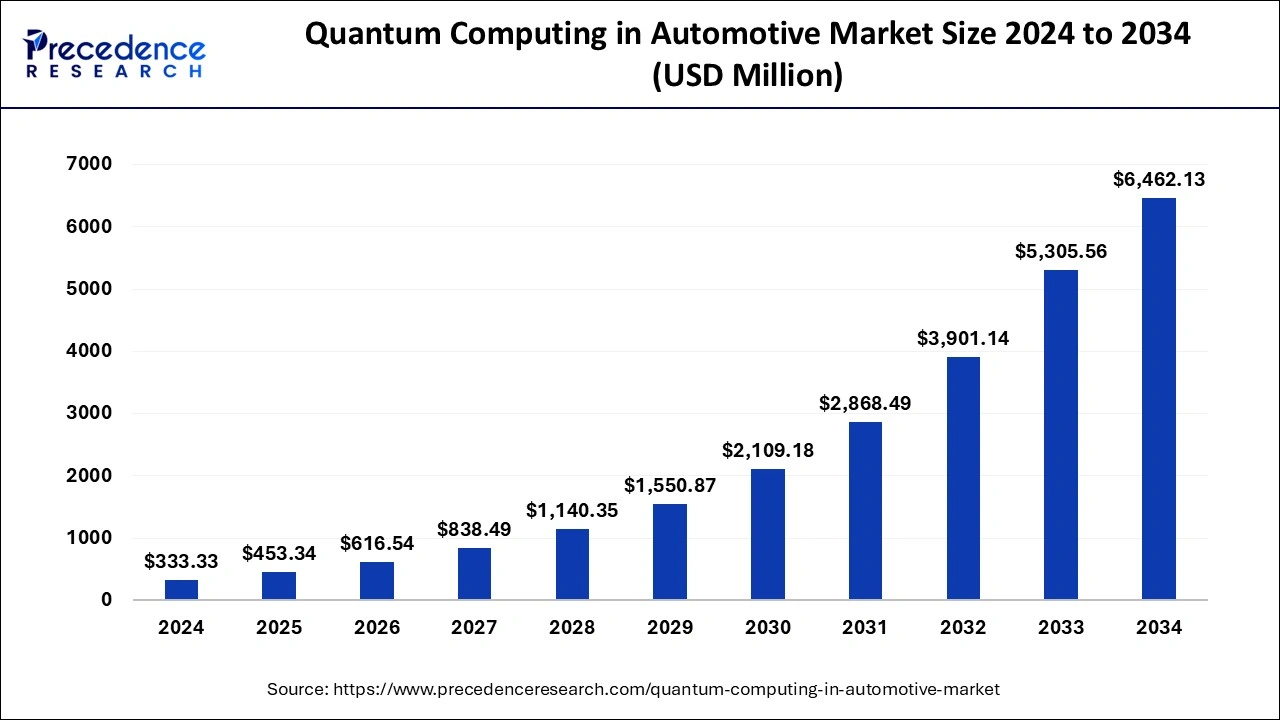

The global quantum computing in automotive market size surpassed USD 245.10 million in 2023 and is projected to be worth around USD 5,305.56 million by 2033, expanding at a CAGR of 36% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the biggest market share of 41% in 2023.

- North America is observed to be the fastest growing region in the market during the forecast period.

- By component, the software segment held the largest market share in 2023.

- By deployment, the cloud segment has accounted for more than 74% of the market share in 2023.

- By application, the routing and traffic segment is poised to dominate due to the traffic congestion is a significant challenge.

- By the stakeholders, the automotive Tier 1 and Tier 2 supplier’s segment is positioned for rapid growth.

The advent of quantum computing has ushered in a new era of technological advancement, with its potential applications extending to various industries, including automotive. Quantum computing in the automotive market represents a paradigm shift, promising revolutionary solutions to complex computational problems that traditional computing methods struggle to address efficiently. By harnessing the principles of quantum mechanics, this technology holds the key to optimizing automotive processes, enhancing vehicle performance, and driving innovation across the entire automotive value chain.

Get a Sample: https://www.precedenceresearch.com/sample/4146

Growth Factors:

Several factors contribute to the growth of quantum computing in the automotive market. These include the increasing complexity of automotive systems and the growing demand for advanced driver-assistance systems (ADAS) and autonomous vehicles. Moreover, the need for faster and more accurate simulations for vehicle design and optimization drives the adoption of quantum computing solutions. Additionally, collaborations between automotive manufacturers and quantum computing companies fuel research and development efforts, accelerating the pace of innovation in the sector.

Region Insights:

The adoption of quantum computing in the automotive sector varies across regions, influenced by factors such as technological infrastructure, regulatory environment, and investment in research and development. Regions with robust technology ecosystems, such as North America and Europe, witness significant activity in this space, with automotive giants and tech startups leading the charge. Emerging markets in Asia-Pacific also show promise, driven by the rapid digitization of the automotive industry and government initiatives to foster innovation.

Quantum Computing in Automotive Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 36% |

| Global Market Size in 2023 | USD 245.10 Million |

| Global Market Size in 2024 | USD 333.33 Million |

| Global Market Size by 2033 | USD 5,305.56 Million |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Application, By Deployment, and By Stakeholders |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Quantum Computing in Automotive Market Dynamics

Drivers:

Key drivers propelling the uptake of quantum computing in the automotive market include the need for superior computational power to address complex optimization problems in vehicle design, manufacturing, and operations. Moreover, the quest for enhanced vehicle safety, performance, and energy efficiency fuels the demand for advanced simulation and modeling capabilities provided by quantum computing. Additionally, the potential cost savings and competitive advantage associated with early adoption drive automotive companies to invest in quantum computing solutions.

Opportunities:

The intersection of quantum computing and automotive presents numerous opportunities for stakeholders. These include leveraging quantum algorithms for optimization, machine learning, and predictive analytics to enhance vehicle design, traffic management systems, and supply chain logistics. Furthermore, quantum-enabled cryptography holds promise for enhancing cybersecurity in connected vehicles and ensuring the integrity of automotive data and communications. Collaborations between automotive and quantum computing companies also create opportunities for co-innovation and the development of tailored solutions.

Challenges:

Despite its immense potential, quantum computing in the automotive market faces several challenges. These include the current limitations of quantum hardware, such as error rates and scalability issues, which hinder the practical implementation of quantum algorithms in real-world automotive applications. Moreover, the shortage of skilled professionals with expertise in both quantum computing and automotive engineering poses a challenge to the adoption and development of quantum-enabled solutions. Additionally, concerns regarding data privacy, security, and regulatory compliance remain areas of uncertainty.

Read Also: Artificial Intelligence (AI) Infrastructure Market Size, Report 2033

Competitive Landscape:

The competitive landscape of quantum computing in the automotive market is characterized by a mix of established automotive manufacturers, technology giants, and specialized quantum computing startups. Automotive companies are partnering with quantum computing providers to explore applications in vehicle design, optimization, and predictive maintenance. Meanwhile, quantum computing startups are pioneering innovative solutions tailored to the automotive industry’s specific needs, aiming to capture market share and establish themselves as key players in the evolving ecosystem. Additionally, research institutions and academic collaborations contribute to the advancement of quantum computing technologies and their application in automotive contexts.

Quantum Computing in Automotive Market Recent Developments

- In January 2023, PASQAL introduced a pulsar studio specifically designed with no-code development platform for neutral atoms quantum computers. Intriguing part of this is pulsar studio can simulate the quantum registers and design pulse sequence with no prior knowledge of coding.

- In September 2023, Rigetti & Co, LLC launched QCS on azure platform of Microsoft with public preview option. They have introduced two types of superconducting quantum processors to all azure quantum users for developing the quantum applications along with execution.

Quantum Computing in Automotive Market Companies

- Accenture plc (Ireland)

- IBM Corporation (US)

- Microsoft Corporation (US)

- D-wave systems, inc. (Canada)

- PASQAL (France)

- Terra Quantum (Switzerland)

- Rigetti & Co, LLC (US)

- IONQ (US)

- Atom Computing Inc (US)

- Quantinuum Ltd. (US)

- Zapata Computing (US)

- Xanada Quantum Technologies Inc (Canada)

- Anyon Systems (Canada)

- Alpine Quantum Technologies (Austria)

- Multiverse Computing (Spain)

- Avanetix (German)

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Application

- Battery Optimization

- Material Research

- Route Planning and Traffic Management

- Autonomous and Connected Vehicles

- Production Planning and Scheduling

- Others

By Deployment

- Cloud

- On-premises

By Stakeholders

- OEM

- Automotive Tier 1 and 2

- Warehousing and Distribution

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/