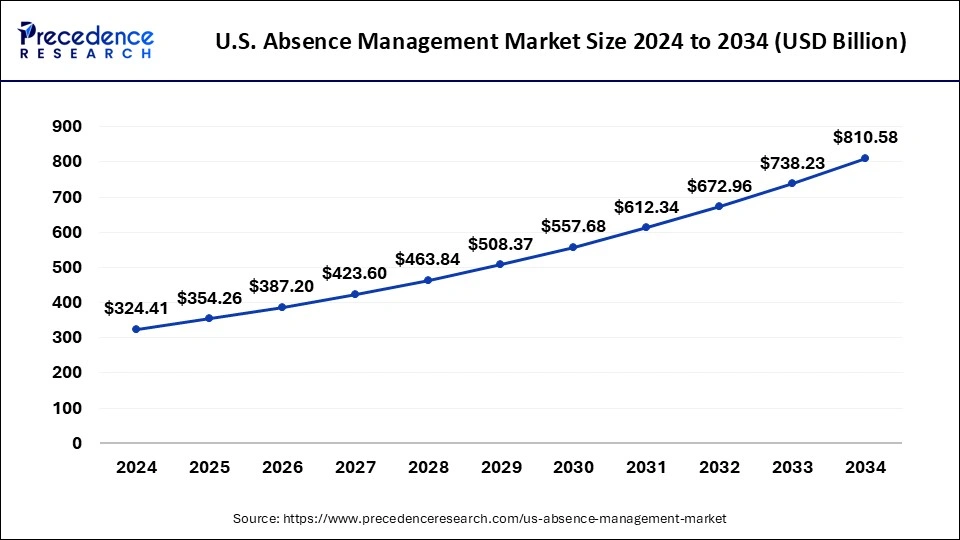

The U.S. absence management market size surpassed USD 297.35 million in 2023 and is predicted to be worth around USD 729.60 million by 2033, notable at a CAGR of 9% from 2024 to 2033.

U.S. Absence Management Market Key Points

- By Deployment Mode, the cloud-based segment dominated the market and generated more than 53.25% of revenue share in 2023.

- By Application, the large enterprises segment contributed the highest revenue share of 60.75% in 2023.

- By End User, the BFSI segment registered more than 25.10% revenue share in 2023.

The U.S. absence management market encompasses a range of solutions and services aimed at helping organizations effectively manage employee absenteeism. It includes software platforms, consulting services, and integration solutions that enable employers to track, monitor, and analyze employee absences. These solutions are critical for maintaining productivity, managing compliance with labor laws, and ensuring smooth operations across various industries.

Get a Sample: https://www.precedenceresearch.com/sample/3054

U.S. Absence Management Market Trends

- Integration of Technology: There is a growing trend towards integrating advanced technology solutions such as AI and data analytics into absence management systems. These technologies help in predicting absence patterns, optimizing scheduling, and improving overall workforce management efficiency.

- Remote Work Impact: The shift towards remote work arrangements has influenced absence management practices. Companies are adapting policies to accommodate remote work while ensuring productivity and addressing absenteeism challenges unique to remote settings.

- Focus on Employee Well-being: Employers are increasingly focusing on employee well-being and work-life balance, which includes addressing factors contributing to absenteeism such as stress, mental health issues, and burnout. Absence management strategies now often include wellness programs and mental health support.

- Flexible Absence Policies: There is a trend towards offering more flexible absence policies that cater to diverse employee needs. This includes options for paid time off (PTO), sick leave, family care leave, and other types of leave that support work-life balance and employee satisfaction.

- Regulatory Compliance: Compliance with federal and state regulations regarding employee leave rights continues to be a significant trend. Employers are required to stay updated with evolving laws such as the Family and Medical Leave Act (FMLA) and other local ordinances that impact absence management practices.

U.S. Absence Management Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 297.35 Million |

| Market Size by 2033 | USD 729.60 Million |

| Growth Rate from 2024 to 2033 | CAGR of 9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Deployment Mode, By Application, and By End User |

Deployment Mode Insights

In the U.S. Absence Management Market, deployment modes play a critical role in meeting organizational needs and IT infrastructure requirements. Cloud-based solutions are increasingly favored for their scalability and accessibility, allowing organizations to manage employee absences efficiently from anywhere. These solutions offer real-time updates, remote access capabilities, and integration with existing HR systems, making them ideal for small to medium-sized enterprises (SMEs) seeking cost-effective, easy-to-implement solutions. On the other hand, large enterprises and industries with stringent data security and compliance needs, such as healthcare and finance, often opt for on-premises solutions. These provide greater control over data privacy and customization options, ensuring regulatory adherence while maintaining sensitive information on-site. Hybrid deployment models combine the benefits of both cloud and on-premises solutions, offering flexibility to cater to diverse IT environments and regulatory obligations.

U.S. Absence Management Market, By Deployment Mode, 2022-2032 (USD Million)

| By Deployment Mode | 2022 | 2023 | 2027 | 2032 |

| On-Premise | 128.22 | 139.01 | 193.8 | 299.47 |

| Cloud-Based | 144.58 | 158.34 | 229.8 | 373.49 |

Application Insights

Absence management solutions in the U.S. are primarily categorized into several key applications that streamline workforce management and enhance operational efficiency. Leave and attendance management form the core of these solutions, automating processes related to leave requests, approvals, and compliance with company policies and labor laws. Advanced analytics and reporting capabilities enable organizations to derive actionable insights from absence data, identifying trends, predicting workforce availability, and optimizing resource allocation. Compliance management is another critical application, ensuring adherence to local, state, and federal regulations governing employee leaves such as FMLA and paid sick leave laws. Automated compliance checks and reporting functionalities help mitigate legal risks and ensure organizations meet mandated leave entitlements accurately and efficiently.

U.S. Absence Management Market, By Application, 2022-2032 (USD Million)

| By Application | 2022 | 2023 | 2027 | 2032 |

| Large Enterprises | 166.41 | 180.64 | 253.1 | 393.68 |

| SMEs | 106.39 | 116.71 | 170.5 | 279.28 |

End User Insights

The U.S. Absence Management Market serves a diverse range of end users across various sectors, each with distinct operational needs and workforce dynamics. Large enterprises across industries deploy absence management solutions to optimize productivity, minimize operational disruptions due to absences, and maintain compliance with regulatory frameworks. Small and medium-sized enterprises (SMEs) benefit from cost-effective cloud-based solutions that streamline leave tracking, reduce administrative burdens, and improve overall HR efficiency without requiring extensive IT investments. Government and public sector organizations, including educational institutions and municipal agencies, rely on absence management solutions to manage employee leaves, ensure staffing continuity, and uphold service delivery standards. Industries such as healthcare and hospitality, characterized by 24/7 operations and high workforce mobility, leverage these solutions to optimize shift scheduling, maintain staffing levels, and deliver seamless patient care or guest services.

U.S. Absence Management Market, By End Users, 2022-2032 (USD Million)

| By End Users | 2022 | 2023 | 2027 | 2032 |

| BFSI | 68.2 | 74.64 | 108.02 | 174.97 |

| Manufacturing | 45.83 | 49.66 | 69.05 | 106.33 |

| Healthcare | 48.97 | 53.82 | 79.21 | 130.89 |

| Retail | 34.51 | 37.85 | 55.28 | 90.51 |

| Government and Public Sector | 34.37 | 37.08 | 50.62 | 76.04 |

| Others | 40.92 | 44.31 | 61.42 | 94.21 |

Read Also: U.S. Payment Integrity Market Size to Surpass USD 10.27 Bn by 2033

Drivers of the U.S. Absence Management Market

Several key factors are driving the growth of the U.S. absence management market. Firstly, the increasing adoption of digital HR solutions by organizations seeking to streamline administrative processes and enhance workforce management efficiency is a significant driver. Secondly, the rise in workforce diversity and remote working arrangements necessitates robust absence management tools to track and manage absenteeism effectively. Additionally, stringent regulatory requirements related to employee leave and benefits also fuel the demand for comprehensive absence management solutions.

Opportunities in the U.S. Absence Management Market

The U.S. absence management market presents several opportunities for growth and innovation. As organizations continue to prioritize employee well-being and work-life balance, there is a growing demand for customizable absence management solutions that cater to diverse workforce needs. Moreover, advancements in artificial intelligence and analytics offer opportunities to develop predictive models for absenteeism, enabling proactive management strategies. Furthermore, the integration of absence management systems with other HR technologies such as payroll and performance management systems presents opportunities for service expansion and market penetration.

Challenges Facing the U.S. Absence Management Market

Despite its growth prospects, the U.S. absence management market faces several challenges. One significant challenge is the complexity of integrating absence management solutions with existing HR and payroll systems, which can hinder seamless implementation and data synchronization. Moreover, privacy concerns related to employee data and compliance with stringent data protection regulations pose challenges for solution providers. Additionally, the diverse nature of workforce preferences and regulatory requirements across states necessitates adaptable and scalable solutions, which can be resource-intensive for vendors to develop and maintain.

Recent Developments:

- In May 2023, UKG agreed with Google Cloud to integrate GenAI (generative A.I.) capabilities.

- In April 2023, Workday partnered with Jefferson Health.

- In January 2023, ADP announced the acquisition of Securax Tech Solutions. The acquisition strengthens ADP’s ability to offer combined payroll and time solutions in the region.

- In September 2022, Trinet acquired Clarus R+D Solutions LLC.

- In November 2021, AbsenceSoft acquired Presagia.

- In December 2020, SAP launched e SAP SuccessFactors Time Tracking solution. A cloud-based solution that offers organizations simple, innovative tools to record, approve and monitor the time of their workforce.

U.S. Absence Management Market Companies

- Kronos

- Workday

- Oracle

- SAP

- Zenefits

- Namely

- Workforce Software

- Ultimate Software

- AbsenceSoft

- ADP