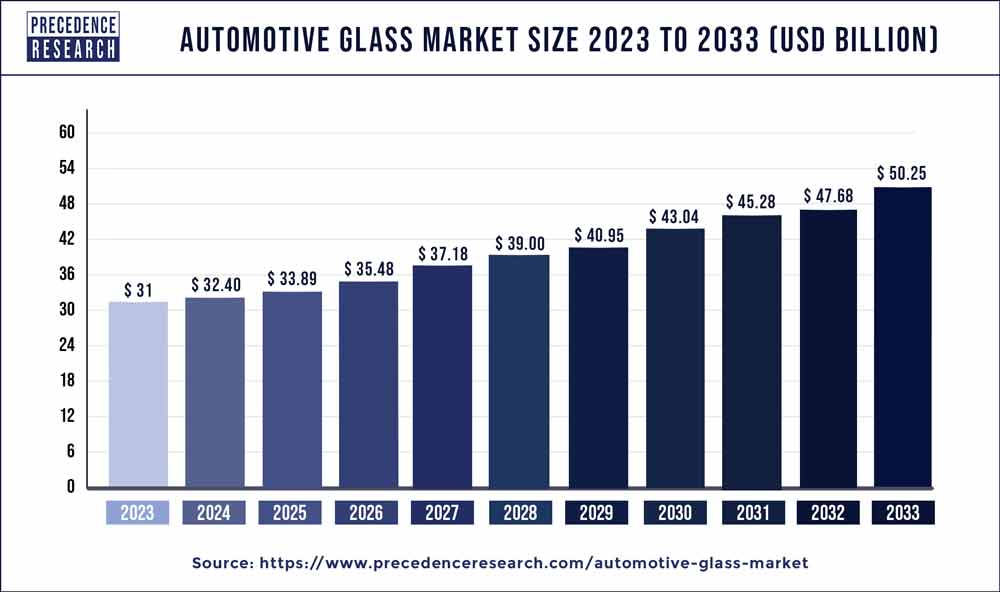

The global automotive glass market size was valued at USD 31 billion in 2023 and is projected to hit around USD 50.25 billion by 2033, rising at a CAGR of 5% from 2024 to 2033.

Key Takeaways

- Asia-Pacific contributed 55% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By product, the tempered glass segment held the largest market share of 60% in 2023.

- By product, the laminated glass segment is anticipated to grow at a remarkable CAGR of 7.3% between 2024 and 2033.

- By vehicle type, the passenger cars segment generated over 59% of the market share in 2023.

- By vehicle type, the light commercial vehicles segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the original equipment manufacturer (OEM) segment generated over 92% of the market share in 2023.

- By end-use, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

Introduction

The automotive glass market plays a crucial role in the automotive industry, serving both functional and aesthetic purposes. Automotive glass includes windshields, side windows, rear windows, and sunroofs, which are essential components for vehicle safety, visibility, and design. The market encompasses a wide range of vehicles, from passenger cars to commercial vehicles, and is influenced by various factors such as technological advancements, consumer preferences, and regulatory standards.

Get a Sample: https://www.precedenceresearch.com/sample/3732

Growth Factors

Several factors are driving the growth of the automotive glass market. Firstly, the increasing production and sales of automobiles worldwide, fueled by rising urbanization, improving living standards, and growing disposable incomes, are driving the demand for automotive glass. Additionally, the growing emphasis on vehicle safety and regulations mandating the use of advanced safety features, including laminated glass for windshields, is boosting market growth. Moreover, the rising popularity of electric vehicles (EVs) and autonomous vehicles (AVs) is creating new opportunities for automotive glass manufacturers, as these vehicles often require specialized glass solutions for enhanced performance and functionality.

Automotive Glass Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5% |

| Global Market Size in 2023 | USD 31 Billion |

| Global Market Size by 2033 | USD 50.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Vehicle Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: U.S. Healthcare ERP Market Size, Growth, Trend, Report 2033

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Automotive Glass Market Companies

- Asahi Glass Co., Ltd.

- Saint-Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Guardian Industries

- AGC Inc.

- Vitro S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- Central Glass Co., Ltd.

- Shenzhen Benson Automobile Glass Co., Ltd.

- Pittsburgh Glass Works (PGW)

- Webasto SE

- Corning Incorporated

- SYP Kangqiao Autoglass Co., Ltd.

- Pilkington Group Limited

Segments Covered in the Report

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-use

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Glass Market

5.1. COVID-19 Landscape: Automotive Glass Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Glass Market, By Product

8.1. Automotive Glass Market Revenue and Volume, by Product, 2024-2033

8.1.1 Tempered Glass

8.1.1.1. Market Revenue and Volume Forecast (2021-2033)

8.1.2. Laminated Glass

8.1.2.1. Market Revenue and Volume Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 9. Global Automotive Glass Market, By Vehicle Type

9.1. Automotive Glass Market Revenue and Volume, by Vehicle Type, 2024-2033

9.1.1. Passenger Cars

9.1.1.1. Market Revenue and Volume Forecast (2021-2033)

9.1.2. Light Commercial Vehicles

9.1.2.1. Market Revenue and Volume Forecast (2021-2033)

9.1.3. Heavy Commercial Vehicles

9.1.3.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 10. Global Automotive Glass Market, By End-use

10.1. Automotive Glass Market Revenue and Volume, by End-use, 2024-2033

10.1.1. Original Equipment Manufacturer (OEM)

10.1.1.1. Market Revenue and Volume Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 11. Global Automotive Glass Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.1.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.1.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.1.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.2.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.2.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.2.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.2.6.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.2.7.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.3.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.3.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.3.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.3.6.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.3.7.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.4.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.4.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.4.6.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.4.7.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.5.4.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Volume Forecast, by Vehicle Type (2021-2033)

11.5.5.3. Market Revenue and Volume Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Asahi Glass Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Saint-Gobain S.A.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Fuyao Glass Industry Group Co., Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nippon Sheet Glass Co., Ltd. (NSG Group)

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Guardian Industries

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AGC Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Vitro S.A.B. de C.V.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Xinyi Glass Holdings Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Central Glass Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Shenzhen Benson Automobile Glass Co., Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/