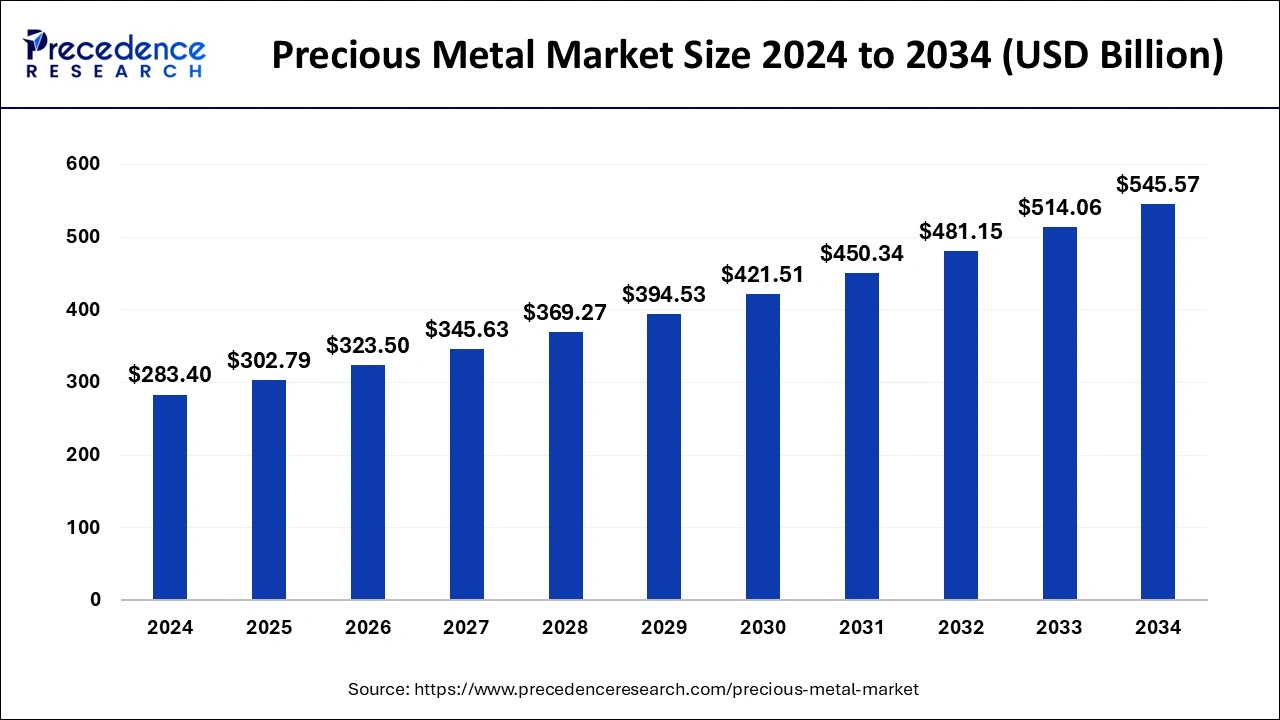

The global precious metal market size surpassed USD 265.26 billion in 2023 and is predicted to be worth around USD 514.06 billion by 2033, growing at a CAGR of 6.84% from 2024 to 2033.

Key Points

- Asia Pacific has held the largest market share of 60% in 2023.

- North America is also expected to gain a significant share of the market during the forecast period.

- By product, the gold segment dominated the market with the largest market share of 83% in 2023.

- By application, the industrial segment has contributed more than 46% of market share in 2023.

- By application, the jewelry segment is expected to witness the fastest CAGR in the market during the forecast period.

The global precious metal market encompasses a variety of valuable metals, including gold, silver, platinum, and palladium, among others. Precious metals have long been regarded as stores of value and are sought after for their intrinsic properties such as rarity, beauty, and resistance to corrosion. The market for precious metals is influenced by diverse factors such as economic conditions, geopolitical tensions, currency fluctuations, industrial demand, and investor sentiment. Understanding the dynamics of the precious metal market requires a comprehensive analysis of these factors along with trends, drivers, opportunities, and challenges that shape the industry.

Get a Sample: https://www.precedenceresearch.com/sample/4051

Growth Factors:

Several key factors drive the growth of the global precious metal market. Economic uncertainty and volatility often lead investors to seek safe-haven assets like gold and silver as stores of value during times of geopolitical tensions, financial crises, or currency devaluations. The demand for precious metals in various industrial applications, including electronics, jewelry, automotive catalysts, and medical devices, contributes to market growth. Additionally, central banks play a significant role in the precious metal market through their gold reserves and purchases, influencing prices and market sentiment. Moreover, investment demand for precious metals in the form of coins, bars, exchange-traded funds (ETFs), and other financial instruments continues to grow as investors seek portfolio diversification and hedging against inflation and currency risks.

Region Insights:

The demand for precious metals varies across regions, reflecting differences in economic conditions, cultural preferences, industrial activities, and investment behavior. Asia, particularly China and India, is a major consumer of gold and silver, driven by cultural traditions, jewelry consumption, and investment demand. China, the world’s largest gold producer and consumer, accounts for a significant portion of global gold demand, both for jewelry and investment purposes. India, with its rich cultural heritage and tradition of gold ownership, exhibits robust demand for gold jewelry, especially during festive seasons and weddings. North America and Europe also represent significant markets for precious metals, driven by investment demand, industrial applications, and jewelry consumption.

Trends:

Several trends shape the dynamics of the global precious metal market. One prominent trend is the increasing adoption of digital platforms for buying, selling, and storing precious metals, offering investors greater convenience, transparency, and accessibility to bullion markets. Another trend is the rise of environmentally sustainable mining practices and ethical sourcing initiatives in the precious metal industry, addressing concerns about environmental degradation, human rights violations, and community impacts associated with mining activities. Moreover, the integration of blockchain technology in the precious metal supply chain is enhancing transparency, traceability, and authenticity, enabling consumers to verify the origin and purity of precious metals.

Precious Metal Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.84% |

| Global Market Size in 2023 | USD 265.26 Billion |

| Global Market Size by 2024 | USD 283.40 Billion |

| Global Market Size by 2033 | USD 514.06 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Precious Metal Market Dynamics

Drivers

Several drivers influence the demand and prices of precious metals. Economic factors such as inflation, interest rates, currency movements, and macroeconomic uncertainty often drive investor demand for gold and other precious metals as safe-haven assets and inflation hedges. Geopolitical tensions, conflicts, and geopolitical risks can also fuel demand for precious metals as investors seek refuge from political instability and uncertainty. Additionally, industrial demand for precious metals in electronics, automotive catalysts, and other high-tech applications is driven by technological advancements, urbanization, and infrastructure development. Furthermore, changes in investor sentiment, market speculation, and monetary policies of central banks can impact the prices of precious metals, driving short-term fluctuations and long-term trends in the market.

Opportunities:

The global precious metal market presents various opportunities for stakeholders across the value chain. Mining companies have the opportunity to explore new deposits, implement sustainable mining practices, and leverage technological innovations to increase production efficiency and reduce environmental impacts. Refiners and fabricators can focus on enhancing product quality, purity, and customization to meet the diverse needs of consumers and industrial users. Financial institutions and investment firms can develop innovative products and services, such as digital gold platforms, ETFs, and structured products, to cater to growing investor demand for precious metals. Moreover, governments and regulatory bodies can support the development of transparent and sustainable supply chains, promote responsible mining practices, and create a conducive environment for investment and trade in precious metals.

Challenges:

Despite the opportunities, the global precious metal market faces several challenges that could impact its growth and sustainability. Environmental concerns associated with mining operations, including habitat destruction, water pollution, and carbon emissions, pose challenges for the industry in meeting sustainability goals and addressing stakeholder expectations. Moreover, geopolitical tensions, trade disputes, and regulatory uncertainties can create volatility and disrupt supply chains, affecting prices and market dynamics. Price manipulation, fraud, and counterfeit products also pose risks to market integrity and consumer confidence, necessitating robust regulatory frameworks and industry standards to address these challenges. Furthermore, shifting consumer preferences, technological disruptions, and evolving investment trends could reshape the landscape of the precious metal market, requiring stakeholders to adapt and innovate to stay competitive and relevant.

Read Also: Multiparameter Patient Monitoring Market Size, Trends, Report by 2033

Recent Developments

- In March 2024, together with his family business and longtime colleague Peter Grosskopf, billionaire investor Eric Sprott in precious metal miners and bullion is launching Argo Digital Gold Ltd., a platform that will allow a new generation of investors to own physical gold.

- In July 2023, Barrick Gold disclosed the extension of the mine life for its Tongon gold project in Côte d’Ivoire. This decision comes as a result of the ongoing positive outcomes from gold exploration activities within the Nielle mining permit area.

Precious Metal Market Companies

- Freeport-McMoRan Inc.

- PJSC Polyus.

- Newmont Corporation.

- Gold Fields Limited.

- Randgold & Exploration Company Limited.

- Barrick Gold Corporation.

- AngloGold Ashanti Limited.

- Kinross Gold Corporation.

Segment Covered in the Report

By Product

- Gold

- Silver

- PGM

By Application

- Jewelry

- Industrial

- Investment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/