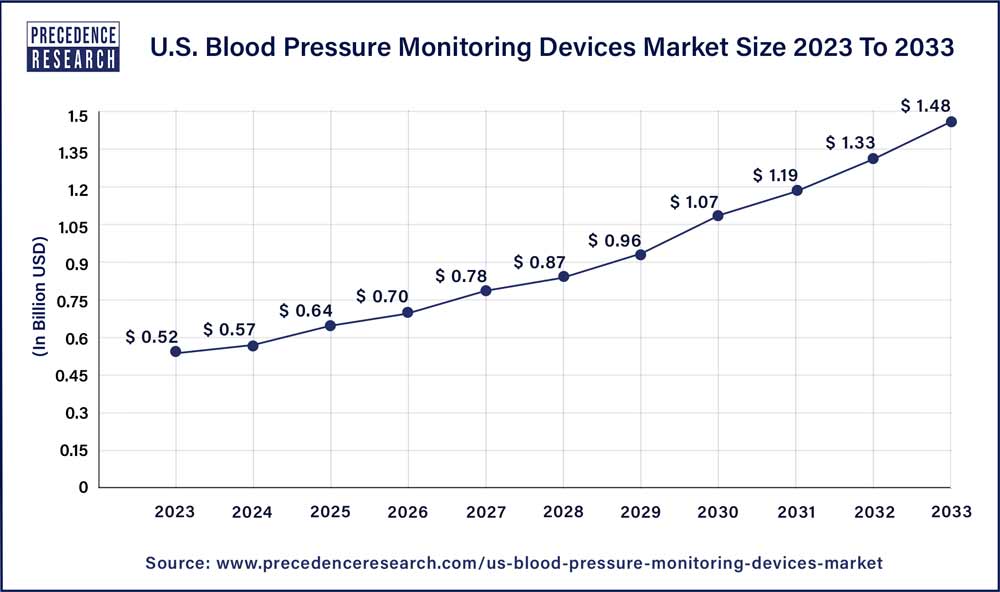

The U.S. blood pressure monitoring devices market size is anticipated to reach around USD 1.48 billion by 2033 from USD 0.52 billion in 2023 expanding at a CAGR of 11.10% from 2024 to 2033.

Key Takeaways

- By product, the sphygmomanometer segment held the largest share of the market in 2023.

- By product, the ambulatory blood pressure monitor segment is expected to witness the fastest rate of expansion during the forecast period of 2024-2033.

- By end user, the hospitals segment held the largest share of the market in 2023 and the segment is observed to grow at the fastest rate during the forecast period.

- By end user, the home healthcare segment is observed to grow at the fastest CAGR during the forecast period.

Introduction:

The U.S. Blood Pressure Monitoring Devices Market has witnessed significant growth in recent years owing to the rising prevalence of hypertension and cardiovascular diseases across the country. Blood pressure monitoring devices play a crucial role in the early detection, management, and monitoring of hypertension, thereby reducing the risk of associated complications such as heart attacks and strokes. With advancements in technology and the introduction of innovative monitoring devices, the market is poised for further expansion in the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/3735

Growth Factors:

Several factors contribute to the growth of the U.S. Blood Pressure Monitoring Devices Market. Firstly, the increasing awareness among individuals regarding the importance of regular blood pressure monitoring drives the demand for home-based monitoring devices. Additionally, the growing geriatric population prone to hypertension, coupled with the rising adoption of sedentary lifestyles and unhealthy dietary habits, fuels the market growth. Moreover, technological advancements such as wireless connectivity, smartphone integration, and wearable monitoring devices enhance convenience and accuracy, further boosting market growth.

U.S. Blood Pressure Monitoring Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.10% |

| U.S. Market Size in 2023 | USD 0.52 Billion |

| U.S. Market Size by 2033 | USD 1.48 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End User |

Read More: Hydrogen Storage Tanks and Transportation Market Size, Trend, Report 2033

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Recent Developments

- In November 2023, the US Food and Drug Administration (FDA) authorized the Symplicity SpyralTM renal denervation (RDN) system, also referred to as the SymplicityTM blood pressure procedure, for the treatment of hypertension, according to a statement made by Medtronic plc, a pioneer in healthcare technology worldwide. Medtronic will start commercializing as soon as this permission is granted.

- In August 2023, to address health disparities and lower the risk of heart attacks and strokes in underprivileged Detroit neighbourhoods, OMRON Healthcare, a pioneer in global heart health, and EPIC Health, Detroit’s healthcare system dedicated to community-focused healthcare, launched a new partnership. Program participants will have access to VitalSightTM, OMRON’s first remote patient monitoring service created exclusively for people with uncontrolled Stage 2 hypertension and other high blood pressure patients.

U.S. Blood Pressure Monitoring Devices Market Companies

- Koninklijke Philips N.V.

- General Electric Company

- SunTech Medical, Inc.

- Welch Allyn

- American Diagnostic Corporation

- Briggs Healthcare

- Spacelabs Healthcare

- GF HEALTH PRODUCTS, INC.

- Rossmax International Limited

- Microlife Corporation

Segments Covered in the Report

By Product

- Digital Blood Pressure Monitor

- Wrist

- Arm

- Finger

- Sphygmomanometer

- Ambulatory Blood Pressure Monitor

- Instruments & Accessories

- Blood pressure cuffs

- Reusable

- Disposable

- Others

- Blood pressure cuffs

- Transducers

- Reusable

- Disposable

By End User

- Ambulatory Surgical Centers & Clinics

- Hospitals

- Home Healthcare

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Blood Pressure Monitoring Devices Market

5.1. COVID-19 Landscape: U.S. Blood Pressure Monitoring Devices Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8.U.S. Blood Pressure Monitoring Devices Market, By Product

8.1. U.S. Blood Pressure Monitoring Devices Market Revenue and Volume, by Product, 2024-2033

8.1.1. Digital Blood Pressure Monitor

8.1.1.1. Market Revenue and Volume Forecast (2021-2033)

8.1.2. Sphygmomanometer

8.1.2.1. Market Revenue and Volume Forecast (2021-2033)

8.1.3. Ambulatory Blood Pressure Monitor

8.1.3.1. Market Revenue and Volume Forecast (2021-2033)

8.1.4. Instruments & Accessories

8.1.4.1. Market Revenue and Volume Forecast (2021-2033)

8.1.5. Transducers

8.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 9. U.S. Blood Pressure Monitoring Devices Market, By End User

9.1. U.S. Blood Pressure Monitoring Devices Market Revenue and Volume, by End User, 2024-2033

9.1.1. Ambulatory Surgical Centers & Clinics

9.1.1.1. Market Revenue and Volume Forecast (2021-2033)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Volume Forecast (2021-2033)

9.1.3. Home Healthcare

9.1.3.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 10. U.S. Blood Pressure Monitoring Devices Market and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Volume Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Volume Forecast, by End User (2021-2033)

Chapter 11. Company Profiles

11.1. Koninklijke Philips N.V.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. General Electric Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SunTech Medical, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Welch Allyn

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. American Diagnostic Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Briggs Healthcare

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Spacelabs Healthcare

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. GF HEALTH PRODUCTS, INC.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rossmax International Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Microlife Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/