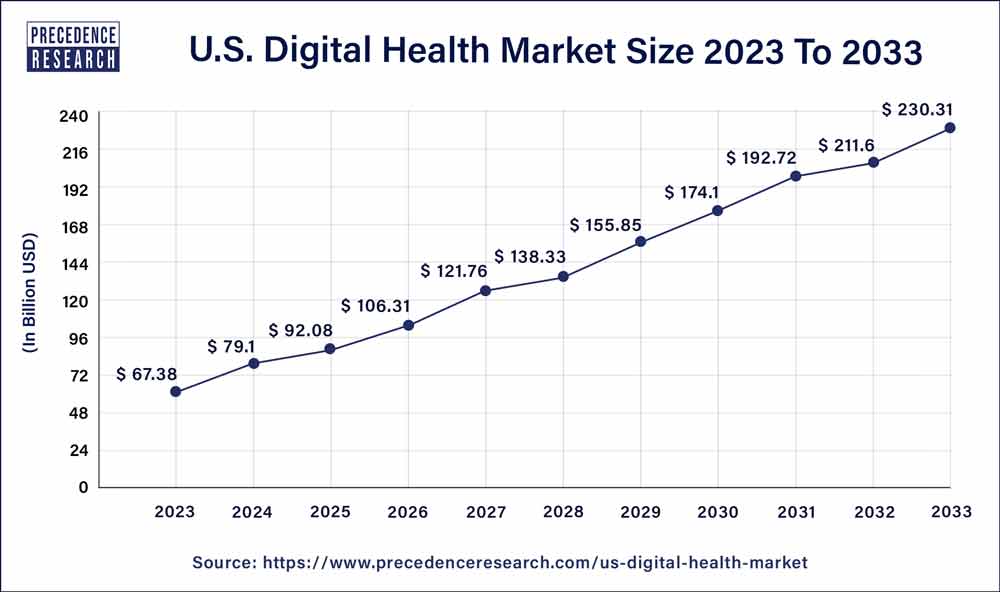

The U.S. digital health market size surpassed USD 67.38 billion in 2023 and is expected to hit around USD 230.31 billion by 2033, notable at a CAGR of 12.61% from 2024 to 2033.

Key Points

- By component, the services segment dominated the market in 2023.

- By component, the hardware segment is growing at a faster rate during the forecast period.

- By technology, the telehealthcare segment dominated the market in 2023.

- By technology, the mHealth segment is expected to witness the fastest rate of expansion during the forecast period.

The U.S. digital health market has witnessed remarkable growth in recent years, driven by the increasing adoption of digital technologies in healthcare delivery and management. This market encompasses a wide range of digital health solutions, including telemedicine, digital therapeutics, wearable devices, health information technology (IT) systems, and remote monitoring tools. These innovations aim to improve patient outcomes, enhance healthcare access and efficiency, and reduce overall healthcare costs. With the ongoing digitization of healthcare services and the growing emphasis on patient-centric care, the U.S. digital health market is poised for sustained expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3771

Growth Factors

List of Contents

ToggleSeveral key factors contribute to the growth of the U.S. digital health market. One significant factor is the rising demand for remote healthcare services, especially in light of the COVID-19 pandemic, which has accelerated the adoption of telemedicine and virtual care solutions. Additionally, favorable government initiatives and policies, such as the promotion of interoperability and the incentivization of electronic health record (EHR) adoption, drive the integration of digital health technologies into the healthcare ecosystem. Moreover, the increasing prevalence of chronic diseases, coupled with the need for proactive and personalized healthcare solutions, fuels the demand for digital health tools that enable continuous monitoring and management of health conditions.

U.S. Digital Health Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.61% |

| U.S. Market Size in 2023 | USD 67.38 Billion |

| U.S. Market Size by 2033 | USD 230.31 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component and By Technology |

U.S. Digital Health Market Dynamics

Drivers

Several drivers propel the growth of the U.S. digital health market. Technological advancements, such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies, empower healthcare providers to deliver more personalized and efficient care. Moreover, the shift towards value-based care models incentivizes healthcare organizations to invest in digital health solutions that improve patient outcomes and reduce healthcare expenditures. Furthermore, the growing consumerization of healthcare, with patients seeking greater control over their health data and treatment decisions, drives the adoption of digital health platforms that empower individuals to actively manage their well-being.

Restraints

Despite its promising growth trajectory, the U.S. digital health market faces certain challenges and restraints. One significant barrier is the complex regulatory landscape, characterized by stringent data privacy and security requirements, which can impede the widespread adoption of digital health solutions. Moreover, interoperability issues and fragmented healthcare IT systems hinder the seamless exchange of health information and integration of digital health technologies across different care settings. Additionally, concerns regarding the accuracy, reliability, and reimbursement of digital health interventions pose challenges to their widespread adoption and acceptance by healthcare providers and payers.

Opportunities

Amidst the challenges, the U.S. digital health market presents significant opportunities for innovation and growth. The increasing focus on population health management and preventive care creates opportunities for digital health companies to develop proactive and preventive health solutions that address the root causes of diseases and promote healthier lifestyles. Furthermore, partnerships and collaborations between healthcare stakeholders, technology firms, and startups can foster the development of integrated digital health ecosystems that deliver comprehensive and coordinated care across the care continuum. Additionally, the expanding market for remote patient monitoring and telehealth services, combined with advancements in wearable technology and home-based care solutions, opens new avenues for improving healthcare access and outcomes, particularly in underserved communities and rural areas.

Read Also: Spatial Computing Market Size to Rake USD 705.15 Bn by 2033

Recent Developments

- In January 2024, LillyDirectTM, a revolutionary digital healthcare experience for Americans with diabetes, migraines, and obesity, was introduced by Eli Lilly & Company. LillyDirect provides resources for managing diseases, such as direct home delivery of some Lilly medications via third-party pharmacy dispensing services, individualized support, and access to independent healthcare providers.

- In July 2023, The Peterson Health Technology Institute (PHTI) was established by the Peterson Center on Healthcare. This nonprofit organization offers unbiased assessments of cutting-edge medical technologies to enhance patient care and reduce expenses.

U.S. Digital Health Market Players

- BioTelemetry Inc

- eClinicalWorks

- Allscripts Healthcare Solutions Inc

- iHealth Lab Inc

- AT & T

- Honeywell International Inc

- Athenahealth Inc.

- Cisco Systems

- McKesson Corporation

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Technology

- Telehealthcare

- Telehealth

- Video Consultation

- LTC Monitoring

- Telecare

- Remote Medication Management

- Activity Monitoring

- Telehealth

- mHealth

- Apps

- Fitness Apps

- Medical Apps

- Wearables

- Glucose Meter

- BP Monitor

- Pulse Oximeter

- Neurological Monitors

- Sleep Apnea Monitor

- Others

- Apps

- Digital Health Systems

- E-prescribing Systems

- Electronic Health Records

- Health Analytics

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/