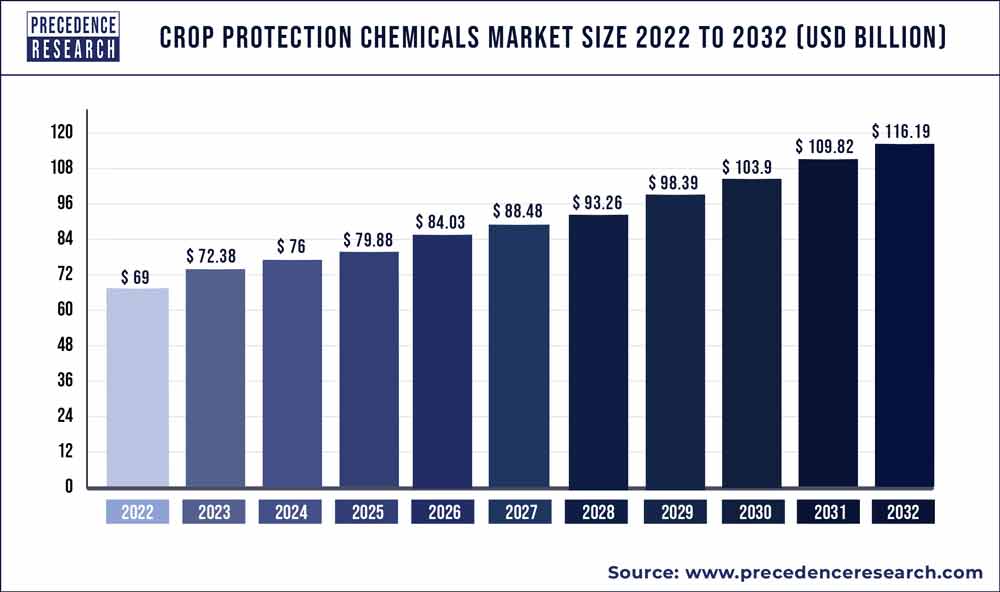

The crop protection chemicals market size was valued approximately at US$ 68.32 billion in 2021 and is projected to reach US$ 92.02 billion by 2030, registering a CAGR of 3.4%.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The crop protection chemicals market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1607

The major driver is a greater emphasis on high agricultural productivity to combat food security. In terms of regulatory measures for safe farming and overall farming culture and practices, the agricultural industry has made significant progress around the world. The growing food demand has prompted agrochemical-based companies to invest in research and development to improve their product and transition to greener alternatives.

The key market players have been seen in the business commercializing bio-based compounds derived from mineral, plant, bacterium, and animal sources. The biopesticides are an example of an area where the industry has made great progress. In recent years, the focus of crop protection research has been on producing chemicals that are safer than older equivalents in order to address the demand for novel molecular solutions to combat pests that have gained resistance to earlier compounds.

The selectivity to control target pests, per hectare low application rate requirements, broad spectrum control to cover a wide group of pests and diseases, and meeting regulatory frameworks in regional and local markets are some of the other main research and development priority areas.

Crop Protection Chemicals Market Scope

| Report Coverage | Details |

| Market Size by 2030 | USD 92.02 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 3.4% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacifc |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Crop Protection Chemicals Market Report Highlights

- Based on the products, herbicides segment is estimated to be the most opportunistic segment during the forecast period. They are commonly employed in weed management, which aids in crop productivity and output quality. The herbicides aid in the reduction of soil erosion as well as the improvement of soil fertility and crop productivity.

- Based on the applications, the cereals and grains segment dominated the global crop protection chemicals market in 2020 with highest market share. The expanding worldwide population has resulted in a greater focus on food security and a high demand for crops, boosting the cereals and grains segment’s growth.

Crop Protection Chemicals Market : Regional Snapshot

North America is the largest segment for crop protection chemicals market in terms of region. The growing public awareness regarding pesticides as well as continual technological developments are driving this industry forward. The agribusiness firms have also been pushed to extend their supplier and production bases in North America as a result of expanding crop demand and rising cultivation in the region.

Asia-Pacific region is the fastest growing region in the crop protection chemicals market.The rice cultivation and the dominance of small-scale enterprises may be found in almost every Asian country.

Crop Protection Chemicals Market Dynamics

Drivers

Emergence of pests due to climatic conditions

The plant diseases and pests have become more common as a result of changing environmental circumstances. The climate change has a substantial impact on crop productivity and insect issue susceptibility. The climate change makes crops more susceptible to various pests and disorders, which has an impact on crop productivity. As a result, each change in the climate causes as shift in farming practices, resulting in lower output. In addition, the fungal population grew as a result of unpredictably wet weather in different parts of the country. Thus, the emergence of pests due to climatic conditions is driving the growth of the crop protection chemicals market.

Restraints

Surge in resistance of pests

One of the key factors limiting the crop protection chemicals market expansion is insect resistance to some crop protection treatments. The increased pest resistance has resulted from the dramatic fall in the efficiency of certain active substances. The changes in insect metabolic patterns, increased reproduction rates, and pest multiplication are all factors contributing to this resistance.

Read Also: Automotive Fasteners Market Size to Touch US$ 38.95 Billion By 2030

Opportunities

Growing organic agriculture

Pesticides made without the use of chemicals are known as biopesticides. Since growing environmental concerns, as well as the potential for pollution and health problems from many conventional pesticides, demand for biopesticides has been continuously increasing in all parts of the world. Biopesticides are becoming more popular as a result of their lower or non-toxic toxicity as compared to synthetic pesticides. Furthermore, unlike traditional pesticides, which frequently harm a wide range of insects, birds, and mammal’s species, biopesticides give more targeted activity to desired pests. Biopesticides can also be very effective in small amounts, requiring less exposure and decomposing quickly; they leave virtually no hazardous residue after application.

Challenges

Problems with pesticide residues

The pesticide residues are of increasing concern because of their persistent nature, poisonous characteristics, bioaccumulation, lipophilicity, and negative health effects. Pesticides are absorbed into the human body through the ingestion of tainted fruits and vegetables. Cancers, birth defects, neurological diseases, endocrine disruptors, and reproductive consequences are among the significant health concerns associated with pesticide residue. The period of exposure and the toxicity of a pesticide define the chemical’s effect. Acute or chronic consequences are possible. The constant monitoring of fruits and vegetables is necessary during farming due to the potential health hazards linked with pesticide ingestion.Difenoconazole and Bifenthrin are two typical pesticides discovered in fruits and vegetables sold to customers.

Some of the prominent players in the global crop protection chemicals market include:

- BASF SE

- The Dow Chemical

- Sumitomo Chemical Co. Ltd

- Bayer Cropscience AG

- Nufarm Limited

- Adama Agricultural Solutions Ltd.

- Arysta Lifesciences Corporation

- America Vanguard Corporation

- Jiangsu Yangnong Chemical Group Co. Ltd

Segments Covered in the Report

By Products

- Herbicides

- By Product

- Selective

- Non-Selective

- By Active Ingredients

- Glyphosate

- Atrazine

- 2,4-D

- Others

- By Product

- Fungicides

- By Active Ingredients

- Chlorathalonil

- Sulfur

- PCNB

- Maneb

- Others

- By Active Ingredients

- Insecticides

- By Active Ingredients

- Malathion

- Carbaryl

- Chlorpyrifos

- Others

- By Active Ingredients

- Biopesticides

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Source

- Synthetic Chemicals

- Biologicals

By Form

- Dry

- Liquid

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others (chemigation and fumigation)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Crop Protection Chemicals Market

5.1. COVID-19 Landscape: Crop Protection Chemicals Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Crop Protection Chemicals Market, By Products Type

8.1. Crop Protection Chemicals Market, by Products Type, 2022-2030

8.1.1. Herbicides

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Fungicides

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Insecticides

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Biopesticides

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Crop Protection Chemicals Market, By Crop Type

9.1. Crop Protection Chemicals Market, by Crop Type, 2022-2030

9.1.1. Cereals & Grains

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Oilseeds & Pulses

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Fruits & Vegetables

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Clearcoat

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Crop Protection Chemicals Market, By Source Type

10.1. Crop Protection Chemicals Market, by Source Type, 2022-2030

10.1.1. Synthetic Chemicals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Biologicals

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Crop Protection Chemicals Market, By Form Type

11.1. Crop Protection Chemicals Market, by Form Type, 2022-2030

11.1.1. Dry

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Liquid

Chapter 12. Global Crop Protection Chemicals Market, By Mode of Application

12.1. Crop Protection Chemicals Market, by Mode of Application, 2022-2030

12.1.1. Foliar Spray

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Seed Treatment

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Soil Treatment

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Crop Protection Chemicals Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Products (2017-2030)

13.1.2. Market Revenue and Forecast, by Crop (2017-2030)

13.1.3. Market Revenue and Forecast, by Source (2017-2030)

13.1.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Products (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Crop (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Source (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.7. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Products (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Crop (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Source (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.1.8.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Products (2017-2030)

13.2.2. Market Revenue and Forecast, by Crop (2017-2030)

13.2.3. Market Revenue and Forecast, by Source (2017-2030)

13.2.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Products (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Crop (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Source (2017-2030)

13.2.7. Market Revenue and Forecast, by Form (2017-2030)

13.2.8. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Products (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Crop (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Source (2017-2030)

13.2.10. Market Revenue and Forecast, by Form (2017-2030)

13.2.11. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Products (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Crop (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Source (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.13. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Products (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Crop (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Source (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Form (2017-2030)

13.2.15. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Products (2017-2030)

13.3.2. Market Revenue and Forecast, by Crop (2017-2030)

13.3.3. Market Revenue and Forecast, by Source (2017-2030)

13.3.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Products (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Crop (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Source (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.7. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Products (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Crop (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Source (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.9. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Products (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Crop (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Source (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.10.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Products (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Crop (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Source (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Form (2017-2030)

13.3.11.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Products (2017-2030)

13.4.2. Market Revenue and Forecast, by Crop (2017-2030)

13.4.3. Market Revenue and Forecast, by Source (2017-2030)

13.4.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Products (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Crop (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Source (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.7. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Products (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Crop (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Source (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.9. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Products (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Crop (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Source (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.10.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Products (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Crop (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Source (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Form (2017-2030)

13.4.11.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Products (2017-2030)

13.5.2. Market Revenue and Forecast, by Crop (2017-2030)

13.5.3. Market Revenue and Forecast, by Source (2017-2030)

13.5.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Products (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Crop (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Source (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.7. Market Revenue and Forecast, by Mode of Application (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Products (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Crop (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Source (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Form (2017-2030)

13.5.8.5. Market Revenue and Forecast, by Mode of Application (2017-2030)

Chapter 14. Company Profiles

14.1. BASF SE

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. The Dow Chemical

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Sumitomo Chemical Co. Ltd

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Bayer Cropscience AG

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Nufarm Limited

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Adama Agricultural Solutions Ltd.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Arysta Lifesciences Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. America Vanguard Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Jiangsu Yangnong Chemical Group Co. Ltd

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s crop protection chemicals market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1607

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com