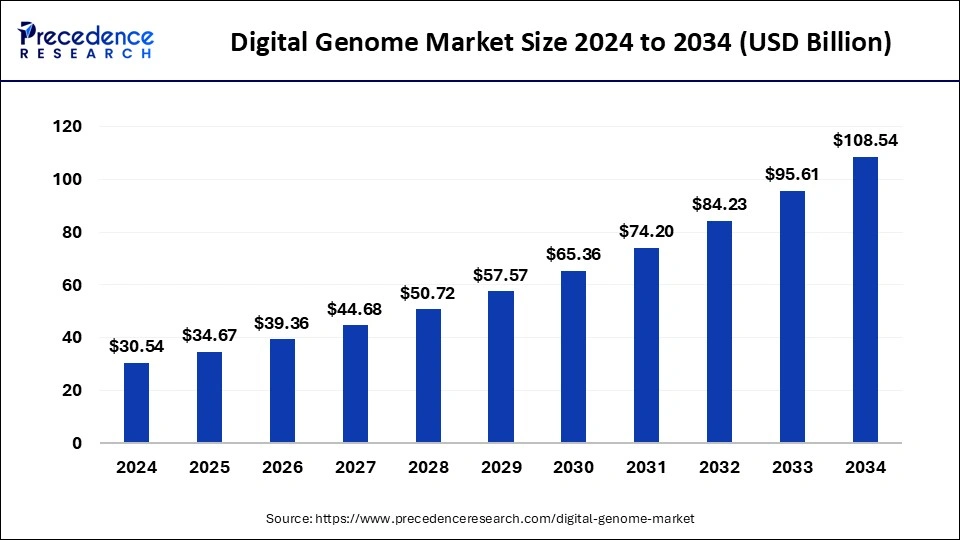

The global digital genome market size surpassed USD 42.23 billion in 2023 and is projected to hit around USD 109.74 billion by 2033, growing at a CAGR of 10.20% from 2024 to 2033.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the sequencing and analyzer instruments segment dominated the market in 2023.

- By product, the DNA/RNA analysis kits segment is observed to witness the fastest rate of expansion during the forecast period.

- By application, the microbiology segment accounted for the largest market share in 2023.

- By end-user, the academic research institutes segment dominated the market in 2023.

Digital Genome Market Overview

The digital genome market encompasses a wide array of technologies and services aimed at understanding, analyzing, and utilizing genomic information in digital form. It involves the use of computational tools, algorithms, and databases to decode, interpret, and store genetic data. With the advancements in genomics, bioinformatics, and data analytics, the digital genome market has witnessed significant growth, offering immense potential for various applications in healthcare, agriculture, biotechnology, and personalized medicine. This market’s evolution has been fueled by the increasing demand for precision medicine, the declining cost of genome sequencing, and the growing adoption of genomic technologies across research and clinical settings.

Get a Sample: https://www.precedenceresearch.com/sample/3963

Growth Factors:

Several factors contribute to the growth of the digital genome market. One primary driver is the rapid advancements in next-generation sequencing (NGS) technologies, which have significantly reduced the cost and time required for genome sequencing. This has democratized access to genomic data, fueling its widespread adoption across diverse sectors. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) algorithms has enhanced the analysis and interpretation of genomic data, unlocking new insights into complex biological processes and disease mechanisms. Additionally, the increasing prevalence of chronic diseases, coupled with the rising demand for personalized medicine, has spurred investments in genomic research and clinical applications, further driving market growth.

Region Insights:

The digital genome market exhibits a global presence, with significant activities concentrated in key regions such as North America, Europe, Asia Pacific, and the rest of the world. North America holds a dominant position in the market, attributed to the presence of established biotechnology and pharmaceutical companies, supportive regulatory frameworks, and robust healthcare infrastructure. The region’s early adoption of genomic technologies and substantial investments in research and development contribute to its leadership in this space. Europe follows closely, driven by initiatives promoting precision medicine and genomic research across member states. Meanwhile, the Asia Pacific region presents lucrative opportunities for market expansion, fueled by increasing healthcare expenditures, rising awareness about genomic medicine, and government initiatives supporting genomics research and innovation.

Digital Genome Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.20% |

| Global Market Size in 2023 | USD 42.23 Billion |

| Global Market Size by 2033 | USD 109.74 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Genome Market Dynamics

Drivers:

Several drivers propel the growth of the digital genome market. The expanding applications of genomic data in drug discovery, diagnostics, and personalized medicine drive market demand. Additionally, the growing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and genetic disorders, underscores the need for genomic solutions for better diagnosis, treatment, and prevention. Moreover, the declining cost of genome sequencing, coupled with technological advancements, has made genomic testing more accessible and affordable, further boosting market adoption. Furthermore, collaborations between academic institutions, biotechnology firms, and healthcare providers facilitate knowledge exchange and accelerate the development and commercialization of genomic technologies and products.

Opportunities:

The digital genome market presents numerous opportunities for innovation and growth. One significant opportunity lies in the expansion of precision medicine initiatives, where genomic data guides personalized treatment decisions tailored to individuals’ genetic profiles. Furthermore, the integration of genomic data with electronic health records (EHRs) and healthcare informatics systems enables comprehensive patient management and healthcare delivery. Additionally, the application of genomics in agricultural biotechnology offers opportunities to enhance crop yields, develop disease-resistant varieties, and address food security challenges. Moreover, the emergence of direct-to-consumer genetic testing services opens up new avenues for consumer engagement, preventive healthcare, and wellness management.

Challenges:

Despite its promising prospects, the digital genome market faces several challenges. Data privacy and security concerns surrounding genomic information pose ethical and regulatory challenges, necessitating robust safeguards to protect individuals’ genetic privacy. Moreover, the complexity of genomic data interpretation and the limited understanding of the functional significance of genetic variations present challenges in translating genomic insights into clinical practice effectively. Furthermore, disparities in access to genomic technologies and services, particularly in low- and middle-income countries, raise concerns about equitable healthcare delivery and widening health inequalities. Additionally, reimbursement issues, regulatory uncertainties, and the lack of standardized protocols for genomic testing and interpretation hinder market growth and adoption.

Read Also: Glucose Biosensors Market Size to Coss USD 50.19 Bn by 2033

Recent Developments

- In February 2024, the government of Telangana announced the Rs 2000 crore investment for the expansion of the Genome Valley Project in Hyderabad. The Chief Minister of Telangana Revanth Reddy announced the government is promoting the 300-acre second phase for the project expansion stated in the inauguration of the BioAsia 2024 meet in Hyderabad.

- In February 2024, Bio-Rad Laboratories, Inc. a leading player in clinical diagnostic products, and life science research announced the launch of the Vericheck ddPCR Replication Competent AAV Kit and Vericheck ddPCR™ Replication Competent Lentivirus Kit. The launch is the cost-effective solution of replication-competent adeno-associated virus (RCAAV), and replication-competent lentivirus (RCL), supports the safer production of gene therapies and cells.

- In February 2024, Veracyte, Inc. a leading player in cancer diagnostics announced the completion of a partnership with C2i Genomics, Inc., with the addition of whole-genome minimal residual disease (MRD) capabilities in its diagnostic platform and increasing the company’s ability to serve patients in the cancer care continuum.

Digital Genome Market Companies

- Illumina, Inc.

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc.

- Thermo Fisher Scientific Inc.

- Oxford Nanopore Technologies Limited

- Nanostring Technologies, Inc.

- IBM Corporation

- Google LLC

- Amazon.com, Inc.

- Desktop Genetics Ltd.

- Ancestry.com LLC.

Segments Covered in the Report

By Product

- Sequencing And Analyzer Instruments

- DNA/RNA Analysis Kits

- Sequencing Chips

- Sequencing and Analyzing Software

- Sample Preparation Instruments

By Application

- Microbiology

- Biological

- Clinical

- Industrial

- Reproductive and Genetic Transplantation

- Livestock and Agriculture

- Forensic Research and Development

By End-user

- Academic Research Institutes

- Diagnostics and Forensic Labs

- Hospitals

- Bio-pharmaceutical Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/