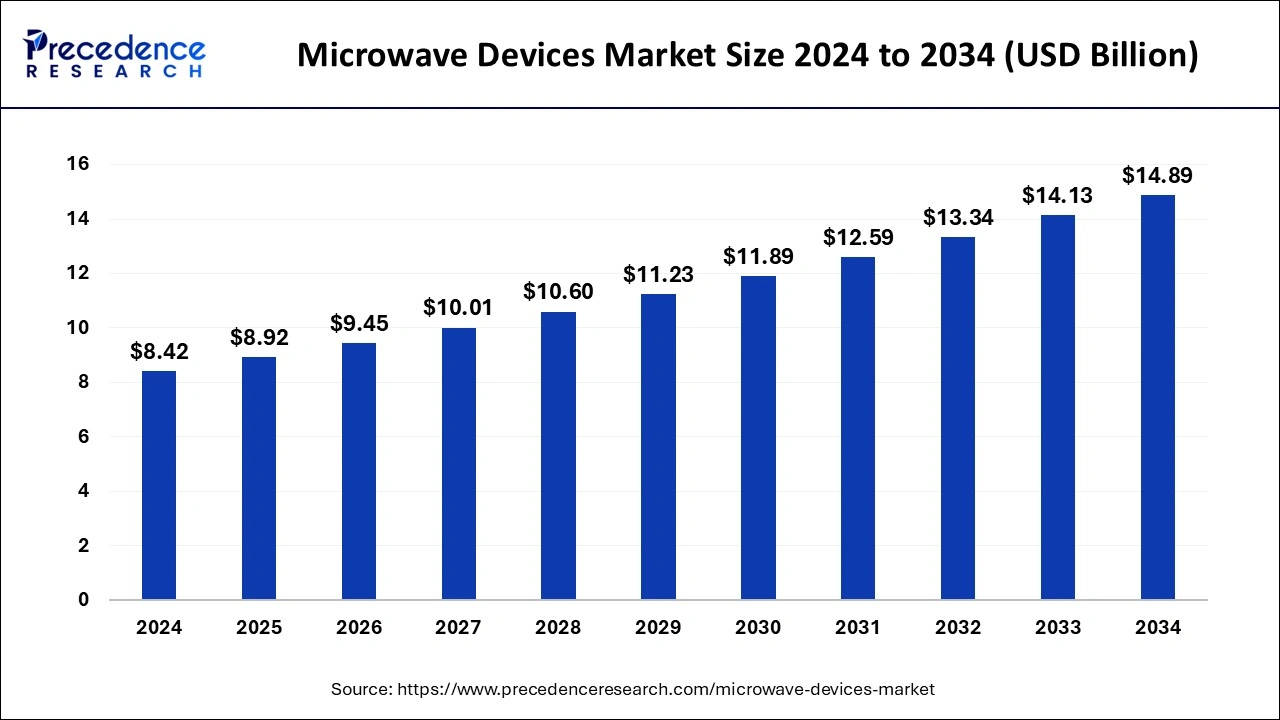

The global microwave devices market size is expected to increase USD 14.13 billion by 2033 from USD 7.95 billion in 2023 with a CAGR of 5.92% between 2024 and 2033.

Key Points

- The North America microwave devices market size reached USD 3.26 billion in 2023 and is expected to attain around USD 5.86 billion by 2033, poised to grow at a CAGR of 6.03% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 41% in 2023.

- Asia Pacific is expected to grow at the highest CAGR of 8.22% during the forecast period.

- By band frequency, the C-band segment has generated the largest revenue share of 33% in 2023.

- By band frequency, the X-band segment is expected to grow at the solid CAGR of 7.62% during the forecast period.

- By application, the military & defense segment has held a major revenue share of 40% in 2023.

The Microwave Devices Market encompasses a wide range of technologies and applications that utilize microwave frequencies for various purposes, including communication, radar systems, heating, and medical applications. Microwave devices play a crucial role in telecommunications, aerospace and defense, healthcare, and industrial sectors due to their high-frequency capabilities and efficiency in data transmission and processing.

Get a Sample: https://www.precedenceresearch.com/sample/4556

Growth Factors

The market growth is driven by increasing demand for high-speed and reliable communication networks, advancements in radar technology for defense and aerospace applications, and the expanding adoption of microwave-based medical imaging and treatment systems. Moreover, technological advancements in semiconductor materials and fabrication techniques contribute to the miniaturization and performance enhancement of microwave devices, further fueling market growth.

Microwave Devices Market Trends

- Rise in Demand for Radar Systems: Radar applications in defense, aerospace, automotive, and meteorology sectors are driving the demand for microwave devices. This includes phased array radar systems and radar for autonomous vehicles.

- Growth in Telecommunication Infrastructure: With the expansion of 5G networks and increasing adoption of satellite communication systems, microwave devices are crucial for microwave links and satellite ground stations.

- Technological Advancements: There’s a continual focus on developing high-frequency microwave devices for improved performance, efficiency, and reliability in various applications.

- Increasing Use in Medical and Healthcare: Microwave devices are finding applications in medical imaging, hyperthermia treatment, and non-invasive surgeries, contributing to the market growth.

- Emergence of Millimeter-Wave Technology: Millimeter-wave microwave devices are gaining traction due to their potential in high-speed data transmission for future communication systems.

- Integration in Consumer Electronics: Microwave components are being integrated into consumer electronics such as smart appliances and IoT devices, enhancing connectivity and functionality.

Region Insights:

North America and Europe lead the global microwave devices market, driven by significant investments in defense and aerospace sectors, as well as robust research and development activities. Asia-Pacific is emerging as a lucrative region, propelled by rapid industrialization, urbanization, and increasing investments in telecommunications infrastructure across countries like China, India, and Japan.

Microwave Devices Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 14.13 Billion |

| Market Size in 2023 | USD 7.95 Billion |

| Market Size in 2024 | USD 8.42Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Band Frequency, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Microwave Devices Market Dynamics

Drivers:

Key drivers include the growing demand for high-frequency and high-bandwidth communication systems, expanding applications in radar and satellite communication, and the increasing integration of microwave technologies in automotive collision avoidance systems and medical devices. Government initiatives to modernize defense capabilities also contribute significantly to market growth.

Opportunities:

Opportunities abound in the development of advanced microwave devices for 5G networks, satellite communication systems, and emerging applications in automotive radar and medical diagnostics. Additionally, the shift towards autonomous vehicles and the Internet of Things (IoT) presents new avenues for microwave device manufacturers to innovate and expand their market presence.

Challenges:

Challenges include the complexity in designing and manufacturing high-frequency microwave components, stringent regulatory requirements in defense and healthcare sectors, and the need for continuous technological innovation to meet evolving market demands. Economic uncertainties and supply chain disruptions also pose challenges to market players.

Read Also: Lancet Market Size to Worth USD 2.22 Billion by 2033

Microwave Devices Market Companies

- Analog Devices, Inc.

- Cobham Limited

- CPI International

- Cytec Corporation

- General Dynamics

- Honeywell International Inc.

- L3 Harris Technologies, Inc.

- Macom

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Qorvo

- Richardson Electronics

- Teledyne Technologies

- Texas Instruments

- Thales Group

- Toshiba Corporation

Recent Developments

- In April 2024, Samsung unveiled Bespoke AI, the company’s next revolutionary innovation phase, along with the goods that would soon be sold in India. These include the air conditioner, microwave, washing machine, and refrigerator, which are all Bespoke AI-powered.

- In February 2024, the readout line solution from Bluefors, which features a traveling wave parametric amplifier (TWPA), was released. Known as the ‘Microwave Readout Module,’ it allows for almost noise-free, near-quantum signal amplification at millikelvin temperatures. The device supports multiplexed reading and has a large frequency range.

- In September 2023, Tempo Australia, with an emphasis on cutting-edge technology and contemporary design, announced the release of six new Sharp microwave models that are expected to revolutionize convenience and culinary possibilities. With its 11 distinct power levels, the inverter technology in all six models ensures accurate and reliable cooking. Inverter technology uses less energy and improves cooking performance.

- In July 2023, DEKA, a division of the El.En. Group, a business registered on the Italian Stock Exchange’s Eurostar Next (ELN.MI) and specializing in the creation and production of state-of-the-art Energy Devices for Surgery and Aesthetics, has announced the launch of its new ‘PRO’ line, which is based on laser and microwave devices, at the 25th World Congress of Dermatology.

Segment Covered in the Report

By Band Frequency

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

By Application

- Communication

- Wireless

- Broadcast

- Others

- Medical

- Military & Defense

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/