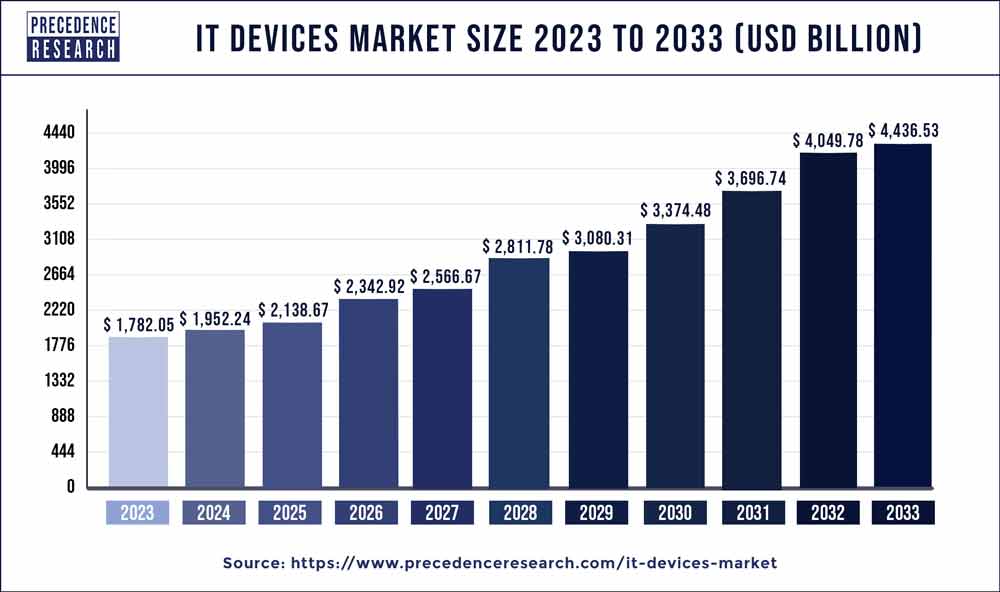

The global IT devices market size surpassed USD 1,782.05 billion in 2023 and is expected to rake around USD 4,436.53 billion by 2033, with a significant CAGR of 9.55% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest share of 36% in 2023.

- North America is expected to expand at a notable CAGR of 11.04% between 2024 and 2033.

- By product, the mobile devices segment has contributed more than 46% of market share in 2023.

- By product, the peripheral devices segment is expected to grow at the fastest CAGR of 11.04% between 2024 and 2033.

- By operating system, the android segment has accounted largest market share of 40% in 2023.

- By operating system, the iOS segment is projected to grow at a double digit CAGR of 11.08% between 2024 and 2033.

- By distribution channel, the offline segment has generated more than 57% of market share in 2023.

- By application, the enterprise segment has captured more than 58% of market share in 2023.

The IT devices market encompasses a wide array of electronic gadgets and hardware used for computing, communication, and data processing. This includes but is not limited to personal computers, laptops, tablets, smartphones, servers, storage devices, networking equipment, and peripherals such as printers and monitors. The market is characterized by rapid technological advancements, increasing digitization across various industries, and a growing demand for efficient and innovative IT solutions. As businesses and individuals alike continue to rely heavily on technology for productivity, communication, and entertainment purposes, the IT devices market remains a dynamic and highly competitive landscape.

Get a Sample: https://www.precedenceresearch.com/sample/3895

Growth Factors

Several key factors contribute to the growth of the IT devices market. Firstly, the proliferation of digital transformation initiatives across industries is driving demand for advanced IT infrastructure and devices capable of supporting modern computing needs. This includes cloud computing, big data analytics, artificial intelligence (AI), and the Internet of Things (IoT), all of which require powerful computing hardware and networking equipment. Additionally, the increasing adoption of remote work and digital learning models, accelerated by the COVID-19 pandemic, has spurred demand for portable devices such as laptops, tablets, and smartphones.

Moreover, the rise of e-commerce and online retail platforms has made IT devices more accessible to consumers worldwide, fueling market growth. Furthermore, continuous innovations in hardware design, performance, and connectivity features are enticing consumers to upgrade their devices more frequently, thereby contributing to market expansion. Additionally, the growing trend towards smart homes and smart cities is creating opportunities for IT device manufacturers to develop interconnected products that enhance convenience, security, and energy efficiency.

Region Snapshot

The IT devices market exhibits a global presence, with significant regional variations in demand, supply chain dynamics, and market trends. North America, comprising the United States and Canada, remains a dominant region due to its robust technology infrastructure, high consumer purchasing power, and early adoption of new technologies. The Asia-Pacific region, particularly China, Japan, South Korea, and India, represents a major growth opportunity driven by rapid urbanization, expanding middle-class population, and increasing investments in digital infrastructure.

Europe, including countries like Germany, the United Kingdom, and France, also holds considerable market share, supported by a mature IT ecosystem and strong emphasis on technological innovation. Emerging economies in Latin America, Africa, and the Middle East are experiencing rising demand for IT devices, driven by improving internet penetration, government initiatives for digital inclusion, and growing awareness among consumers about the benefits of technology adoption.

IT Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.55% |

| Global Market Size in 2023 | USD 1,782.05 Billion |

| Global Market Size by 2033 | USD 4,436.53 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Operating System, By Distribution Channel, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Diverse product portfolio catering to various consumer and enterprise needs.

- Strong brand presence and established distribution networks globally.

- Continuous innovation in hardware design, performance, and features.

- Strategic partnerships and collaborations with software developers and service providers.

- Robust after-sales support and warranty services enhancing customer satisfaction.

Weaknesses:

- Vulnerability to supply chain disruptions, particularly due to dependence on component suppliers.

- Intense competition from both established players and new entrants.

- Price volatility driven by fluctuations in raw material costs and currency exchange rates.

- Concerns regarding data privacy and cybersecurity impacting consumer trust.

- Limited market penetration in rural and underdeveloped regions due to infrastructure challenges.

Opportunities:

- Growing demand for IT devices in emerging markets with rising disposable incomes.

- Expansion of e-commerce platforms facilitating easier access to a wider customer base.

- Adoption of subscription-based business models for software and services, creating recurring revenue streams.

- Integration of AI, IoT, and blockchain technologies into IT devices for enhanced functionality and security.

- Increasing focus on sustainability and eco-friendly manufacturing practices driving demand for energy-efficient devices.

Threats:

- Intensifying competition from counterfeit products and unauthorized sellers affecting brand reputation.

- Regulatory compliance requirements and trade tensions impacting global supply chains.

- Rapid technological obsolescence leading to shorter product lifecycles and reduced margins.

- Economic downturns and geopolitical uncertainties affecting consumer spending on discretionary items.

- Rising concerns about electronic waste management and environmental sustainability regulations.

Read Also: Animal Model Market Size to Attain USD 5.72 Billion by 2033

Recent Developments

- In February 2024, Xiaomi announced that it is about to work on the launch of a new wearable device. The launch of the wearable device for detecting unexpected hidden cameras and alerting users from being secretly photographed.

- In February 2024, Honar is about to launch Honar X9b 5G, its second phone in India. The company is promoting its launch and specification of the phone on its social media. It specifically prompted their phone to have features like an ‘ultra-bounce’ display and claimed customers don’t need to apply any tempered glass on it.

- In February 2024, tech-giant Apple is planning to launch its inaugural foldable device within the upcoming year. The launch presents itself as a replacement for the 7-8 inch existing iPad mini. As per the Korean publication, The Elec the company is currently assessing the timeline for the launching of the device between 2026 and 2027.

- In February 2024, Cupertino announced the Apple TV, Apple Music, and Apple devices standalone apps are available globally. The latest app is made for the replacement of iTunes stores on Windows PCs running Windows 11 and Windows 10 (only x86-based systems are supported at this time).

- In January 2024, the Global launch of the Samsung Galaxy Ring is set to be confirmed for the second half of 2024. The smart ring is planning to launch with the Galaxy Z Fold 6. The Galaxy Ring is incorporated with the sensors monitors for fitness and health.

IT Devices Market Companies

- Microsoft Corporation

- Open Systems International Inc.

- Rockwell Automation Inc.

- S & C Electric Company

- Samsung Electronics Co Ltd

- Schneider Electric S.E.

- Siemens AG

- ABB Ltd.

- Apple Inc.

- Cisco Systems

- Dell Technologies Inc.

- Eaton Corporation

- Honeywell International Inc.

- Landis Gyr Inc.

- Lenovo Group Limited

Segments Covered in the Report

By Product

- Mobile Devices

- Peripheral Devices

- Computers and Laptops

- Networking Equipment

By Operating system

- Windows

- macOS

- Linux

- iOS

- Android

- Others

By Distribution Channel

- Online

- Offline

By Application

- Enterprise

- Consume

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/