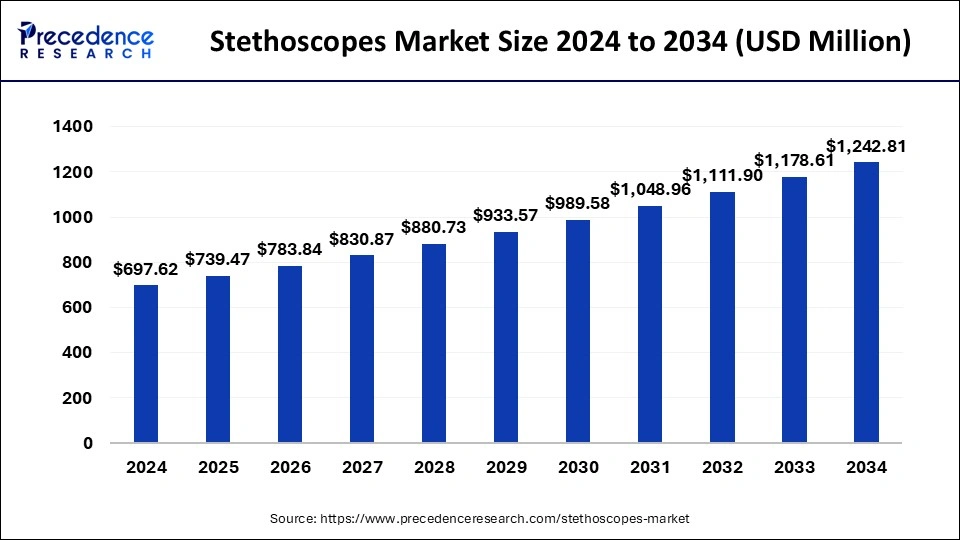

The global stethoscopes market size surpassed USD 658.13 million in 2023 and is estimated to hit around USD 1,178.61 million by 2033, growing at a CAGR of 6% from 2024 to 2033.

Key Points

- North America has held the largest share of 34% in 2023.

- Asia Pacific is the fastest-growing region in the market.

- By technology type, the traditional acoustic stethoscope segment has generated more than 75% of the market share in 2023.

- By technology type, the smart stethoscope segment is expected to expand at the fastest CAGR of 7.10% between 2024 and 2033.

- Based on sales channels, the distributors segment has captured the largest market share of 55% in 2023.

- Based on sales channels, the e-commerce segment is projected to grow at a CAGR of 7.05% between 2024 and 2033.

- By end use, the hospital segment dominated the market with the largest market share of 42% in 2023.

The stethoscopes market encompasses a range of medical devices crucial for auscultation, allowing healthcare professionals to listen to internal sounds of the body, such as heartbeat and lung function. As an essential diagnostic tool used in various medical settings, including hospitals, clinics, and ambulatory care centers, stethoscopes play a pivotal role in patient assessment and monitoring. This overview explores the growth factors, regional insights, drivers, restraints, and opportunities shaping the stethoscopes market globally.

Get a Sample: https://www.precedenceresearch.com/sample/3959

Growth Factors:

The stethoscopes market is driven by several factors, including the increasing prevalence of cardiovascular and respiratory diseases worldwide. With the rising burden of chronic conditions such as hypertension, heart failure, and chronic obstructive pulmonary disease (COPD), there is a growing demand for diagnostic tools like stethoscopes for early detection and management. Moreover, advancements in stethoscope technology, such as electronic stethoscopes with amplification and noise reduction features, enhance diagnostic accuracy and ease of use, driving market growth.

Furthermore, the expanding healthcare infrastructure in emerging economies, coupled with improving access to medical services, fuels the adoption of stethoscopes. Government initiatives aimed at strengthening primary healthcare systems and improving healthcare access in rural areas contribute to market growth by increasing the demand for medical devices, including stethoscopes. Additionally, the growing emphasis on preventive care and health screenings drives the demand for diagnostic tools, further boosting the stethoscopes market.

Region Insights

The stethoscopes market exhibits regional variations influenced by factors such as healthcare infrastructure, disease prevalence, regulatory environment, and consumer preferences. North America and Europe dominate the market owing to well-established healthcare systems, high adoption rates of advanced medical devices, and increasing healthcare expenditure. In these regions, technological advancements and product innovations drive market growth, with a focus on enhancing diagnostic capabilities and patient comfort.

Asia-Pacific presents significant growth opportunities driven by rapid urbanization, increasing healthcare spending, and a growing patient population. Countries like China, India, and Japan are witnessing a surge in demand for stethoscopes due to the rising burden of chronic diseases and improving access to healthcare services. Moreover, government initiatives aimed at modernizing healthcare infrastructure and expanding access to medical devices contribute to market growth in the region.

Stethoscopes Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6% |

| Global Market Size in 2023 | USD 658.13 Million |

| Global Market Size by 2033 | USD 1,178.61 Million |

| U.S. Market Size in 2023 | USD 179.01 Million |

| U.S. Market Size by 2033 | USD 322.59 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology Type, By Sales Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Stethoscopes Market Dynamics

Drivers:

Several drivers propel the growth of the stethoscopes market globally. The growing prevalence of chronic diseases, particularly cardiovascular and respiratory conditions, drives the demand for diagnostic tools like stethoscopes for early detection and monitoring. Technological advancements in stethoscope design, such as Bluetooth connectivity, digital auscultation, and mobile app integration, enhance diagnostic capabilities and improve workflow efficiency for healthcare professionals.

Moreover, increasing healthcare expenditure and investments in healthcare infrastructure drive market growth by expanding the reach of medical services and increasing access to diagnostic tools. Additionally, the rising awareness about preventive healthcare and the importance of regular health screenings encourage individuals to seek medical attention, boosting the demand for diagnostic devices like stethoscopes. Furthermore, the growing adoption of telemedicine and remote patient monitoring solutions amid the COVID-19 pandemic accelerates the demand for digital stethoscopes and telehealth-compatible devices.

Restraints:

Despite the growth drivers, the stethoscopes market faces certain restraints and challenges. One of the primary challenges is the presence of alternative diagnostic technologies, such as ultrasound and echocardiography, which offer advanced imaging capabilities and may replace traditional auscultation in certain clinical scenarios. Moreover, counterfeit and low-quality stethoscopes flooding the market pose a challenge to manufacturers and healthcare professionals, compromising diagnostic accuracy and patient care.

Regulatory challenges, including compliance requirements and certification processes, also pose hurdles for market players, particularly in emerging markets with evolving regulatory frameworks. Additionally, budget constraints and limited healthcare resources in certain regions may hinder the adoption of stethoscopes, especially in underserved communities and low-income settings. Furthermore, concerns about infection control and hygiene maintenance associated with traditional stethoscopes may drive demand for single-use or disposable alternatives, impacting market growth.

Opportunities:

Despite the challenges, the stethoscopes market presents opportunities for innovation, expansion, and market penetration. Advancements in stethoscope technology, including the development of smart stethoscopes with AI-based algorithms for automated diagnosis and decision support, open new avenues for market players to differentiate their products and enhance diagnostic capabilities. Moreover, the growing adoption of telemedicine and remote patient monitoring creates opportunities for manufacturers to develop stethoscopes with telehealth compatibility and remote auscultation features.

Furthermore, strategic partnerships and collaborations between healthcare providers, medical device manufacturers, and technology companies facilitate the development and commercialization of innovative stethoscope solutions. Additionally, investments in research and development aimed at improving stethoscope design, functionality, and usability can drive product innovation and market growth. Moreover, expanding market penetration in emerging economies through targeted marketing strategies and distribution networks presents growth opportunities for market players seeking to tap into new markets and customer segments.

Read Also: Glaucoma Treatment Market Size to Attain USD 8.45 Bn by 2033

Recent Developments

- In August 2022, Caregility, a telehealth platform company, partnered with Eko, a developer of stethoscopes. Their integration will provide a cloud platform from Caregility to Eko’s smart stethoscopes and software. This will give high-quality auscultation for patients while doing the examination, that is, listening for heart rate and other body sounds with lungs.

- In April 2022, Sanolla Ltd, an Israeli startup, launched an AI-based stethoscope with a smart infrasound feature, which is audible too while doing a patient’s check-up. This is the first smart stethoscope that is approved by the United States Food and Drug Administration for use in the market by medical professionals.

Stethoscopes Market Companies

- 3M

- Medline Industries Inc

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Eko Devices Inc.

- GF Health Products, Inc.

- Rudolf Riester GmbH (Halma Plc)

- American Diagnostics Corporation

- Cardionics

- PAUL HARTMANN AG

- Heine Optotechnik GmbH & Co. KG.

- STETHOME SP. Z O.O.

Segments Covered in the Report

By Technology Type

- Electronic/Digital Stethoscope

- Smart Stethoscope

- Traditional Acoustic Stethoscope

By Sales Channel

- Distributors

- E-Commerce

- Direct Purchase

By End-use

- Home Healthcare

- Hospitals

- Clinics

- Nurse Practitioners

- EMT/ First Responders

- Veterinary

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/