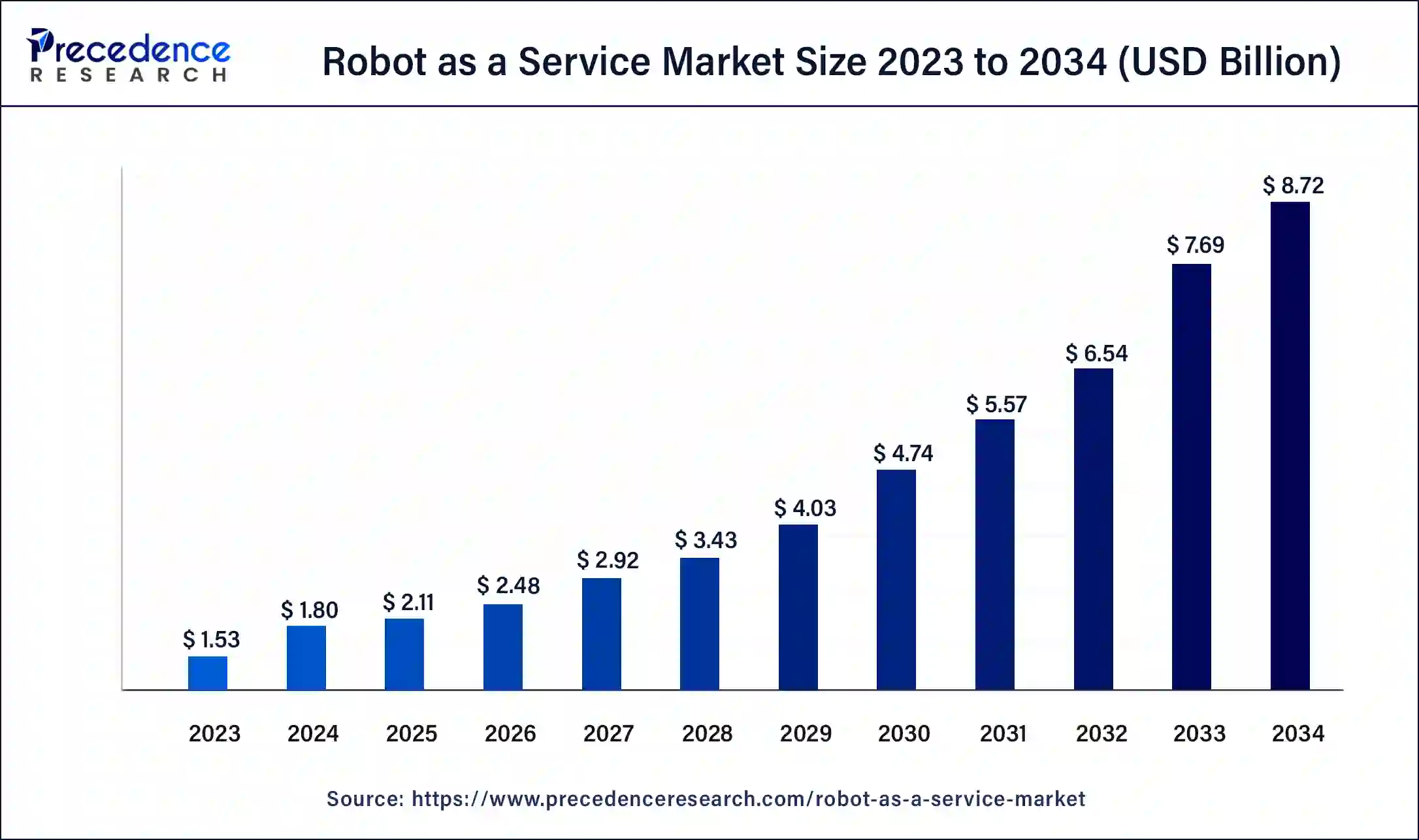

The global robot as a service market size surpassed USD 1.53 billion in 2023 and is anticipated to hit around USD 7.69 billion by 2033, expanding at a CAGR of 17.52% from 2024 to 2033.

Key Points

- North America has accounted more than 38% of the market share in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 20.04% during the forecast period.

- By enterprise size, the large enterprises segment has accounted more than 70% of market share in 2023.

- By enterprise size, the small & medium enterprises segment is expected to grow at a CAGR of 19.04% between 2024 and 2033.

- By application, the handling application segment has held the major market share of 37% in 2023.

- By industry verticals, the automotive industry segment accounted for the highest market share of 18% in 2023.

The Robot as a Service (RaaS) market has witnessed significant growth in recent years, driven by the increasing adoption of automation and robotics across various industries. RaaS refers to the business model where companies offer robots and automation solutions as a service rather than selling them outright. This approach allows businesses to access advanced robotic technologies without the need for large upfront investments in hardware and software. The RaaS model offers benefits such as flexibility, scalability, and cost-effectiveness, making it an attractive option for organizations looking to streamline their operations and improve efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/4016

Growth Factors:

Several factors are contributing to the rapid growth of the RaaS market. One of the key drivers is the rising demand for automation solutions to enhance productivity and reduce operational costs. Businesses across industries, including manufacturing, healthcare, logistics, and agriculture, are increasingly turning to robots to perform repetitive tasks more efficiently and accurately. Additionally, advancements in robotics technology, such as artificial intelligence (AI), machine learning, and sensor technologies, are enabling robots to perform a wider range of tasks with greater precision and autonomy, further driving the adoption of RaaS solutions.

Moreover, the growing focus on workplace safety and the need to mitigate risks associated with manual labor are driving the adoption of robotic solutions. Robots can perform hazardous tasks in environments such as manufacturing plants, construction sites, and warehouses, reducing the risk of accidents and injuries to human workers. Furthermore, the ongoing trend towards digital transformation and Industry 4.0 initiatives is fueling the demand for connected and intelligent robotic systems that can seamlessly integrate with existing infrastructure and enable real-time data exchange and analytics.

Region Insights:

The adoption of RaaS solutions varies across different regions, with certain regions leading the market due to factors such as technological advancement, industrial development, and government initiatives. North America and Europe are among the leading regions in terms of RaaS adoption, driven by the presence of a mature industrial base, strong R&D capabilities, and a favorable regulatory environment. Countries like the United States, Germany, and the United Kingdom are witnessing significant investments in robotics and automation technologies across various industries, driving the growth of the RaaS market.

Asia Pacific is also emerging as a lucrative market for RaaS, fueled by rapid industrialization, urbanization, and the growing emphasis on automation in countries such as China, Japan, and South Korea. These countries are investing heavily in robotics and AI technologies to enhance their manufacturing capabilities and maintain competitiveness in the global market. Moreover, the increasing adoption of e-commerce and logistics automation in the region is driving the demand for robotic solutions for warehouse automation and last-mile delivery.

Robot as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.52% |

| Global Market Size in 2023 | USD 1.53 Billion |

| Global Market Size by 2033 | USD 7.69 Billion |

| U.S. Market Size in 2023 | USD 440 Million |

| U.S. Market Size by 2033 | USD 2,190 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Enterprise Size, By Application, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Robot as a Service Market Dynamics

Drivers:

Several drivers are propelling the growth of the RaaS market. One of the primary drivers is the need for cost-effective and flexible automation solutions. Traditional robotics investments often require significant upfront capital expenditure, making them inaccessible to small and medium-sized enterprises (SMEs) with limited financial resources. RaaS offers a subscription-based model that allows businesses to pay for robotic services on a usage basis, eliminating the need for large upfront investments and providing greater flexibility in scaling operations according to demand.

Additionally, the shortage of skilled labor in certain industries is driving the adoption of robotic solutions to fill the gap. Robots can perform repetitive and labor-intensive tasks with high precision and efficiency, reducing the reliance on human workers for routine operations. This is particularly evident in industries such as manufacturing, where the aging workforce and changing demographics are creating challenges in finding skilled workers. By deploying robots through RaaS models, businesses can overcome labor shortages and improve operational efficiency.

Moreover, the increasing focus on sustainability and environmental conservation is driving the adoption of robotic solutions that can reduce energy consumption and waste generation. Modern robots are designed to be energy-efficient and produce fewer emissions compared to traditional manufacturing processes, making them an attractive option for companies looking to minimize their carbon footprint. RaaS providers are offering environmentally friendly robotic solutions that help businesses achieve their sustainability goals while improving productivity and profitability.

Opportunities:

The RaaS market presents numerous opportunities for both established players and new entrants to capitalize on the growing demand for robotic solutions across industries. One of the key opportunities lies in offering specialized robotic services tailored to specific industry verticals and applications. For example, there is a growing demand for collaborative robots (cobots) that can work alongside human workers in manufacturing environments, performing tasks such as assembly, pick-and-place, and quality inspection.

Furthermore, the integration of advanced technologies such as AI, machine learning, and computer vision presents opportunities for RaaS providers to offer more intelligent and autonomous robotic solutions. AI-powered robots can learn from their interactions with the environment and continuously improve their performance over time, making them more adaptable to changing operational requirements. This opens up opportunities for RaaS providers to offer predictive maintenance, anomaly detection, and other value-added services that enhance the reliability and performance of robotic systems.

Additionally, the expansion of the RaaS market into new industry verticals such as healthcare, agriculture, and retail presents significant growth opportunities. Robots are increasingly being used in healthcare settings for tasks such as patient care, medication dispensing, and surgical assistance. In agriculture, robots are being deployed for precision farming activities such as planting, harvesting, and crop monitoring. Similarly, in the retail sector, robots are being used for inventory management, shelf stocking, and customer service, enhancing operational efficiency and customer experience.

Challenges:

Despite the promising growth prospects, the RaaS market faces several challenges that could hinder its expansion. One of the main challenges is the perception of robots replacing human jobs, leading to resistance from workers and labor unions. While robots can automate repetitive tasks and improve efficiency, there are concerns about job displacement and the impact on employment opportunities, especially for low-skilled workers. RaaS providers need to address these concerns by emphasizing the role of robots as complements rather than substitutes to human workers, focusing on tasks that are difficult, dangerous, or repetitive.

Moreover, the complexity of deploying and integrating robotic systems into existing workflows poses a challenge for businesses, particularly SMEs with limited technical expertise. Implementing robotic solutions requires careful planning, customization, and training to ensure seamless integration with existing processes and systems. RaaS providers need to offer comprehensive support services, including training, maintenance, and troubleshooting, to help businesses overcome these challenges and maximize the benefits of robotic automation.

Another challenge is the regulatory and ethical considerations associated with the use of robots in various applications, particularly in sensitive areas such as healthcare and security. Concerns about data privacy, safety standards, and liability issues need to be addressed to ensure compliance with regulatory requirements and build trust among stakeholders. RaaS providers must adhere to industry standards and best practices to mitigate risks and ensure the responsible use of robotic technologies.

Furthermore, the upfront costs of developing and deploying robotic solutions can be prohibitive for RaaS providers, particularly startups and smaller companies. Developing advanced robotic technologies requires substantial investments in research and development (R&D), prototyping, and testing, which may not be feasible for all companies. RaaS providers need access to adequate funding and resources to develop innovative robotic solutions that meet the evolving needs of customers and stay competitive in the market.

Read Also: Barrier Films Market Size to Surpass USD 61.86 Billion by 2033

Recent Developments

- In November 2022, Smart Robotics Inc. developed a smart robot that can pick products from enterprises’ manufacturing sites. This COBOT collaborative robot can handle lightweight products such as office stationery and papers.

- In February 2022, Ricoh acquired Axon Ivy AG as a strategic investment to expand its digital process automation capacity and strengthen its roots in the global market as a robot service provider.

Robot as a Service Market Companies

- Ademco Global

- Aethon

- ABB Group

- Amazon Web Services Inc.

- Beetl Robotics

- Berkshire Grey Inc.

- Cobalt Robotics

- CYBERDYNE Inc.

- Fanuc Corporation

- iRobot Corporation

- inVia Robotics

- Kongsberg Maritime

- KUKA AG

- Locus Robotics

- Northrop Grumman

- RedZone Robotics

- Relay Robotics

- Yaskawa Electric Corporation

Segments Covered in the Report

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Application

- Handling

- Assembling And Disassembling

- Dispensing

- Processing

- Welding And Soldering

- Others

By Industry Vertical

- BFSI

- Défense

- Healthcare

- Automotive

- Manufacturing

- Retail

- Telecom & IT

- Logistics & Transportation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/