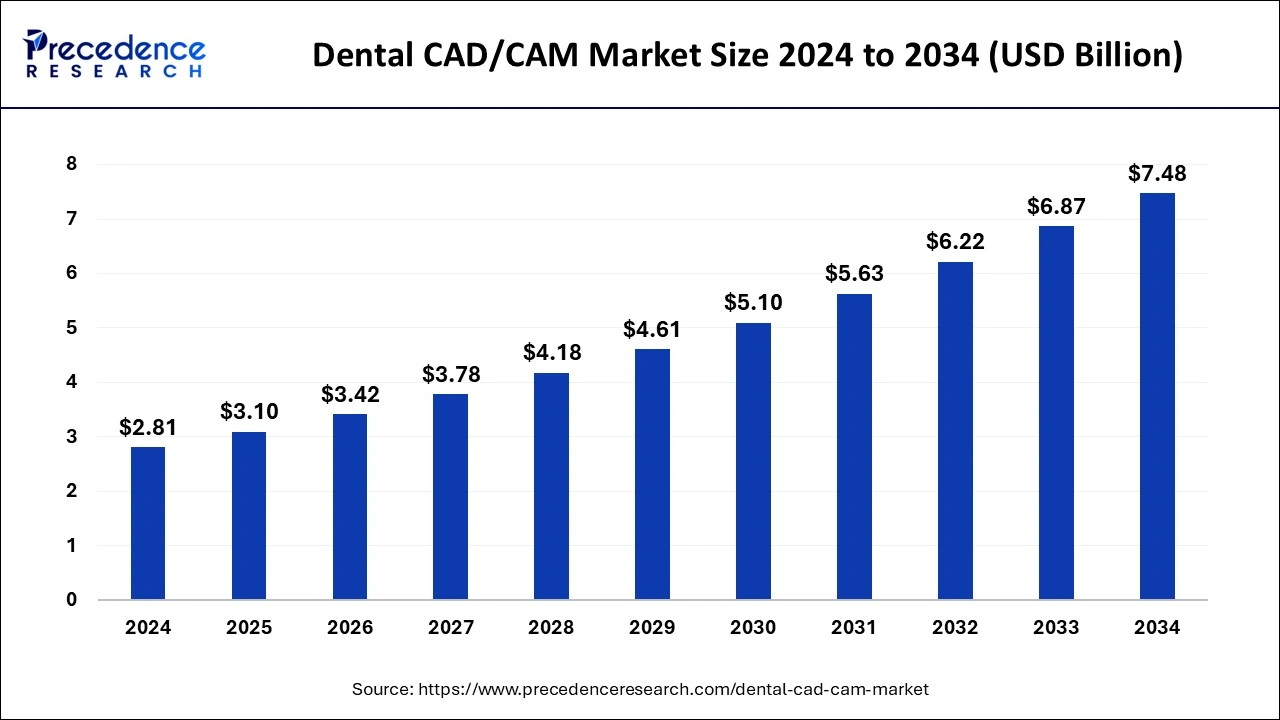

The global dental CAD/CAM market size surpassed USD 2.54 billion in 2023 and is projected to hit around USD 6.87 billion by 2033, growing at a CAGR of 10.46% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 36% in 2023.

- Asia Pacific is expected to witness notable growth in the market during the forecast period.

- By type, the in-lab system segment dominated the dental CAD/CAM market in 2023.

- By component, the hardware segment had the highest market share in 2023.

- By component, the software segment is expected to grow in the market during the forecast period.

- By end-user, the dental clinics segment dominated the market with the largest share in 2023.

The Dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) market has witnessed significant growth in recent years, driven by advancements in technology and increasing demand for precise and efficient dental solutions. CAD/CAM technology has revolutionized the dental industry by enabling dentists and dental laboratories to design and manufacture dental restorations with unprecedented accuracy and speed. This technology allows for the creation of crowns, bridges, implants, and other dental prostheses with superior fit and aesthetics, enhancing patient outcomes and satisfaction.

Get a Sample: https://www.precedenceresearch.com/sample/3946

Growth Factors:

Several factors contribute to the rapid growth of the Dental CAD/CAM market. Firstly, the rising prevalence of dental disorders and the aging population have increased the demand for dental restorations, driving the adoption of CAD/CAM technology. Additionally, the shift towards digital dentistry and the growing preference for minimally invasive procedures have fueled the demand for CAD/CAM solutions. Moreover, advancements in software algorithms, materials science, and 3D printing technologies have improved the efficiency and versatility of CAD/CAM systems, further propelling market growth.

Dental CAD/CAM Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.46% |

| Global Market Size in 2023 | USD 2.54 Billion |

| Global Market Size by 2033 | USD 6.87 Billion |

| U.S. Market Size in 2023 | USD 690 Million |

| U.S. Market Size by 2033 | USD 1,880 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Component, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dental CAD/CAM Market Dynamics

Drivers:

Several drivers are fueling the expansion of the Dental CAD/CAM market. One of the key drivers is the increasing awareness among dental practitioners about the benefits of CAD/CAM technology, including improved accuracy, faster turnaround times, and enhanced patient comfort. Additionally, the growing demand for customized dental restorations to meet individual patient needs is driving the adoption of CAD/CAM systems. Furthermore, the integration of CAD/CAM technology with digital impression systems and intraoral scanners has streamlined the dental workflow, reducing chairside time and enhancing productivity.

Restraints:

Despite the significant growth prospects, the Dental CAD/CAM market faces certain restraints that may hinder its expansion. One of the primary challenges is the high initial investment required for setting up CAD/CAM equipment and software, which may deter small-scale dental practices from adopting this technology. Moreover, the lack of standardized protocols and interoperability issues between different CAD/CAM systems pose challenges for seamless integration and workflow optimization. Additionally, concerns regarding the quality and durability of CAD/CAM restorations compared to conventional techniques may limit widespread acceptance among dental professionals and patients.

Opportunity:

Despite the challenges, the Dental CAD/CAM market presents lucrative opportunities for growth and innovation. The increasing adoption of digital dentistry and the emergence of cloud-based CAD/CAM solutions offer new avenues for market expansion. Moreover, the growing trend towards chairside CAD/CAM systems allows for on-demand production of dental restorations, reducing turnaround times and enhancing patient satisfaction. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into CAD/CAM software holds promise for automated design optimization and predictive analytics, unlocking new opportunities for personalized dental care.

Read Also: Vascular Closure Devices Market Size to Cross USD 3.30 Bn by 2033

Region Insights:

The Dental CAD/CAM market exhibits regional variations in terms of adoption rates, regulatory landscape, and market dynamics. North America dominates the market, driven by the presence of advanced healthcare infrastructure, high dental care expenditure, and early adoption of CAD/CAM technology. Europe follows closely, supported by favorable reimbursement policies, increasing dental tourism, and growing investments in digital dentistry. The Asia-Pacific region is poised for rapid growth, fueled by rising disposable incomes, expanding dental healthcare infrastructure, and growing awareness about dental aesthetics. Additionally, Latin America and the Middle East & Africa are witnessing increasing adoption of CAD/CAM technology, driven by improving access to dental care and rising demand for cosmetic dentistry services.

Recent Developments

- In February 2024, Carbon announced the launch of automated 3D printing tools for the advancements in print preparation, post-processing, and print production for dental users of their 3D printing technology. The organization also collaborates with Desktop Health.

- In February 2024, Halo Dental Technologies announced the launch of its “Digital Dental Mirror.” The launch is the advancement in dentistry that transformed and enhanced the patient’s care.

- In February 2024, Kerr Dental, a leading manufacturer of quality dental and restorative products, launched the new SimpliCut™ rotary products. The latest launch is the pre-sterilized single patient-use diamond burs line, manufactured to enhance efficiencies and reduce the requirement for sterilization, cleaning, and processing.

- In February 2024, Havant MP Alan Mak launched the mobile dental service, allowing NHS care for the residencies of Hampshire and the Isle of Wight with the risk of social exclusion.

- In February 2024, Nexa3D announced its collaboration with North American dental partners Harris Discount Dental Supply and CAD-Ray. Additionally, it launched the three resins from dental market juggernaut Pac-Dent, Inc., allowing efficiency in the workflow of the restorative and surgical applications for labs for the practices using Nexa3D’s XiP desktop printer by LSPc technology.

Dental CAD/CAM Market Companies

- 3M Company

- Amann Girbach AG

- Danaher Corporation

- Dental wings Inc.

- Dentsply Sirona Inc.

- Institut Straumann AG

- Ivoclar vivadent AG

- Planmeca OY

- Roland DAG

- Zirkonzahn GMBH

Segments Covered in the Report

By Type

- In-lab System

- In-office System

By Component

- Hardware

- Software

By End-user

- Dental Clinics

- Dental Laboratories

- Dental Milling Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/