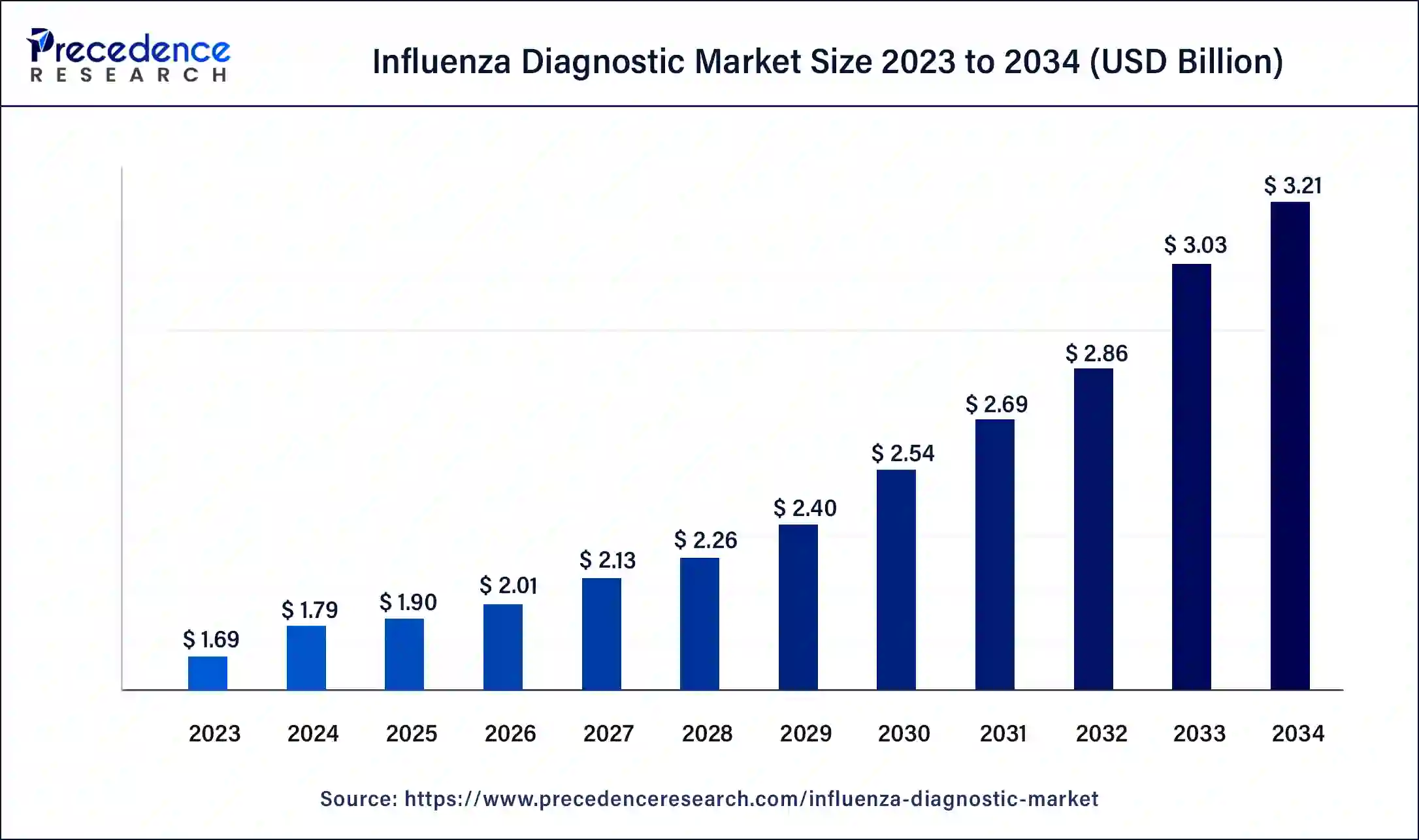

The global influenza diagnostic market size surpassed USD 1.69 billion in 2023 and is estimated to hit around USD 2.97 billion by 2033, growing at a CAGR of 5.80% from 2024 to 2033.

Key Points

- North America dominated the market with the highest market share of 34% in 2023.

- Asia Pacific is observed to be the fastest-growing region in the market during the forecast period.

- By test type, the RIDT segment has contributed the largest share of 31% in 2023.

- By end-use, the hospitals segment dominated the market with the major market share of 48% in 2023.

The Influenza Diagnostic Market is a vital sector within the healthcare industry aimed at diagnosing and managing influenza infections. Influenza, commonly known as the flu, is a highly contagious respiratory illness caused by influenza viruses. It poses significant public health challenges globally, leading to substantial morbidity, mortality, and economic burden. Effective and timely diagnosis is crucial for appropriate patient management, outbreak control, and public health surveillance. The Influenza Diagnostic Market encompasses various diagnostic techniques, including molecular assays, rapid antigen tests, serological tests, and viral culture, each offering distinct advantages in terms of sensitivity, specificity, turnaround time, and cost-effectiveness.

Get a Sample: https://www.precedenceresearch.com/sample/3965

Growth Factors:

Several factors contribute to the growth of the Influenza Diagnostic Market. Firstly, the seasonal nature of influenza outbreaks drives the demand for diagnostic tests, especially during peak flu seasons. Additionally, increasing awareness among healthcare professionals and the general population regarding the importance of early diagnosis and prompt treatment further fuels market growth. Moreover, technological advancements in diagnostic techniques, such as the development of multiplex PCR assays and point-of-care testing devices, enhance the accuracy and efficiency of influenza diagnosis, driving market expansion. Furthermore, the growing prevalence of influenza infections, coupled with the emergence of novel influenza strains and potential pandemics, underscores the need for robust diagnostic capabilities, thereby stimulating market growth.

Region Insights:

The Influenza Diagnostic Market exhibits regional variations influenced by factors such as epidemiological trends, healthcare infrastructure, regulatory landscape, and socioeconomic factors. In developed regions like North America and Europe, well-established healthcare systems, high healthcare expenditures, and proactive public health measures contribute to robust market growth. Additionally, widespread adoption of advanced diagnostic technologies and stringent regulatory standards further bolster market dynamics in these regions. In contrast, developing regions in Asia-Pacific, Latin America, and Africa face unique challenges, including limited access to healthcare services, inadequate laboratory infrastructure, and resource constraints. However, increasing healthcare investments, rising awareness about infectious diseases, and government initiatives to strengthen healthcare infrastructure are driving market growth in these regions, albeit at a slower pace compared to developed economies.

Influenza Diagnostic Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.80% |

| Global Market Size in 2023 | USD 1.69 Billion |

| Global Market Size by 2033 | USD 2.97 Billion |

| U.S. Market Size in 2023 | USD 400 Million |

| U.S. Market Size by 2033 | USD 710 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Influenza Diagnostic Market Dynamics

Drivers:

Several drivers propel the growth of the Influenza Diagnostic Market. Firstly, the growing incidence of influenza infections worldwide, fueled by factors such as population growth, urbanization, international travel, and changing climatic conditions, creates a substantial demand for diagnostic tests. Additionally, the increasing adoption of rapid diagnostic tests (RDTs) and point-of-care (POC) testing devices in various healthcare settings, including hospitals, clinics, and pharmacies, accelerates market expansion by facilitating timely diagnosis and treatment decisions. Moreover, heightened public health awareness, coupled with initiatives by governmental and non-governmental organizations to promote influenza surveillance and control programs, augments market growth. Furthermore, strategic collaborations, partnerships, and acquisitions among key market players to enhance product portfolios, expand geographic presence, and leverage technological expertise drive market competitiveness and innovation.

Opportunities:

The Influenza Diagnostic Market presents several opportunities for growth and innovation. Firstly, the development of novel diagnostic technologies, such as next-generation sequencing (NGS), biosensors, and artificial intelligence (AI)-based algorithms, holds promise for improving the accuracy, speed, and cost-effectiveness of influenza diagnosis. Furthermore, expanding market penetration in emerging economies through strategic alliances with local distributors, healthcare providers, and government agencies enables market players to tap into underserved regions with significant growth potential. Additionally, diversification of product offerings to include multiplex assays capable of detecting multiple respiratory pathogens simultaneously enhances market competitiveness and addresses evolving clinical needs. Moreover, investment in research and development (R&D) activities aimed at identifying novel biomarkers, antigenic targets, and therapeutic interventions for influenza provides avenues for long-term market growth and differentiation.

Challenges:

Despite favorable market dynamics, the Influenza Diagnostic Market faces several challenges that warrant attention. Firstly, the seasonal variability and unpredictability of influenza outbreaks pose challenges for manufacturers, healthcare providers, and public health authorities in terms of forecasting demand, stockpiling supplies, and implementing timely interventions. Additionally, the emergence of antigenic drift and shift in influenza viruses necessitates ongoing surveillance and periodic updates to diagnostic assays to maintain accuracy and efficacy. Furthermore, cost constraints, reimbursement limitations, and pricing pressures in healthcare systems worldwide pose challenges for market players in terms of achieving profitability and sustaining competitive pricing strategies. Moreover, regulatory hurdles, including the need for clinical validation studies, regulatory approvals, and compliance with quality standards, can delay market entry and product commercialization efforts. Lastly, competition from alternative diagnostic modalities, such as syndromic panels and molecular syndromic testing platforms, adds complexity to the market landscape and requires continuous innovation and differentiation strategies to maintain market share and relevance.

Read Also: Mammography Systems Market Size to Cross USD 6.22 Bn by 2033

Recent Developments

- In May 2023, Hologic Inc. declared that the Panther Fusion assay had received 510(k) clearance from the U.S. Food and Drug Administration (FDA). This assay is a molecular diagnostic test that can identify and distinguish between four common respiratory viruses that can present with similar clinical symptoms: influenza A (flu A), influenza B (flu B), severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) and respiratory syncytial virus (RSV).

- In January 2023, the healthcare goods and solutions firm 2San released a dual kit for SARS-CoV-2 and Influenza A+B. The OTC kit was introduced to ease the strain on healthcare facilities due to the continued demand on the National Health Service (NHS) following the epidemic.

Influenza Diagnostic Market Companies

- 3M Company

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Meridian Bioscience, Inc.

- Quidel Corporation

- SEKISUI Diagnostics

- Thermo Fisher Scientific, Inc.

- Hologic, Inc.

- F. Hoffmann-La Roche Ltd

- SA Scientific Ltd

Segments Covered in the Report

By Test Type

- RIDT

- RT-PCR

- Cell Culture

- Others

By End-use

- Hospitals

- POCT

- Laboratories

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/