- North America held the largest share of 34% the market in 2023. The region is observed to sustain the position during the forecast period.

- Europe is expected to witness the fastest rate of growth while being the second largest marketplace in the upcoming years.

- By type, the diagnostic segment led the point-of-care ultrasound market with the largest share in 2023.

- By type, the therapeutic segment is observed to witness a notable rate of growth during the forecast period.

- By portability, the trolley-based devices segment held the largest share of the market in 2023. The segment is observed to continue to grow at an impressive rate during the forecast period.

- By portability, the handheld devices segment is observed to grow at the rapid pace during the forecast period.

- By application, the emergency medicine segment held the largest share of the market in 2023.

- By end users, the hospitals segment accounted for the largest market share in 2023.

- By end users, the clinics segment is expected to grow at a rapid CAGR during the forecast period.

The point-of-care ultrasound (POCUS) market has witnessed significant growth in recent years, driven by advancements in technology, increasing adoption of portable ultrasound devices, and the rising demand for point-of-care diagnostics. POCUS refers to the use of ultrasound at the bedside for immediate patient care decisions, providing real-time imaging and diagnostic capabilities. This market encompasses a wide range of applications across various medical specialties, including emergency medicine, critical care, obstetrics, and musculoskeletal imaging. The compact size, affordability, and ease of use of POCUS devices have made them indispensable tools for healthcare providers in diverse clinical settings, leading to a surge in market demand.

Get a Sample: https://www.precedenceresearch.com/sample/3903

Growth Factors

Several factors contribute to the rapid expansion of the point-of-care ultrasound market. Firstly, technological advancements have led to the development of more compact and portable ultrasound devices with enhanced imaging capabilities. These advancements have increased the accessibility of ultrasound technology, allowing healthcare providers to perform diagnostic procedures at the point of care, thereby improving patient outcomes and reducing the need for traditional imaging modalities such as X-rays and CT scans.

Secondly, the growing emphasis on value-based healthcare and the need for efficient and cost-effective diagnostic solutions have fueled the adoption of point-of-care ultrasound. Compared to traditional imaging modalities, POCUS offers several advantages, including lower cost, reduced time to diagnosis, and decreased patient exposure to radiation. These benefits have contributed to the widespread integration of POCUS into clinical practice across various medical specialties.

Moreover, the increasing prevalence of chronic diseases and the rising demand for point-of-care diagnostics have further propelled market growth. POCUS is particularly valuable in emergency and critical care settings, where rapid and accurate diagnosis is crucial for patient management. Additionally, the expanding applications of POCUS beyond traditional imaging, such as guided interventions and procedural assistance, have extended its utility across a wide range of clinical scenarios, driving market expansion.

Furthermore, the COVID-19 pandemic has underscored the importance of point-of-care diagnostics in enabling rapid triage and management of patients. During the pandemic, POCUS played a critical role in assessing lung involvement and guiding interventions in patients with COVID-19-related respiratory complications, highlighting its relevance in infectious disease management.

Region:

The point-of-care ultrasound market exhibits significant regional variation, with North America and Europe accounting for the largest market shares. In North America, the United States dominates the market, driven by the presence of a well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and favorable reimbursement policies. The growing prevalence of chronic diseases, along with the increasing demand for efficient diagnostic solutions, further contributes to market growth in the region.

Similarly, Europe represents a lucrative market for point-of-care ultrasound, fueled by increasing healthcare expenditure, rising awareness about the benefits of POCUS, and supportive government initiatives. Countries such as Germany, the United Kingdom, and France are among the key contributors to market growth in Europe, owing to their robust healthcare systems and strong emphasis on innovation and technological advancement.

Asia-Pacific is poised to witness significant growth in the point-of-care ultrasound market, driven by rapid urbanization, expanding healthcare infrastructure, and increasing healthcare expenditure in countries such as China, India, and Japan. The growing prevalence of chronic diseases, coupled with rising demand for point-of-care diagnostics in underserved rural areas, presents lucrative opportunities for market expansion in the region.

Latin America and the Middle East & Africa are also expected to experience substantial growth in the POCUS market, driven by improving access to healthcare services, increasing investment in healthcare infrastructure, and rising adoption of portable ultrasound devices in remote and resource-limited settings.

Point-of-care Ultrasound Market Scope

| Report Coverage | Details |

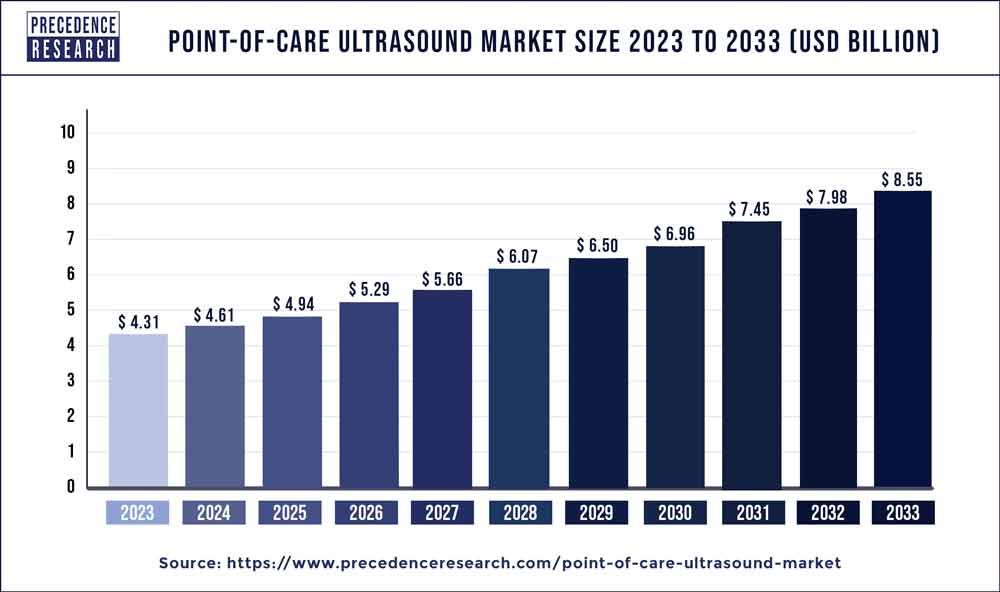

| Growth Rate from 2024 to 2033 | CAGR of 7.10% |

| Global Market Size in 2023 | USD 4.31 Billion |

| Global Market Size by 2033 | USD 8.55 Billion |

| U.S. Market Size in 2023 | USD 1.03 Billion |

| U.S. Market Size by 2033 | USD 2.03 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Portability, By Application, and By End users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis:

Strengths:

- Portability and ease of use of POCUS devices facilitate point-of-care diagnostics in diverse clinical settings.

- Real-time imaging capabilities enable rapid and accurate diagnosis, leading to improved patient outcomes.

- Cost-effectiveness compared to traditional imaging modalities makes POCUS an attractive diagnostic solution.

- Expanding applications beyond traditional imaging, such as guided interventions, enhance the utility of POCUS across various medical specialties.

Weaknesses:

- Limited expertise and training among healthcare providers may hinder the effective utilization of POCUS technology.

- Image quality and diagnostic accuracy of POCUS devices may vary depending on user proficiency and device quality.

- Regulatory challenges and varying reimbursement policies across different regions may impede market growth.

Opportunities:

- Growing demand for point-of-care diagnostics in emerging markets presents significant growth opportunities for POCUS manufacturers.

- Technological advancements, such as artificial intelligence and machine learning integration, can further enhance the capabilities and utility of POCUS devices.

- Increasing focus on telemedicine and remote patient monitoring creates new avenues for the application of POCUS in virtual healthcare settings.

- Collaboration with academic institutions and research organizations can drive innovation and foster the development of advanced POCUS technologies.

Threats:

- Competition from alternative diagnostic modalities, such as handheld devices and smartphone-based applications, poses a threat to market penetration and revenue growth.

- Regulatory uncertainties and compliance challenges in emerging markets may hinder market entry and expansion for POCUS manufacturers.

- Economic instability and healthcare budget constraints in certain regions could dampen market demand and investment prospects.

Competitive Landscape:

The point-of-care ultrasound market is characterized by intense competition, with several prominent players vying for market share through product innovation, strategic collaborations, and geographic expansion. Key players in the market include major medical device manufacturers such as GE Healthcare, Philips Healthcare, Siemens Healthineers, Fujifilm Sonosite, and Canon Medical Systems Corporation. These companies leverage their extensive product portfolios, technological expertise, and global distribution networks to maintain their competitive positions and capture new market opportunities.

In addition to multinational corporations, the market also comprises a growing number of smaller players and startups focused on developing innovative POCUS solutions tailored to specific clinical needs. These players often differentiate themselves through niche product offerings, such as handheld or wireless ultrasound devices, and targeted marketing strategies aimed at specific medical specialties or healthcare settings.

Moreover, strategic partnerships and collaborations play a crucial role in shaping the competitive landscape of the POCUS market. Companies frequently collaborate with healthcare institutions, academic research centers, and technology providers to enhance product development, expand market reach, and drive clinical validation of their POCUS solutions. Furthermore, mergers and acquisitions are common strategies employed by key players to strengthen their market presence, acquire complementary technologies, and capitalize on emerging growth opportunities.

Read Also: LASIK Eye Surgery Devices Market Size to Attain USD 3.69 Bn by 2033

Recent Developments

- In October 2023, Butterfly Network announced a 5-Year co-development agreement with Forest Neurotech for next-generation brain-computer interfaces using ultrasound-on-chip technology. The agreement includes USD 20MM to be paid to Butterfly for annual licensing, chip purchases, services, and milestone payments, of which USD 3.5MM was received on signing.

- In October 2023, GE HealthCare announced that it signed a USD 44 million contract with the Biomedical Advanced Research and Development Authority (BARDA) part of the Administration for Strategic Preparedness and Response (ASPR) within the U.S. Department of Health and Human Services (HHS) to develop and obtain regulatory clearance for next-generation advanced point-of-care ultrasound technology with new artificial intelligence (AI) applications.

- In July 2023, Konica Minolta Healthcare Americas Inc. announced the launch of PocketPro H2, a new wireless handheld ultrasound device for general imaging in point-of-care applications.

- In February 2022, Philips announced it has expanded its ultrasound portfolio with advanced hemodynamic assessment and measurement capabilities on its handheld point-of-care ultrasound, Lumify. Lumify assists clinicians in quantifying blood flow in a wide range of point-of-care diagnostic applications including cardiology, vascular, abdominal, urology, obstetrics, and gynecology as well as helps in the early assessment of gestational age and the identification of high-risk pregnancies.

Point-of-care Ultrasound Market Companies

- Koninklijke Philips N.V.

- GE Healthcare

- FUJIFILM Sonosite, Inc.

- Hitachi Ltd.

- ALPINION MEDICAL SYSTEMS Co., Ltd

- Terason Corporation

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- EDAN Instruments

- Esaote S.p.A

- Butterfly Network Inc.

- Teknova Medical System

- DRE medical

- Landwind Medical

- Terason Corporation

- CHISON Medical Technologies

- Siemens

- Mindray Bio-Medical Electronics

- B. Braun

- Canon Medical Systems

- Analogic Corporation

Segments Covered in the Report

By Type

- Diagnostic

- Therapeutic

By Portability

- Trolley-Based Devices

- Handheld Devices

By Application

- Emergency Medicine

- Cardiology

- Obstetrics & Gynecology

- Urology

- Vascular Surgery

- Musculoskeletal

By End users

- Hospitals

- Clinics

- Maternity Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/