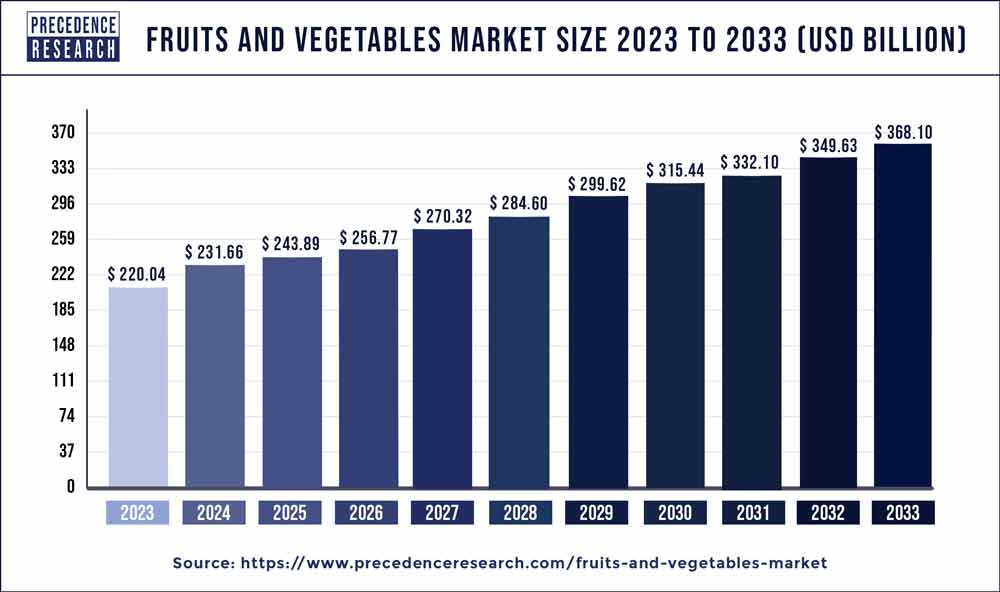

The fruits and vegetables market size was valued at USD 220.04 billion in 2023 and is expected to hit around USD 368.10 billion by 2033 with a CAGR of 5.28% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest share in 2023.

- North America is observed to grow at a significant rate during the forecast period.

- By product, the fresh fruits & vegetables segment held the largest share of the market in 2023.

- By distribution channel, the supermarkets/hypermarkets segment dominated the market in 2023. The segment is observed to sustain the position throughout the forecast period.

The fruits and vegetables market is a crucial sector within the global food industry, encompassing a wide array of fresh produce consumed by people worldwide. This market segment plays a vital role in meeting the nutritional needs of populations and driving economic activity across various regions. From staple fruits like apples and bananas to diverse vegetables such as tomatoes and spinach, this market caters to a broad spectrum of consumer preferences and dietary requirements. In recent years, the fruits and vegetables market has experienced significant growth driven by several factors, including shifting consumer preferences towards healthier food choices, increasing awareness about the importance of a balanced diet, and advancements in agricultural practices and technologies.

Get a Sample: https://www.precedenceresearch.com/sample/3827

Growth Factors

Several factors contribute to the growth of the fruits and vegetables market. One significant factor is the growing emphasis on health and wellness among consumers. With rising concerns about lifestyle-related diseases such as obesity and cardiovascular ailments, there has been a heightened demand for fresh fruits and vegetables known for their nutritional benefits. Additionally, changing dietary patterns, particularly in urban areas, where consumers are increasingly adopting plant-based diets or incorporating more fruits and vegetables into their meals, have fueled market growth. Furthermore, the expansion of distribution channels, including online grocery platforms and specialty stores, has made fruits and vegetables more accessible to consumers, driving market expansion.

Fruits and Vegetables Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.28% |

| Global Market Size in 2023 | USD 220.04 Billion |

| Global Market Size by 2033 | USD 368.10 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fruits and Vegetables Market Dynamics

Drivers:

Numerous drivers propel the growth of the fruits and vegetables market. One key driver is the increasing awareness of the environmental and social implications of food choices. Consumers are becoming more conscious of sustainability issues and the carbon footprint associated with food production and transportation. As a result, there is a growing preference for locally sourced and organic fruits and vegetables, driving demand for products that are perceived to be more environmentally friendly and socially responsible. Additionally, government initiatives promoting healthy eating habits and initiatives to reduce food waste have also contributed to market growth by encouraging consumption of fresh produce.

Opportunities:

The fruits and vegetables market presents various opportunities for growth and innovation. One notable opportunity lies in expanding product offerings to cater to changing consumer preferences and dietary trends. For instance, there is a rising demand for exotic fruits and heirloom vegetables driven by consumers’ interest in exploring new flavors and culinary experiences. Capitalizing on this trend, producers and retailers can diversify their product portfolios to include a wider range of specialty fruits and vegetables, thereby tapping into new market segments. Moreover, technological advancements in agriculture, such as vertical farming and hydroponics, present opportunities to increase efficiency and productivity in fruit and vegetable production while minimizing environmental impact.

Challenges:

Despite its growth prospects, the fruits and vegetables market faces several challenges. One significant challenge is ensuring food safety and quality throughout the supply chain. Fresh produce is susceptible to contamination from pathogens, pesticides, and improper handling, posing risks to consumer health. Addressing these challenges requires robust food safety regulations, stringent quality control measures, and investment in infrastructure and training to enhance hygiene practices among producers and distributors. Additionally, volatile weather patterns and climate change can impact crop yields and quality, leading to supply disruptions and price fluctuations, posing challenges for market players.

Read Also: Dry Eye Treatment Devices Market Size to Rise USD 888.48 Mn by 2033

Recent Developments

- In December 2022, the Del Monte Zero pineapple was introduced by Fresh Del Monte Produce, Inc. as their first certified carbon-neutral pineapple. Select European markets as well as North American markets carry the product. The Del Monte Gold, HoneyGlow, and Del Monte pineapple types are the extensions of this product range.

- In October 2023, two new products for the fruit and vegetable market, the ComandanTY Tomato and the TigerGrey Zucchini from its Seminis seed brand were unveiled by Bayer. The firm has expanded its product line to include new items, which are intended to increase farmer productivity and improve the taste and quality of food on the plates of ultimate customers.

Competitive Landscape:

The fruits and vegetables market is characterized by intense competition among producers, distributors, and retailers vying for market share. Key players in the industry include multinational corporations, local growers, and agribusiness conglomerates. The competitive landscape is shaped by factors such as product quality, price competitiveness, branding and marketing strategies, and distribution networks. Multinational companies often leverage their global presence and economies of scale to dominate market segments, while smaller players may focus on niche markets or differentiate themselves through organic or specialty produce. Moreover, the emergence of e-commerce platforms and direct-to-consumer models has disrupted traditional distribution channels, giving rise to new competitors and opportunities for market entry.

Fruits and Vegetables Market Companies

- General Mills Inc.

- Tanimura & Antle Fresh Foods, Inc.

- Fresh Del Monte Produce, Inc.

- Sunkist Growers, Inc.

- Chiquita Brands International, Inc.

- Nestlé

- Fresh Pro

- Sysco Corporation

- Dole Food Company, Inc.

- C.H. Robinson Worldwide, Inc.

Segments Covered in the Report

By Product

- Fresh Fruits & Vegetables

- Frozen Fruits & Vegetables

- Dried Fruits & Vegetables

By Distribution Channel

- Grocery Stores

- Supermarkets/Hypermarkets

- Online

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/