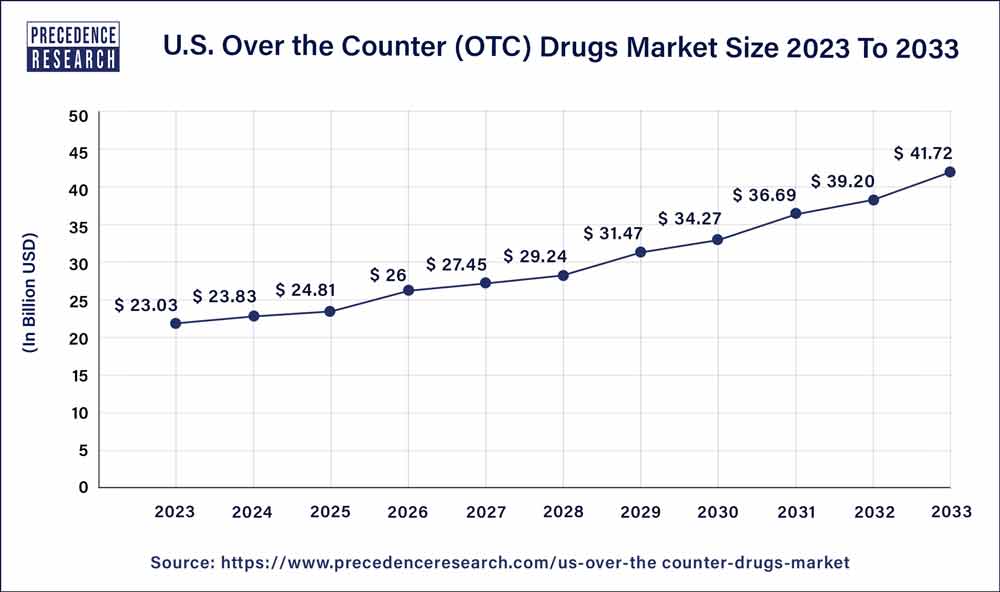

The U.S. over the counter (OTC) drugs market size reached USD 23.03 billion in 2023 and is expected to grow around USD 41.72 billion by 2033, notable at a CAGR of 6.42% from 2024 to 2033.

Key Takeaways

- By product type, the cough & cold products segment held the largest share of the market in 2023, the segment is observed to witness a notable growth during the forecast period.

- By dosage form, the tablets segment dominated the market with the largest share in 2023.

- By route of administration, the oral segment held the largest share of the market and is expected to sustain the position throughout the forecast period.

- By distribution channel, the drug stores & retail pharmacies segment dominated the U.S. over the counter (OTC) drugs market in 2023.

The U.S. Over the Counter (OTC) Drugs Market encompasses a vast array of pharmaceutical products that are available for purchase without a prescription. This market segment plays a crucial role in providing consumers with accessible and convenient solutions for managing common health conditions and ailments. Over the years, the demand for OTC drugs has surged, driven by factors such as increasing healthcare awareness among consumers, rising self-medication trends, and the expanding availability of these products through various distribution channels including pharmacies, supermarkets, and online platforms.

Get a Sample: https://www.precedenceresearch.com/sample/3753

Growth Factors

Several factors contribute to the growth of the U.S. OTC Drugs Market. Firstly, the growing emphasis on preventive healthcare and self-care practices has propelled the demand for over-the-counter medications, as consumers seek to address minor health concerns promptly and independently. Additionally, the aging population in the United States, coupled with the rising prevalence of chronic conditions such as allergies, cold and flu, and digestive disorders, has further fueled the demand for OTC drugs. Moreover, the expanding product innovation and development efforts by pharmaceutical companies, aimed at introducing new formulations and improving the efficacy of existing OTC medications, are driving market growth.

U.S. Over the Counter (OTC) Drugs Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.42% |

| U.S. Market Size in 2023 | USD 23.03 Billion |

| U.S. Market Size by 2033 | USD 41.72 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Dosage Form, By Route of Administration, and By Distribution Channel |

U.S. Over the Counter (OTC) Drugs Market Dynamics

Drivers:

Numerous drivers are propelling the expansion of the U.S. OTC Drugs Market. One significant driver is the growing preference for OTC drugs due to their affordability and accessibility compared to prescription medications. Additionally, the convenience of purchasing OTC drugs without the need for a doctor’s prescription aligns with the busy lifestyles of many consumers, driving demand further. Furthermore, the widespread availability of OTC drugs across multiple retail channels, including brick-and-mortar pharmacies, online platforms, and convenience stores, enhances their accessibility, thereby stimulating market growth. Moreover, the proactive efforts of pharmaceutical companies to engage in marketing and promotional activities aimed at raising consumer awareness about OTC products contribute to market expansion.

Restraints:

Despite the favorable growth prospects, the U.S. OTC Drugs Market faces certain restraints that may impede its growth trajectory. One such restraint is the stringent regulatory framework governing the sale and marketing of OTC drugs, which imposes compliance requirements on manufacturers and distributors. Additionally, concerns regarding the safety and efficacy of certain OTC medications, particularly those with active ingredients prone to misuse or abuse, pose challenges to market growth. Furthermore, the increasing prevalence of counterfeit OTC drugs in the market raises safety concerns among consumers and erodes trust in the authenticity of these products, thereby restraining market expansion.

Opportunities:

Amidst the challenges, the U.S. OTC Drugs Market presents several opportunities for growth and innovation. One notable opportunity lies in the rising demand for natural and herbal OTC remedies, driven by the growing consumer preference for alternative healthcare solutions and the perceived safety and efficacy of plant-based ingredients. Additionally, advancements in technology, such as telemedicine and digital health platforms, present opportunities for expanding the reach of OTC drugs to underserved populations and enhancing consumer access to healthcare information and products. Furthermore, strategic collaborations and partnerships between pharmaceutical companies and retail chains can facilitate the introduction of new OTC products and strengthen distribution networks, thereby capitalizing on emerging market opportunities.

Read Also: Artificial Intelligence Engineering Market Size, Share, Report by 2033

Recent Developments

- In July 2023, a leading manufacturer of consumer self-care products Perrigo Company plc announced that Opill®, a daily oral contraceptive that solely contains progestin, has been authorized by the FDA for use by people of all ages as an over-the-counter (OTC) medication. The first birth control pill to be sold over-the-counter in the US was called Opill.

- In June 2023, Foster & Thrive, a carefully chosen private brand of over-the-counter (OTC) health and wellness products, was recently introduced by McKesson Corporation MCK. The launch will include OTC items bearing the Health Mart and Sunmark brands, to unify the company’s private brand portfolio.

Key Market Players

- Bayer AG

- Takeda Pharmaceutical Company Ltd.

- Pfizer

- Johnson & Johnson Services Inc.

- Sanofi S.A.

- Novartis AG

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline PLC

- Mylan

- UPM Pharmaceuticals

Segments Covered in the Report

By Product Type

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Antacids

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/