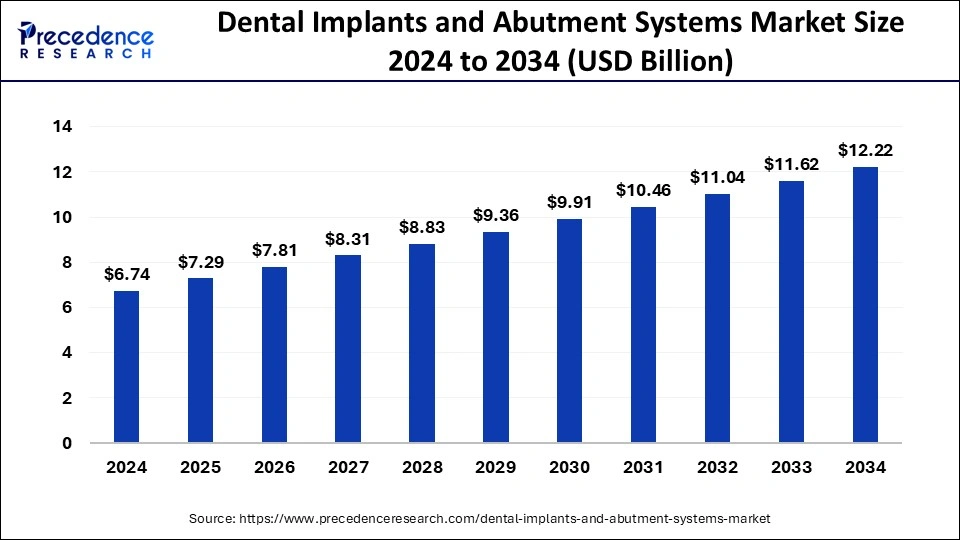

The global dental implants and abutment systems market size reached USD 6.31 billion in 2023 and is projected to grow around USD 11.95 billion by 2033 with a CAGR of 6.59% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 34% in 2023.

- By product, the dental implants segment dominated the dental implants and abutment systems market in 2023.

- By material, the titanium segment dominated the market with the largest share in 2023.

- By end-use, the dental clinics segment dominated the dental implants and abutment systems market in 2023.

The dental implants and abutment systems market is a crucial segment within the broader dental industry, catering to patients seeking durable and aesthetically pleasing solutions for tooth replacement. Dental implants offer a permanent solution for individuals with missing teeth, providing stability, functionality, and natural-looking results. The market encompasses a range of products and technologies, including dental implants, abutments, prosthetic components, and surgical instruments, catering to the diverse needs of patients and dental professionals.

Get a Sample: https://www.precedenceresearch.com/sample/3923

One of the key drivers fueling the growth of the dental implants and abutment systems market is the rising prevalence of dental disorders and edentulism globally. Factors such as aging populations, poor oral hygiene practices, and lifestyle-related risk factors contribute to the increasing incidence of tooth loss, driving demand for dental implant procedures. Moreover, growing awareness about the benefits of dental implants, such as improved chewing efficiency, speech clarity, and enhanced aesthetics, further stimulates market growth, as patients increasingly opt for permanent tooth replacement solutions over traditional alternatives like dentures and bridges.

Dental Implants and Abutment Systems Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.59% |

| Global Market Size in 2023 | USD 6.31 Billion |

| Global Market Size by 2033 | USD 11.95 Billion |

| U.S. Market Size in 2023 | USD 1.61 Billion |

| U.S. Market Size by 2033 | USD 3.05 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Material, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancements play a significant role in shaping the evolution of the dental implants and abutment systems market, driving innovation in implant design, materials, and surgical techniques. Advancements in 3D imaging, computer-aided design (CAD), and computer-aided manufacturing (CAM) technologies have revolutionized treatment planning and implant placement, enabling more precise, predictable, and minimally invasive procedures. Furthermore, the development of novel implant materials, such as titanium alloys, zirconia, and ceramic-based implants, offer improved biocompatibility, osseointegration, and esthetics, expanding the treatment options available to patients and clinicians.

The growing demand for cosmetic dentistry and aesthetic dental procedures is another significant growth driver for the dental implants and abutment systems market. Increasingly, patients seek dental implant solutions that not only restore function but also enhance their smile aesthetics and overall facial appearance. As a result, dental implant manufacturers focus on developing implant systems with customizable esthetic options, such as color-matched abutments, ceramic crowns, and gingival contours, to achieve natural-looking results that blend seamlessly with the patient’s existing dentition.

The expanding elderly population worldwide, coupled with the growing prevalence of age-related dental problems, presents a lucrative growth opportunity for the dental implants and abutment systems market. Elderly individuals are more prone to tooth loss due to factors such as periodontal disease, tooth decay, and age-related bone resorption, necessitating the need for comprehensive tooth replacement solutions. Dental implants offer a reliable and long-lasting option for elderly patients seeking to regain oral function and quality of life, driving demand for implant-based restorative treatments in geriatric dentistry.

Geographically, North America and Europe dominate the dental implants and abutment systems market, owing to factors such as well-established healthcare infrastructure, high disposable incomes, and favorable reimbursement policies for dental procedures. However, emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in demand for dental implants, driven by factors such as rising healthcare expenditure, increasing adoption of advanced dental technologies, and growing awareness about oral health and aesthetics.

Despite the numerous growth drivers, the dental implants and abutment systems market also face several challenges that could impact market growth in the coming years. High treatment costs associated with dental implant procedures, limited insurance coverage for implant treatments, and reimbursement challenges pose barriers to access for certain patient populations, particularly in developing countries. Additionally, concerns related to peri-implantitis, implant failures, and long-term complications underscore the importance of continuous research and development efforts to improve implant design, materials, and treatment protocols, enhancing long-term clinical outcomes and patient satisfaction.

Read Also: Genetic Analysis Market Size to Rise USD 23.60 Bn by 2033

Recent Developments

- In November 2023, Keystone Dental Holdings, a leader in dental implant technology, announced the commercial debut of the GENESIS ACTIVETM Implant System. This cutting-edge surgical technique will revolutionize the way dentists insert and restore implants.

- In September 2023, A pioneer in dental implant solutions, Neoss Group, is happy to announce the release of the latest Multi-Unit Abutment for its revolutionary Neoss4+ Treatment Solution. This system will revolutionize how dentists treat entire arch restorations. With the launch of the Neoss4+ and its ground-breaking Multi-Unit Abutment, Neoss is once more proving its dedication to improving dental implant technology and patient care.

Dental Implants and Abutment Systems Market Companies

- Ziacom

- Dentsply Sirona

- Envista Holdings Corporation

- Biocon LLC

- AB Dental Devices Ltd

- National Dentex Labs

- AVINENT Science and Technology

- Cortex

- Henry Schein Inc.

- Institut Straumann AG

- Osstem Implant Co., Ltd

- ZimVie Inc.

- Biotem

- Dentium

- Adin Dental Implant Systems Ltd.

- Keystone Dental Group

- Dentalpoint AG

- BHI Implants

- Ditron Dental

- Cowellmedi Co. Ltd

- TAV Dental

- Glidewell

- BioHorizons

- BioThread Dental Implant Systems

- Dynamic Abutment Solutions

Segments Covered in the Report

By Product

- Dental Implants

- Tapered Implants

- Parallel-walled Implants

- Abutment Systems

- Stock Abutments

- Custom Abutments

- Abutments Fixation Screws

By Material

- Titanium

- Zirconium

- Others

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/