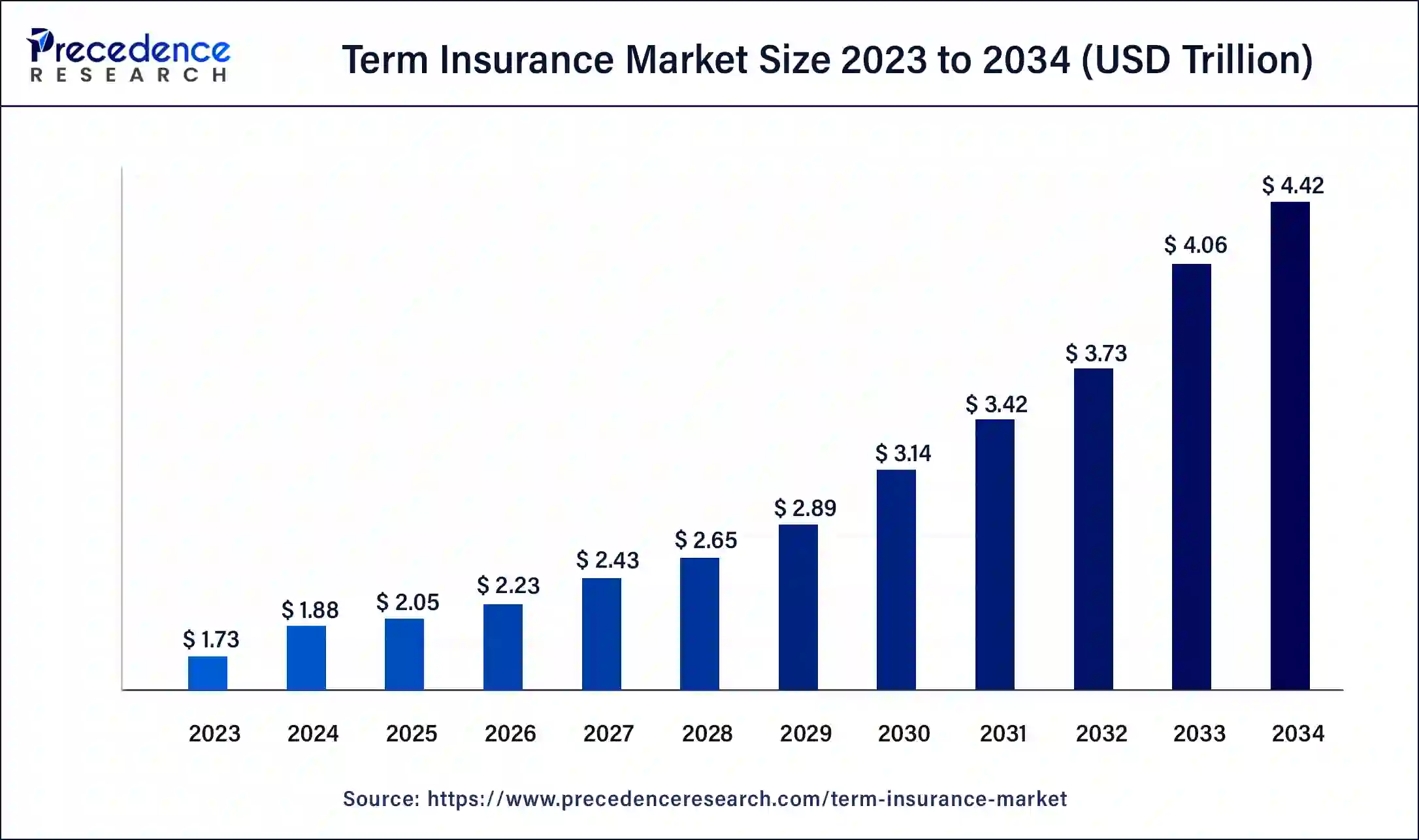

The global term insurance market size surpassed USD 1.73 trillion in 2023 and is projected to rake around USD 4 trillion by 2033, growing at a CAGR of 8.75% from 2024 to 2033.

Key Points

- Asia-Pacific has contributed more than 34% of market share in 2023.

- Europe is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, in 2023, the individual-level term life insurance segment has held the highest market share of 76%.

- By type, the group-level term insurance segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By distribution channel, the tied agents & branches segment has held 53% market share in 2023.

- By distribution channel, the light brokers segment is anticipated to witness rapid growth over the projected period.

The term insurance market plays a crucial role in the global insurance industry by providing financial protection to individuals and families against the risk of untimely death. Term insurance policies offer coverage for a specified period, typically ranging from 5 to 30 years, and pay out a death benefit to beneficiaries if the insured individual passes away during the policy term. This segment of the insurance market is characterized by its affordability and simplicity, making it an attractive option for individuals seeking basic life insurance coverage.

Get a Sample: https://www.precedenceresearch.com/sample/3989

Growth Factors: Several key growth factors drive the expansion of the term insurance market. One significant factor is increasing awareness among consumers about the importance of financial planning and risk management. As individuals recognize the need to protect their loved ones’ financial security in the event of their death, demand for term insurance policies rises. Additionally, demographic trends such as population growth, urbanization, and rising incomes in emerging markets contribute to the expansion of the market, as more people seek to safeguard their families’ future financial well-being.

Region Insights:

The term insurance market exhibits varying dynamics across different regions of the world. In mature insurance markets such as North America and Europe, term insurance products are well-established and widely used as part of individuals’ overall financial planning strategies. These regions boast robust regulatory frameworks, sophisticated distribution channels, and high levels of consumer awareness, driving steady demand for term insurance policies. In contrast, emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities due to expanding middle-class populations, rising disposable incomes, and increasing awareness of the need for life insurance coverage.

Drivers:

Several drivers propel the growth of the term insurance market globally. Economic growth and rising affluence in emerging markets create favorable conditions for insurance penetration and demand for life insurance products, including term insurance. Furthermore, advancements in technology and digitalization have transformed the distribution and underwriting processes, making term insurance more accessible and affordable to a broader segment of the population. Moreover, regulatory reforms aimed at enhancing consumer protection and promoting insurance market development contribute to the expansion of the term insurance market by fostering trust and confidence among consumers.

Opportunities:

The term insurance market presents numerous opportunities for insurers, reinsurers, and intermediaries to capitalize on evolving consumer needs and market trends. Product innovation, including the development of customizable term insurance solutions and riders offering additional coverage benefits, can help insurers differentiate themselves in a competitive market landscape. Moreover, leveraging data analytics and artificial intelligence enables insurers to improve risk assessment, pricing accuracy, and customer engagement, enhancing the overall value proposition of term insurance products. Additionally, partnerships with financial institutions, employers, and digital platforms can expand distribution channels and reach underserved market segments, driving growth and market penetration.

Challenges:

Despite its growth potential, the term insurance market faces several challenges that warrant attention from industry participants and policymakers. One significant challenge is the perception of term insurance as a commoditized product, leading to price competition and margin pressure for insurers. Balancing affordability with adequate coverage levels while maintaining profitability remains a key challenge for insurers operating in this segment. Moreover, regulatory complexity, including compliance requirements and solvency standards, poses challenges for insurers navigating diverse regulatory environments across different markets. Additionally, consumer education and awareness initiatives are needed to address misconceptions about term insurance and promote its value as an essential component of financial planning and risk management.

Read Also: Compartment Syndrome Monitoring Devices Market Size, Report 2033

Recent Developments

- In December 2023, The Smart Total Elite Protection Plan, a comprehensive term life insurance policy created to fit modern lifestyles, was unveiled by Max Life Insurance Company. This plan provides broad coverage that is tailored to changing customer needs.

- In June 2023, after receiving an IRDAI license in just two weeks, Go Digit Life Insurance Limited, a life insurance company supported by modern technology, started operations. In order to “Make insurance simple,” the “Digit Life Group Term Insurance” plan will prioritize providing high customizability to its clients, or groups.

- In May 2023, The American mutual life insurer New York Life debuted a broad selection of affordably cost term life insurance products. These services increase the return on clients’ investments in protection while preparing them for opportunities and financial uncertainty.

Term Insurance Market Companies

- MetLife (United States)

- AIA Group Limited (Hong Kong)

- Prudential Financial Inc. (United States)

- Manulife Financial Corporation (Canada)

- China Life Insurance Company Limited (China)

- Allianz SE (Germany)

- New York Life Insurance Company (United States)

- Japan Post Holdings Co., Ltd. (Japan)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- Northwestern Mutual Life Insurance Company (United States)

- State Farm Mutual Automobile Insurance Company (United States)

- AXA S.A. (France)

- Dai-ichi Life Holdings, Inc. (Japan)

- Zurich Insurance Group Ltd. (Switzerland)

- LIC (Life Insurance Corporation of India) (India)

Segments Covered in the Report

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/