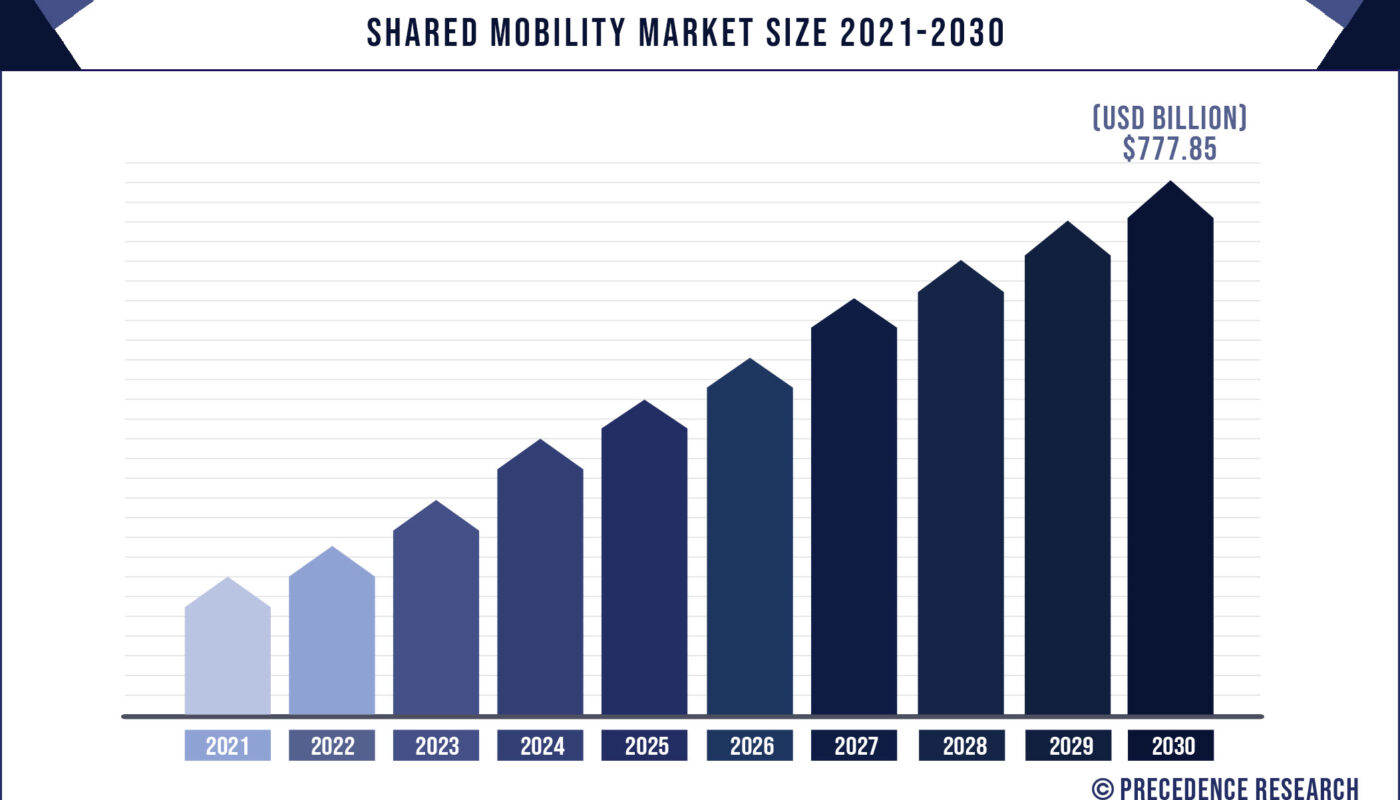

According to Precedence Research, The shared mobility market size garnered US$ 420.15 billion in 2020 and is expected to generate US$ 777.85 billion by 2030, manifesting a CAGR of 8.5% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The shared mobility market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global shared mobility market include:

Avis Budget Group, ANI Technologies Pvt. Ltd. (OLA), car2go NA LLC, Beijing Xiaoju Technology Co, Ltd., The Hertz Corporation, WingzInc., Uber Technologies Inc., Curb Mobility, GrabHoldings Inc., Lyft Inc., Careem Inc., Curb Mobility, Cabify, Europcar Mobility Group, The Hertz Corporation, BayerischeMotoren Werke AG (BMW), Daimler AG, Transdev, General Motors Company, Ford Motor Company, Robert Bosch GmbH, Hyundai Motor Company, Enterprise Holdings Inc., Meru Cabs, Jugnoo, Zoomcar, Revv car, MylesGett Inc., BayerischeMotoren Werke AG (BMW),The Hertz Corporation and Zipcar Inc.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1329

Crucial factors accountable for market growth are:

- The surge in rising on road traffic congestion, lack of parking spaces, high fuel prices, and high cost of personal vehicle ownership.

- Rising internet penetration fosters the market growth.

- Rapid growth of automobile industry.

- Government initiatives in promoting the shared mobility services.

Shared Mobility Market Report Highlights

- The Vehicle Rental/Leasing type segment accounted for more than xx% revenue share in 2020.

- The Passenger Cars segment of the Shared Mobility Market is estimated to lead the market with a market share of more than xx% in 2020.

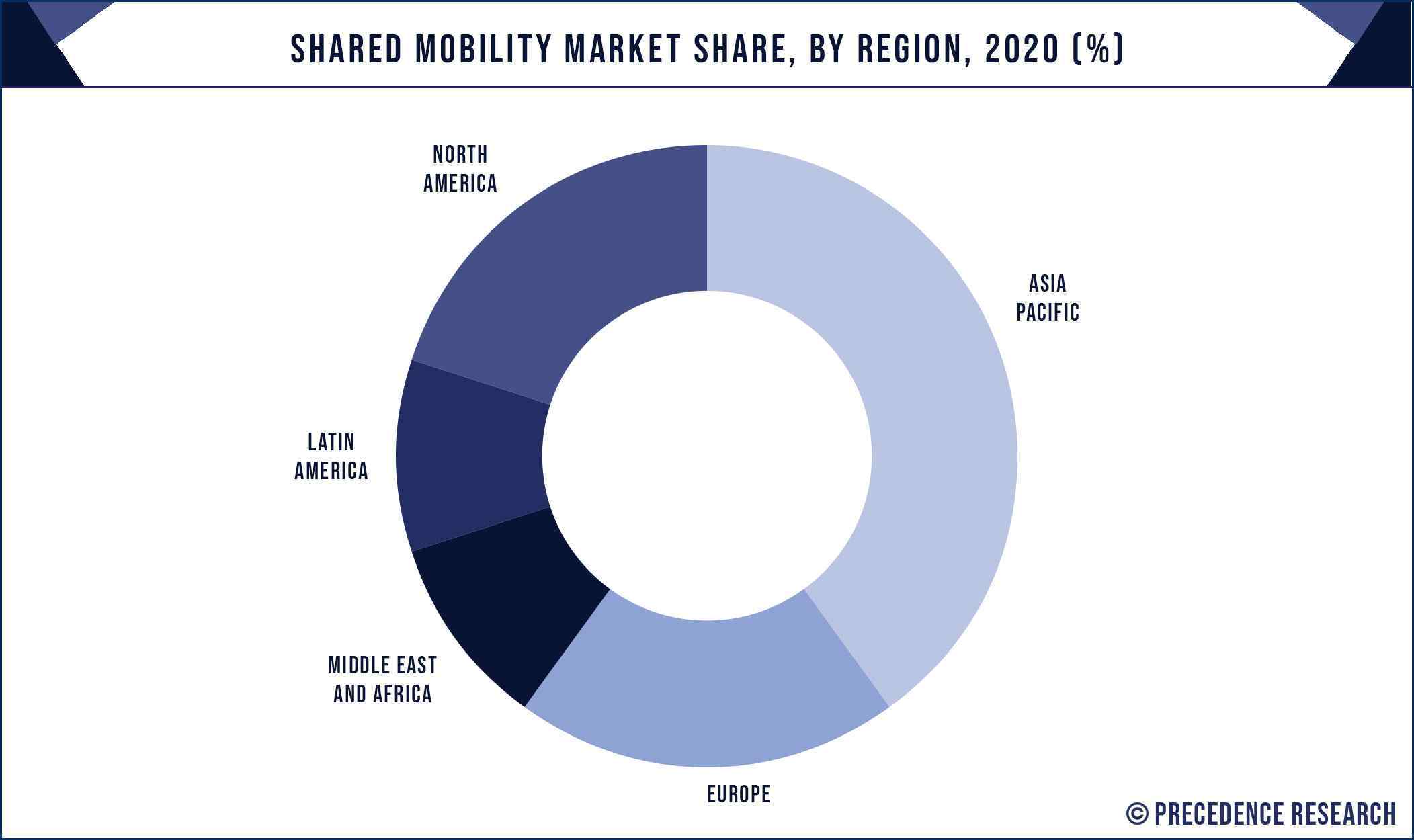

- By Geography Asia Pacific is expected to lead the market contributing more than xx% revenue share in 2020 owing the rise in On-road vehicle traffic and costs of vehicle ownership in the countries of this region

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Shared Mobility Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Shared Mobility Market Dynamics

Driver

The rapid growth of the automobile industry and the Government initiatives in promoting the use of shared mobility services across the world are expected to drive the growth of the shared mobility market. For instance, On 27th July 2021, Intercity mobility startup Zingbus, announced that they have raised INR 44.6 crore and these funds will be utilized in order to develop technology for the next leap of improvement in traveler experience and expansion of their service in new geographical location.

Opportunity

The growing concerns over the air pollution caused by the extensive use of automobiles and the Government initiatives in encouraging the shared mobility services are some factors that is expected to create opportunities for the shared mobility market.

Challenges

The unlikeliness of the travelers to travel with unknown individuals and the rising concerns over theft of private information are some of the attributes that is expected to challenge the growth of the shared mobility market.

Recent Developments

- On 19th July 2021, Share Now and Mercedes-Benz Rent has announced that they are expanding their car share service in five location of Germany such as Stuttgart, Frankfurt, Cologne, Hamburg and Berlin.

- On 28th July 2020, Zoom car announced that it has collaborated with ETO Motors in order to boost the electric mobility.

- On 19th April 2021, Gett, the ride-hailing startup announced that it has signed a pact with Curb Mobility to integrate yellow taxis into Gett’s app, which will now cover some 65 cities across the U.S.

- On 13th April 2021, Grab Holdings Inc. Southeast Asia’s leading superapp, announcedthat it intends to go public in the U.S. in partnership with Altimeter Growth Corp. The public listing will strengthen Grab’s strong business momentum.

- On 25th October 2021, The Hertz Corporation announced that it has ordered 100,000 Tesla Inc. vehicles by the end of 2022, a move aimed at including more electric vehicles in its car-rental fleet.

- On 9th September 2021, Transdev, through its subsidiary Cityway, and the River Parishes Transit Authority (RPTA) in Louisiana, USA is enhancing its services with the launch of a new innovative Transit On-Demand booking platform that allows customers to book their rides on a mobile application, the RPTA website or on the phone with customer service.

Regional Snapshots

The Asia Pacific region dominated the shared mobility market contributing more than xx% in 2020 and is expected to witness significant growth during the forecast period owing to significant rise in on road traffic and high costs of vehicle ownership in countries such as India and China. For instance, On 23rd September 2021, OLA announced that it is building a ‘new mobility ecosystem’ with the consumer at its core. This will to brought to people through Ola-designed electric vehicles (EVs) customized for diverse shared mobility needs.

Market Segments Covered

By Type

- Ride-sharing

- Vehicle Rental/Leasing

- Ride Sourcing

- Private

By Vehicle Type

- Passenger Cars

- LCVs

- Busses & Coaches

- Micro Mobility

By Business Model

- P2P

- B2B

- B2C

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Research Objective

- To provide a comprehensive analysis of the shared mobility industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global shared mobility market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the shared mobility

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Shared Mobility Market, By Type

7.1. Shared Mobility Market, by Type, 2021-2030

7.1.1. Ride-sharing

7.1.1.1. Market Revenue and Forecast (2019-2030)

7.1.2. Vehicle Rental/Leasing

7.1.2.1. Market Revenue and Forecast (2019-2030)

7.1.3. Ride Sourcing

7.1.3.1. Market Revenue and Forecast (2019-2030)

7.1.4. Private

7.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 8. Global Shared Mobility Market, By Vehicle

8.1. Shared Mobility Market, by Vehicle, 2021-2030

8.1.1. Passenger Cars

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. LCVs

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Busses & Coaches

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Micro Mobility

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Shared Mobility Market, By Business Model

9.1. Shared Mobility Market, by Business Model, 2021-2030

9.1.1. P2P

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. B2B

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. B2C

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Shared Mobility Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.1.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.1.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.1.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.1.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.2.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.2.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.2.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.2.6.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.2.7.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.2.7.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.3.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.3.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.3.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.3.6.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.3.7.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.3.7.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.4.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.4.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.4.6.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Type (2019-2030)

10.4.7.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.4.7.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.5.4.3. Market Revenue and Forecast, by Business Model (2019-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Type (2019-2030)

10.5.5.2. Market Revenue and Forecast, by Vehicle (2019-2030)

10.5.5.3. Market Revenue and Forecast, by Business Model (2019-2030)

Chapter 11. Company Profiles

11.1. Avis Budget Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ANI Technologies Pvt. Ltd. (OLA)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. car2go NA LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Beijing Xiaoju Technology Co, Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. General Motors Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ford Motor Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Robert Bosch GmbH

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Hyundai Motor Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. The Hertz Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. WingzInc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. Uber Technologies Inc.

11.11.1. Company Overview

11.11.2. Product Offerings

11.11.3. Financial Performance

11.11.4. Recent Initiatives

11.12. Curb Mobility

11.12.1. Company Overview

11.12.2. Product Offerings

11.12.3. Financial Performance

11.12.4. Recent Initiatives

11.13. GrabHoldings Inc.

11.13.1. Company Overview

11.13.2. Product Offerings

11.13.3. Financial Performance

11.13.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s shared mobility market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1329

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com