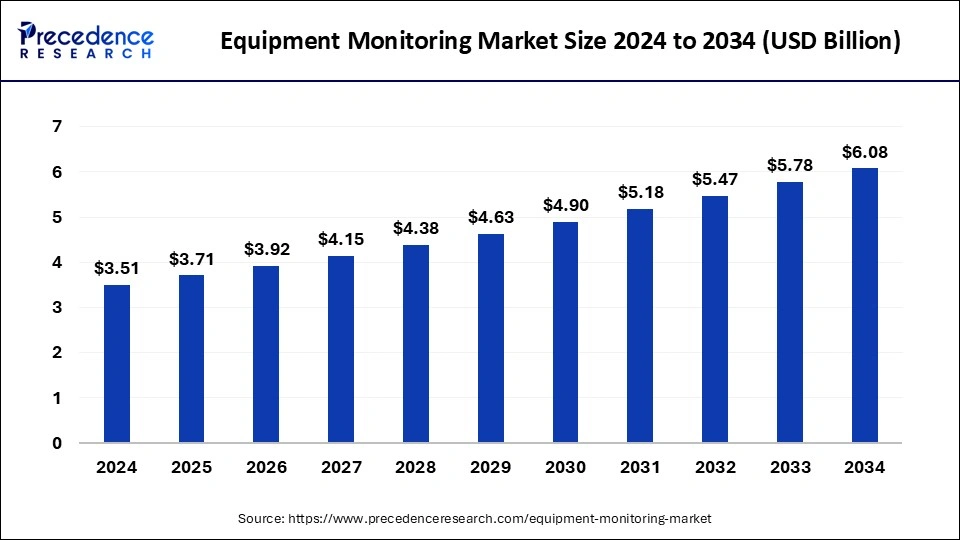

The global equipment monitoring market size is expected to increase USD 5.78 billion by 2033 from USD 3.32 billion in 2023 with a CAGR of 5.71% between 2024 and 2033.

Key Points

- The North America equipment monitoring market size reached USD 1.43 billion in 2023 and is expected to attain around USD 2.51 billion by 2033, poised to grow at a CAGR of 5.78% between 2024 and 2033.

- North America dominated the equipment monitoring market with the largest revenue share of 43% in 2023.

- Europe holds a significant share of the global market.

- By region, Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By monitoring type, the vibration monitoring segment dominated the market in 2023.

- By monitoring process, the online equipment monitoring segment is expected to grow at a significant rate in the market during the forecast period.

- By deployment type, the on-premises segment has contributed more than 71% of revenue share in 2023.

- By service offering, the oil & gas segment dominated the market with the largest share in 2023.

The Equipment Monitoring Market encompasses a range of technologies and solutions designed to track, analyze, and manage the performance and condition of various industrial equipment and machinery. This market has seen substantial growth due to increasing adoption of predictive maintenance strategies, driven by advancements in IoT (Internet of Things) sensors, connectivity solutions, and data analytics capabilities. Equipment monitoring enables businesses to enhance operational efficiency, reduce downtime, optimize resource utilization, and improve overall equipment effectiveness (OEE). Key sectors benefiting from equipment monitoring solutions include manufacturing, energy and utilities, healthcare, transportation, and agriculture.

Get a Sample: https://www.precedenceresearch.com/sample/4596

Growth Factors

The growth of the Equipment Monitoring Market is primarily fueled by several key factors. Firstly, the shift from reactive to proactive maintenance approaches has been pivotal. Organizations are increasingly leveraging real-time data from sensors embedded in equipment to predict potential failures before they occur. This predictive maintenance strategy not only minimizes unplanned downtime but also reduces maintenance costs and extends equipment lifespan. Secondly, advancements in sensor technologies, such as IoT sensors capable of monitoring various parameters like temperature, vibration, and pressure, have significantly enhanced the monitoring capabilities across diverse industries.

Moreover, the integration of AI (Artificial Intelligence) and machine learning algorithms with equipment monitoring systems has revolutionized fault detection and diagnostics. These technologies enable automated analysis of large volumes of data to identify patterns, anomalies, and potential issues, thereby enabling proactive decision-making and maintenance scheduling. Furthermore, the growing emphasis on regulatory compliance and safety standards in industries like healthcare and aerospace has spurred the adoption of continuous monitoring solutions to ensure adherence to stringent guidelines.

Regional Insights

Regionally, the Equipment Monitoring Market exhibits varying dynamics influenced by industrialization levels, technological adoption rates, and regulatory frameworks. North America holds a prominent position in the market, driven by the presence of a mature industrial sector and early adoption of advanced monitoring technologies. The region benefits from robust infrastructure for IoT deployment and significant investments in digital transformation initiatives across manufacturing and energy sectors.

In Europe, stringent regulations related to environmental sustainability and workplace safety have propelled the demand for equipment monitoring solutions. The region emphasizes predictive maintenance to reduce carbon footprints and enhance operational efficiency. Meanwhile, Asia-Pacific is emerging as a lucrative market, fueled by rapid industrialization in countries like China and India. Increasing investments in smart manufacturing and infrastructure development are driving the adoption of IoT-enabled monitoring solutions in the region.

Equipment Monitoring Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 5.78 Billion |

| Market Size in 2023 | USD 3.32 Billion |

| Market Size in 2024 | USD 3.51 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.71% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Monitoring Type, Monitoring Process, Deployment Type, Service Offering, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Equipment Monitoring Market Dynamics

Drivers

Several key drivers are accelerating the growth of the Equipment Monitoring Market globally. One of the primary drivers is the increasing adoption of Industry 4.0 principles, which advocate for the integration of IoT, AI, and big data analytics in manufacturing and industrial operations. Industry 4.0 initiatives aim to create interconnected smart factories capable of autonomous decision-making and predictive maintenance, thereby optimizing production processes and reducing downtime.

Additionally, the rise in demand for remote monitoring solutions has been instrumental. With the proliferation of mobile devices and cloud computing, businesses can remotely monitor equipment performance and receive real-time alerts on their smartphones or tablets. This capability is particularly beneficial for multinational corporations managing dispersed manufacturing facilities or infrastructure assets across different geographical locations.

Moreover, the need for operational efficiency and cost reduction remains a significant driver. Equipment monitoring helps organizations streamline maintenance activities, allocate resources more effectively, and minimize operational disruptions. By preventing equipment failures through early detection of anomalies, businesses can achieve higher productivity levels and enhance customer satisfaction by ensuring consistent product quality and service delivery.

Opportunities

The Equipment Monitoring Market presents several opportunities for innovation and growth. One of the key opportunities lies in the development of integrated platform solutions that combine equipment monitoring with other functionalities such as asset management, inventory optimization, and supply chain visibility. Integrated platforms offer holistic insights into overall business operations, enabling enterprises to make informed decisions and optimize their entire value chain.

Furthermore, the expansion of IoT ecosystems and the advent of 5G technology are poised to unlock new opportunities. IoT-enabled sensors and devices can now transmit large volumes of data at high speeds, facilitating real-time monitoring and analysis across diverse industrial environments. This capability is crucial for industries like logistics, where real-time tracking of shipments and equipment conditions is essential for efficient supply chain management.

Additionally, the rise of edge computing presents opportunities for localized data processing and decision-making. Edge devices equipped with AI algorithms can perform real-time analytics on streaming data from equipment sensors, reducing latency and enabling faster response times to potential maintenance issues or operational anomalies. Edge computing also enhances data security by minimizing the need to transmit sensitive information over long distances.

Challenges

Despite the promising growth prospects, the Equipment Monitoring Market faces several challenges that could hinder market expansion. One of the primary challenges is data interoperability and integration across heterogeneous systems and legacy equipment. Many industrial facilities operate with diverse equipment types and brands, each generating data in different formats. Ensuring seamless integration and compatibility of monitoring solutions with existing infrastructure can be complex and costly.

Moreover, concerns related to data privacy and cybersecurity pose significant challenges. Equipment monitoring involves the collection, transmission, and storage of sensitive operational data. Securing this data against cyber threats, unauthorized access, or data breaches is crucial to maintaining trust and compliance with data protection regulations such as GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in the United States.

Furthermore, the initial investment and deployment costs associated with equipment monitoring solutions can be prohibitive for small and medium-sized enterprises (SMEs). While large corporations can justify investments based on long-term operational savings and efficiency gains, SMEs may face financial constraints in adopting advanced monitoring technologies. Bridging this gap and offering scalable, cost-effective solutions tailored to the needs of SMEs represent a challenge and opportunity for market players.

Read Also: Carbon Dioxide Removal Market Size to Worth USD 2,548.29 Mn by 2033

Equipment Monitoring Market Companies

- SKF

- Emerson Electric

- General Electric

- Honeywell International

- National Instruments

- Parker Hannifin Corporation

- Rockwell Automation, Inc.

- Schaeffler AG

- ABB

- Fortive Corporation

- ALS Limited

- Schneider Electric Co.

Recent Developments

- In June 2024, Teledyne FLIR LLC, a defense industry company, announced the launch of the SV89 Vibration Monitoring Solution Kits and FLIR SV88, which assist customers in monitoring critical equipment by continuously detecting faults, alerting to potential defects and future problems and analyzing vibration. The SV88 and SV89 Vibration Monitoring Solution Kits’ multi-communication protocols, IP66 rating, wireless functionality, and rugged design enable customers to make crucial data-driven decisions that prolong the life of expensive equipment by warning of possible problems.

- In May 2024, Datadog, Inc., a company that is focused on developing the monitoring and security platform for cloud applications, revealed the launch of the IT Event Management to its suite of AIOps (artificial intelligence for information technology operations) capabilities. Datadog’s event management feature allows it to intelligently combine, correlate, and enhance all alert events and significant signals from both Datadog and other third-party observability tools into a single, coherent view. By reducing alert fatigue, this technique enables teams to concentrate their efforts and resources on fixing problems.

Segment Covered in the Report

By Monitoring Type

- Vibration Monitoring

- Thermal Monitoring

- Lubrication Monitoring

- Corrosion Monitoring

- Noise Monitoring

- Motor Current Monitoring

- Gps Tracking

- Alarm Monitoring

By Monitoring Process

- Portable Equipment Monitoring

- Online Equipment Monitoring

By Deployment Type

- Cloud

- On-premises

By Service Offering

- Chemicals

- Automotive

- Aerospace & Defense

- Food & Beverages

- Oil & Gas

- Power Generation

- Metals & Mining

- Others (Electronic &Semiconductor, Cement, Paper & Pulp, and Healthcare)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/