others

By Resin Type

- Thermoplastic

- Thermosetting

- Others

By Manufacturing Process Type

- Injection Molding Process

- Resin Transfer Molding Process

- Pultrusion Process

- Layup Process

- Filament Winding Process

- Compression Molding Process

- Others

By End Use

- Electrical & Electronics

- Automotive & Transportation

- Wind Energy

- Aerospace & Defense

- Pipes & Tanks

- Construction & Infrastructure

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Composites Market, By Product

7.1. Composites Market, by Product Type, 2020-2027

7.1.1. Glass Fiber

7.1.1.1. Market Revenue and Forecast (2016-2027)

7.1.2. Carbon Fiber

7.1.2.1. Market Revenue and Forecast (2016-2027)

7.1.3. Others

7.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 8. Global Composites Market, By Resin

8.1. Composites Market, by Resin, 2020-2027

8.1.1. Thermoplastic

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. Thermosetting

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Composites Market, By Manufacturing Process

9.1. Composites Market, by Manufacturing Process , 2020-2027

9.1.1. Injection Molding Process

9.1.1.1. Market Revenue and Forecast (2016-2027)

9.1.2. Resin Transfer Molding Process

9.1.2.1. Market Revenue and Forecast (2016-2027)

9.1.3. Pultrusion Process

9.1.3.1. Market Revenue and Forecast (2016-2027)

9.1.4. Layup Process

9.1.4.1. Market Revenue and Forecast (2016-2027)

9.1.5. Filament Winding Process

9.1.5.1. Market Revenue and Forecast (2016-2027)

9.1.6. Compression Molding Process

9.1.6.1. Market Revenue and Forecast (2016-2027)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2016-2027)

Chapter 10. Global Composites Market, By End use

10.1. Composites Market, by End use, 2020-2027

10.1.1. Electrical & Electronics

10.1.1.1. Market Revenue and Forecast (2016-2027)

10.1.2. Automotive & Transportation

10.1.2.1. Market Revenue and Forecast (2016-2027)

10.1.3. Wind Energy

10.1.3.1. Market Revenue and Forecast (2016-2027)

10.1.4. Aerospace & Defense

10.1.4.1. Market Revenue and Forecast (2016-2027)

10.1.5. Pipes & Tanks

10.1.5.1. Market Revenue and Forecast (2016-2027)

10.1.6. Construction & Infrastructure

10.1.6.1. Market Revenue and Forecast (2016-2027)

10.1.7. Marine

10.1.7.1. Market Revenue and Forecast (2016-2027)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2016-2027)

Chapter 11. Global Composites Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2016-2027)

11.1.2. Market Revenue and Forecast, by Resin (2016-2027)

11.1.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.1.4. Market Revenue and Forecast, by End use (2016-2027)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.1.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.1.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.1.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Product (2016-2027)

11.1.6.2. Market Revenue and Forecast, by Resin (2016-2027)

11.1.6.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.1.6.4. Market Revenue and Forecast, by End use (2016-2027)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2016-2027)

11.2.2. Market Revenue and Forecast, by Resin (2016-2027)

11.2.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.2.4. Market Revenue and Forecast, by End use (2016-2027)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.2.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.2.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.2.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Product (2016-2027)

11.2.6.2. Market Revenue and Forecast, by Resin (2016-2027)

11.2.6.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.2.6.4. Market Revenue and Forecast, by End use (2016-2027)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Product (2016-2027)

11.2.7.2. Market Revenue and Forecast, by Resin (2016-2027)

11.2.7.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.2.7.4. Market Revenue and Forecast, by End use (2016-2027)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Product (2016-2027)

11.2.8.2. Market Revenue and Forecast, by Resin (2016-2027)

11.2.8.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.2.8.4. Market Revenue and Forecast, by End use (2016-2027)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2016-2027)

11.3.2. Market Revenue and Forecast, by Resin (2016-2027)

11.3.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.3.4. Market Revenue and Forecast, by End use (2016-2027)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.3.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.3.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.3.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Product (2016-2027)

11.3.6.2. Market Revenue and Forecast, by Resin (2016-2027)

11.3.6.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.3.6.4. Market Revenue and Forecast, by End use (2016-2027)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Product (2016-2027)

11.3.7.2. Market Revenue and Forecast, by Resin (2016-2027)

11.3.7.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.3.7.4. Market Revenue and Forecast, by End use (2016-2027)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Product (2016-2027)

11.3.8.2. Market Revenue and Forecast, by Resin (2016-2027)

11.3.8.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.3.8.4. Market Revenue and Forecast, by End use (2016-2027)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2016-2027)

11.4.2. Market Revenue and Forecast, by Resin (2016-2027)

11.4.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.4.4. Market Revenue and Forecast, by End use (2016-2027)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.4.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.4.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.4.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Product (2016-2027)

11.4.6.2. Market Revenue and Forecast, by Resin (2016-2027)

11.4.6.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.4.6.4. Market Revenue and Forecast, by End use (2016-2027)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Product (2016-2027)

11.4.7.2. Market Revenue and Forecast, by Resin (2016-2027)

11.4.7.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.4.7.4. Market Revenue and Forecast, by End use (2016-2027)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Product (2016-2027)

11.4.8.2. Market Revenue and Forecast, by Resin (2016-2027)

11.4.8.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.4.8.4. Market Revenue and Forecast, by End use (2016-2027)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Product (2016-2027)

11.5.5.2. Market Revenue and Forecast, by Resin (2016-2027)

11.5.5.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.5.5.4. Market Revenue and Forecast, by End use (2016-2027)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Product (2016-2027)

11.5.6.2. Market Revenue and Forecast, by Resin (2016-2027)

11.5.6.3. Market Revenue and Forecast, by Manufacturing Process (2016-2027)

11.5.6.4. Market Revenue and Forecast, by End use (2016-2027)

Chapter 12. Company Profiles

12.1. Huntsman Corporation LLC

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SGL Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Teijin Ltd

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. PPG Industries, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Toray Industries, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Owens Corning

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hexcel Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. DuPont

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Momentive Performance Materials, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Jushi Group Co., Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Compagnie de Saint-Gobain S.A

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

12.12. Weyerhaeuser Company

12.12.1. Company Overview

12.12.2. Product Offerings

12.12.3. Financial Performance

12.12.4. Recent Initiatives

12.13. Cytec Industries

12.13.1. Company Overview

12.13.2. Product Offerings

12.13.3. Financial Performance

12.13.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Why Buy this Report?

The purpose of Precedence Research’s composites market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1018

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the current size of global composites market?” answer-0=”As per Precedence Research, the global composites market size was reached at US$ 94.34 billion in 2021 and is anticipated to hit US$ 163.14 billion by 2030. ” image-0=”” headline-1=”h6″ question-1=”What are the main influencing factors of composites market?” answer-1=”Some of the main influencing factors of composites market include proliferating requirement for lightweight materials in the defense, automotive and aerospace sector, rising demand for chemical and corrosion resistance materials in pipe & tank and construction field. ” image-1=”” headline-2=”h6″ question-2=”How much is the CAGR of composites market?” answer-2=”The global composites market is growing at a CAGR of 6.3% from 2022 to 2030. ” image-2=”” headline-3=”h6″ question-3=”What as the glass fiber segment revenue in 2021?” answer-3=”In 2021, glass fiber appeared as prominent segment and amounted for around 62% revenue share of the total market.” image-3=”” headline-4=”h6″ question-4=”Ho much was the market revenue of thermosetting resin segment in 2021?” answer-4=”In 2021, among various resins type segment of global composites market, thermosetting resin segment lead the market with over 70% revenue share.” image-4=”” headline-5=”h6″ question-5=”Which region dominated the global composite market in 2021?” answer-5=”Asia Pacific dominated the global composite market in 2021.” image-5=”” headline-6=”h6″ question-6=”Which are the top companies contributing in composite market?” answer-6=”The top key companies contributing in composite market are Huntsman Corporation LLC, SGL Group, Teijin Ltd, PPG Industries, Inc., Toray Industries, Inc., Owens Corning and more ” image-6=”” count=”7″ html=”true” css_class=””]