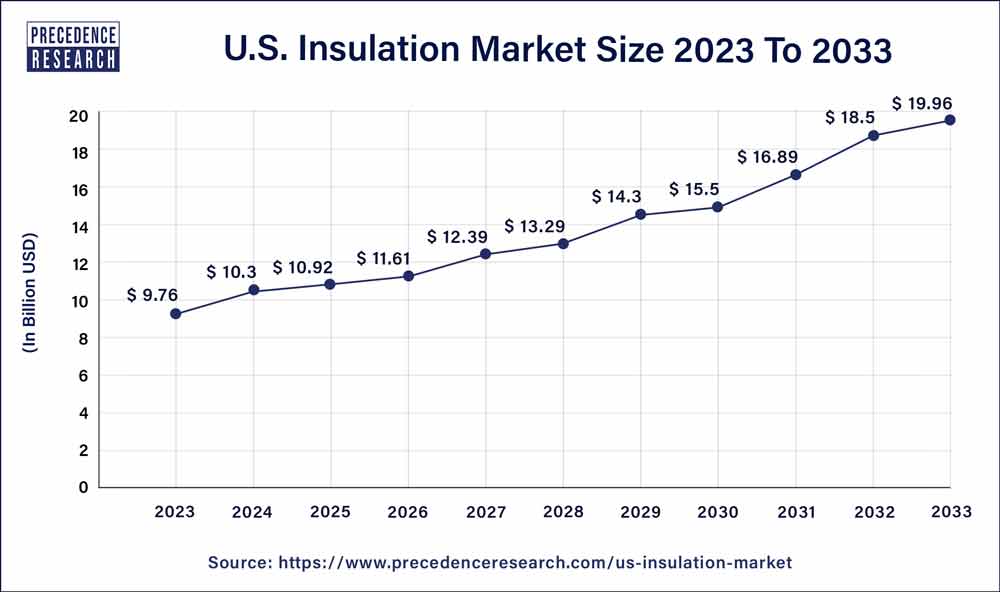

The U.S. insulation market size was valued at USD 9.76 billion in 2023 and is projected to hit around USD 19.96 billion by 2033, growing at a CAGR of 7.63% from 2024 to 2033.

Key Takeaways

- By product, the expanded polystyrene segment held the dominating share of the market in 2023.

- By function, the thermal segment is expected to capture the largest market share during the forecast period.

- By form, the foam segment held the largest share of the market in 2023.

- By end user, the construction segment is expected to continue to dominate the U.S. insulation market during the forecast period.

The U.S. insulation market is a crucial segment within the construction industry, driven by the growing emphasis on energy efficiency, sustainability, and regulatory mandates. Insulation materials play a pivotal role in reducing energy consumption, enhancing building performance, and mitigating environmental impact. With increasing awareness about climate change and the need to reduce carbon emissions, the demand for efficient insulation solutions has seen a significant uptick in recent years. The market encompasses a wide range of insulation products, including fiberglass, foam board, mineral wool, cellulose, and others, catering to diverse applications across residential, commercial, and industrial sectors.

Growth Factors:

Several factors contribute to the growth of the U.S. insulation market. One of the primary drivers is the rising adoption of green building practices and stringent energy efficiency regulations. Government initiatives such as tax incentives and rebates for energy-efficient upgrades incentivize building owners and developers to invest in high-performance insulation materials. Additionally, advancements in insulation technology, such as the development of eco-friendly and sustainable materials, have expanded the market’s potential. Moreover, the surge in construction activities, driven by urbanization, infrastructure development, and renovation projects, further fuels the demand for insulation products across the country.

U.S. Insulation Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.63% |

| U.S. Market Size in 2023 | USD 9.76 Billion |

| U.S. Market Size by 2033 | USD 19.96 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Function, By Function, and By End User |

U.S. Insulation Market Dynamics

Drivers:

The drivers propelling the growth of the U.S. insulation market are multifaceted. Energy savings is a significant driver, as effective insulation reduces heating and cooling costs for buildings, making them more economically viable in the long run. Furthermore, the increasing focus on indoor comfort and air quality drives demand for insulation materials with soundproofing and moisture control properties. The growing trend of retrofitting existing buildings with energy-efficient upgrades also acts as a driver, as property owners seek to improve the performance of older structures while reducing their environmental footprint.

Restraints:

Despite the promising growth prospects, the U.S. insulation market faces certain restraints that could hinder its expansion. One of the key challenges is the volatility in raw material prices, particularly for petroleum-based insulation products like foam board and spray foam. Fluctuations in oil prices can impact manufacturing costs and ultimately, the pricing of insulation materials, posing challenges for manufacturers and consumers alike. Moreover, regulatory uncertainties and changing building codes may create compliance challenges for industry players, necessitating continuous adaptation and investment in research and development.

Opportunities:

The U.S. insulation market presents several opportunities for innovation and expansion. The growing demand for sustainable and eco-friendly building materials opens avenues for manufacturers to develop bio-based insulation products derived from renewable sources such as recycled materials, agricultural waste, and natural fibers. Additionally, the advent of smart insulation technologies, integrating sensors and data analytics to optimize energy efficiency and indoor comfort, offers exciting prospects for market players. Furthermore, partnerships and collaborations between insulation manufacturers, building contractors, and energy service companies can facilitate the adoption of integrated insulation solutions and drive market growth.

Read Also: Organic Peroxide Market Size to Worth USD 1.93 Billion by 2033

Recent Developments

- In July 2023, Specialist Supplies & Insulation (“SPI”) will be acquired by TopBuild Corp., a prominent installer and specialist distributor of insulation and building material supplies to the construction industry in the United States and Canada.

- In November 2023, a major housing development in Ballyclare, Northern Ireland, requested KORE Insulation’s low-carbon EPS insulation since it was introduced. Northern Ireland’s leading home builder, Braidwater Group, is developing Cloughan View, a 127-unit development. High energy efficiency is a hallmark of modern homes, and KORE Low Carbon EPS floor insulation is a major contributor to this.

- In November 2023, Soprema was chosen by UPM Raflatac, a leading global provider of eco-friendly and inventive self-adhesive paper and film solutions, as its primary partner for recycling label waste in the EMEIA area. Soprema, one of the top waterproofing and roofing specialists in the world, will recycle label trash collected through UPM Raflatac’s RafCycleTM recycling program into new building and insulation materials.

U.S. Insulation Market Companies

- Saint Gobain

- GAF

- Kingspan Group

- Knauf Insulation

- Johns Manville

- 3M

- Owens Corning

- Cellofoam North America, Inc.

- BASF

- Huntsman International LLC

Segments Covered in the Report

By Product

- Expanded polystyrene

- Glass wool

- Mineral wool

- Cellulose

- Calcium silicate

- Others

By Function

- Thermal

- Acoustic

- Electric

- Others

By Form

- Blanket

- Foam

- Board

- Pipe

- Others

By End User

- Industrial use

- Construction

- Residential

- Non-residential & Commercial

- Original equipment manufacturer

- Transportation

- Automotive

- Marine

- Aerospace

- Appliances

- Packaging

- Furniture

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/