Key Takeaways

- By component type, the electric vehicle supply equipment (EVSE) segment held the largest share of the market in 2023.

- By application type, the battery electric vehicles (BEVs) segment held the dominating share of the market in 2023 and the segment is observed to sustain the position throughout the forecast period.

Introduction

The U.S. Vehicle-to-Grid (V2G) technology market is witnessing significant growth as the transportation and energy sectors converge. V2G technology enables electric vehicles (EVs) to interact with the power grid, allowing them to both draw electricity from the grid and feed excess energy back into it when needed. This innovative approach not only enhances the flexibility and reliability of the electric grid but also opens up new revenue streams for EV owners and utilities. With increasing emphasis on sustainability and the electrification of transportation, the U.S. V2G technology market is poised for rapid expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3738

Growth Factors:

Several factors are driving the growth of the U.S. V2G technology market. Firstly, the rising adoption of electric vehicles across the country is creating a larger pool of potential participants for V2G programs. Additionally, government incentives and policies aimed at promoting clean energy and reducing greenhouse gas emissions are encouraging both consumers and businesses to invest in EVs and V2G infrastructure. Moreover, advancements in battery technology and smart grid solutions are improving the efficiency and viability of V2G systems, further fueling market growth.

U.S. Vehicle-to-Grid Technology Market Scope

| Report Coverage | Details |

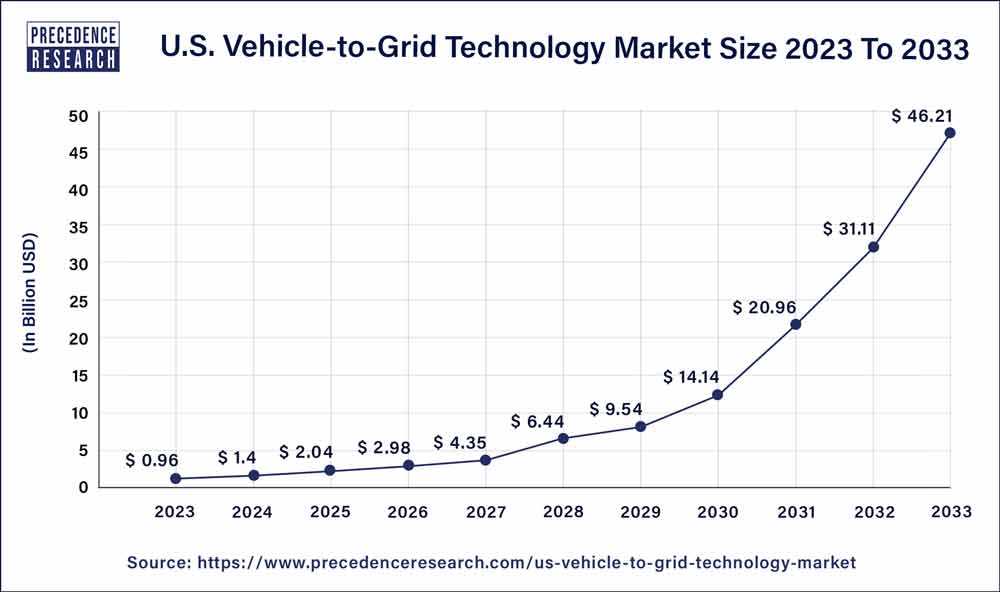

| Growth Rate from 2024 to 2033 | CAGR of 47.42% |

| U.S. Market Size in 2023 | USD 0.96 Billion |

| U.S. Market Size by 2033 | USD 46.21 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component Type and By Application Type |

Read More: Photodynamic Therapy Market Size to Attain USD 8.42 Bn by 2033

Recent Developments

- In November 2023, a vehicle-to-grid (V2G) research agreement for battery electric automobiles (BEVs) using a Toyota bZ4X was struck between Toyota Motor North America (Toyota) and San Diego Gas & Electric Company (SDG&E), a major utility serving 3.7 million people in Southern California. Due to research being done on V2G, owners of BEVs will be able to charge their batteries from the grid and discharge surplus energy back into it through the use of bidirectional power flow technology. The integration of renewable energy sources, increased energy resilience and stability, and the possibility of reduced power costs are some of the ways that V2G technology may satisfy consumer desires.

- In December 2023, Hager Energy and IoTecha, a leading provider of intelligent EV charging platforms, have been collaborating for some time to offer innovative and cutting-edge charging options. With the announcement of bidirectional charging support for new ID models (and existing models via an ID Software update) and the availability of a “Vehicle to Home” solution with Hager Energy’s DC home power station, Volkswagen recently announced a significant accomplishment and a critical turning point in this partnership. Together with the IoTecha Smart Charging controllers, Hager Energy’s distinctive product design and expertise in home energy management are allowing the two companies to lead the EV charging industry into a new era that fully embraces the benefits of e-mobility.

U.S. Vehicle-to-Grid Technology Market Companies

- ABB

- AC Propulsion, Inc.

- Edison International

- EV Grid, Inc.

- Fermata Energy

- Hitachi, Ltd

- Honda Motor Co., Ltd.

- NRG Energy, Inc

- Nuvve Holding Corp.

- Wallbox Inc

Segments Covered in the Report

By Component Type

- Smart Meters

- Electric Vehicle Supply Equipment (EVSE)

- Software

- Home Energy Management (HEM)

By Application Type

- Battery Electric Vehicles (BEVs)

- Fuel Cell Vehicles (FCVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Vehicle-to-Grid Technology Market

5.1. COVID-19 Landscape: U.S. Vehicle-to-Grid Technology Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Vehicle-to-Grid Technology Market, By Component Type

8.1. U.S. Vehicle-to-Grid Technology Market, by Component Type, 2024-2033

8.1.1. Smart Meters

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electric Vehicle Supply Equipment (EVSE)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Home Energy Management (HEM)

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global U.S. Vehicle-to-Grid Technology Market, By Application Type

9.1. U.S. Vehicle-to-Grid Technology Market, by Application Type, 2024-2033

9.1.1. Battery Electric Vehicles (BEVs)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Fuel Cell Vehicles (FCVs)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Plug-in Hybrid Electric Vehicles (PHEVs)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global U.S. Vehicle-to-Grid Technology Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Component Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application Type (2021-2033)

Chapter 11. Company Profiles

11.1. ABB

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. AC Propulsion, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Edison International

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. EV Grid, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Fermata Energy

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Hitachi, Ltd

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Honda Motor Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. NRG Energy, Inc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Nuvve Holding Corp.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wallbox Inc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/