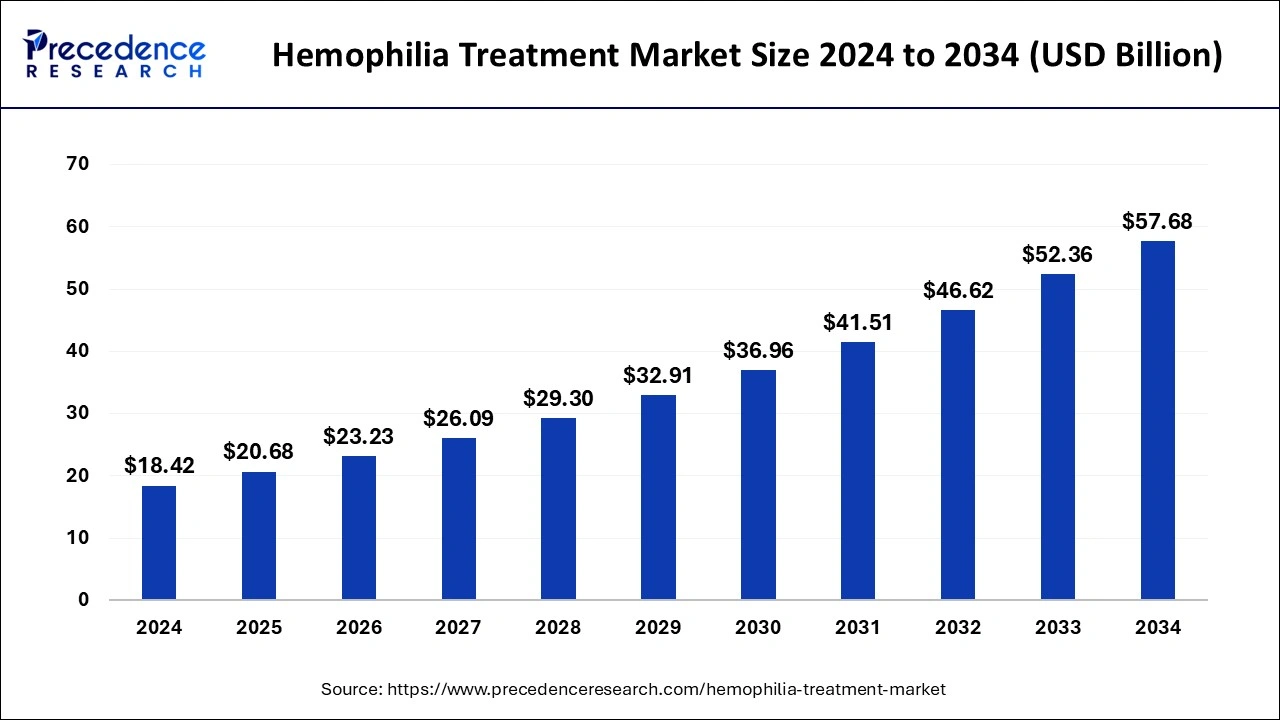

The global hemophilia treatment market size is expected to increase USD 52.36 billion by 2033 from USD 16.40 billion in 2023 with a CAGR of 12.31% between 2024 and 2033.

Key Points

- The North America hemophilia treatment market size reached USD 7.38 billion in 2023 and is expected to attain around USD 23.82 billion by 2033, poised to grow at a CAGR of 12.43% between 2024 and 2033.

- North America registered the largest revenue share of the hemophilia treatment market in 2023.

- Europe is considered the fastest-growing market in the forecasted years.

- By region, Asia Pacific is expected to witness notable growth in the market in the forecasted years.

- By type, the hemophilia A segment dominated the market in 2023 and is expected to grow further over the forecast period.

- By drug therapy, in 2023, the recombinant coagulation factor segment dominated the market.

- By drug therapy, the non-factor replacement therapy segment is expected to grow at the fastest rate in the market over the forecast period.

The Hemophilia Treatment Market is characterized by ongoing advancements in therapies and management approaches for hemophilia A and B, driven by genetic and diagnostic innovations. Hemophilia A, caused by factor VIII deficiency, and hemophilia B, caused by factor IX deficiency, are primarily treated through replacement therapies involving recombinant clotting factors. The market is witnessing a shift towards extended half-life products, offering prolonged protection and reduced dosing frequency for patients. Additionally, gene therapy trials hold promise for potentially offering long-term or curative treatments. Geographically, North America and Europe dominate the market due to high diagnosis rates, advanced healthcare infrastructure, and robust reimbursement policies, while emerging regions are seeing increased awareness and access to treatment options. Overall, the market is poised for growth with ongoing research into novel therapies and expanding treatment accessibility globally.

Get a Sample: https://www.precedenceresearch.com/sample/4567

Hemophilia Treatment Market Scope

List of Contents

Toggle| Report Coverage | Details |

| Market Size by 2033 | USD 52.36 Billion |

| Market Size in 2023 | USD 16.40 Billion |

| Market Size in 2024 | USD 18.42 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 12.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Drug Therapy, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hemophilia Treatment Market Dynamics

Drivers

The Hemophilia Treatment Market is driven by several key factors. First and foremost, advancements in treatment options, including gene therapy and extended half-life products, have significantly improved patient outcomes. These innovations are reducing treatment frequency and enhancing efficacy, thereby increasing patient compliance and quality of life. Moreover, rising awareness about hemophilia, coupled with proactive government initiatives and support from healthcare organizations, is driving early diagnosis and treatment initiation. Additionally, increasing investment in research and development by pharmaceutical companies to develop novel therapies and improve existing treatment options is further propelling market growth.

Market Challenges

Despite the advancements, the Hemophilia Treatment Market faces certain challenges. One of the primary challenges is the high cost associated with newer treatments such as gene therapy, which may limit access for some patients, particularly in developing regions. Moreover, the complexity of treatment regimens, including the need for regular intravenous infusions, poses challenges in patient adherence and management. Furthermore, variability in treatment response among patients and the risk of developing inhibitors to clotting factors remain significant clinical challenges that require ongoing research and personalized treatment approaches.

Opportunities

The Hemophilia Treatment Market presents several opportunities for growth and expansion. There is a growing trend towards personalized medicine, driven by advancements in genetic testing and precision medicine approaches, which holds promise for tailoring treatments to individual patient needs. Moreover, the expanding pipeline of novel therapies, including non-factor replacement therapies and extended half-life products, offers opportunities for diversification and addressing unmet medical needs. Additionally, increasing healthcare expenditure and improving access to healthcare services in emerging economies present untapped opportunities for market players to expand their presence and reach a broader patient population.

Read Also: AI in Project Management Market Size to Worth USD 12.75 Bn by 2033

Treatment Type

The Hemophilia Treatment Market primarily revolves around replacement therapy with clotting factor concentrates. These therapies are designed to replenish the deficient clotting factors in patients with hemophilia, thereby enabling effective blood clotting and management of bleeding episodes. Clotting factor concentrates can be derived from human plasma or produced synthetically using recombinant DNA technology, offering varying degrees of purity and safety profiles.

Drug Therapy

Drug therapy for hemophilia focuses on administering clotting factor concentrates, tailored to the specific deficiency:

- Factor VIII Replacement (Hemophilia A): Factor VIII concentrates are the cornerstone of treatment for patients with hemophilia A. These therapies are available in different formulations, including standard and extended half-life versions, to provide sustained clotting factor activity and reduce treatment frequency.

- Factor IX Replacement (Hemophilia B): Patients with hemophilia B receive Factor IX concentrates, which aim to replace the deficient clotting factor and prevent bleeding episodes. Similar to Factor VIII therapies, Factor IX products are available in various formulations to meet different patient needs.

Drug therapy is administered via intravenous (IV) infusion, ensuring rapid absorption and immediate correction of clotting factor levels during acute bleeding episodes or as prophylactic treatment to prevent spontaneous bleeding events. Ongoing advancements in drug therapy for hemophilia include the development of novel extended half-life products and investigational gene therapies, offering potential improvements in efficacy, safety, and patient convenience.

Regional Insights

The Hemophilia Treatment Market shows varied regional dynamics influenced by healthcare infrastructure, treatment accessibility, and patient demographics. North America holds a significant share, driven by advanced healthcare systems and high treatment adoption rates. Europe follows suit with robust healthcare spending and comprehensive reimbursement policies. Asia-Pacific exhibits rapid growth due to improving healthcare facilities and increasing awareness. Meanwhile, Latin America and Middle East & Africa are seeing rising demand for hemophilia treatments amidst expanding healthcare access and growing patient population awareness. These regions collectively contribute to the global landscape of hemophilia treatment markets, each with unique challenges and opportunities.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4567

Hemophilia Treatment Market Companies

- Pfizer Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bayer AG (Germany)

- Shire (Ireland)

- CSL Behring (Australia)

- Grifols, S.A. (Spain)

- Biogen Inc. (U.S.)

- Sanofi S.A. (France)

- BioMarin Pharmaceutical Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Octapharma AG (Switzerland)

- Sobi (Sweden)

- Pfizer Inc. (U.S.)

Recent Developments

- In November 2023, Japan approved a new Novo Nordisk hemophilia drug that will launch in 2024. Novo Nordisk itself has identified the candidate as a potential blockbuster.

- In March 2022, in its Phase 1/2 B-LIEVE dose-confirmation clinical trial of FLT180a for the treatment of hemophilia B, a crippling genetic bleeding illness brought on by a lack in the clotting factor IX protein, Freeline Therapeutics Holdings plc dosed the first patient.

- In February 2022, at the 15th Annual Virtual Congress of the European Association for Haemophilia and Allied Disorders (EAHAD), BioMarin Pharmaceutical Inc. presented encouraging findings from a two-year analysis of the Phase 3 GENEr8-1 study and an overall safety update of valoctocogene roxaparvovec, an investigational gene therapy for the treatment of adults with severe hemophilia A.

Segments Covered in the Report

By Type

- Hemophilia A

- Hemophilia B

By Drug Therapy

- Recombinant Coagulation Factor Concentrates Therapy

- Plasma-derived Coagulation Factor Concentrates Therapy

- Non-factor Replacement Therapy

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/