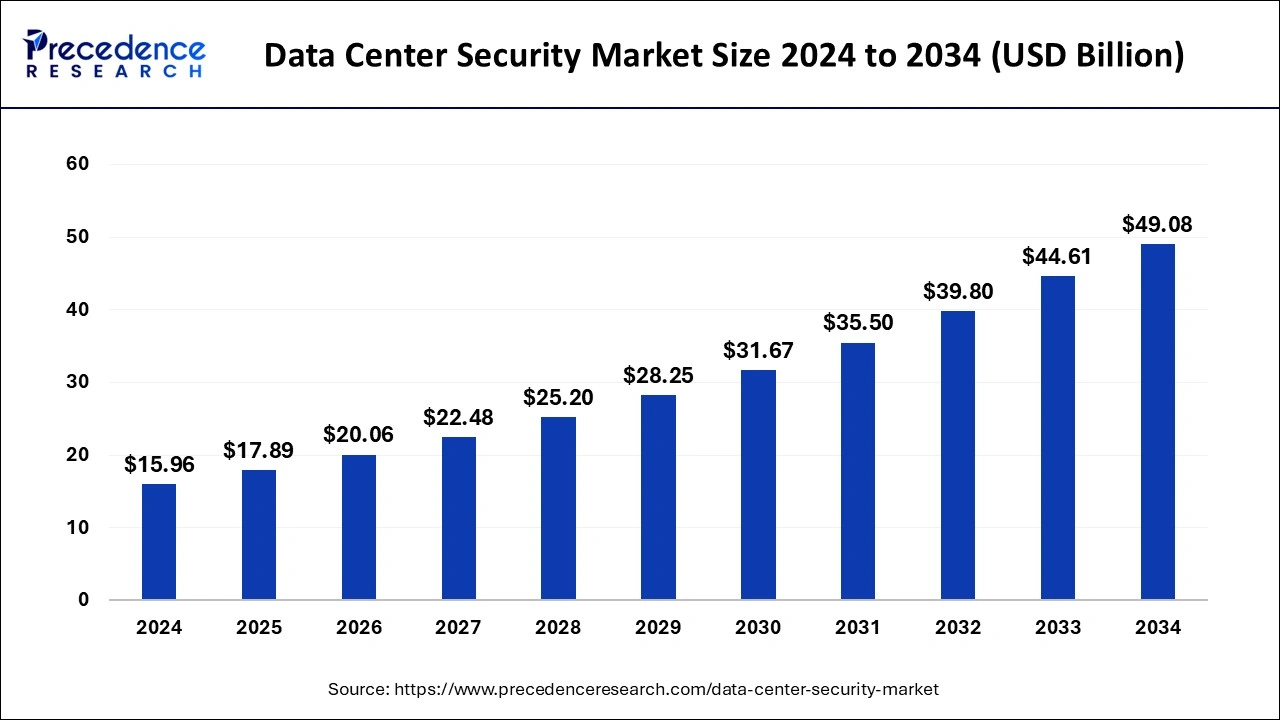

The global data center security market size surpassed USD 14.24 billion in 2023 and is anticipated to hit around USD 44.61 billion by 2033, growing at a CAGR of 12.01% from 2024 to 2033.

Key Points

- North America contributed more than 37% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the solution segment has held the largest market share of 76% in 2023.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By data center type, the small data center segment has generated over 46% of market share in 2023.

- By data center type, the large data center segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the BFSI segment has accounted over 21% of market share in 2023.

- By industry vertical, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The Data Center Security Market is witnessing robust growth globally, driven by the increasing demand for secure and reliable data storage solutions. With the proliferation of digitalization across various industries and the growing volume of sensitive data generated, stored, and transmitted, the need to safeguard data centers against cyber threats has become paramount. Data center security solutions encompass a range of technologies and services designed to protect data centers from unauthorized access, cyberattacks, data breaches, and other security risks. These solutions include access control systems, firewalls, intrusion detection and prevention systems, encryption technologies, biometric authentication, and security management software.

Get a Sample: https://www.precedenceresearch.com/sample/4020

Growth Factors

Several factors are fueling the growth of the Data Center Security Market. Firstly, the escalating frequency and sophistication of cyber threats have heightened awareness among organizations regarding the importance of robust data center security measures. Additionally, stringent regulatory requirements mandating the protection of sensitive data have compelled businesses to invest in advanced security solutions for their data centers. Furthermore, the rapid adoption of cloud computing, IoT (Internet of Things), and big data analytics has expanded the attack surface, driving the demand for comprehensive security solutions to safeguard critical infrastructure and assets.

Region Insights

The Data Center Security Market exhibits a strong presence across various regions, with North America and Europe emerging as prominent contributors to market growth. North America leads the market due to the presence of major technology companies, stringent data protection regulations, and increasing investments in cybersecurity infrastructure. Europe follows closely, driven by the implementation of GDPR (General Data Protection Regulation) and initiatives aimed at enhancing cybersecurity across industries. Moreover, the Asia Pacific region is witnessing rapid growth, fueled by the expanding IT infrastructure, increasing internet penetration, and rising awareness regarding data security among enterprises in countries like China, India, and Japan.

Data Center Security Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.10% |

| Global Market Size in 2023 | USD 14.24 Billion |

| Global Market Size by 2033 | USD 44.61 Billion |

| U.S. Market Size in 2023 | USD 3.95 Billion |

| U.S. Market Size by 2033 | USD 12.38 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Data Center Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center Security Market Dynamics

Drivers:

Several key drivers are propelling the expansion of the Data Center Security Market. One of the primary drivers is the escalating number of cyberattacks targeting data centers, leading organizations to prioritize cybersecurity investments. Moreover, the growing adoption of cloud-based services and virtualization technologies has necessitated robust security measures to protect sensitive data stored in cloud environments. Additionally, the emergence of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is revolutionizing data center security by enabling real-time threat detection and response capabilities.

Opportunities

The Data Center Security Market presents numerous opportunities for vendors and service providers to capitalize on emerging trends and market demands. One significant opportunity lies in the integration of advanced technologies like AI, ML, and blockchain into data center security solutions to enhance threat intelligence, automate security operations, and ensure regulatory compliance. Moreover, the rising adoption of hybrid and multi-cloud environments creates opportunities for offering specialized security solutions tailored to the unique requirements of diverse cloud architectures. Furthermore, the increasing emphasis on zero-trust security models presents avenues for developing innovative security solutions that enforce strict access controls and authentication mechanisms.

Challenges

Despite the favorable growth prospects, the Data Center Security Market faces several challenges that could impede its expansion. One such challenge is the evolving nature of cyber threats, which necessitates continuous innovation and adaptation of security technologies to keep pace with emerging threats. Additionally, the complexity of modern data center environments, characterized by hybrid infrastructures, distributed workloads, and interconnected systems, poses challenges for implementing holistic security strategies. Moreover, the shortage of skilled cybersecurity professionals exacerbates the challenge of maintaining robust security posture and effectively managing security operations within data centers.

Read Also: Workforce Management Market Size to Surpass USD 28.64 Bn by 2033

Recent Developments

- In August 2022, NVIDIA unveiled a novel data center solution in collaboration with Dell Technologies, tailored for the AI era. This innovation integrates Dell PowerEdge servers with NVIDIA BlueField DPUs and GPUs, along with NVIDIA AI Enterprise software. The comprehensive offering extends cutting-edge capabilities in AI training, inference, data processing, and data science, complemented by robust zero-trust security features, catering to enterprises worldwide. The solution is finely tuned for VMware vSphere 8 enterprise workload platform, promising enhanced performance and efficiency.

- In November 2023, Schneider Electric, renowned for its leadership in energy management and automation, announced a substantial $3 billion multi-year agreement with Compass Datacenters. This agreement extends their ongoing partnership, leveraging synergies between their supply chains to manufacture and deliver prefabricated modular data center solutions, bolstering scalability and agility in data center deployments.

- In March 2023, Cisco, a prominent provider of networking, cloud, and cybersecurity solutions, unveiled ambitious plans to strengthen its commitment to India. This initiative includes establishing a new data center in Chennai, introducing advanced risk-based capabilities across its security portfolio for hybrid and multi-cloud environments, and launching enhanced features for its Duo Risk-Based Authentication solution.

- In October 2023, leading cybersecurity firm Fortinet announced the establishment of two dedicated data centers in Pune and Bengaluru to expand its Universal SASE, AI-powered Security Services, and FortiCloud offerings across India and SAARC regions. This strategic move underscores Fortinet’s unwavering dedication to fortifying its presence and support infrastructure in India, complementing its existing investments in development and support centers in the country.

Data Center Security Market Companies

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- McAfee, LLC

- Juniper Networks, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Development LP

- Broadcom Inc.

- FireEye, Inc.

- Symantec Corporation

- F5 Networks, Inc.

- VMware, Inc.

Segments Covered in the Report

By Component

- Solution

- Service

By Data Center Type

- Small Data Center

- Medium Data Center

- Large Data Center

By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Media and Entertainment

- Government

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/