List of Contents

ToggleKey Takeaways

- By function, the finance & billing segment held the largest share of 34% in 2023.

- By function, the inventory management segment is expected to grow at the fastest rate during the forecast period of 2024-2033.

- By deployment, the on-premise segment held the largest share of 75% in 2023.

- The cloud segment is observed to witness the fastest expansion at a CAGR of 9.4% during the forecast period.

- By end user, the hospitals segment held the largest share of the U.S. healthcare ERP market and the segment is observed to sustain the dominance throughout the forecast period.

Introduction:

The U.S. healthcare sector is undergoing a transformation driven by technological advancements and regulatory changes, with Enterprise Resource Planning (ERP) systems playing a pivotal role in streamlining operations and improving efficiency. Healthcare ERP solutions integrate various functions such as finance, human resources, supply chain management, and patient care into a single platform, enabling healthcare organizations to optimize processes and enhance patient outcomes.

Get a Sample: https://www.precedenceresearch.com/sample/3731

Growth Factors:

Several factors are fueling the growth of the U.S. healthcare ERP market. Increasing digitization and the adoption of electronic health records (EHRs) are driving demand for integrated ERP solutions that can seamlessly integrate with existing systems. Moreover, the need for better cost management and resource allocation in healthcare organizations is prompting the adoption of ERP systems to improve financial visibility and operational efficiency. Additionally, regulatory requirements such as the implementation of ICD-10 codes and Meaningful Use criteria are driving healthcare providers to invest in ERP solutions to ensure compliance and enhance data security.

U.S. Healthcare ERP Market Scope

| Report Coverage | Details |

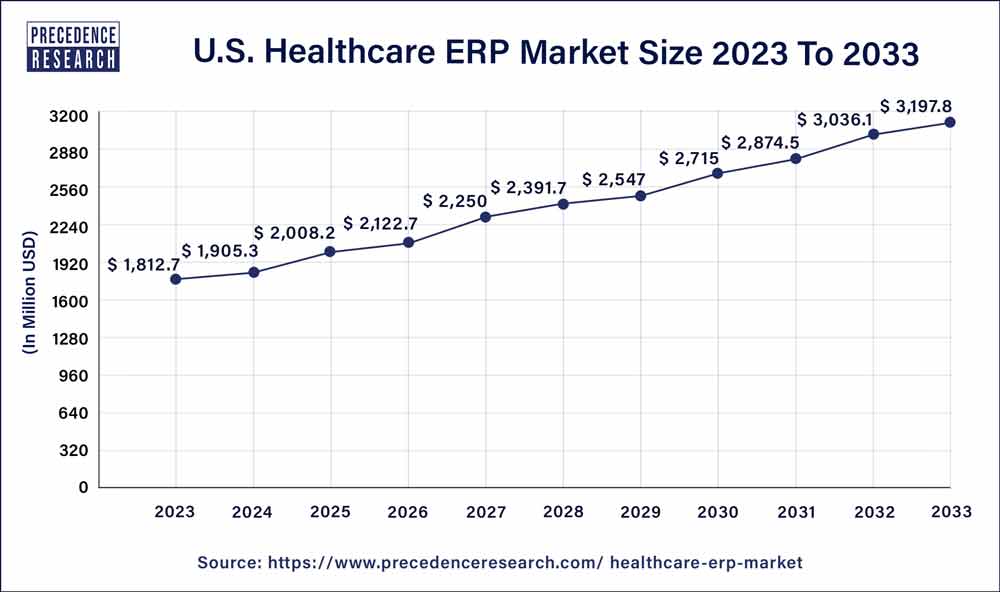

| Growth Rate from 2024 to 2033 | CAGR of 5.92% |

| U.S. Market Size in 2023 | USD 1,812.7 Million |

| U.S. Market Size by 2033 | USD 3,197.8 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Function, By Deployment, and By End User |

U.S. Healthcare ERP Market Dynamics

Drivers

The adoption of ERP systems in the U.S. healthcare sector is driven by the growing need for interoperability and data integration across various departments and systems. ERP solutions enable healthcare organizations to streamline processes, improve collaboration among different departments, and provide a unified view of patient data. Furthermore, the shift towards value-based care models and population health management initiatives necessitates robust data analytics capabilities, which ERP systems can provide. Additionally, the COVID-19 pandemic has accelerated the adoption of telemedicine and remote healthcare delivery models, further driving the demand for integrated ERP solutions to support virtual care delivery.

Restraint:

Despite the benefits offered by ERP systems, several challenges hinder their adoption and implementation in the U.S. healthcare sector. One significant restraint is the complexity of ERP implementations, which often require extensive customization and integration with existing systems. Healthcare organizations may face resistance from staff members accustomed to legacy systems, leading to adoption challenges and potential disruptions in workflow. Moreover, concerns about data privacy and security pose barriers to the adoption of cloud-based ERP solutions, particularly in light of stringent regulatory requirements such as HIPAA.

Opportunity

The U.S. healthcare ERP market presents significant opportunities for vendors and service providers to innovate and address the evolving needs of healthcare organizations. As healthcare providers continue to focus on improving patient outcomes and reducing costs, there is growing demand for ERP solutions that offer advanced analytics, interoperability, and scalability. Vendors can capitalize on this opportunity by developing tailored ERP solutions for specific healthcare segments, such as hospitals, ambulatory care centers, and long-term care facilities. Moreover, partnerships and collaborations with EHR vendors, telehealth providers, and data analytics firms can enable ERP vendors to offer comprehensive solutions that meet the diverse needs of healthcare organizations.

Region Snapshot

The U.S. healthcare ERP market is characterized by regional variations in adoption and implementation, influenced by factors such as healthcare infrastructure, regulatory environment, and market maturity. States with large urban centers and academic medical centers tend to exhibit higher adoption rates of ERP systems, driven by the need for advanced clinical and administrative functionalities. Moreover, regions with a high concentration of healthcare providers, such as the Northeast and West Coast, present lucrative opportunities for ERP vendors to expand their market presence. However, challenges such as interoperability issues and resource constraints persist across all regions, underscoring the need for continued innovation and collaboration within the U.S. healthcare ecosystem.

Read Also: Gear Pumps Market Size to Rake USD 12.8 Billion by 2033

Recent Developments

- In April 2023, an industry cloud provider, Infor, announced that it had been chosen as an Amazon HealthLake Partner by Amazon Web Services (AWS). This demonstrates Infor’s resolve to fortify its partnership with AWS and its commitment to offering sector-specific solutions driven by dependable, scalable, and secure cloud services.

- In April 2023, Workday, Inc., a leading provider of bU.S.iness cloud solutions for finance and HR, reported sU.S.tained growth in the healthcare sector after adding many new healthcare firms to its expanding worldwide client base.

- In September 2023, Microsoft and Mercy, a healthcare institution, partnered for an extended period. Through this partnership, Microsoft will U.S.e artificial intelligence (AI) and other digital technologies to enhance patient care and free up more time for doctors, nurses, and advanced practice clinicians. Mercy intends to U.S.e Microsoft Azure OpenAI Service to improve treatment.

U.S. Healthcare ERP Market Companies

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- McKesson Corporation

- Infor, Inc. (Koch IndU.S.tries)

- Epicor Software Corporation

- Veradigm LLC

- Azalea Health

- Premier, Inc

- Rootstock Software

Segments Covered in the Report

By Function

- Supply Chain & Logistics

- Finance & Billing

- Inventory Management

- Patient Relationship Management

- Others

By Deployment

- On-Premise

- Cloud

By End User

- Hospitals

- Clinics

- Nursing Homes

- Others

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Healthcare ERP Market

5.1. COVID-19 Landscape: U.S. Healthcare ERP Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Healthcare ERP Market, By Function

8.1. U.S. Healthcare ERP Market, by Function, 2024-2033

8.1.1 Supply Chain & Logistics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Finance & Billing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Inventory Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Patient Relationship Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Healthcare ERP Market, By Deployment

9.1. U.S. Healthcare ERP Market, by Deployment, 2024-2033

9.1.1. On-Premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Healthcare ERP Market, By End User

10.1. U.S. Healthcare ERP Market, by End User, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Nursing Homes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Healthcare ERP Market and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Function (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by End User (2021-2033)

Chapter 12. Company Profiles

12.1. Microsoft Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Oracle Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. SAP SE

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. McKesson Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Infor, Inc. (Koch IndU.S.tries)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Epicor Software Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Veradigm LLC

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Azalea Health

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Premier, Inc

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Rootstock Software

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/