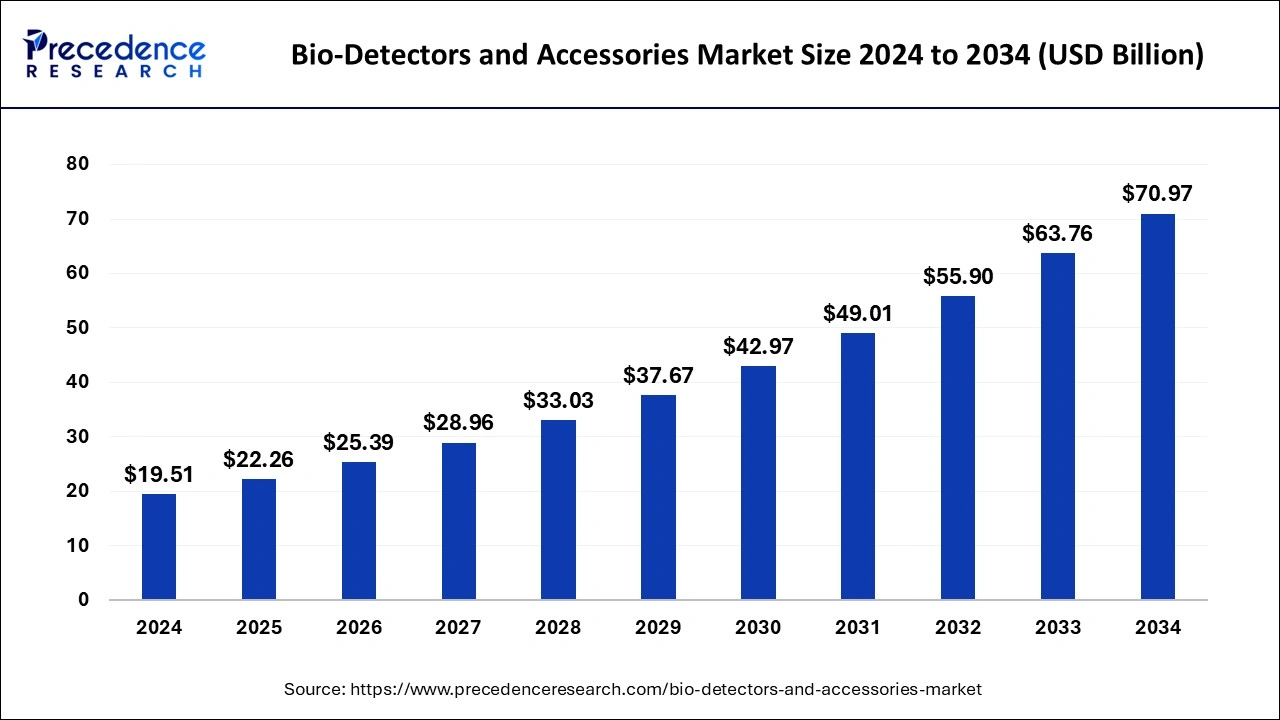

The global bio-detectors and accessories market size surpassed USD 17.11 billion in 2023 and is projected to be worth around USD 63.76 billion by 2033, growing at a CAGR of 14.06% from 2024 to 2033.

Key Points

- North America dominated the bio-detectors and accessories market by region in 2023.

- Asia Pacific is expected to grow at the highest CAGR by region during the forecast period.

- The instruments segment dominated the market by product in 2023.

- The reagents & media segment is expected to grow rapidly in the market by product during the forecast period.

- The clinical segment dominated the market by application in 2023.

- The food & environmental segment is expected to gain a significant share of the market by application during the forecast period.

- The point-of-care testing segment dominated the market by end-use in 2023.

- The diagnostics segment is expected to grow at the highest CAGR in the market by end-use during the forecast period.

The Bio-Detectors and Accessories Market encompasses a wide array of technologies and devices used for the detection and analysis of biological substances and pathogens. These tools play a critical role in various sectors, including healthcare, food safety, environmental monitoring, and defense. Bio-detectors and accessories range from simple handheld devices to sophisticated laboratory equipment, catering to the diverse needs of industries and research institutions worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4147

Growth Factors

The market for bio-detectors and accessories is driven by several key factors. Technological advancements have led to the development of highly sensitive and specific detection systems, increasing their adoption across various applications. Moreover, the growing concerns regarding food safety, disease outbreaks, and environmental pollution have fueled the demand for reliable and rapid detection methods. Additionally, increasing investments in research and development activities aimed at enhancing detection capabilities contribute to market growth.

Region Insights

The market for bio-detectors and accessories exhibits a global presence, with significant regional variations in demand and adoption. Developed regions such as North America and Europe lead the market due to their robust healthcare infrastructure, stringent regulatory standards, and high investment in research and development. Emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth, driven by increasing healthcare expenditure, rising awareness about infectious diseases, and government initiatives to improve healthcare infrastructure.

Bio-Detectors and Accessories Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.06% |

| Global Market Size in 2023 | USD 17.11 Billion |

| Global Market Size in 2024 | USD 19.51 Billion |

| Global Market Size by 2033 | USD 63.76 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Bio-detectors and Accessories Market Dynamics

Drivers

Several drivers propel the growth of the bio-detectors and accessories market. The expanding applications of bio-detection technologies across various industries, including healthcare, agriculture, and environmental monitoring, drive market growth. Additionally, the rising prevalence of infectious diseases, foodborne illnesses, and environmental contamination necessitates the use of advanced detection methods, further boosting market demand. Moreover, increasing government initiatives to combat bioterrorism and ensure public safety contribute to market expansion.

Opportunities

The bio-detectors and accessories market present ample opportunities for growth and innovation. The integration of artificial intelligence and machine learning algorithms into detection systems enhances their accuracy and efficiency, opening avenues for novel applications. Furthermore, the adoption of point-of-care testing and portable detection devices enables decentralized testing and expands market reach, especially in remote and resource-limited settings. Additionally, partnerships and collaborations between industry players and research institutions facilitate technology transfer and product development, fostering market growth.

Challenges

Despite the promising growth prospects, the bio-detectors and accessories market faces several challenges. High costs associated with advanced detection technologies and equipment pose a barrier to market penetration, particularly in developing regions with limited financial resources. Moreover, regulatory hurdles and compliance requirements for obtaining approval for new detection products can delay market entry and increase development costs. Additionally, the evolving nature of biological threats and pathogens necessitates continuous innovation and adaptation, posing challenges to market players in maintaining competitiveness.

Competitive Landscape

The bio-detectors and accessories market is characterized by intense competition, with numerous players vying for market share. Key players in the market focus on research and development activities to introduce innovative products and maintain a competitive edge. Strategic partnerships, mergers, and acquisitions are common strategies adopted by companies to expand their product portfolios and geographic presence. Moreover, investments in marketing and promotional activities play a crucial role in enhancing brand visibility and market penetration. Overall, the market is dynamic and characterized by rapid technological advancements and evolving customer preferences.

Read Also: Quantum Computing in Automotive Market Size, Share, Report 2033

Bio-detectors and Accessories Market Recent Developments

- In April 2024, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostic products, announced the launch of its first ultrasensitive multiplexed digital PCR assay, the ddPLEX ESR1 Mutation Detection Kit. The assay expands the company’s Droplet Digital PCR (ddPCR™) offering for the oncology market, where highly sensitive and multiplexed mutation detection assays aid translational research, therapy selection, and disease monitoring.

- In December 2023, HiGenoMB in joint collaboration with NG Biotech are making this rapid kit available to Indian market. The kit is a rapid test for the qualitative detection and differentiation of five common carbapenemase enzymes (KPC (K), OXA-48-like (O), IMP (I), VIM (V), NDM (N)) in bacterial colonies.

- In October 2023, VedaBio, the biotechnology company leading a paradigm shift in molecular detection, announced the launch with initial funding of over $40 million backed by lead investor OMX Ventures along with a select group of family offices, including Kleinmuntz Associates. VedaBio has unlocked the true power of CRISPR for molecular detection by developing the CRISPR Cascade, a revolutionary platform born from the intersection of engineering and biology.

Bio-detectors and Accessories Market Companies

- BioDetection Instruments, Inc.

- PositiveID Corporation

- BioDetection Systems

- Bertin Technologies

- BBI Detection

- Smith Detection

- MSA, the Safety Company

- Research International

- Shimadzu Corporation

- Agilent Technologies

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Response BioMedical, Corp.

- Physical Sciences, Inc.

- NetBio, Inc.

- MBio Diagnostics, Inc.

Segment Covered in the Report

By Product

- Instruments

- Reagents & Media

- Accessories & Consumables

By Application

- Clinical

- Food & Environmental

- Defense

By End-use

- Point Of Care Testing

- Diagnostics

- Research Laboratories

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/