Key Takeaways

- North America contributed 33% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By application, the transportation segment has held the largest market share of 32% in 2023.

- By application, the energy infrastructure segment is anticipated to grow at a remarkable CAGR of 11.4% between 2024 and 2033.

- By service, the operational asset management segment generated over 40% of the market share in 2023.

- By service, the strategic asset management segment is expected to expand at the fastest CAGR over the projected period.

- By component, the services segment generated over 66% of the market share in 2023.

- By component, the solution segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The infrastructure asset management market has become increasingly vital in today’s global landscape, as governments and organizations seek efficient ways to manage and maintain their infrastructure assets. This market encompasses a wide range of sectors, including transportation, utilities, telecommunications, and public facilities, all of which require effective strategies for asset lifecycle management. This analysis delves into the evolving trends and opportunities within the infrastructure asset management market, examining key drivers, challenges, and emerging technologies shaping its trajectory.

Get a Sample: https://www.precedenceresearch.com/sample/3719

Growth Factors:

Several factors are driving the growth of the infrastructure asset management market. Firstly, aging infrastructure in many regions has heightened the need for proactive maintenance and asset renewal strategies to ensure reliability and safety. Additionally, the growing complexity of infrastructure networks, coupled with increasing regulatory requirements and stakeholder expectations, has spurred demand for advanced asset management solutions. Moreover, the adoption of digital technologies, such as Internet of Things (IoT), artificial intelligence (AI), and predictive analytics, is revolutionizing asset management practices, enabling real-time monitoring, predictive maintenance, and data-driven decision-making.

Infrastructure Asset Management Market Scope

| Report Coverage | Details |

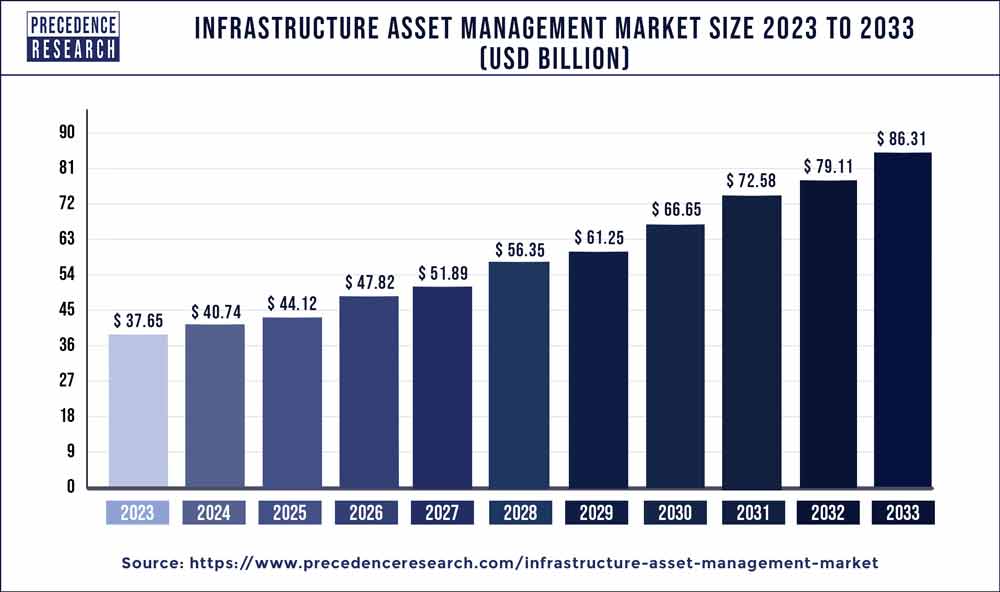

| Growth Rate from 2024 to 2033 | CAGR of 8.70% |

| Global Market Size in 2023 | USD 37.65 Billion |

| Global Market Size by 2033 | USD 86.31 Billion |

| U.S. Market Size in 2023 | USD 8.70 Billion |

| U.S. Market Size by 2033 | USD 19.94 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Service, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Infrastructure Asset Management Market Dynamics

Drivers:

Key drivers propelling the infrastructure asset management market include the imperative to optimize asset performance and maximize return on investment. Governments and asset owners are under pressure to make informed decisions regarding asset maintenance, rehabilitation, and replacement to extend asset lifecycles and minimize lifecycle costs. Furthermore, the need for resilience and adaptability in the face of natural disasters, climate change, and disruptive events has heightened the importance of robust asset management strategies. Moreover, the shift towards performance-based contracting models and outcome-focused procurement approaches is incentivizing investments in asset management technologies and services that deliver tangible value and outcomes.

Restraints:

Despite the growth prospects, the infrastructure asset management market faces several challenges and restraints. One significant restraint is the lack of standardized data and interoperability among disparate asset management systems, which hampers data integration and decision-making across the asset lifecycle. Additionally, budget constraints and competing priorities often limit investment in comprehensive asset management programs, leading to deferred maintenance and increased risk of asset failure. Moreover, organizational silos and cultural resistance to change can impede the adoption of integrated asset management approaches, hindering collaboration and information sharing among stakeholders.

Opportunities:

Amidst the challenges, the infrastructure asset management market presents significant opportunities for innovation and collaboration. Advances in sensor technology, remote monitoring, and predictive analytics offer opportunities to enhance asset performance, optimize maintenance schedules, and minimize downtime. Moreover, the emergence of asset performance management (APM) platforms and digital twins enables asset owners to simulate scenarios, assess risks, and optimize asset strategies in a virtual environment. Furthermore, public-private partnerships (PPPs) and alternative financing models provide avenues for leveraging private sector expertise and investment to address infrastructure challenges while sharing risks and rewards.

Region Insights

The landscape of the infrastructure asset management market varies across regions, reflecting differences in infrastructure priorities, regulatory frameworks, and investment landscapes. In developed economies, such as North America and Europe, governments are focusing on modernizing aging infrastructure networks and enhancing resilience to climate change and natural disasters. Consequently, there is a growing demand for advanced asset management solutions, driven by regulatory mandates and funding initiatives. In emerging economies, rapid urbanization, population growth, and infrastructure deficits present opportunities for investment in asset management technologies and services to improve infrastructure efficiency, reliability, and sustainability.

Read Also: Healthcare Digital Payment Market Size to Worth $81.36 Bn By 2033

Recent Developments

- In June 2023, Macquarie Asset Management (MAM) completed the recapitalization of Coastal Waste & Recycling, making MAM the primary owner. This strategic investment is anticipated to accelerate Coastal’s growth, solidifying its position as a leading privately owned integrated solid waste and recycling enterprise in the Southeast region.

- In April 2023, Siemens Digital Industries Software and IBM announced an extended partnership, focusing on creating a combined software solution. This collaboration integrates their expertise in systems engineering, service lifecycle management, and asset management, offering an innovative solution to address complex challenges in these domains.

- In September 2022, WSP acquired John Wood Group plc’s Environment & Infrastructure Business, combining their strengths to deliver a broader range of multidisciplinary services. This strategic move enhances their capacity to provide innovative solutions, ultimately delivering increased value to their clients.

Infrastructure Asset Management Market Companies

- IBM Corporation

- SAP SE

- Oracle Corporation

- Schneider Electric SE

- Bentley Systems, Incorporated

- ABB Ltd

- Siemens AG

- Infor Inc.

- eMaint (Fluke Corporation)

- IPS-Intelligent Process Solutions

- Dude Solutions, Inc.

- Cityworks (Trimble Inc.)

- Hexagon AB

- Yokogawa Electric Corporation

- Mott MacDonald Group Limited

Segments Covered in the Report

By Application

- Transportation infrastructure

- Energy infrastructure

- Water & waste infrastructure

- Critical infrastructure

- Mining

- Others

By Service

- Strategic asset management

- Operational asset management

- Tactical asset management

By Component

- Solution

- Services

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Infrastructure Asset Management Market

5.1. COVID-19 Landscape: Infrastructure Asset Management Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Infrastructure Asset Management Market, By Application

8.1. Infrastructure Asset Management Market, by Application, 2024-2033

8.1.1 Transportation infrastructure

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Energy infrastructure

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Water & waste infrastructure

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Critical infrastructure

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Mining

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Infrastructure Asset Management Market, By Service

9.1. Infrastructure Asset Management Market, by Service, 2024-2033

9.1.1. Strategic asset management

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Operational asset management

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Tactical asset management

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Infrastructure Asset Management Market, By Component

10.1. Infrastructure Asset Management Market, by Component, 2024-2033

10.1.1. Solution

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Services

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Infrastructure Asset Management Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Component (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Component (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.3. Market Revenue and Forecast, by Component (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Component (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Component (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Component (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.3. Market Revenue and Forecast, by Component (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Component (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Component (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Component (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Component (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Component (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Component (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.3. Market Revenue and Forecast, by Component (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Component (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Component (2021-2033)

Chapter 12. Company Profiles

12.1. IBM Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SAP SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Oracle Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Schneider Electric SE

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Bentley Systems, Incorporated

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ABB Ltd

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Siemens AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Infor Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. eMaint (Fluke Corporation)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. IPS-Intelligent Process Solutions

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/