Key Points

- North America dominated the market in 2023.

- By categories, the low-fat segment dominated the market during the forecast period.

- By ingredients, the whole milk segment dominated the organic ice cream market.

- By flavor, the vanilla segment held the largest share of the market in 2023.

- By packaging type, the paperboard segment held the largest market share in 2023.

- By distribution channel, the supermarkets & hypermarkets segment dominated the market in 2023.

The organic ice cream market has witnessed significant growth in recent years due to increasing consumer demand for healthier and more sustainable food options. Organic ice cream is made from natural ingredients that are grown without the use of synthetic pesticides, herbicides, or fertilizers. This emphasis on natural ingredients appeals to consumers who are concerned about the environmental impact of conventional agriculture and the potential health risks associated with consuming synthetic chemicals. Additionally, organic ice cream often contains higher levels of nutrients and fewer artificial additives, further contributing to its appeal among health-conscious consumers.

Get a Sample: https://www.precedenceresearch.com/sample/3905

Growth Factors

Several factors have contributed to the growth of the organic ice cream market. One key driver is the growing consumer awareness of health and wellness issues. As people become more conscious of the importance of diet in maintaining overall health, they are increasingly seeking out food products that are perceived as healthier alternatives to conventional options. Organic ice cream, with its focus on natural ingredients and absence of synthetic chemicals, fits into this trend perfectly.

Furthermore, the rise of environmentally conscious consumerism has also played a significant role in driving demand for organic ice cream. Consumers are increasingly concerned about the environmental impact of food production and are actively seeking out products that are produced in a sustainable and eco-friendly manner. Organic ice cream, which is made from ingredients that are grown using environmentally friendly farming practices, aligns with these values and has consequently seen growing demand.

The increasing availability of organic ice cream in mainstream retail channels has also contributed to market growth. As consumer demand for organic products has risen, retailers have responded by expanding their selection of organic offerings, including ice cream. This increased accessibility has made organic ice cream more readily available to consumers, further driving market growth.

Region Snapshot

The organic ice cream market is experiencing growth across various regions, with North America and Europe leading the way. In North America, the United States dominates the market, driven by strong consumer demand for organic products and a well-established distribution infrastructure. Europe, particularly countries like Germany, France, and the United Kingdom, also has a significant share of the market, fueled by increasing consumer awareness of health and environmental issues.

In addition to North America and Europe, the organic ice cream market is also growing in emerging markets such as Asia Pacific and Latin America. In these regions, rising disposable incomes, changing dietary preferences, and increasing awareness of health and wellness issues are driving demand for organic food products, including ice cream.

Organic Ice Cream Market Scope

| Report Coverage | Details |

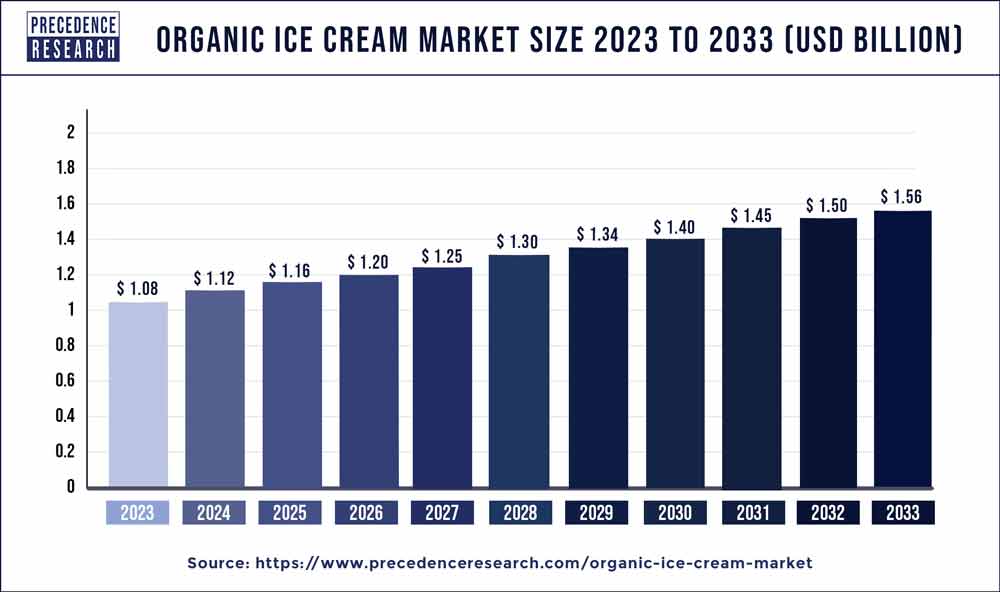

| Global Market Size in 2023 | USD 1.08 Billion |

| Global Market Size by 2033 | USD 1.56 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.74% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Categories, By Ingredients, By Flavor, By Packaging Type, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Growing consumer demand for healthier and more sustainable food options.

- Increasing availability of organic ice cream in mainstream retail channels.

- Strong emphasis on natural ingredients and environmentally friendly farming practices.

Weaknesses:

- Higher production costs compared to conventional ice cream due to the use of organic ingredients.

- Limited availability of organic ice cream in some regions, particularly in developing countries.

- Perception of organic products as being more expensive, which may deter price-sensitive consumers.

Opportunities:

- Continued expansion of distribution channels to reach new consumer segments.

- Innovation in flavors and product formulations to cater to changing consumer preferences.

- Potential for growth in emerging markets as consumer awareness of health and environmental issues increases.

Threats:

- Competition from conventional ice cream brands offering lower-priced alternatives.

- Regulatory challenges related to organic certification and labeling requirements.

- Potential for supply chain disruptions due to factors such as weather events or fluctuations in ingredient prices.

Read Also: Medium-chain Triglycerides Market Size, Trends, Report 2033

Competitive Landscape:

The organic ice cream market is highly competitive, with numerous players vying for market share. Some of the key players in the market include:

- Ben & Jerry’s: Known for its innovative flavors and commitment to social and environmental responsibility, Ben & Jerry’s is a leading player in the organic ice cream market. The company offers a wide range of organic ice cream flavors made from high-quality, sustainably sourced ingredients.

- Häagen-Dazs: Another well-known brand in the ice cream industry, Häagen-Dazs offers a selection of organic ice cream flavors that appeal to discerning consumers looking for premium-quality products. The company’s strong brand reputation and commitment to quality have helped it maintain a competitive edge in the market.

- Stonyfield Organic: As a pioneer in the organic food industry, Stonyfield Organic has established itself as a trusted provider of organic dairy products, including ice cream. The company’s focus on organic farming practices and commitment to sustainability resonate with consumers seeking environmentally friendly food options.

- Three Twins Ice Cream: With a dedication to using organic ingredients and environmentally sustainable practices, Three Twins Ice Cream has carved out a niche for itself in the organic ice cream market. The company’s unique flavor offerings and commitment to social responsibility have helped it stand out in a crowded marketplace.

Recent Developments

- In August 2023, with an emphasis on luxury products, the Gujarat Cooperative Milk Marketing Federation, which sells dairy products under the Amul brand, is growing. With 100 Amul Ice Lounge locations by FY24, the cooperative is building upmarket ice cream shops in India.

Organic Ice Cream Market Companies

- Yeo Valley Family Farms

- Mackie’s of Scotland

- Crystal Creamery

- Clover Stornetta Farms Inc.

- Boulder Organic Ice Cream

- Three Twins Ice Cream

- Oob Organic

- Straus Family Creamery

- Blue Marble Ice Cream

- Organic Meadow Limited Partnership

- Oregon Ice Cream

- LUV Ice Cream

Segments Covered in the Report

By Categories

- Reduced Fat

- Low Fat

- Light

- Fat-Free

By Ingredients

- Whole Milk

- Cream

- Skimmed Milk

- Flavoring & Sweetening Agent

- Others

By Flavor

- Chocolate

- Vanilla

- Strawberry

- Butter Pecan

- Black Raspberry

- Coffee

- Mint Chocolate Chip

- Others

By Packaging Type

- Paperboard

- Flexible Packaging

- Rigid Plastics

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Food and Drink Specialist

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/