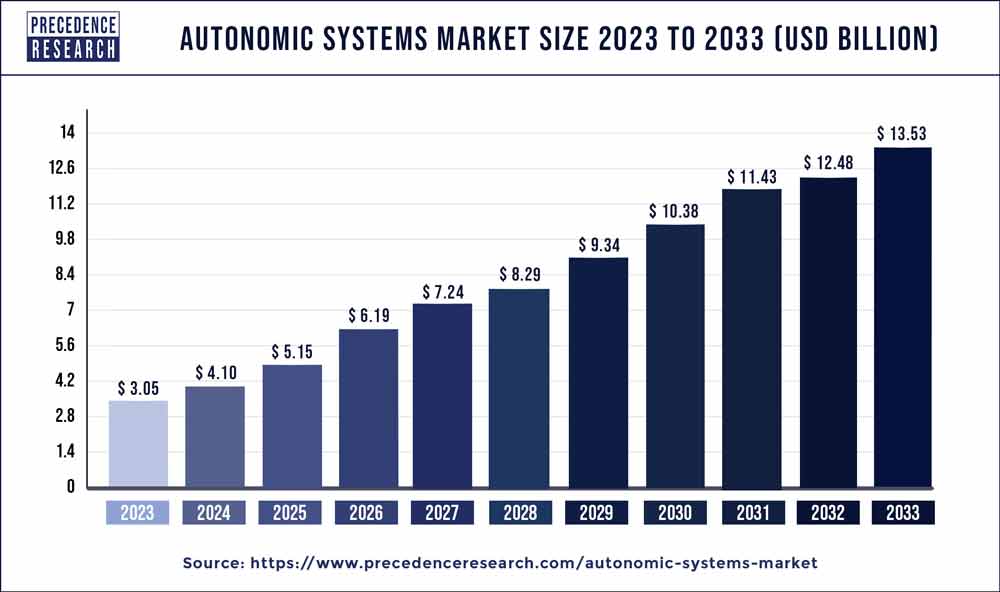

The global autonomic systems market size reached USD 3.05 billion in 2023 and is expected to hit around USD 13.53 billion by 2033, notable at a CAGR of 14.19% from 2024 to 2033.

Key Takeaways

- North America held the largest share of the market while carrying a 38% share in 2023.

- Asia Pacific is observed to witness the fastest expansion at a CAGR of 18.6% during the forecast period.

- By type, the Enterprise Software Application segment held the largest market share of 42% in the autonomic systems market in 2023.

- By application, the Information Technology (IT) segment held 29% of the market share in 2023.

Overview of the Autonomic Systems Market:

The autonomic systems market is witnessing substantial growth driven by the increasing adoption of automation technologies across various industries. Autonomic systems, also known as self-regulating systems, are designed to operate and manage themselves with minimal human intervention. These systems leverage artificial intelligence (AI), machine learning (ML), and advanced analytics to automate processes, optimize performance, and enhance efficiency. The market encompasses a wide range of applications, including autonomous vehicles, industrial automation, smart infrastructure, healthcare, and more. As organizations strive to streamline operations, reduce costs, and improve productivity, the demand for autonomic systems is expected to surge in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3754

Growth Factors:

Several factors contribute to the growth of the autonomic systems market. Firstly, advancements in AI and ML technologies have significantly enhanced the capabilities of autonomic systems, enabling them to learn and adapt to changing environments autonomously. This ability to self-optimize and self-heal drives efficiency and reliability, making autonomic systems increasingly attractive to businesses across various sectors. Additionally, the proliferation of IoT (Internet of Things) devices and sensors generates vast amounts of data, which can be leveraged by autonomic systems to make informed decisions in real-time. Moreover, the increasing focus on digital transformation and Industry 4.0 initiatives is fueling the demand for automation solutions, further propelling the growth of the autonomic systems market.

Autonomic Systems Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.19% |

| Global Market Size in 2023 | USD 3.05 Billion |

| Global Market Size by 2033 | USD 13.53 Billion |

| U.S. Market Size in 2023 | USD 0.81 Billion |

| U.S. Market Size by 2033 | USD 3.60 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomic Systems Market Dynamics

Drivers:

Several key drivers are driving the adoption of autonomic systems across industries. One significant driver is the need for operational efficiency and cost reduction. Autonomic systems enable organizations to automate repetitive tasks, minimize human errors, and optimize resource utilization, leading to significant cost savings. Another driver is the growing complexity of systems and processes, particularly in sectors such as manufacturing, healthcare, and transportation. Autonomic systems offer a solution to manage and control these complex environments effectively. Furthermore, the increasing focus on safety and risk management drives the adoption of autonomic systems in critical applications such as autonomous vehicles and smart infrastructure, where human error can have significant consequences.

Restraints:

Despite the promising growth prospects, the autonomic systems market faces certain restraints that may hinder its widespread adoption. One major restraint is the concern surrounding data security and privacy. As autonomic systems rely heavily on data collected from sensors and connected devices, there is a risk of unauthorized access, data breaches, and privacy violations. Addressing these security concerns is crucial to gaining the trust of businesses and consumers. Additionally, the high initial investment required for implementing autonomic systems can be a barrier for small and medium-sized enterprises (SMEs). The complexity of integrating autonomic systems with existing infrastructure and legacy systems also poses a challenge for organizations, requiring significant expertise and resources.

Opportunities:

Despite the challenges, the autonomic systems market presents significant opportunities for growth and innovation. One key opportunity lies in the development of industry-specific solutions tailored to the unique needs and requirements of different sectors. For example, in healthcare, autonomic systems can revolutionize patient care by automating routine tasks, optimizing hospital operations, and enhancing clinical decision-making. Similarly, in agriculture, autonomic systems can improve crop yield, reduce resource wastage, and mitigate environmental impact through precision farming techniques. Furthermore, the emergence of edge computing and 5G technology opens up new possibilities for deploying autonomic systems at the network edge, enabling real-time processing and decision-making in distributed environments. Moreover, the increasing focus on sustainability and environmental conservation presents opportunities for autonomic systems to optimize energy consumption, reduce carbon emissions, and support green initiatives across industries.

Read Also: U.S. Over the Counter (OTC) Drugs Market Size To Hit USD 41.72 Bn by 2033

Recent Developments

- In September 2022, Seagate Technology Holdings plc has unveiled its latest innovation, the next-generation Exos® X systems, representing advanced storage arrays driven by Seagate’s sixth generation controller architecture. These systems prioritize data protection, integrating the ADAPT (Advanced Distributed Autonomic Protection Technology) erasure coding solution alongside Seagate’s pioneering self-healing storage technology, ADR (Autonomous Drive Regeneration). This combination of cutting-edge technologies aims to fortify stored data against potential threats, ensuring enhanced reliability and resilience in storage environments.

- In October 2023, BT and Google Cloud forged a new alliance with a strong focus on advancing cybersecurity innovation. As part of this collaboration, BT will serve as a managed services delivery partner for Google’s Autonomic Security Operations (ASO) product, which is built on Google Chronicle. This partnership underscores a shared commitment to leveraging cutting-edge technologies and expertise to enhance cybersecurity capabilities. By integrating Google’s ASO solution into its managed services portfolio, BT aims to bolster its offerings and provide customers with robust security measures to safeguard their digital assets and infrastructure.

Autonomic Systems Market Companies

- IBM Corporation (United States)

- Hewlett Packard Enterprise (HPE) (United States)

- Cisco Systems, Inc. (United States)

- Dell Technologies Inc. (United States)

- Google (Alphabet Inc.) (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- VMware, Inc. (United States)

- Nutanix, Inc. (United States)

- Red Hat, Inc. (United States)

- Fujitsu Limited (Japan)

- NEC Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Huawei Technologies Co., Ltd. (China)

- Tencent Holdings Limited (China)

Segments Covered in the Report

By Type

- Data Management

- IT service management

- Networking

- Enterprise Software Application

By Application

- Government

- Banking

- Financial Services and Insurance (BFSI)

- Healthcare

- Information Technology

- Telecom

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/