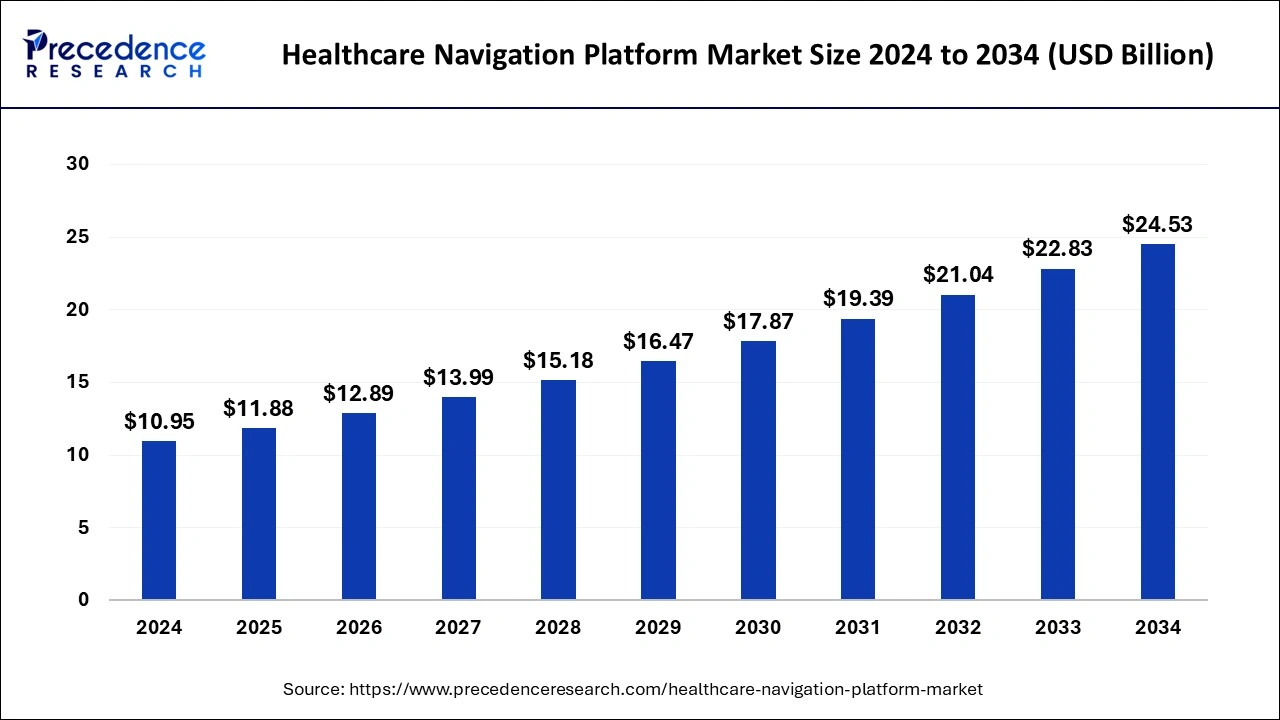

The global healthcare navigation platform market size is expected to increase USD 22.83 billion by 2033 from USD 10.09 billion in 2023 with a CAGR of 8.51% between 2024 and 2033.

Key Points

- The North America healthcare navigation platform market size accounted for USD 4.34 billion in 2023 and is expected to attain around USD 9.82 billion by 2033.

- North America led the market with the largest market share of 43% in 2023.

- Asia Pacific is expected to grow significantly in the global market.

- By end use, the large enterprises segment has held the major market share of 76% in 2023.

- By end use, the SME segment is expected to show significant growth in the market.

- By deployment, the cloud-based segment accounted for the highest market share of 64% in 2023.

- By deployment insights, the on-premises segment is projected to grow with a notable CAGR in the global market.

The healthcare navigation platform market has experienced substantial growth in recent years due to the increasing complexity of healthcare systems, rising patient expectations, and the need for efficient care coordination. Healthcare navigation platforms offer tools and technologies designed to streamline patient journeys, improve access to care, and enhance overall patient experience. These platforms encompass a range of solutions, including appointment scheduling, patient referral management, care coordination software, and telehealth integration, aimed at optimizing healthcare delivery and improving outcomes.

Get a Sample: https://www.precedenceresearch.com/sample/4254

Growth Factors

Several key factors are driving the growth of the healthcare navigation platform market. One primary driver is the growing emphasis on patient-centered care and the need to enhance patient engagement. Healthcare navigation platforms empower patients to take an active role in managing their health by providing easy access to information, resources, and support services. Additionally, the rising adoption of digital health solutions, spurred by advancements in telemedicine and mobile technology, has accelerated the demand for integrated healthcare navigation platforms that can facilitate virtual care delivery and remote monitoring.

Region Insights

The adoption of healthcare navigation platforms varies by region, influenced by factors such as healthcare infrastructure, regulatory environment, and technological readiness. Developed regions like North America and Europe have witnessed significant adoption of healthcare navigation platforms, driven by robust healthcare systems, high digital literacy among patients, and favorable reimbursement policies for telehealth services. In contrast, emerging markets in Asia Pacific and Latin America are experiencing rapid growth fueled by increasing healthcare investments, expanding internet penetration, and a growing demand for accessible healthcare solutions.

Healthcare Navigation Platform Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.51% |

| Global Market Size in 2023 | USD 10.09 Billion |

| Global Market Size in 2024 | USD 10.95 Billion |

| Global Market Size by 2033 | USD 22.83 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Deployment and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare Navigation Platform Market Dynamics

Drivers

Several drivers are contributing to the growth of the healthcare navigation platform market. One key driver is the need to address healthcare inefficiencies and improve care coordination across diverse healthcare settings. Healthcare navigation platforms facilitate seamless communication and information exchange among healthcare providers, leading to better care transitions and reduced medical errors. Moreover, the shift towards value-based care models and population health management strategies has incentivized healthcare organizations to adopt technology-enabled solutions that can optimize resource allocation and improve patient outcomes.

Opportunities

The healthcare navigation platform market presents numerous opportunities for innovation and expansion. One key opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance predictive analytics and personalized care navigation. Advanced analytics capabilities can enable healthcare providers to identify high-risk patients, predict disease progression, and optimize treatment pathways. Additionally, partnerships between healthcare organizations and technology providers can drive the development of interoperable platforms that enable seamless data sharing and care coordination across different healthcare settings.

Challenges

Despite its growth prospects, the healthcare navigation platform market faces certain challenges. One significant challenge is data privacy and security concerns associated with the handling of sensitive patient information. Compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) is crucial to maintaining patient trust and ensuring regulatory compliance. Additionally, interoperability issues between disparate healthcare IT systems and varying levels of digital maturity among healthcare providers pose challenges to the seamless integration of healthcare navigation platforms into existing workflows.

Read Also: Data Center RFID Market Size to Worth USD 12.21 Bn by 2033

Healthcare Navigation Platform Market Recent Developments

- In March 2023, a care and health service provider, Transcarent have acquired 98point6, an AI-based virtual care platform and care business of an on-demand primary care company. This acquisition has a goal to provide Transcarent access to AI-powered virtual care technology which aids deliver high-quality & on-demand care. It is basically an affiliated medical group that delivers skilled providers.

- In May 2023, Sharecare launched Sharecare+, a digital-focused, precision advocacy solution. That is specifically designed to streamline benefits navigation and integrate clinical care delivery effectively. Sharecare+ aims to address individuals’ needs through its clinical coaching and lifestyle expertise. This can be done by utilizing AI-powered digital capabilities and a comprehensive set of analytics.

- In May 2022, Accolade introduced Medication Integrated Care, an innovative solution coupled with advanced analytics driven by Rx Savings solutions. This offering is tailored for employers who have concerns related to affordability, complications with prescription medications, and obstacles to care. The innovative approach aims to provide employers with effective tools to navigate the complexities of healthcare and improve overall health outcomes for employees.

Healthcare Navigation Platform Market Companies

- Quantum CorpHealth Pvt Ltd.

- Accolade

- Transparent

- Included Health, LLC

- Sharecare, Inc.

- Apree Health

- Health Advocate

- Health Joy, LLC

- Wellframe

Segments Covered in the Report

By Deployment

- On-premises

- Cloud-based

By End-use

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/