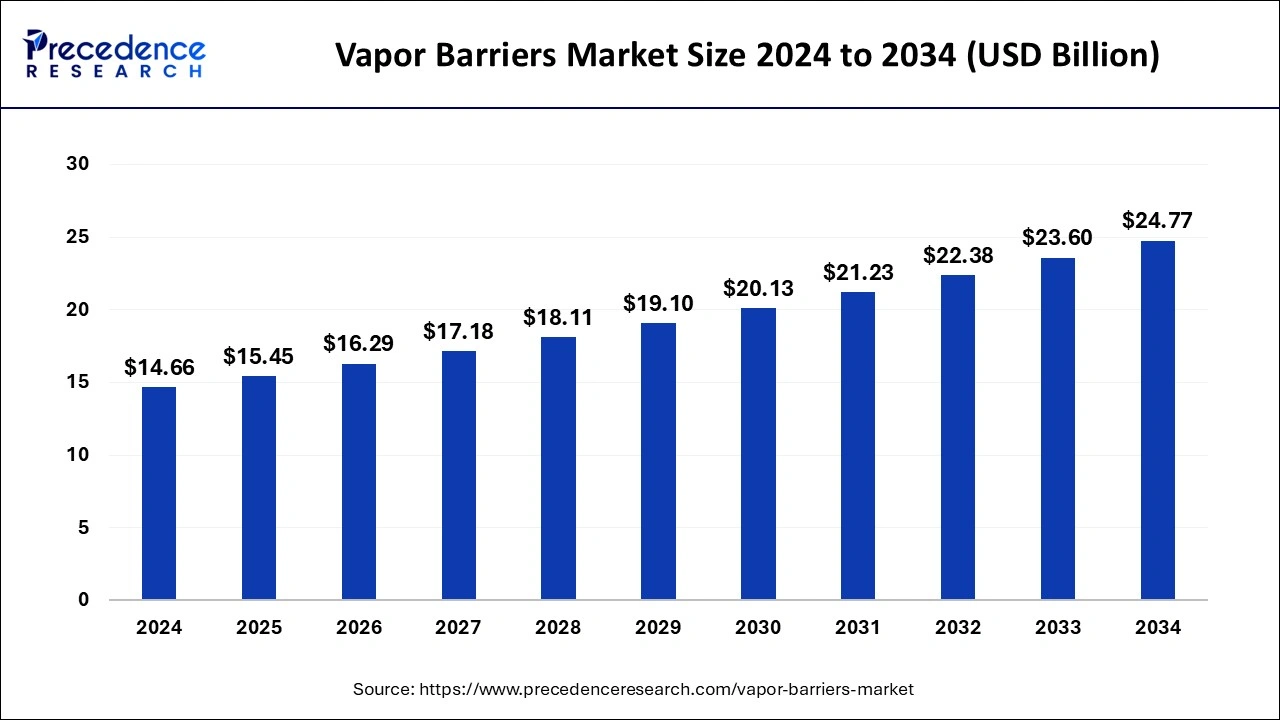

Vapor Barriers Market Size to Hit USD 23.60 Bn by 2033

The global vapor barriers market size surpassed USD 13.90 billion in 2023 and is projected to grow around USD 23.60 billion by 2033, growing at a CAGR of 5.43% from 2024 to 2033.

Key Points

- The North America vapor barriers market size reached USD 5.06 billion in 2023 and is projected to hit around USD 8.59 billion by 2033.

- North America held the dominant share of 36.4% in the vapor barriers market in 2023.

- Asia Pacific is observed to expand at a rapid pace during the forecast period.

- By material, the polymer segment accounted for the dominating share of around 52% in 2023.

- By material, the metal sheet segment is expected to witness a significant share during the forecast period.

- By application, the insulation segment held the largest share of 41% in 2023.

- By installation, the membranes segment held the largest segment of the market in 2023.

- By installation, the cementitious waterproofing segment is expected to grow significantly during the forecast period.

- By end-use industry, the construction segment held the dominating share of the market in 2023.

- By end-use industry, the automotive segment is expected to grow notably.

The vapor barriers market encompasses a range of materials used to prevent the passage of water vapor into or out of a structure. These barriers play a critical role in the construction industry, as they help to maintain the structural integrity of buildings by preventing moisture damage and mold growth. Vapor barriers are commonly used in foundations, walls, and roofs, and they can be made from materials such as polyethylene, foil, and asphalt.

Get a Sample: https://www.precedenceresearch.com/sample/4107

Growth Factors:

The growth of the vapor barriers market is driven by the increasing demand for energy-efficient buildings and the need to adhere to stringent building codes and regulations. The construction industry’s focus on sustainability and energy conservation has led to a higher demand for high-quality vapor barriers. Additionally, the rising awareness of the importance of indoor air quality and moisture control in residential and commercial buildings contributes to market growth.

Region Insights:

The vapor barriers market is geographically segmented, with different regions experiencing varying levels of demand. North America and Europe are key markets due to their well-established construction industries and stringent building codes. In contrast, the Asia-Pacific region is expected to experience significant growth due to rapid urbanization, increased infrastructure development, and a growing focus on energy-efficient building practices.

Vapor Barriers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.43% |

| Global Market Size in 2023 | USD 13.90 Billion |

| Global Market Size in 2024 | USD 14.66 Billion |

| Global Market Size by 2033 | USD 23.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Application, By Installation, and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vapor Barriers Market Dynamics

Drivers:

Several factors drive the vapor barriers market, including the need for moisture control in construction projects, the increasing adoption of energy-efficient building materials, and the rising awareness of health and safety standards in buildings. Moreover, the growing demand for durable and long-lasting building materials also boosts the market.

Opportunities:

Opportunities in the vapor barriers market include the development of innovative materials with enhanced performance characteristics, such as increased durability and resistance to puncture or tear. Additionally, the rise in smart construction technologies and the integration of vapor barriers with other building materials present opportunities for market players to differentiate their products and gain a competitive edge.

Challenges:

Despite the growth potential, the vapor barriers market faces challenges such as the availability of alternative moisture control solutions, which may compete with traditional vapor barriers. Additionally, variations in building codes and regulations across regions can create challenges for market players in terms of standardization and compliance. Rising raw material costs may also pose a challenge for manufacturers, impacting production costs and pricing.

Read Also: Urodynamic Equipment and Consumables Market Size, Report By 2033

Recent Developments

- In August 2022, Americover Inc. launched its newest product, the Pro Crawl Anti-Mold Vapor Barrier embedded with Mold Prevention Technology. This product is the second generation of high-performance vapor barriers, which began with the Original Pro Crawl Barrier, designed to reduce vapor transmission in the crawl space significantly.

- In March 2024, Toppan announced the launch of the Indian production of BOPP-based barrier film. Toppan has developed GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP). GL-SP is a new addition to the range of products for sustainable packaging in the Toppan Group’s GL BARRIER1 series of transparent vapor-deposited barrier films, which enjoy a leading share of the global market, according to Toppan. Toppan and TSF have a focus on markets in the Americas, Europe, India, and the ASEAN region.

Vapor Barriers Market Companies

- Glenroy Inc.

- Celplast Metallized Product Ltd.

- Polifilm Group

- ProAmpac Holdings

- Optimum Plastics, Inc.

- 3M Company

- Amcor Limited

- SAES Getters S.p.A.

- Kalliomuovi Oy

- GLT Products

- UFP Industries, Inc.

- W.R. Meadows, Inc.

- BMI Icopal

- Carlisle Companies Inc.

- Reflectix, Inc.

- Layfield Group Ltd.

- Reef Industries, Inc.

- Visqueen Building Product

- RPM International Inc.

- DuPont de Nemours, Inc.

- BASF SE

Segments Covered in the Report

By Material

- Glass

- Metal Sheet

- Polymers

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

By Application

- Insulation

- Waterproofing

- Corrosion Resistance

- Others

By Installation

- Membranes

- Coatings

- Cementitious Waterproofing

- Stacking and Filling

By End-use Industry

- Construction

- Packaging

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/