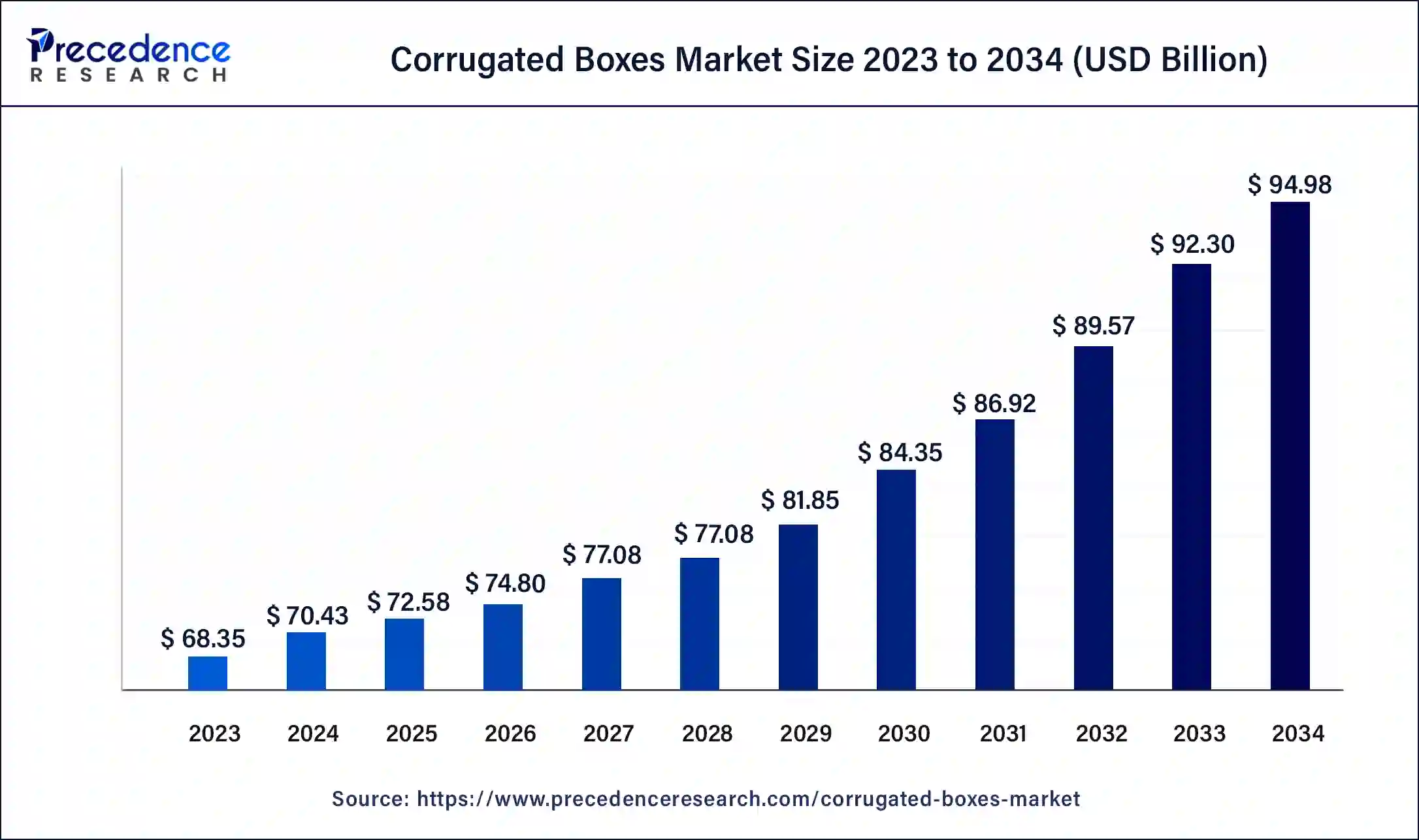

The global corrugated boxes market size is expected to increase USD 92.30 billion by 2033 from USD 68.35 billion in 2023 with a CAGR of 3.05% between 2024 and 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 38% in 2023.

- North America is expected to experience significant expansion in the global market over the projected period.

- By technology, the flexography printing segment has held the major revenue share of 26% in 2023.

- By technology, the digital printing segment is expected to witness the fastest growth over the forecast period.

- By end use, the food & beverage segment has contributed more than 36% of revenue share in 2023.

- By end use, the electronics goods segment is projected to witness rapid growth in the market during the forecast period.

The corrugated boxes market is a critical segment within the packaging industry, primarily used for the transportation and storage of goods. These boxes are made from corrugated paperboard, which consists of a fluted corrugated sheet and one or two flat linerboards. The market has seen consistent growth due to the increasing demand from various industries such as food and beverages, electronics, e-commerce, and personal care. Corrugated boxes are favored for their durability, light weight, and recyclability, making them an environmentally friendly packaging option. The market is segmented by type (single-wall, double-wall, and triple-wall corrugated boxes), end-use industry, and geography.

Get a Sample:https://www.precedenceresearch.com/sample/4316

Growth Factors

Several factors are driving the growth of the corrugated boxes market. The booming e-commerce industry is a significant contributor, as the need for safe and efficient packaging for shipping products directly to consumers has surged. Additionally, the increasing awareness and demand for sustainable packaging solutions have propelled the adoption of corrugated boxes, which are recyclable and made from renewable resources. The rise in consumer goods consumption, coupled with advancements in printing technology that enhance branding opportunities on corrugated boxes, further fuels market growth.

Region Insights

Regionally, the corrugated boxes market is experiencing varied growth rates. Asia-Pacific dominates the market, driven by rapid industrialization, a growing population, and a burgeoning e-commerce sector, particularly in countries like China and India. North America and Europe also hold significant market shares due to the strong presence of major retail and consumer goods companies and a high emphasis on sustainable packaging solutions. Meanwhile, emerging economies in Latin America and Africa are witnessing gradual growth, supported by increasing industrial activities and improving economic conditions.

Corrugated Boxes Market Scope

| Report Coverage | Details |

| Corrugated Boxes Market Size in 2023 | USD 68.35 Billion |

| Corrugated Boxes Market Size in 2024 | USD 70.43 Billion |

| Corrugated Boxes Market Size by 2033 | USD 92.30 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.05% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Box Layer, By Technology, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Corrugated Boxes Market Dynamics

Drivers

The primary drivers of the corrugated boxes market include the explosive growth of the e-commerce industry, which demands robust and reliable packaging solutions for shipping and logistics. Additionally, the push towards sustainability and environmental responsibility has led many companies to choose corrugated boxes over plastic alternatives. Innovations in packaging design and materials, which enhance the strength and versatility of corrugated boxes, also play a crucial role. Furthermore, the expansion of the food and beverage industry, which requires secure packaging for perishable goods, contributes significantly to market demand.

Opportunities

Opportunities in the corrugated boxes market are abundant, particularly in the development of smart packaging solutions. The integration of technologies such as RFID tags and QR codes can transform traditional corrugated boxes into interactive, trackable packages, enhancing supply chain efficiency and consumer engagement. Additionally, the growing trend of customized packaging for branding and promotional purposes opens new avenues for market players. The rise of eco-friendly packaging options, driven by regulatory pressures and consumer preferences, also presents significant opportunities for innovation and market expansion.

Challenges

Despite the positive growth trajectory, the corrugated boxes market faces several challenges. Fluctuations in raw material prices, particularly for paper and pulp, can impact production costs and profit margins. The market also encounters competition from alternative packaging materials like plastics and metals, which may offer certain advantages in specific applications. Environmental concerns related to deforestation and the carbon footprint of manufacturing processes pose additional hurdles. Moreover, the need for continuous innovation to meet changing consumer preferences and regulatory requirements can strain resources and capabilities of market players.

Read Also: Neobanking Market Size to Attain USD 3,799.25 Billion by 2033

Corrugated Boxes Market Recent Developments

- In November 2023, Fresh Del Monte Produce Inc., one of the world’s leading vertically integrated producers, marketers, and distributors of high-quality fresh and fresh-cut fruits and vegetables, is proud to announce a strategic partnership with Arena Packaging, a leading packaging, design, and pooling company in North America, to introduce reusable plastic containers (RPCs) for bananas.

- In July 2022, WestRock Co. agreed to acquire the remaining interest in Grupo Gondi for USD 970 million, plus debt. This move aims to bolster WestRock’s presence in the expanding Latin American corrugated boxes market. Grupo Gondi’s extensive infrastructure across Mexico enhances WestRock’s capacity and competitiveness in the region’s packaging markets.

- In May 2022, Mondi announced an investment of EUR 280 million to increase the production of corrugated boards and cardboard. This investment will help to expand capacity and increase efficiency in the Czech Republic, Poland, Germany, and Turkey. Of this investment figure, EUR 185 million will go to the company’s network of corrugated solutions plants in Central and Eastern Europe.

- In April 2022, DS Smith, a UK-based sustainable packaging provider, developed and launched a corrugated cardboard box for e-commerce shipments of medical devices. This new corrugated cardboard box features a single-material solution in place of glued packaging with a single-use plastic insert.

Corrugated Boxes Market Companies

- DS Smith

- Mondi Group

- WestRock

- Smurfit Kappa Group

- International Paper Company

- Pratt Industries

- Stora Enso

- Atlantic Packaging

- Georgia-Pacific Packaging LLC

- Nelson Container Corporation

- Others

Segments Covered in the Report

By Type

- Slotted Boxes

- Telescope Boxes

- Others

By Box Layer

- Single-Phase Corrugated

- Single-Wall Corrugated Box

- Double Wallboard

- Triple Wallboard

By Technology

- Lithography

- Flexo

- Digital Printing

- Rotogravure

- Silkscreen

- Others

By End-use

- Food & Beverages

- Household Products

- Cosmetics

- Healthcare And Pharmaceuticals

- Personal Care

- Shipping And Logistics

- Electronics

- Textile

- E-commerce

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/